Prévision du prix GHST 2025 : Le token d’Aavegotchi atteindra-t-il de nouveaux sommets au sein de l’écosystème dynamique du gaming NFT ?

Introduction : Positionnement de GHST sur le marché et valeur d’investissement

Aavegotchi (GHST), projet de crypto-collectibles reposant sur le DeFi, s’est imposé depuis sa création. En 2025, la capitalisation boursière d’Aavegotchi s’élève à 21 148 402 $, avec une offre en circulation d’environ 51 157 239 tokens et un cours proche de 0,4134 $. Qualifié d’« expérience DeFi ludifiée », cet actif joue un rôle croissant à la croisée de la finance décentralisée et du jeu blockchain.

Cet article propose une analyse approfondie des tendances du prix de GHST entre 2025 et 2030, intégrant l’historique, la dynamique de l’offre et de la demande, l’évolution de l’écosystème et les facteurs macroéconomiques, afin d’offrir aux investisseurs des prévisions de prix fiables et des stratégies concrètes.

I. Rétrospective des prix de GHST et situation actuelle du marché

Historique de l’évolution du prix de GHST

- 2024 : GHST atteint son record historique de 3,63 $ le 2 avril, une étape majeure pour le projet.

- 2025 : Le marché subit une correction, GHST touche son plus bas historique à 0,311585 $ le 23 juin.

Situation actuelle du marché GHST

Au 5 octobre 2025, GHST s’échange à 0,4134 $, en recul de 2,68 % sur 24 heures. Sa capitalisation atteint 21 148 402 $, le plaçant au 1 067e rang des cryptomonnaies. L’offre en circulation s’établit à 51 157 239 tokens, soit 96,98 % de l’offre totale de 52 747 802 GHST.

La semaine passée, GHST affiche une hausse de 3,25 %. Néanmoins, la tendance reste baissière sur le long terme : –3,27 % sur 30 jours et –56,07 % sur un an.

Le cours actuel marque une forte baisse par rapport au plus haut historique, traduisant une correction prolongée. Les échanges sur 24 heures atteignent 18 129 $, témoignant d’une activité modérée.

Cliquez pour consulter le cours actuel de GHST

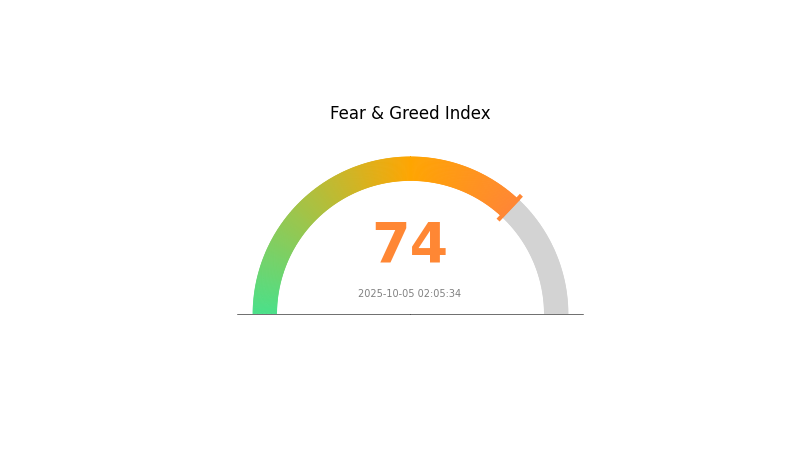

Indicateur de sentiment du marché GHST

05 octobre 2025 : Indice Fear and Greed : 74 (Greed)

Cliquez pour consulter l’Indice Fear & Greed

Le marché crypto affiche aujourd’hui un haut niveau de cupidité, l’indice Fear and Greed atteignant 74. Ce score élevé témoigne d’un optimisme excessif, susceptible d’entraîner une surévaluation des prix. Si la tendance haussière peut stimuler la hausse, la prudence s’impose. Les traders aguerris considèrent souvent l’extrême cupidité comme un signal contrariant annonçant une correction possible. Il est essentiel d’analyser rigoureusement et de gérer son risque avant toute décision d’investissement dans un marché aussi tendu.

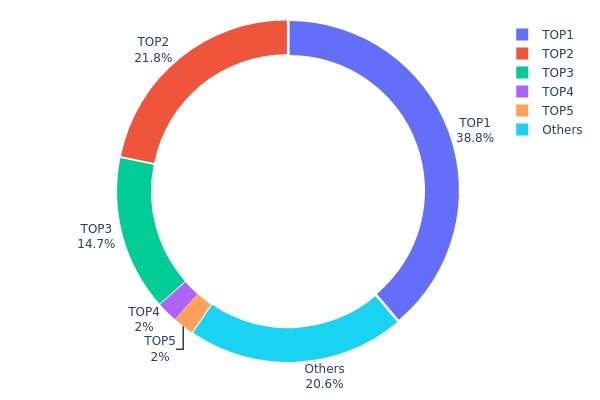

Répartition des détentions GHST

La distribution des adresses GHST révèle une forte concentration de détention. La première adresse détient 38,83 % du total, les deuxième et troisième détiennent respectivement 21,82 % et 14,69 %. Les trois principales adresses contrôlent ainsi 75,34 % des tokens GHST, traduisant une influence majeure sur le réseau.

Cette concentration interroge sur la stabilité du marché et le risque de manipulation des prix. Un nombre restreint de porteurs majeurs peut influencer fortement la dynamique de GHST. Cette faible décentralisation peut nuire à la résilience et à la gouvernance de l’écosystème.

On note toutefois que 20,68 % des tokens sont répartis entre d’autres adresses, assurant une certaine participation plus large. Malgré tout, la structure actuelle expose le marché à la volatilité et à l’influence de quelques gros détenteurs.

Cliquez pour consulter la répartition des détentions GHST

| Top | Adresse | Quantité détenue | Détention (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 20 486,32K | 38,83 % |

| 2 | 0x3154...0f2c35 | 11 514,20K | 21,82 % |

| 3 | 0xf977...41acec | 7 753,38K | 14,69 % |

| 4 | 0xdde7...5af429 | 1 052,38K | 1,99 % |

| 5 | 0xf6ae...fc3223 | 1 052,38K | 1,99 % |

| - | Autres | 10 889,14K | 20,68 % |

II. Facteurs déterminants du prix futur de GHST

Mécanisme d’offre

- Demande et offre : L’équilibre entre demande et offre est essentiel pour le prix de GHST.

- Tendances historiques : Les variations passées de l’offre ont influencé les mouvements du prix de GHST.

- Impact actuel : La configuration actuelle de l’offre devrait peser sur le prix à court terme.

Dynamique institutionnelle et whales

- Influence des whales : Les gros investisseurs (« whales ») peuvent fortement influencer le cours de GHST par leurs opérations.

Contexte macroéconomique

- Situation économique : L’état de l’économie mondiale influe sur le prix de GHST via le sentiment et l’appétence au risque.

- Taux d’intérêt : Les variations à venir des taux directeurs des banques centrales peuvent affecter l’attrait de GHST.

Développement technique et écosystème

- Adoption et usages : L’adoption et les usages concrets de GHST au sein de son écosystème renforcent sa valeur.

- Projets de l’écosystème : Le développement de DApps majeures et de projets utilisant GHST peut soutenir son cours.

III. Prévisions du prix GHST pour 2025-2030

Prévisions 2025

- Scénario conservateur : 0,3594 $ – 0,4131 $

- Scénario neutre : 0,4131 $ – 0,5000 $

- Scénario optimiste : 0,5000 $ – 0,55769 $ (nécessite une reprise soutenue et une adoption accrue de la plateforme Aavegotchi)

Prévisions 2027-2028

- Phase attendue : Croissance potentielle avec volatilité accrue

- Fourchette de prix prévisionnelle :

- 2027 : 0,26112 $ – 0,68482 $

- 2028 : 0,30615 $ – 0,62407 $

- Moteurs principaux : Expansion de l’écosystème Aavegotchi, tendances du marché crypto, nouveaux partenariats potentiels

Prévisions long terme 2030

- Scénario de base : 0,60641 $ – 0,70343 $ (avec une croissance stable de l’adoption)

- Scénario optimiste : 0,70343 $ – 0,80555 $ (en cas d’expansion importante des usages)

- Scénario transformateur : 0,80555 $+ (si le gaming NFT devient mainstream)

- 31 décembre 2030 : GHST 0,65492 $ (prix moyen projeté)

| Année | Prix maximal prévisionnel | Prix moyen prévisionnel | Prix minimal prévisionnel | Variation (%) |

|---|---|---|---|---|

| 2025 | 0,55769 | 0,4131 | 0,3594 | 0 |

| 2026 | 0,49995 | 0,48539 | 0,38346 | 17 |

| 2027 | 0,68482 | 0,49267 | 0,26112 | 19 |

| 2028 | 0,62407 | 0,58874 | 0,30615 | 42 |

| 2029 | 0,70343 | 0,60641 | 0,48513 | 46 |

| 2030 | 0,80555 | 0,65492 | 0,57633 | 58 |

IV. Stratégies d’investissement professionnelles et gestion des risques GHST

Méthodologie d’investissement GHST

(1) Stratégie de détention long terme

- Public visé : Investisseurs long terme dans GameFi et DeFi

- Recommandations :

- Accumuler du GHST lors des baisses de marché

- Participer à l’écosystème Aavegotchi pour obtenir des récompenses

- Stocker les tokens dans un portefeuille non-custodial sécurisé

(2) Stratégie de trading actif

- Outils d’analyse technique :

- Moyennes mobiles : Identifier les tendances et points de retournement

- RSI : Surveiller les états de surachat et de survente

- Conseils pour le swing trading :

- Suivre la corrélation du GHST avec les tendances du marché crypto

- Surveiller les mises à jour du projet et l’activité communautaire

Cadre de gestion des risques GHST

(1) Principes d’allocation d’actifs

- Investisseurs prudents : 1 à 3 % du portefeuille crypto

- Investisseurs dynamiques : 5 à 10 % du portefeuille crypto

- Investisseurs professionnels : Jusqu’à 15 % du portefeuille crypto

(2) Solutions de couverture des risques

- Diversification : Investir dans différents projets GameFi et DeFi

- Stop-loss : Utiliser pour limiter les pertes potentielles

(3) Solutions de stockage sécurisé

- Recommandation de hot wallet : Gate Web3 Wallet

- Stockage à froid : Portefeuille hardware pour conservation longue durée

- Bonnes pratiques : Activer la double authentification, choisir des mots de passe forts et mettre à jour les logiciels

V. Risques et défis majeurs pour GHST

Risques de marché GHST

- Volatilité : Fluctuations de prix importantes sur le marché crypto

- Liquidité : Difficultés potentielles lors de transactions de gros volumes

- Concurrence : Les nouveaux projets GameFi peuvent affecter la part de marché de GHST

Risques réglementaires GHST

- Réglementation incertaine : Évolutions possibles des lois mondiales sur les cryptoactifs

- Fiscalité : Modification des règles fiscales sur les cryptoactifs et les récompenses de jeu

- Exigences AML/KYC : Durcissement des obligations de conformité pouvant freiner l’adoption

Risques techniques GHST

- Vulnérabilités des smart contracts : Risques de sécurité sur l’écosystème Aavegotchi

- Scalabilité : Congestion du réseau Ethereum pouvant dégrader l’expérience utilisateur

- Interopérabilité : Difficultés d’intégration avec d’autres blockchains

VI. Conclusion et recommandations

Évaluation de la valeur d’investissement GHST

GHST permet d’accéder aux secteurs dynamiques du GameFi et du DeFi, avec une proposition unique mêlant gaming et finance. Les investisseurs doivent cependant garder à l’esprit la volatilité élevée et l’incertitude réglementaire du secteur.

Recommandations pour investir dans GHST

✅ Débutants : Commencez avec de petites positions et familiarisez-vous avec l’écosystème Aavegotchi ✅ Investisseurs expérimentés : Optez pour une approche diversifiée, en associant GHST à d’autres cryptoactifs reconnus ✅ Investisseurs institutionnels : Intégrez GHST dans un portefeuille GameFi et DeFi diversifié

Comment participer au trading GHST

- Trading spot : Disponible sur Gate.com et sur les principales plateformes

- Staking : Rejoignez les programmes de staking GHST pour obtenir des récompenses

- Participation à l’écosystème : Impliquez-vous dans le jeu Aavegotchi et la gouvernance pour maximiser vos avantages

L’investissement en cryptomonnaies comporte des risques majeurs. Cet article ne constitue pas un conseil en investissement. Chaque investisseur doit prendre ses décisions avec discernement en fonction de sa propre tolérance au risque, et il est recommandé de consulter des professionnels de la finance. N’investissez jamais plus que ce que vous pouvez vous permettre de perdre.

FAQ

Quelle est l’offre maximale du token GHST ?

L’offre maximale de GHST est de 52 747 802 tokens, plafond atteint après la clôture du Bancor.

Qu’est-ce que GHST crypto ?

GHST est le token de gouvernance du jeu blockchain Aavegotchi. Il confère un droit de vote au sein d’AavegotchiDAO et constitue le pilier de l’économie et de la gouvernance de l’écosystème.

Le token HOT atteindra-t-il 1 $ ?

D’après les prévisions actuelles, HOT ne devrait pas atteindre 1 $ à court terme. Les projections estiment un maximum autour de 0,25 $ à l’horizon 2029. Son potentiel à long terme reste incertain.

Quelle est la prévision de prix pour GRT en 2025 ?

Selon les tendances du marché, The Graph (GRT) pourrait atteindre un maximum de 1,77 $ et un minimum de 1,06 $ en 2025.

Prévision du prix SUPER 2025 : analyse des tendances du marché et de la valorisation future du token SUPER au sein d’un écosystème blockchain en constante évolution

Prévisions du prix DEGO pour 2025 : analyse des facteurs déterminants et des tendances du marché en vue du potentiel de croissance à long terme

Prévision du prix BMT 2025 : Analyse des tendances du marché à venir et du potentiel d’investissement

GAFI vs AVAX : analyse comparative de deux principaux écosystèmes blockchain dédiés au gaming et à la DeFi

RON vs FLOW : deux approches comparées pour optimiser la sérialisation des données

Comprendre le concept de bridges dans la blockchain

Qu'est-ce que BTR : Guide complet de Beyond the Rack et son impact sur le commerce en ligne

Qu'est-ce que CGN : Guide complet sur les Conditional Generation Networks et leurs applications dans l'intelligence artificielle moderne

Qu'est-ce que PUMPBTC : guide complet du Bitcoin Pump Token et de son impact sur le marché