Prediksi Harga INIT 2025: Analisis Pasar dan Outlook Masa Depan untuk Pertumbuhan Token Initial Network

Pendahuluan: Posisi Pasar dan Nilai Investasi INIT

Initia (INIT), blockchain Layer 1 yang menyatukan appchain, telah mencatat kemajuan signifikan sejak awal peluncurannya. Hingga tahun 2025, kapitalisasi pasar INIT mencapai $45.443.125, dengan pasokan beredar sekitar 148.750.000 token dan harga berkisar di $0,3055. Aset yang dikenal sebagai “appchain unifier” ini memainkan peran kunci dalam mengoptimalkan nilai blockchain aplikasi spesifik melalui infrastruktur terintegrasi dan ekonomi yang selaras.

Artikel ini menghadirkan analisis menyeluruh atas tren harga INIT dari 2025 hingga 2030, dengan menggabungkan pola historis, dinamika pasokan-permintaan, pengembangan ekosistem, dan faktor makroekonomi untuk memberikan prediksi harga profesional serta strategi investasi praktis bagi investor.

I. Tinjauan Sejarah Harga INIT dan Status Pasar Terkini

Evolusi Harga Historis INIT

- Mei 2025: INIT mencapai rekor tertinggi di $1,446, menjadi pencapaian penting bagi proyek ini

- September 2025: Harga turun tajam ke titik terendah di $0,2921

- 30 September 2025: INIT diperdagangkan di $0,3055, menandakan pemulihan dari level terendah baru-baru ini

Situasi Pasar Terkini INIT

Saat ini INIT diperdagangkan di $0,3055 dengan volume perdagangan 24 jam sebesar $323.406. Token ini mengalami penurunan 2,23% dalam 24 jam terakhir. Kapitalisasi pasar INIT sebesar $45.443.125 menempatkannya di peringkat ke-728 pasar kripto global. Pasokan beredar INIT adalah 148.750.000 token, merepresentasikan 14,88% dari total pasokan 1.000.000.000 INIT. Dalam sepekan terakhir, INIT turun 5,59%, penurunan 30 hari sebesar 9,95%, dan year-to-date menunjukkan penurunan tajam 52,91%.

Indikator Sentimen Pasar INIT

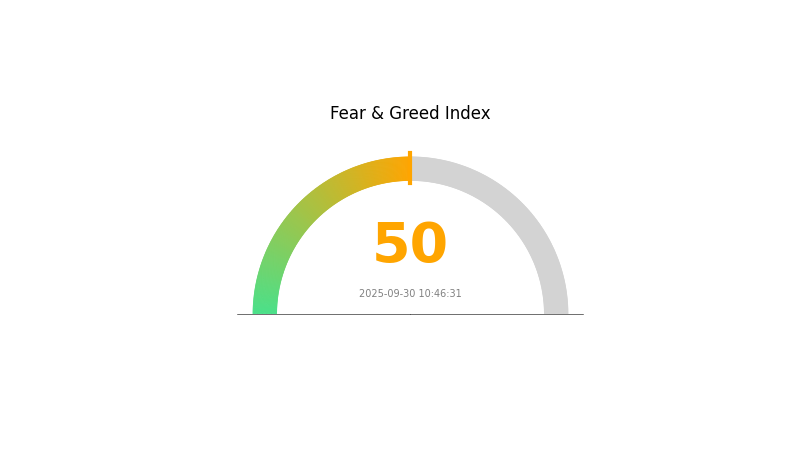

30-09-2025 Indeks Fear and Greed: 50 (Netral)

Lihat Indeks Fear & Greed saat ini

Sentimen pasar kripto saat ini berada dalam keseimbangan, dengan nilai Fear and Greed Index di 50 yang menunjukkan posisi netral. Investor saat ini tidak menunjukkan sikap terlalu pesimis maupun optimis. Momen ini ideal untuk optimisme yang terukur, di mana pengambilan keputusan rasional menjadi prioritas. Trader perlu tetap waspada dengan menganalisis risiko dan peluang yang ada. Lakukan riset mendalam. Pertimbangkan diversifikasi portofolio untuk menghadapi pasar yang seimbang secara efektif.

Distribusi Kepemilikan INIT

Data distribusi kepemilikan alamat untuk INIT menunjukkan tabel kosong, menandakan tidak ada informasi spesifik mengenai pemegang utama dan persentasenya. Beberapa kemungkinan terkait struktur pasar INIT saat ini dapat muncul akibat ketiadaan data ini.

Tanpa data distribusi yang pasti, penilaian konsentrasi kepemilikan INIT menjadi sulit. Ketidakhadiran pemilik besar bisa menandakan struktur kepemilikan yang terdesentralisasi, sehingga risiko manipulasi pasar oleh whale menurun. Investor harus menafsirkan hal ini dengan hati-hati karena ketiadaan data bisa berarti informasi belum tersedia atau tidak terlacak publik.

Dari sudut pandang pasar, tidak adanya pemegang besar yang jelas dapat menurunkan volatilitas. Kemungkinan aksi jual atau akumulasi berlebihan dari pemain utama menjadi lebih kecil. Kondisi ini berpotensi membuat pergerakan harga lebih stabil. Faktor lain tetap memengaruhi dinamika pasar.

Lihat distribusi kepemilikan INIT saat ini

| Tahun | Address | Holding Qty | Holding (%) |

|---|

II. Faktor Utama yang Mempengaruhi Harga Masa Depan INIT

Mekanisme Pasokan

- Sentimen Pasar: Performa pasar kripto global sangat memengaruhi token baru seperti INIT.

- Pola Historis: Sebagai token baru, INIT mengalami fase penemuan harga dan volatilitas awal.

- Dampak Terkini: Tren pasar kripto utama seperti pergerakan harga Bitcoin dan Ethereum turut memengaruhi harga INIT.

Dinamika Institusi dan Whale

- Listing di Bursa: Listing di bursa utama berdampak besar pada harga dan likuiditas INIT.

Lingkungan Makroekonomi

- Sifat Lindung Nilai Inflasi: Kinerja aset kripto dalam lingkungan inflasi memengaruhi persepsi nilai INIT.

Pengembangan Teknologi dan Ekosistem

- Sistem L1 dan L2: Initia memanfaatkan sistem L1 dan L2 yang saling terhubung untuk membangun ekosistem multi-chain baru.

- Aplikasi Ekosistem: Initia menargetkan arsitektur, produk, dan tumpukan ekonomi di ekosistemnya.

III. Proyeksi Harga INIT 2025-2030

Proyeksi 2025

- Prediksi konservatif: $0,29108 - $0,3064

- Prediksi netral: $0,3064 - $0,35

- Prediksi optimis: $0,35 - $0,41977 (dengan sentimen pasar dan pencapaian proyek positif)

Proyeksi 2027-2028

- Fase pasar yang diharapkan: Potensi pertumbuhan dengan volatilitas lebih tinggi

- Rentang harga diproyeksikan:

- 2027: $0,41468 - $0,56467

- 2028: $0,25648 - $0,53811

- Pemicu utama: Pencapaian proyek, adopsi pasar, dan tren pasar kripto global

Proyeksi Jangka Panjang 2029-2030

- Skenario dasar: $0,52051 - $0,54653 (asumsi pertumbuhan proyek dan stabilitas pasar)

- Skenario optimis: $0,57256 - $0,6777 (asumsi kinerja proyek kuat dan kondisi pasar mendukung)

- Skenario transformasi: $0,70 - $0,80 (jika terjadi inovasi besar dan adopsi luas)

- 31-12-2030: INIT $0,54653 (naik 78% dari level 2025)

| Tahun | Prediksi Harga Tertinggi (USD) | Prediksi Harga Rata-rata (USD) | Prediksi Harga Terendah (USD) | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,41977 | 0,3064 | 0,29108 | 0 |

| 2026 | 0,51921 | 0,36308 | 0,23964 | 18 |

| 2027 | 0,56467 | 0,44115 | 0,41468 | 44 |

| 2028 | 0,53811 | 0,50291 | 0,25648 | 64 |

| 2029 | 0,57256 | 0,52051 | 0,37477 | 70 |

| 2030 | 0,6777 | 0,54653 | 0,2842 | 78 |

IV. Strategi Investasi Profesional INIT dan Manajemen Risiko

Metodologi Investasi INIT

(1) Strategi Holding Jangka Panjang

- Cocok untuk: Investor jangka panjang dan percaya pada teknologi Initia

- Saran operasional:

- Akumulasi token INIT saat harga turun

- Tahan minimal 1-2 tahun untuk menghadapi volatilitas jangka pendek

- Simpan token di dompet perangkat keras

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Rata-rata bergerak (Moving Average): Untuk identifikasi tren dan level support/resistance

- Indeks Kekuatan Relatif (RSI): Identifikasi kondisi overbought/oversold

- Poin penting perdagangan ayunan:

- Tentukan titik entry dan exit berdasarkan indikator teknikal

- Gunakan stop-loss untuk membatasi kerugian

Kerangka Manajemen Risiko INIT

(1) Prinsip Alokasi Aset

- Investor konservatif: 1-3% dari portofolio kripto

- Investor agresif: 5-10% dari portofolio kripto

- Investor profesional: Hingga 15% dari portofolio kripto

(2) Solusi Lindung Nilai Risiko

- Diversifikasi: Investasi pada beberapa proyek blockchain L1

- Stop-loss: Terapkan untuk membatasi kerugian

(3) Solusi Penyimpanan Aman

- Rekomendasi hot wallet: Gate web3 wallet

- Penyimpanan dingin: dompet perangkat keras untuk penyimpanan jangka panjang

- Keamanan: Aktifkan 2FA, gunakan password unik, dan update software secara berkala

V. Risiko dan Tantangan Potensial bagi INIT

Risiko Pasar INIT

- Volatilitas tinggi: Harga bisa berfluktuasi signifikan

- Persaingan: Blockchain L1 lain dapat merebut pangsa pasar

- Adopsi terbatas: Lambatnya adopsi teknologi Initia dapat menekan nilai token

Risiko Regulasi INIT

- Regulasi tidak pasti: Perubahan regulasi kripto dapat memengaruhi status INIT

- Kendala lintas yurisdiksi: Regulasi yang berbeda antar negara dapat menghambat pertumbuhan

- Klasifikasi token sekuritas: Potensi INIT dikategorikan sebagai token sekuritas

Risiko Teknis INIT

- Kerentanan smart contract: Potensi eksploitasi dalam ekosistem Initia

- Tantangan skalabilitas: Kemampuan menghadapi beban jaringan yang meningkat

- Isu interoperabilitas: Kendala integrasi dengan jaringan blockchain lain

VI. Kesimpulan dan Rekomendasi Tindakan

Penilaian Nilai Investasi INIT

INIT memiliki potensi sebagai solusi blockchain L1 inovatif, namun menghadapi persaingan ketat dan risiko regulasi. Nilai jangka panjang menjanjikan, tetapi risiko jangka pendek tetap tinggi.

Rekomendasi Investasi INIT

✅ Pemula: Mulai dengan pembelian kecil dan berkala untuk membangun posisi

✅ Investor berpengalaman: Pertimbangkan alokasi moderat dan manajemen risiko aktif

✅ Investor institusi: Lakukan penelitian menyeluruh dan jadikan sebagai bagian dari portofolio kripto terdiversifikasi

Metode Partisipasi Trading INIT

- Perdagangan spot: Tersedia di Gate.com dan bursa utama lainnya

- Staking: Validasi jaringan Initia untuk potensi imbalan

- Integrasi DeFi: Eksplorasi peluang DeFi di ekosistem Initia

Investasi cryptocurrency sangat berisiko tinggi, dan artikel ini bukan merupakan saran investasi. Investor harus mengambil keputusan secara bijak sesuai profil risiko masing-masing dan disarankan berkonsultasi dengan penasihat keuangan profesional. Jangan pernah berinvestasi melebihi kemampuan Anda untuk menanggung kerugian.

FAQ

Berapa prediksi harga INIT coin di tahun 2030?

Berdasarkan tren pasar saat ini, harga maksimum INIT coin diprediksi mencapai $2,41 pada tahun 2030, menunjukkan potensi pertumbuhan signifikan.

Apakah INIT layak dibeli?

Berdasarkan tren pasar dan prospek pertumbuhan di sektor Web3, INIT dapat menjadi pilihan beli yang menjanjikan. Namun, selalu lakukan riset menyeluruh sebelum berinvestasi.

Berapa harga INIT?

Per 30-09-2025, harga INIT adalah $0,3102, naik 2,33% dalam 24 jam terakhir.

Berapa prediksi harga Shiba Inu di tahun 2025?

Shiba Inu diperkirakan mencapai $0,00001388 pada Oktober 2025, berdasarkan tren dan proyeksi pasar pada September 2025.

Prediksi Harga SUI 2025: Analisis Perkembangan Masa Depan dan Nilai Investasi Blockchain Pendatang Baru

INV vs AVAX: Analisis Komparatif atas Dua Platform Blockchain Terdepan

ALPINE vs APT: Perbandingan Sistem Manajemen Paket pada Distribusi Linux

SWAP vs NEAR: Menyelami Perbedaan Kunci Antara Kedua Protokol Blockchain

Apakah Polygon Ecosystem Token (POL) merupakan investasi yang layak?: Analisis potensi dan risiko dari solusi scaling layer-2 ini

Apakah Astar Token (ASTR) adalah investasi yang menjanjikan?: Analisis potensi dan risiko token dalam ekosistem Polkadot

Apa itu L3: Panduan Lengkap Mengenai Layer 3 Switching dan Arsitektur Jaringan