McKinsey's groundbreaking report: 13 cutting-edge technologies defining the next five years.

From the era of the steam engine to the internet’s quiet revolution, each technological wave has quietly reshaped the world.

Now, we stand on the verge of an even more profound technological transformation—artificial intelligence has learned to “think,” robots have broken free from factory confines, semiconductors have become the “new oil” of the intelligent age, and space is shifting from a distant aspiration to a new commercial frontier.

Which technologies will define the next five or even ten years?

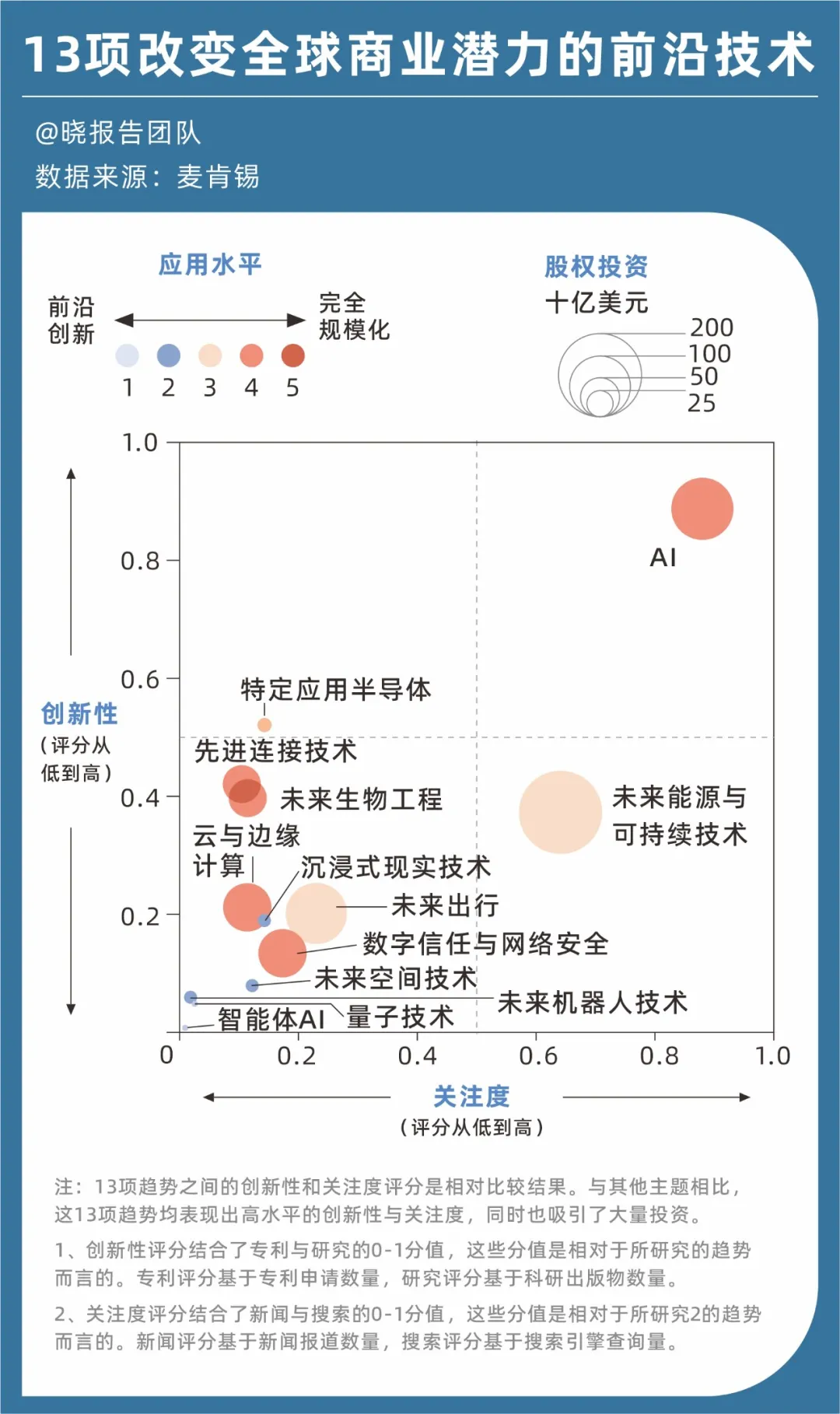

McKinsey’s latest “2025 Technology Trends Outlook” report addresses this question, identifying 13 frontier technologies with the potential to transform global business. The report maps these technologies’ trajectories across four dimensions: innovation, market attention, capital investment, and application maturity.

Capital is flowing heavily into AI, future energy and sustainability, and next-generation mobility—sectors advancing from technical breakthroughs to large-scale deployment. AI stands out as the clear leader in both innovation and market focus.

By contrast, technologies such as application-specific semiconductors, advanced connectivity, next-gen bioengineering, cloud and edge computing, digital trust, and cybersecurity may not attract the same spotlight as AI, yet they have quietly become the “infrastructure” of our digital society, with adoption nearing industrial scale.

Immersive reality, future space tech, next-gen robotics, quantum technologies, and AI agents remain in the incubation phase, but their disruptive potential is clear. For example, AI agents have become one of the fastest-growing trends, with $1.1 billion in equity investment in 2024—a 1,562% year-over-year increase.

Visitors experience the Yungang Grottoes using AR glasses

Every one of these technology trends is set to reshape industries and has already become a critical competitive advantage for both nations and enterprises.

In China, these technologies are part of the nation’s strategic industry roadmap through 2035, with clear development targets. For example, the future space sector is projected to exceed ¥800 billion by 2030, focusing on crewed low-altitude flight, deep space and ocean exploration, and polar development.

We have distilled the key insights and data from the McKinsey report to share the latest developments, trends, and talent requirements in these fields.

13 Sectors and Trillion-Dollar Opportunities

McKinsey groups these 13 frontier technologies into three categories based on their fundamental “characteristics”: the AI Revolution, Computing and Connectivity Frontiers, and Advanced Engineering.

Each group plays a distinct role—one “thinks,” one “connects,” one “acts.” Together, they intersect and amplify each other, painting a comprehensive picture of the coming decade’s technological surge.

◎ The first category, the AI Revolution, includes AI and AI agents. As AI’s influence grows, its costs are plummeting—some inference tasks are now 900 times cheaper than a year ago.

McKinsey notes that AI is not only a revolutionary and strategic innovation but also accelerates advancement in other fields and creates new “business opportunities” at the intersections—serving as a key catalyst for application-specific semiconductors, for example.

AI agent technology has rapidly become a focal point for enterprise and consumer tech. AI agents function as “virtual colleagues,” autonomously planning and executing multi-step tasks.

Major companies are integrating agent capabilities into existing AI products or developing new, task-specific applications, with rapid progress in fields like software development and mathematics that have robust training datasets.

Market sentiment is strong. MarketsandMarkets forecasts the AI agent market will soar from $5.1 billion in 2024 to $47.1 billion by 2030, with a compound annual growth rate of 44.8%.

◎ The second category, Computing and Connectivity Frontiers, forms the “backbone” of AI and the digital world. This includes application-specific semiconductors, advanced connectivity, cloud and edge computing, immersive reality, digital trust and cybersecurity, and quantum technologies.

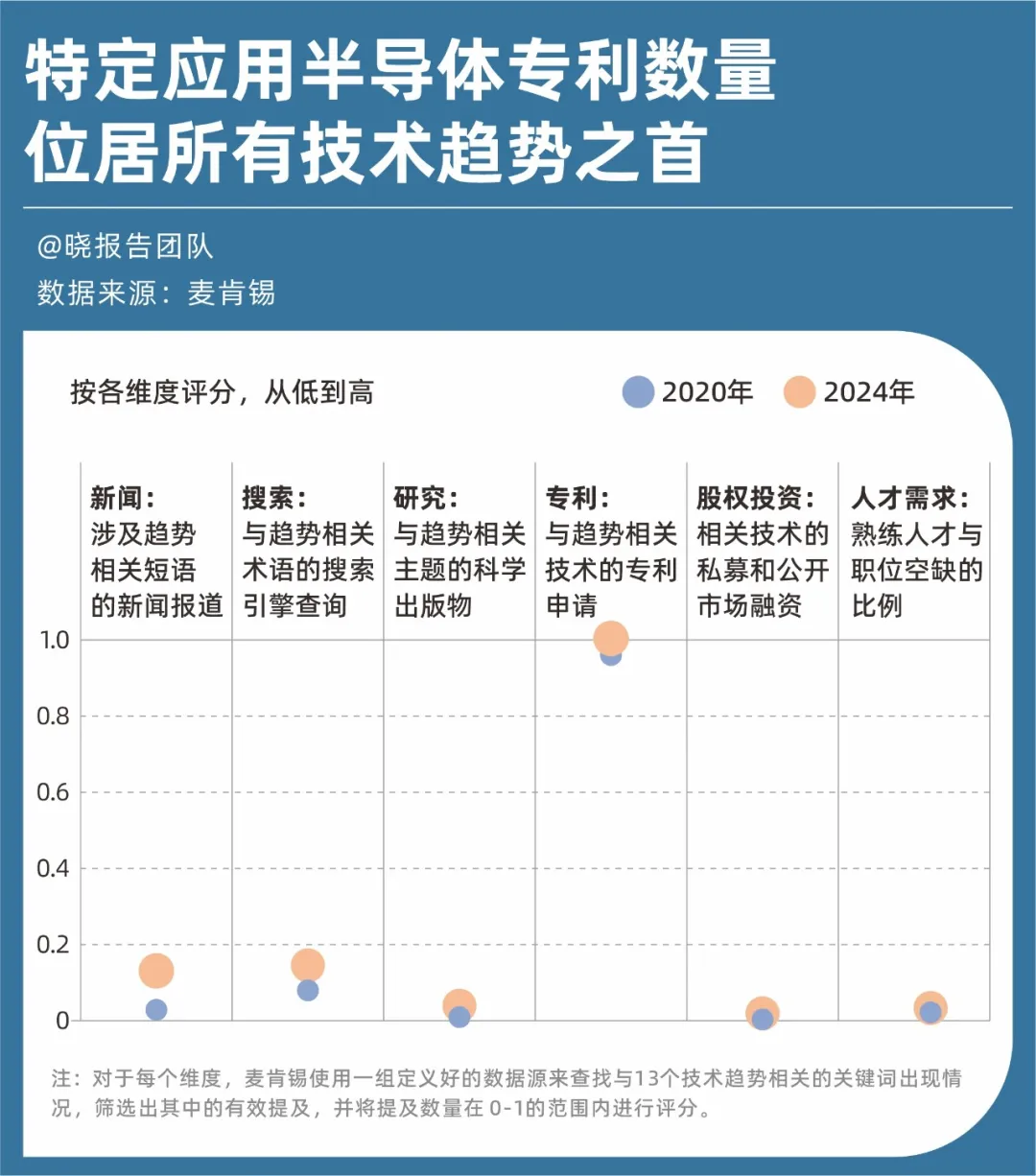

Application-specific semiconductors are highlighted as a major trend. These chips, tailored for AI workloads, have become the “new oil” of tech—leading all technology trends in patent filings and attracting $7.5 billion in investment last year.

AI’s insatiable demand for computing power drives the rise of cloud and edge computing. McKinsey projects that by 2030, global data center capacity demand could triple, with about 70% of that driven by AI workloads.

Advanced connectivity has seen 5G reach 2.25 billion users globally, with China leading in standalone network deployments. 6G is on the horizon, bringing new capabilities like integrated sensing. In immersive reality, AR/VR is expanding from gaming to healthcare and industrial design, with devices like Apple Vision Pro and Meta Quest redefining human-computer interaction. In quantum technology, companies such as Google, IBM, and Microsoft are making breakthroughs in error correction and stability, even as the field remains on the frontier.

These technologies are like the ancient Silk Road’s waystations and roads—while they don’t generate goods directly, they define the scale and boundaries of commerce.

◎ The third category, Advanced Engineering, includes next-gen robotics, future mobility, bioengineering, space technologies, and energy and sustainability. These sectors “materialize” digital capabilities, bringing technology out of the screen and into the real world.

Over the last six decades, robots have become fixtures in advanced manufacturing, with more than 4 million industrial robots at work in sectors like automotive. AI is accelerating the expansion of robotics into airports, large retail, and restaurants. McKinsey partner Ani Kelkar projects this market could reach $900 billion by 2040.

In mobility, China’s electric vehicle market grew 36% even amid global headwinds. Autonomous driving, drone delivery, and air taxis are moving from concept to pilot to commercial reality. By 2034, the commercial drone delivery market is projected to reach $2.9 billion, with a 40% compound annual growth rate.

Bioengineering is harnessing technologies like gene editing and synthetic biology to improve health, enhance human capabilities, transform the food value chain, and create innovative products. CRISPR gene editing has received its first FDA approval, and AI is slashing the cost and time required for drug discovery. The 2024 Nobel Prize in Chemistry went to three scientists using AI to predict protein structures and design new proteins.

In energy and sustainability, China dominates global solar manufacturing and accounts for 60% of global hydrogen electrolyzer capacity. Nuclear power is gaining attention for its stable baseload capability, with 31 countries pledging to triple nuclear capacity by 2050.

Intelligent robotic arms streamline photovoltaic panel manufacturing

Six Key Trends Shaping the Future

McKinsey’s report identifies six major trends that offer a roadmap for tracking these 13 frontier technologies.

① The Rise of Autonomous Systems

Systems are no longer limited to executing commands—they now learn, adapt, and collaborate.

When AI agents can autonomously plan workflows, robots adapt to unfamiliar environments, and self-driving cars navigate complex cities, we must ask: what remains uniquely human? The answer lies in creativity, ethical judgment, and strategic vision—qualities machines struggle to replicate.

Autonomous vehicles are now operating commercially

② New Modes of Human-Machine Collaboration

Human-machine interaction is entering a new era, defined by more natural interfaces, multimodal input, and adaptive intelligence. The line between “operator” and “co-creator” is blurring.

From immersive training environments and haptic robotics to voice-driven copilots and sensor-enabled wearables, technology is becoming increasingly responsive to human intent. This evolution is shifting the paradigm from “machines replacing humans” to “machines augmenting human capabilities.”

③ The Challenge of Scaling

Surging demand for compute-intensive workloads—especially from AI agents, next-gen robotics, and immersive reality—is straining global infrastructure. Power shortages, fragile chip supply chains, and lengthy data center buildouts are real obstacles.

Scaling these technologies requires not only technical and architectural solutions but also addressing talent, policy, and execution challenges. The digital world’s prosperity depends on robust support from the physical world.

Technicians monitor chip production equipment

④ Regional and National Competition

Control of key technologies is now the focal point of global competition. The US and China are locked in fierce rivalry over semiconductors, AI, and quantum computing, while Europe seeks digital sovereignty through regulations like the AI Act.

Technology has become a cornerstone of national security and economic sovereignty, no longer a borderless public good. This environment challenges global collaboration but also encourages regions to develop distinctive strengths.

⑤ Scale and Specialization Advancing in Parallel

Innovation in cloud services and advanced connectivity is driving both scale and specialization. General-purpose model training infrastructure is expanding rapidly in massive, energy-hungry data centers, while edge innovation is accelerating, with low-power tech embedded in phones, cars, home systems, and industrial devices.

This dual-track progress has produced both massive language models and an ever-growing range of domain-specific AI tools capable of operating nearly anywhere.

⑥ The Imperative of Responsible Innovation

As technology grows more powerful and personalized, trust has become the key adoption barrier. Enterprises must now prove their AI models, gene editing, or immersive platforms are transparent, fair, and accountable.

Ethical considerations are no longer just the right thing to do—they are strategic levers that can accelerate or hinder scale, investment, and long-term impact.

Where Are Capital and Talent Headed?

Let’s examine the “financial prospects” and “talent landscape” for these frontier technologies—where are capital and talent converging?

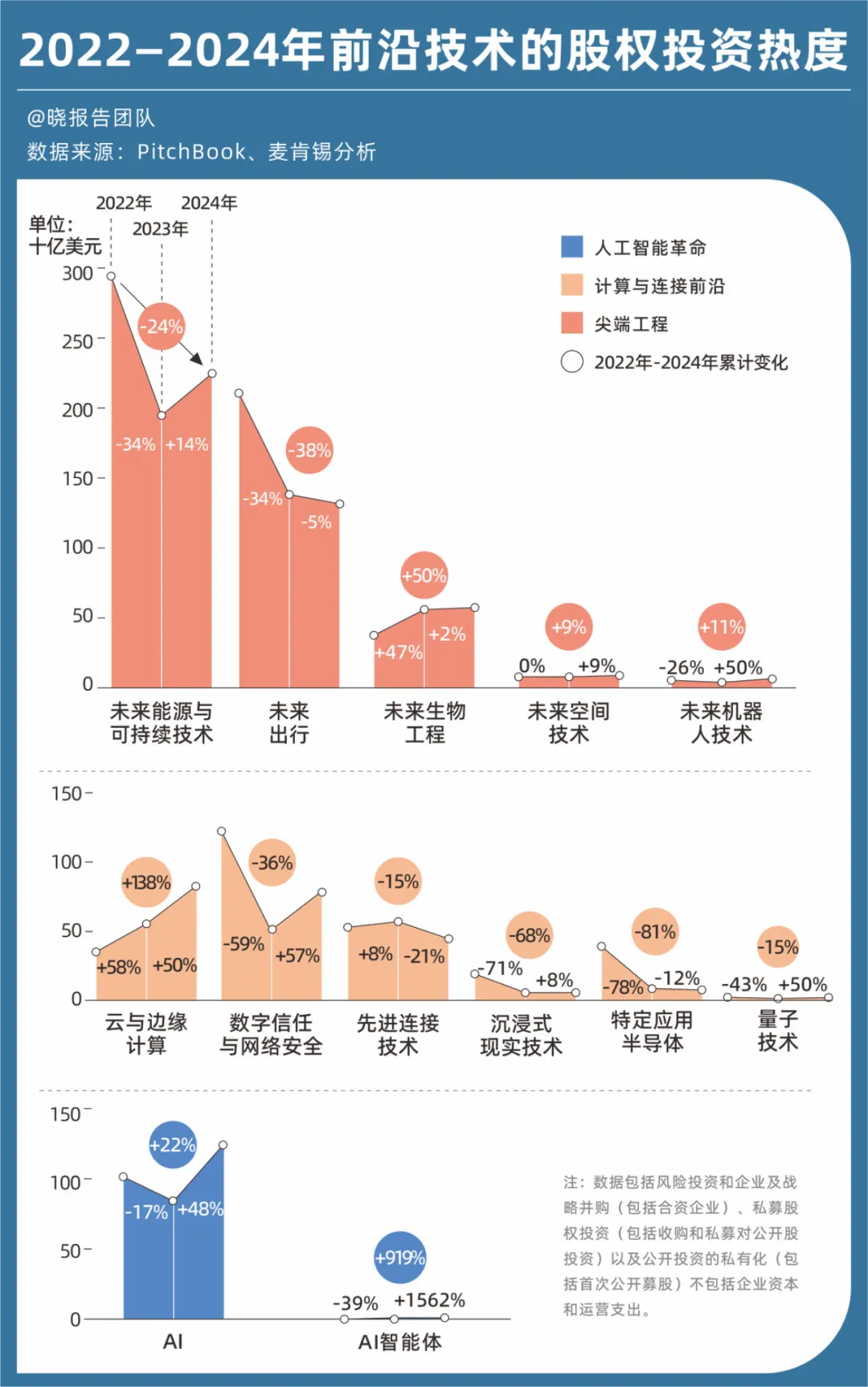

In 2024, investment in these 13 frontier technologies is rising, with AI and cloud/edge computing leading in both scale and growth.

The top five recipients of capital in 2024 are: future energy and sustainability ($223.2 billion), future mobility ($131.6 billion), AI ($124.3 billion), cloud and edge computing ($80.8 billion), and digital trust and cybersecurity ($77.8 billion).

AI agent technology is the fastest-growing segment, with investment up 1,562% in 2024. Future bioengineering and cloud/edge computing have seen funding increase for two consecutive years. After a brief dip, investment in AI and next-gen robotics has rebounded above levels from two years ago.

Alongside capital flows, an intense competition for talent is underway.

McKinsey notes that in 2024, six of the frontier technologies are seeing rising job demand. AI agent roles are up 985%, with AI and application-specific semiconductor roles growing 35% and 22%, respectively. Software engineers are the most in-demand professionals.

These talent demand ratios reveal a stark reality: technology is evolving far faster than talent pipelines. The gap is especially wide in AI and application-specific semiconductors—the most in-demand fields today.

AI’s need for data scientists is most acute, with a supply-demand ratio of just 0.5 (two openings for every candidate). Companies are fiercely competing for professionals skilled in Python for data processing and model building. In application-specific semiconductors, the gap is even wider—there is only one qualified candidate for every ten job openings for experts in GPU architecture and machine learning hardware.

In cross-disciplinary areas like next-gen robotics and bioengineering, demand is rising for hybrid professionals. Next-gen robotics requires both mechanical engineers and AI/software experts, with a 0.2 ratio for those with AI skills. In bioengineering, professionals who can design robotic arms and program them for intelligent grasping are even rarer.

Future energy, sustainability, and space technology—fields shaping humanity’s future—face even sharper shortages. Green skills experts in clean energy and sustainability have a supply-demand ratio below 0.1—fewer than one qualified applicant per ten openings. While overall hiring in space tech may be down, demand for software engineers and Python experts remains strong as daily satellite data volumes soar.

These data points signal that future talent must go beyond coding. The most valuable professionals over the next decade will combine “technology + application,” “software + hardware,” and “algorithm + ethics.”

Conclusion

Looking back from the threshold of this technological era, China finds itself in a complex and nuanced position.

At the application layer, the achievements are striking: broad 5G coverage, high EV penetration, dominance in solar manufacturing, and leadership in commercial drone deployments—these are clear “Chinese advantages.” Yet at the foundational layer, risks remain in semiconductors, foundational AI models, quantum computing, and original biopharma innovation.

Meituan’s drone delivery business is booming

McKinsey’s report offers a key insight: future competition is not about single-point breakthroughs, but about ecosystems, talent pipelines, and values.

Statement:

- This article is republished from [Wu Xiaobo Channel], copyright belongs to the original author [Ba Jiuling]. For any concerns about this republication, please contact the Gate Learn team, who will address them promptly according to established procedures.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Without explicit mention of Gate, reproduction, distribution, or plagiarism of this translated article is prohibited.

Related Articles

Blockchain Profitability & Issuance - Does It Matter?

In-depth Analysis of API3: Unleashing the Oracle Market Disruptor with OVM

An Overview of BlackRock’s BUIDL Tokenized Fund Experiment: Structure, Progress, and Challenges

Smart Money Concepts and ICT Trading

How blockchain interoperability works: A beginner’s guide to cross-chain technology