EagleEye

#ETHTrendWatch

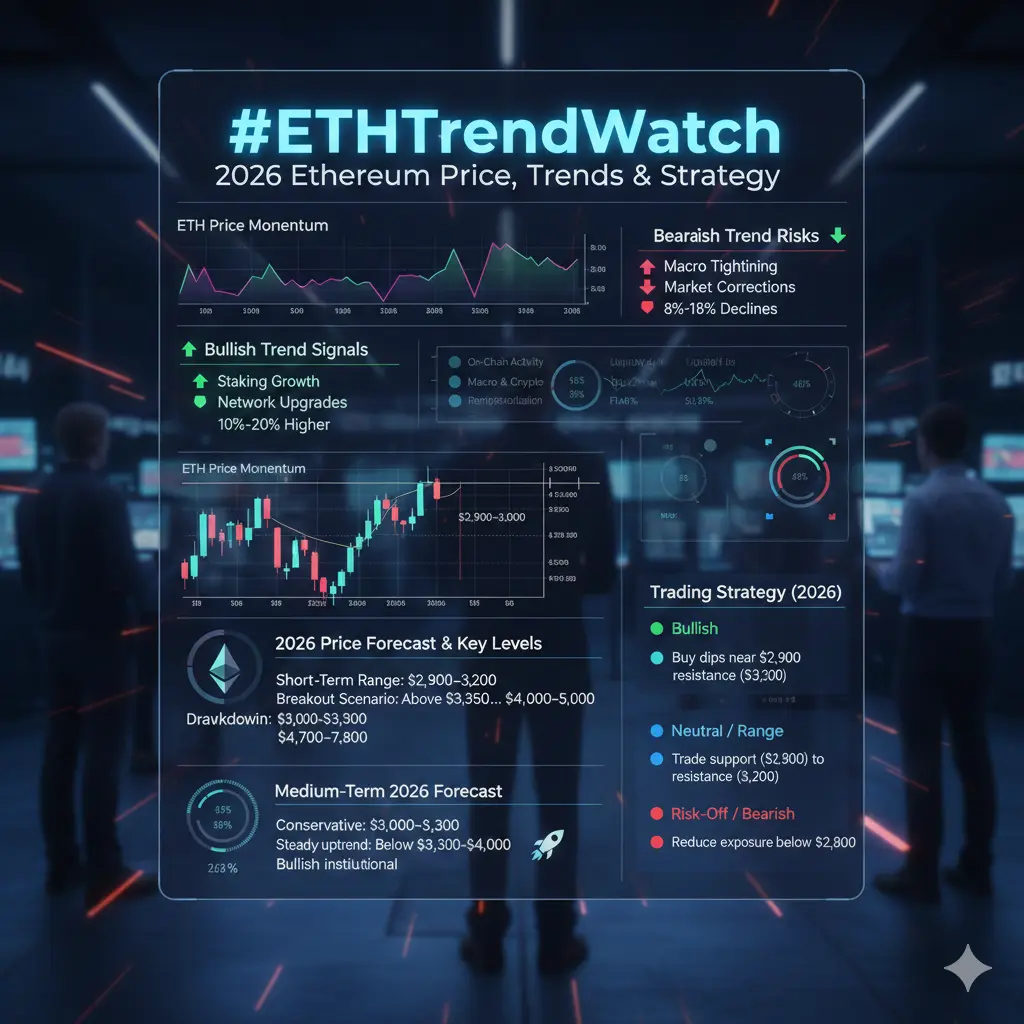

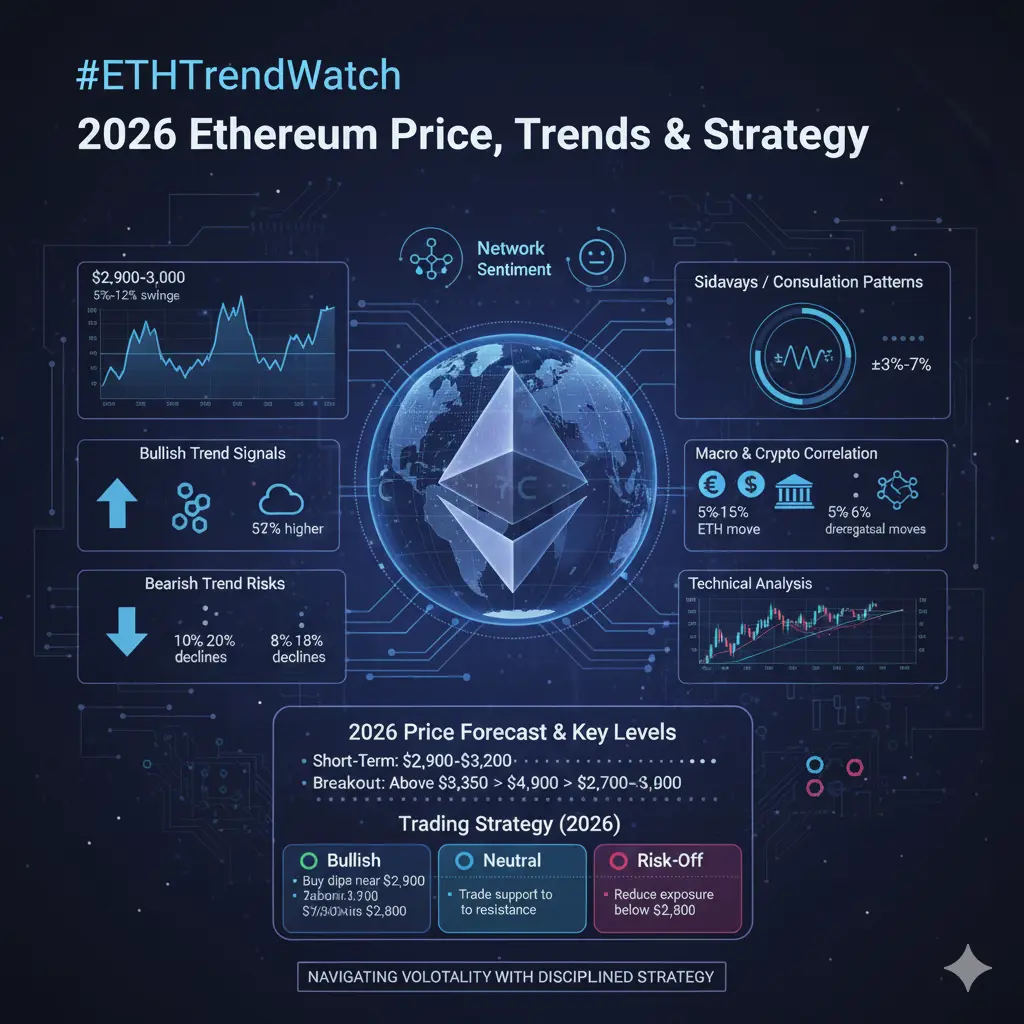

Ethereum’s current market behavior reflects a period of consolidation rather than a deterioration in fundamentals. While near-term price action has been constrained by broader macro uncertainty and fluctuating liquidity conditions, the underlying structure of the Ethereum network continues to strengthen. Activity across the ecosystem remains robust, particularly through the expansion of layer-2 solutions, sustained staking participation, and Ethereum’s role as the primary settlement layer for decentralized finance, tokenized real-world assets, and on-chain applications. These d

Ethereum’s current market behavior reflects a period of consolidation rather than a deterioration in fundamentals. While near-term price action has been constrained by broader macro uncertainty and fluctuating liquidity conditions, the underlying structure of the Ethereum network continues to strengthen. Activity across the ecosystem remains robust, particularly through the expansion of layer-2 solutions, sustained staking participation, and Ethereum’s role as the primary settlement layer for decentralized finance, tokenized real-world assets, and on-chain applications. These d