SingleCycleDAMNXUN

No content yet

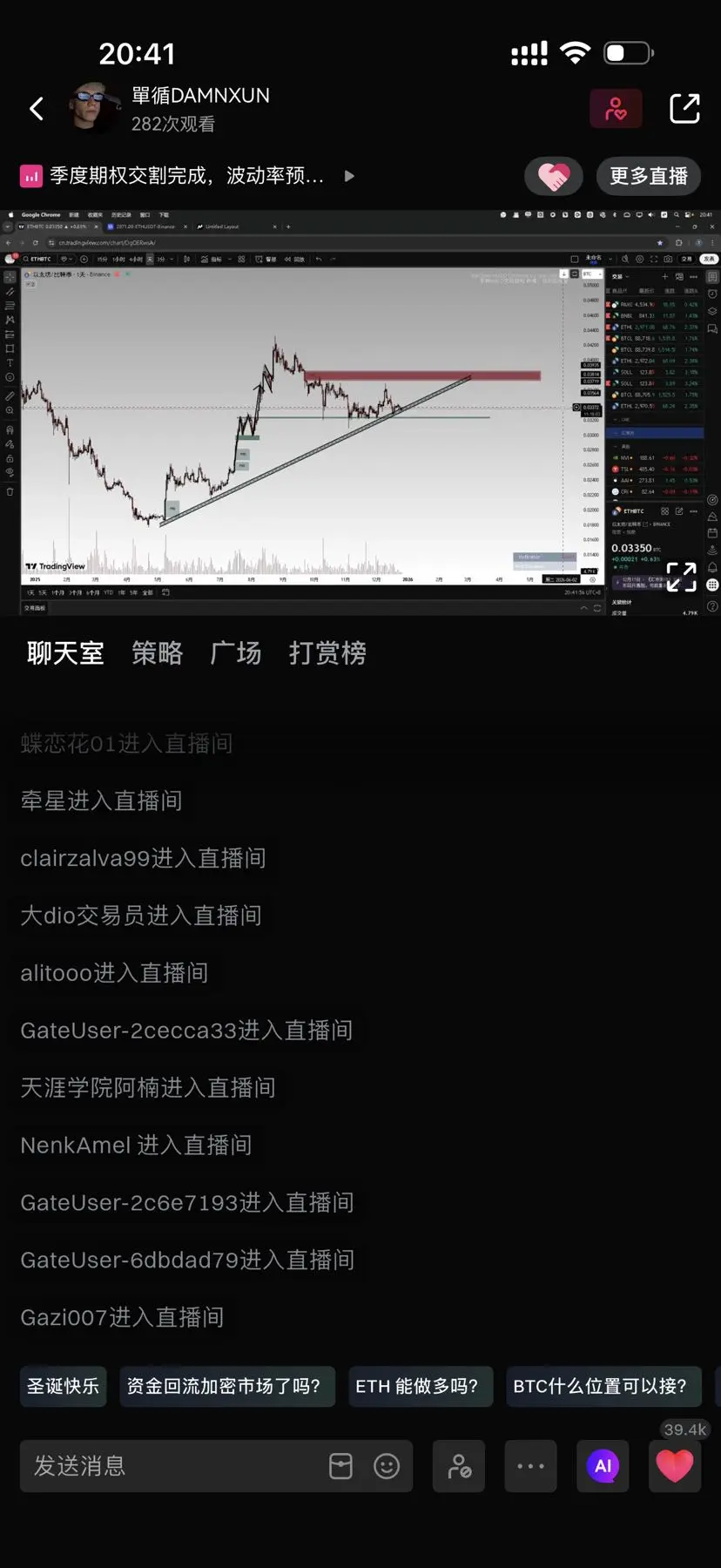

Yesterday, after the ETH long position discussed in the live broadcast was perfectly entered, this wave was basically fully captured.

Then, the BTC 895 short position was also entered. These are the strategies discussed in the live broadcast for over half an hour yesterday.

Currently, the short positions are floating with profits.

Pushing to break even, then observing the 882 and 872 levels.

If it can't go down, then exit; if it can go down, then continue to hold and take more.

View OriginalThen, the BTC 895 short position was also entered. These are the strategies discussed in the live broadcast for over half an hour yesterday.

Currently, the short positions are floating with profits.

Pushing to break even, then observing the 882 and 872 levels.

If it can't go down, then exit; if it can go down, then continue to hold and take more.

- Reward

- 1

- Comment

- Repost

- Share

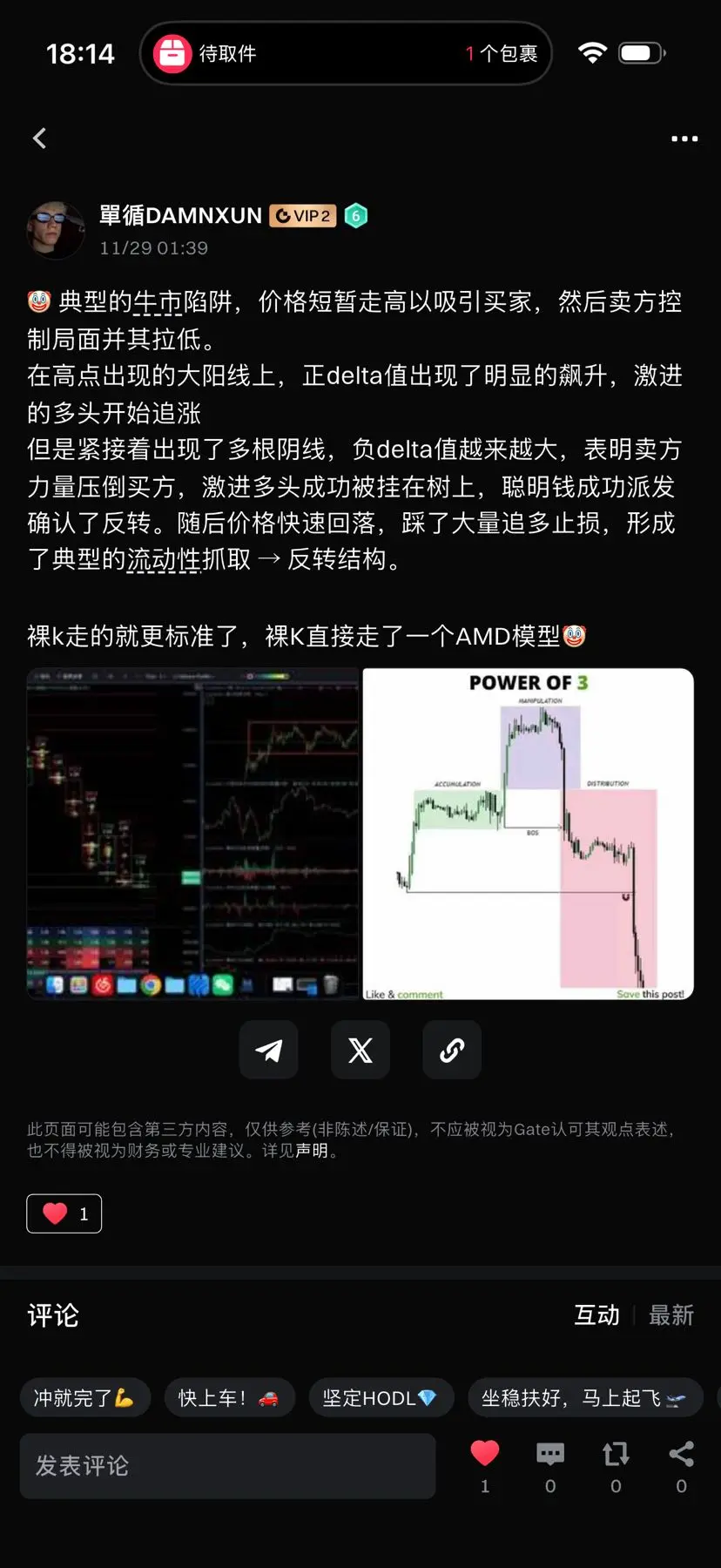

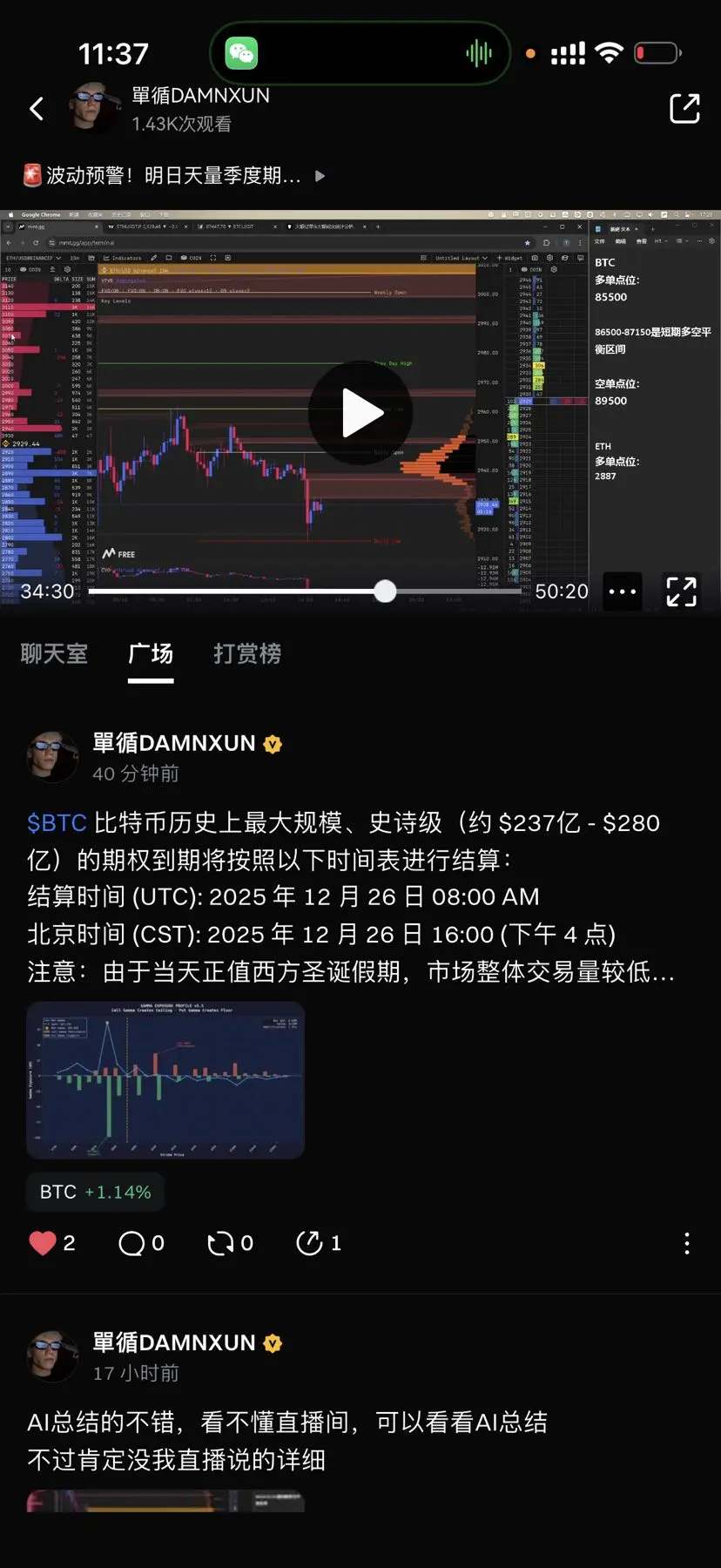

$BTC The largest and most epic options expiration in Bitcoin history (approximately $23.7 billion - $28 billion) will be settled according to the following schedule:

Settlement Time (UTC): December 26, 2025, 08:00 AM

Beijing Time (CST): December 26, 2025, 4:00 PM (4 PM)

Note: Due to the Western Christmas holiday on that day, overall market trading volume is low (liquidity is thin), which may lead to more intense and “strange” volatility before and after the 4:00 PM settlement.

Now, let's look at similar historical situations (Bitcoin's large-scale options expiration market review):

1. December

Settlement Time (UTC): December 26, 2025, 08:00 AM

Beijing Time (CST): December 26, 2025, 4:00 PM (4 PM)

Note: Due to the Western Christmas holiday on that day, overall market trading volume is low (liquidity is thin), which may lead to more intense and “strange” volatility before and after the 4:00 PM settlement.

Now, let's look at similar historical situations (Bitcoin's large-scale options expiration market review):

1. December

BTC1,45%

- Reward

- 2

- Comment

- Repost

- Share

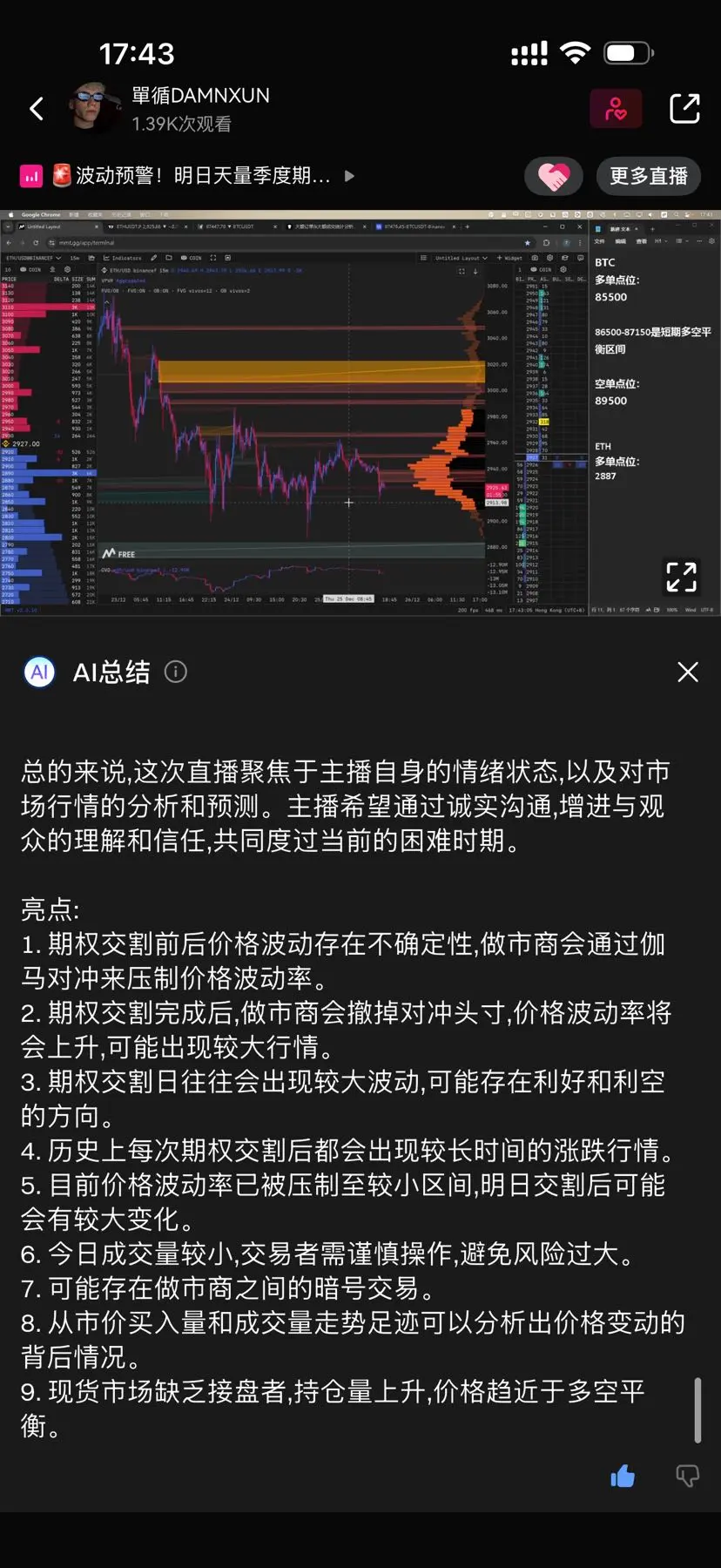

The AI summary is pretty good. I can't understand the live broadcast room, but you can check out the AI summary.

However, it definitely isn't as detailed as what I say in the live broadcast.

View OriginalHowever, it definitely isn't as detailed as what I say in the live broadcast.

- Reward

- 3

- Comment

- Repost

- Share

$BTC Key Price Levels Today (Focus Area)

• Long: 87,150, 85,500

• Short: 86,500

🟢Long Strategy

• 87,150: Price rotates to this level and stabilizes/holds = go long, target returning to the equilibrium zone/previous day's POC (quick profit-taking style).

• 85,500: Only consider if it shows a clear previous day's low sweep + recovery (uSFP) — otherwise, do not chase the knife during holiday行情.

🔴Short Strategy

• 86,500 is the pivot point: Rejected from below/not able to recover = continue shorting, aiming to fill the lower SP area and rotate to lower levels.

Detailed strategies will be explaine

• Long: 87,150, 85,500

• Short: 86,500

🟢Long Strategy

• 87,150: Price rotates to this level and stabilizes/holds = go long, target returning to the equilibrium zone/previous day's POC (quick profit-taking style).

• 85,500: Only consider if it shows a clear previous day's low sweep + recovery (uSFP) — otherwise, do not chase the knife during holiday行情.

🔴Short Strategy

• 86,500 is the pivot point: Rejected from below/not able to recover = continue shorting, aiming to fill the lower SP area and rotate to lower levels.

Detailed strategies will be explaine

BTC1,45%

- Reward

- 1

- Comment

- Repost

- Share

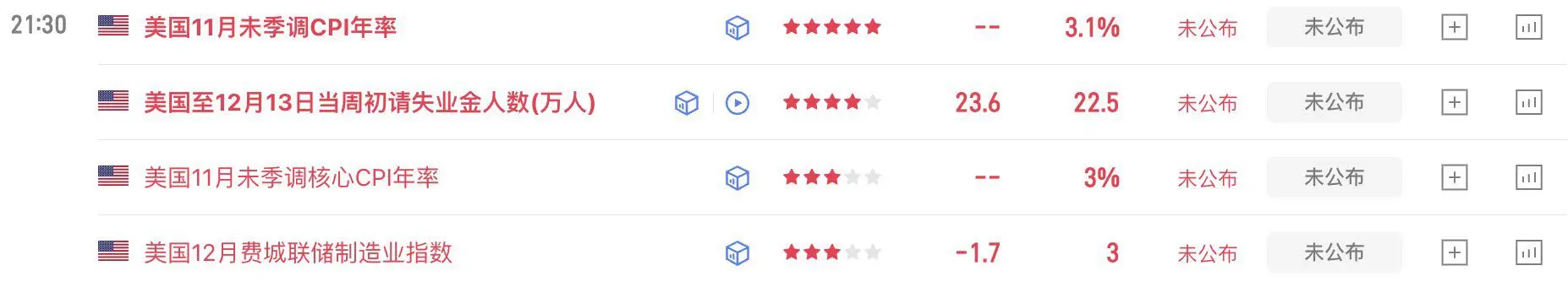

Due to missing data in October, there is no prior data available. The current market expectation is 3.1%. The key focus tonight is whether the CPI data will be in the 20s or 30s.

If the CPI drops to 2.9% or lower, it indicates that inflation is under control from a data perspective, reinforcing the Federal Reserve's continued rate cuts in 2026.

If the CPI is at 3.0% or rebounds to above 3.1%, it may strengthen the narrative of sticky inflation, temper expectations of rate cuts, and cause U.S. Treasury yields to rise. Technology stocks that are sensitive to interest rates may come under pressur

If the CPI drops to 2.9% or lower, it indicates that inflation is under control from a data perspective, reinforcing the Federal Reserve's continued rate cuts in 2026.

If the CPI is at 3.0% or rebounds to above 3.1%, it may strengthen the narrative of sticky inflation, temper expectations of rate cuts, and cause U.S. Treasury yields to rise. Technology stocks that are sensitive to interest rates may come under pressur

BTC1,45%

- Reward

- 1

- Comment

- Repost

- Share

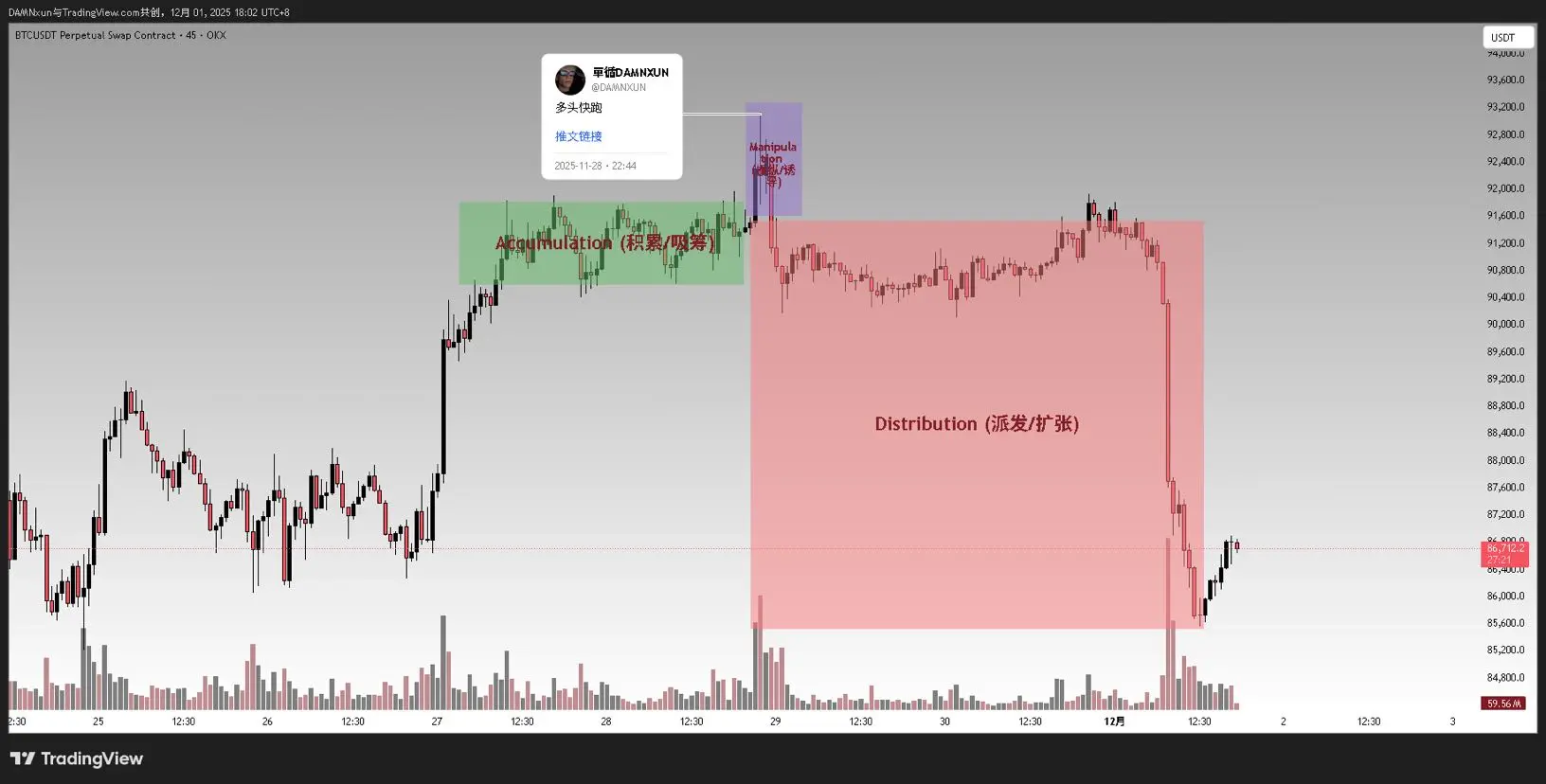

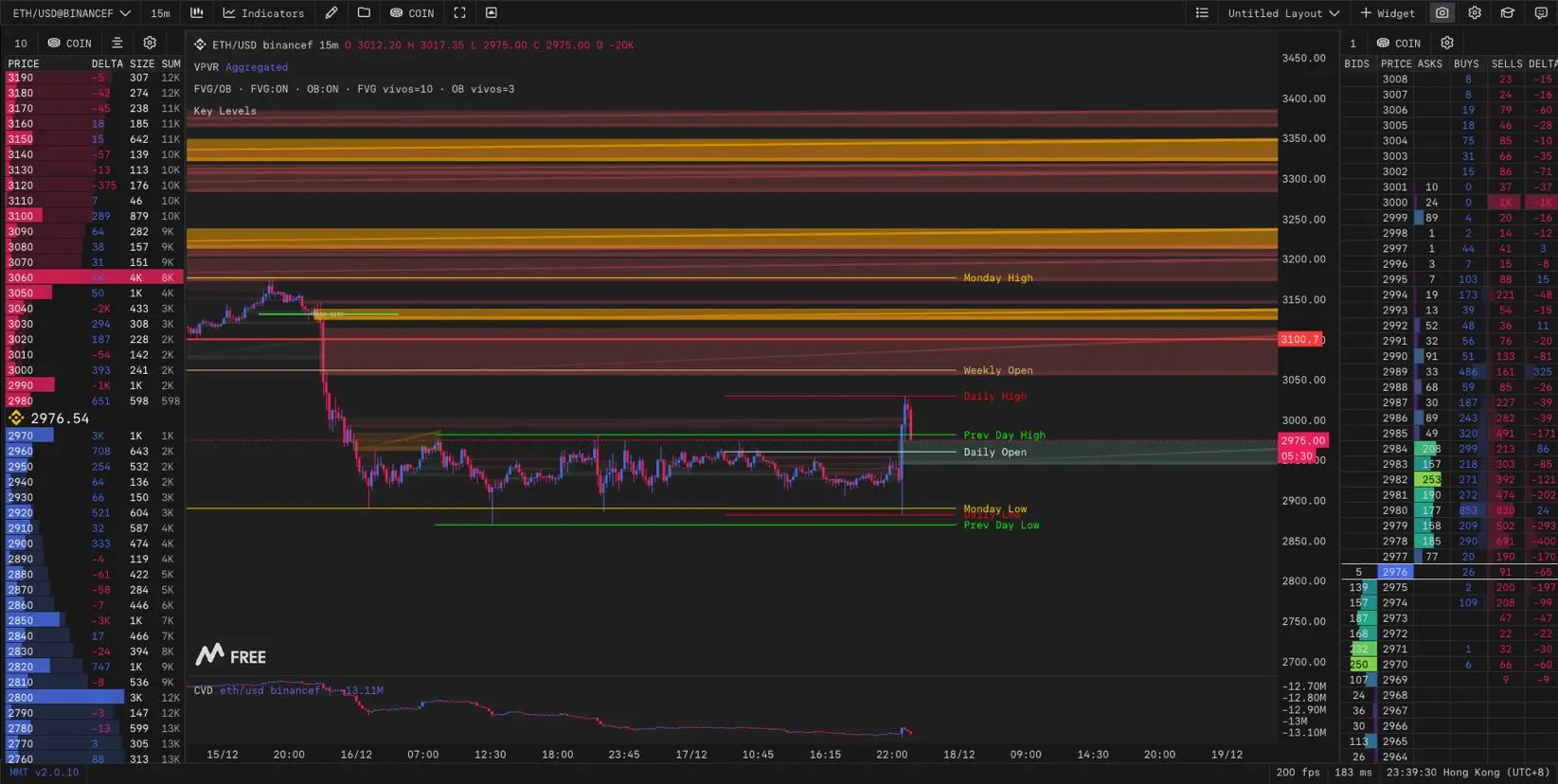

Once again, the strategy was emphasized several times in the live broadcast room.

$ETH quickly recovered after capturing the liquidity at yesterday's low point, directly gaining 130 points.

Basically fully gained.

Clocking out directly!

If you want to follow the exchange for copying trades, you can subscribe directly, or you can earn money by copying trades before subscribing.

$ETH quickly recovered after capturing the liquidity at yesterday's low point, directly gaining 130 points.

Basically fully gained.

Clocking out directly!

If you want to follow the exchange for copying trades, you can subscribe directly, or you can earn money by copying trades before subscribing.

ETH0,99%

- Reward

- 1

- 2

- Repost

- Share

IcedCoffee123 :

:

Just go for it💪View More

🚨Tonight at 21:30, five-star data release

Current structure: Bears still dominate, short-term weak correction possible, but limited in strength. The strategy remains “rebound and short.”

Key levels:

- Resistance: 86500 / 87000 / 87500, strong resistance at 88100-89000

- Support: 85500 (critical); if broken, next support at 84700, further break likely to test 81000; in extreme cases, before the end of the month, testing the major support zone at 76000-74000

Various indicators show no clear bottom signals, still leaning bearish.

Market characteristics: Asian session has low volume, high uncerta

Current structure: Bears still dominate, short-term weak correction possible, but limited in strength. The strategy remains “rebound and short.”

Key levels:

- Resistance: 86500 / 87000 / 87500, strong resistance at 88100-89000

- Support: 85500 (critical); if broken, next support at 84700, further break likely to test 81000; in extreme cases, before the end of the month, testing the major support zone at 76000-74000

Various indicators show no clear bottom signals, still leaning bearish.

Market characteristics: Asian session has low volume, high uncerta

BTC1,45%

- Reward

- 2

- 1

- Repost

- Share

GateUser-1f9c9859 :

:

Hop on board!🚗Last week, Goldman Sachs stated that the RMB is undervalued by 25%,

My first thought upon seeing this news was that this is very likely a move by the US to force the RMB to appreciate,

Why does the US want to force the RMB to appreciate?

China is an export-oriented economy, and a continuous appreciation of the RMB means a shrinking trade surplus,

How to understand the trade surplus:

RMB becoming more expensive = made in China becomes more expensive

RMB becoming cheaper = made in China becomes cheaper

Therefore, RMB appreciation causes Chinese goods to lose their price advantage,

For example,

P

View OriginalMy first thought upon seeing this news was that this is very likely a move by the US to force the RMB to appreciate,

Why does the US want to force the RMB to appreciate?

China is an export-oriented economy, and a continuous appreciation of the RMB means a shrinking trade surplus,

How to understand the trade surplus:

RMB becoming more expensive = made in China becomes more expensive

RMB becoming cheaper = made in China becomes cheaper

Therefore, RMB appreciation causes Chinese goods to lose their price advantage,

For example,

P

- Reward

- 3

- Comment

- Repost

- Share

The live broadcast just finished, and it was a waterfall. You can watch the replay.

View Original

- Reward

- 2

- Comment

- Repost

- Share

$BTC is moving a bit more standard; every time it encounters the POC of the value range I mentioned in my previous post from last week, it gets pushed down again. This time it has been pushed down again, but the difference is that there are fewer sellers at the same position. There is hope for another upward push tonight, but the strategy remains unchanged; otherwise, it provides an opportunity to get on board, and I won't participate in the breakout orders.

BTC1,45%

- Reward

- 4

- Comment

- Repost

- Share

The BTC price touched the previously untested POC of the consolidation value range from the previous week yesterday. This position coincides with the "supply wall" of both Spot and contracts, and the order book depth shows strong selling pressure.

After touching the POC, there has been continuous selling, causing the price to directly break below the recent local range. This morning, there was a false breakdown, but it has now recovered.

Boring market conditions. It's very difficult to trade this kind of small range fluctuation if you look at naked K lines, as the ups and downs are all fal

After touching the POC, there has been continuous selling, causing the price to directly break below the recent local range. This morning, there was a false breakdown, but it has now recovered.

Boring market conditions. It's very difficult to trade this kind of small range fluctuation if you look at naked K lines, as the ups and downs are all fal

BTC1,45%

- Reward

- like

- Comment

- Repost

- Share