diznifigo

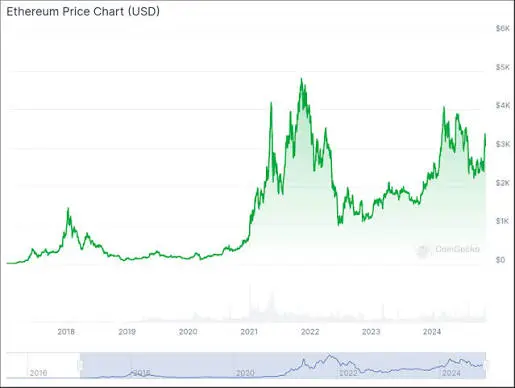

J.P. Morgan recently announced a significant step in its blockchain strategy by transitioning to Ethereum with the launch of its first tokenized money market fund, named My OnChain Net Yield Fund (MONY).

This fund, backed by $100 million of the bank’s own capital, is open to investors with a minimum investment of $1 million, while institutional investors are required to invest at least $25 million.

Key features of the MONY fund:

Tokenization and access: The fund enables institutional and high-profile investors to access short-duration government securities through tokenized assets on the Ethe

This fund, backed by $100 million of the bank’s own capital, is open to investors with a minimum investment of $1 million, while institutional investors are required to invest at least $25 million.

Key features of the MONY fund:

Tokenization and access: The fund enables institutional and high-profile investors to access short-duration government securities through tokenized assets on the Ethe

ETH-3.57%