2025 B2Price Prediction: Market Trends and Investment Opportunities for the Digital Currency

Introduction: B2's Market Position and Investment Value

BSquared Network (B2) as a modular Bitcoin scaling solution, has made significant strides in enhancing Bitcoin's scalability and functionality since its inception. As of 2025, B2's market capitalization has reached $46,761,699.6, with a circulating supply of approximately 46,893,000 tokens, and a price hovering around $0.9972. This asset, known as the "Bitcoin Scaling Innovator," is playing an increasingly crucial role in expanding Bitcoin's ecosystem and capabilities.

This article will provide a comprehensive analysis of B2's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. B2 Price History Review and Current Market Status

B2 Historical Price Evolution

- 2025 June: B2 reached its all-time low of $0.3154, marking a critical point in its price history

- 2025 September: B2 achieved its all-time high of $1.0026, demonstrating significant growth

- 2025 Q3: Rapid price appreciation, with B2 surging over 165% in a 30-day period

B2 Current Market Situation

As of September 30, 2025, B2 is trading at $0.9972, showing strong performance with an 8.16% increase in the last 24 hours. The token has experienced remarkable growth, with a 45.87% increase over the past week and an impressive 165.9% surge in the last 30 days. B2's market capitalization stands at $46,761,699.6, ranking it at 712 in the global cryptocurrency market. The token's 24-hour trading volume is $987,888.714234, indicating active market participation. With a circulating supply of 46,893,000 B2 tokens out of a total supply of 210,000,000, the current market represents about 22.33% of the fully diluted valuation.

Click to view the current B2 market price

B2 Market Sentiment Indicator

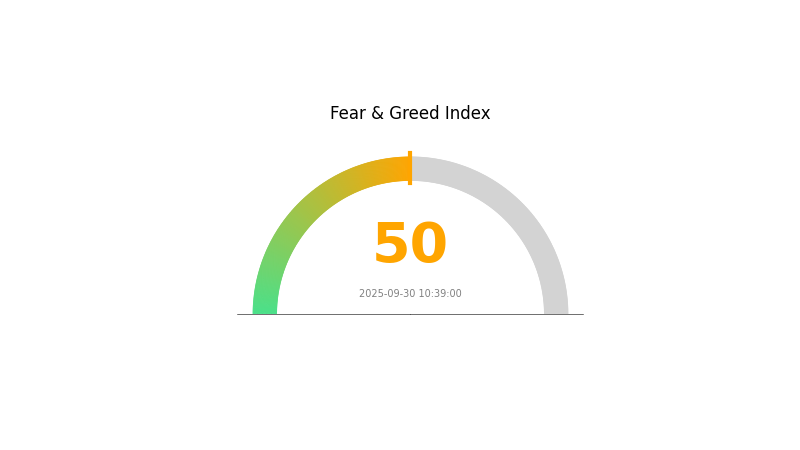

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment is currently balanced, with the Fear and Greed Index at 50, indicating a neutral stance. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic. While some may view this as a period of stability, others might see it as a potential turning point. Traders should remain vigilant, as market conditions can shift rapidly. As always, it's crucial to conduct thorough research and manage risks wisely when making investment decisions in the crypto space.

B2 Holdings Distribution

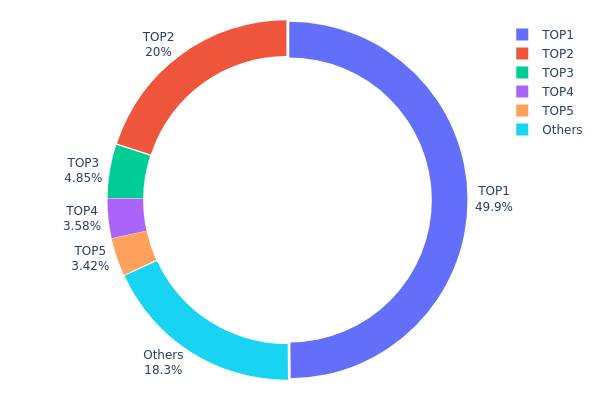

The address holdings distribution chart provides crucial insights into the concentration of B2 tokens among different wallet addresses. Analysis of this data reveals a highly centralized token distribution, with the top 5 addresses controlling 81.71% of the total supply. The largest holder alone possesses nearly half (49.87%) of all B2 tokens, followed by a second address holding 20%.

This level of concentration raises concerns about market stability and potential price manipulation. With such a significant portion of tokens in few hands, large-scale sell-offs or acquisitions by these major holders could lead to extreme price volatility. Furthermore, this centralization may undermine the project's claims of decentralization and could potentially deter new investors worried about market fairness.

The current distribution structure suggests a relatively immature market for B2, with limited circulation among a broader base of users. This concentration may indicate that the token is still in an early adoption phase or that there are significant barriers to wider distribution. As the project evolves, monitoring changes in this distribution will be crucial for assessing improvements in decentralization and overall market health.

Click to view the current B2 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xaf92...6fab9f | 104733.76K | 49.87% |

| 2 | 0xa8ca...6fc67c | 42000.00K | 20.00% |

| 3 | 0xc882...84f071 | 10184.19K | 4.84% |

| 4 | 0x93de...85d976 | 7520.18K | 3.58% |

| 5 | 0x5153...88a90f | 7183.11K | 3.42% |

| - | Others | 38378.77K | 18.29% |

II. Key Factors Affecting Future B2 Prices

Supply Mechanism

- OPEC+ Production: OPEC+ is considering increasing production beyond the planned 137,000 barrels per day for November.

- Historical Pattern: Previous OPEC+ production increases have typically led to downward pressure on oil prices.

- Current Impact: The potential production increase is causing oil prices to drop, with WTI crude futures falling 4% in recent trading.

Institutional and Major Player Dynamics

- Institutional Holdings: ETFs and central banks are becoming major buyers of gold, driving up prices.

- Corporate Adoption: N/A

- National Policies: Some countries are increasing gold holdings to diversify away from the US dollar.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions and potential easing policies are significantly influencing gold prices.

- Inflation Hedging Properties: Gold is seen as an inflation hedge, with prices rising as inflation concerns persist.

- Geopolitical Factors: Global economic uncertainties and geopolitical conflicts are supporting gold prices.

Technical Developments and Ecosystem Building

- Economic Data Releases: US economic indicators, such as GDP and PCE inflation data, are impacting market sentiments and asset prices.

- Federal Reserve Leadership Change: The upcoming change in Federal Reserve leadership in 2026 is creating uncertainty about future monetary policies.

III. B2 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.56783 - $0.9962

- Neutral prediction: $0.9962 - $1.39468

- Optimistic prediction: $1.39468 - $1.50 (requires significant market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $1.21923 - $1.63429

- 2028: $1.39239 - $1.71483

- Key catalysts: Technological advancements, wider industry partnerships, and favorable regulatory developments

2030 Long-term Outlook

- Base scenario: $1.8765 - $2.58956 (assuming steady market growth and continued adoption)

- Optimistic scenario: $2.58956 - $3.00 (assuming strong market performance and widespread integration)

- Transformative scenario: $3.00 - $3.50 (assuming revolutionary use cases and mainstream acceptance)

- 2030-12-31: B2 $2.58956 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.39468 | 0.9962 | 0.56783 | 0 |

| 2026 | 1.39866 | 1.19544 | 0.71726 | 19 |

| 2027 | 1.63429 | 1.29705 | 1.21923 | 30 |

| 2028 | 1.71483 | 1.46567 | 1.39239 | 46 |

| 2029 | 2.16274 | 1.59025 | 1.47893 | 59 |

| 2030 | 2.58956 | 1.8765 | 1.33231 | 88 |

IV. Professional Investment Strategies and Risk Management for B2

B2 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high-risk tolerance and belief in Bitcoin's scaling solutions

- Operational suggestions:

- Accumulate B2 tokens during market dips

- Set a target holding period of at least 2-3 years

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined levels

B2 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate investments across various Bitcoin scaling solutions

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, regularly update software

V. Potential Risks and Challenges for B2

B2 Market Risks

- High volatility: B2 price may experience significant fluctuations

- Competition: Other Bitcoin scaling solutions may gain market share

- Limited adoption: Slow integration with existing Bitcoin infrastructure

B2 Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on Bitcoin-related projects

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws for crypto assets

B2 Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the B2 Rollup system

- Scalability challenges: Unforeseen issues in handling increased transaction volume

- Integration complexity: Difficulties in seamless integration with the Bitcoin network

VI. Conclusion and Actionable Recommendations

B2 Investment Value Assessment

B2 Network presents a promising long-term value proposition as a Bitcoin scaling solution, but carries short-term risks due to market volatility and technical uncertainties.

B2 Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider B2 as part of a diversified crypto portfolio

B2 Trading Participation Methods

- Spot trading: Purchase B2 tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore yield farming opportunities with B2 tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, followed closely by Ethereum. These predictions are based on current market trends and expert analysis.

What is B2 crypto?

B2 crypto is a Bitcoin Layer 2 solution that enhances Bitcoin's capabilities. It aims to improve scalability and efficiency, often referred to as BSquared Network.

How much will Bluzelle coin price be in 2030?

Based on current predictions, Bluzelle coin price could reach around $0.05 by 2030, assuming a 5% annual growth rate.

What is the main goal of the B2 network?

The B2 network aims to enhance Bitcoin's transaction speed and expand its application capabilities, improving scalability and efficiency.

2025 MERL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 B2 Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is BSquared Network (B2) a good investment?: Evaluating the potential and risks of this emerging blockchain platform

What is the Core Value and Risk Analysis of B2 Project in 2025?

2025 MERL Price Prediction: Will This Emerging Crypto Asset Reach New Heights?

Is Stacks (STX) a good investment?: Analyzing the potential of this Bitcoin layer-2 solution

APRO Oracle: Oracle 3.0 Multi-Chain Data Infrastructure

Pi Network Prepares to Launch PiBank Digital Banking and Pi Smart Contracts for Financial Revolution

What is an NFT?

How to Buy Solana: A Step-By-Step Guide

What is Bitcoin and How Does It Work?