2025 BLUAI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of BLUAI

Bluwhale AI (BLUAI) represents Web3's Intelligence Layer—a consumer-powered decentralized AI network where developers and enterprises deploy AI agents to serve financial services for 3.6 million users. Since its token generation event in October 2025, BLUAI has established itself as a pivotal asset within the multi-chain AI infrastructure ecosystem. As of December 23, 2025, BLUAI boasts a market capitalization of $5.3 million with a circulating supply of approximately 1.228 billion tokens, currently trading at $0.004312. Backed by major financial institutions including UOB and SBI Holdings, and supported by leading blockchain ecosystems such as Sui, Arbitrum, Tezos, Cardano, and Movement Labs, BLUAI is positioned as a governance and incentive token driving intelligent financial interactions across Web3.

This report provides a comprehensive analysis of BLUAI's price trajectory through 2030, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

Bluwhale AI (BLUAI) Market Analysis Report

I. BLUAI Price History Review and Current Market Status

BLUAI Historical Price Evolution

- October 26, 2025: Token Generation Event (TGE) launch, reaching all-time high of $0.03763

- December 18, 2025: Price declined to all-time low of $0.004094, marking significant market correction

- December 23, 2025: Current price at $0.004312, representing a 88.54% decline from peak

BLUAI Current Market Situation

As of December 23, 2025, BLUAI is trading at $0.004312, reflecting considerable market volatility since its October launch. The token has experienced a sharp correction from its all-time high of $0.03763, representing an 88.54% decline. Over the past 24 hours, BLUAI has declined by 1.05%, with the hourly change at -0.51% and a 7-day decline of 12.37%. The 30-day performance shows a more pronounced downturn of -41.66%.

The current market capitalization stands at $5,295,136, with a fully diluted valuation of $43,120,000. Trading volume over the past 24 hours reached $155,858.46, reflecting moderate liquidity. The circulating supply comprises 1.228 billion tokens out of a total supply of 10 billion tokens, representing 12.28% circulation ratio. With 40,722 token holders, BLUAI maintains a market dominance of 0.0013%.

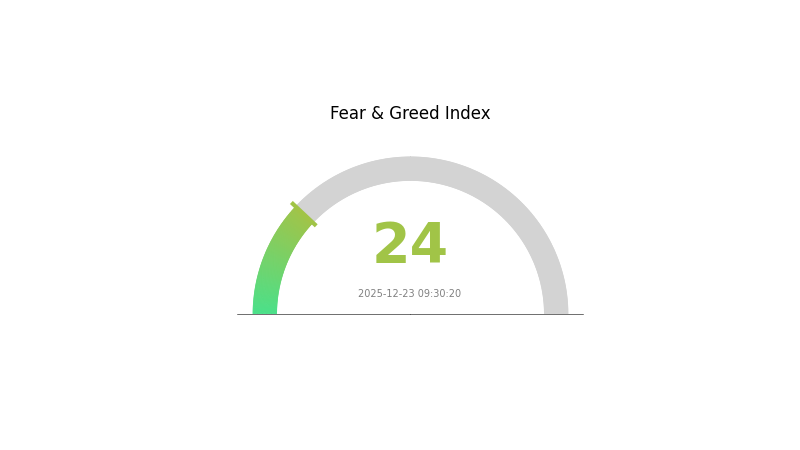

The token's 24-hour trading range spans from $0.004251 to $0.004694. Current market sentiment indicates "Extreme Fear" with a VIX reading of 24, suggesting heightened market uncertainty and risk aversion among crypto investors.

Click to view current BLUAI market price

BLUAI Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as the index plummets to 24. This significant drop signals heightened investor anxiety and risk aversion across the digital asset space. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as panic selling may have created attractive entry points. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitoring sentiment shifts on Gate.com's market data platform can help investors stay informed about potential market turning points and make more strategic positioning decisions.

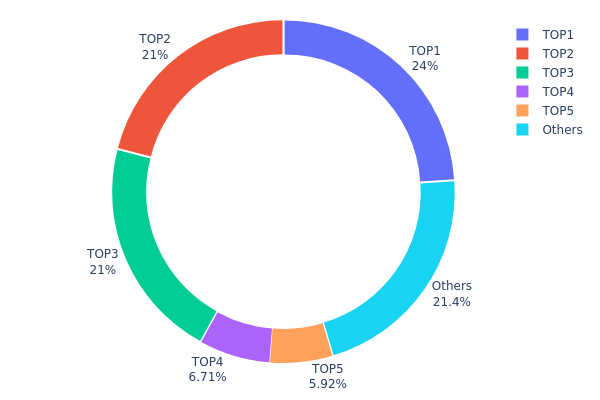

BLUAI Holdings Distribution

The address holdings distribution map provides a granular view of how BLUAI tokens are distributed across the blockchain ecosystem, revealing the concentration levels among major stakeholders and offering critical insights into the token's decentralization structure. By analyzing the top wallet addresses and their respective holding percentages, we can assess market concentration risk, identify potential price influence vectors, and evaluate the overall health of the network's token distribution.

Current analysis of BLUAI's address distribution reveals a notable degree of concentration among top holders. The leading four addresses collectively control approximately 72.65% of all circulating tokens, with the largest address holding 23.95% and the second and third addresses each maintaining 21.00% stakes. This concentration pattern indicates significant centralization risk, as decision-making power regarding the token's future is concentrated among a limited number of entities. However, the presence of a substantial "Others" category accounting for 21.43% of holdings suggests a meaningful distribution beyond the top tier, providing some degree of decentralization buffering against coordinated manipulation.

The existing address distribution structure carries important implications for market dynamics and price stability. High concentration among top holders elevates the potential for significant price volatility should these major stakeholders decide to rebalance their positions. The concentrated nature may also facilitate coordinated actions, though the relatively dispersed secondary holdings provide some market resilience. For investors and market participants monitoring BLUAI, understanding this distribution hierarchy remains essential for evaluating systematic risks and potential scenarios involving major holder activity on platforms such as Gate.com.

View the current BLUAI holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc131...378d65 | 2395833.33K | 23.95% |

| 2 | 0xf91e...660ae7 | 2100000.00K | 21.00% |

| 3 | 0xf137...19be2f | 2100000.00K | 21.00% |

| 4 | 0x6622...0697c9 | 670833.33K | 6.70% |

| 5 | 0xb7a9...bb633d | 592250.00K | 5.92% |

| - | Others | 2141083.33K | 21.43% |

II. Core Factors Affecting BLUAI's Future Price

Institutional and Major Holder Dynamics

- Institutional Capital: Institutional funding is identified as a primary driving factor in BLUAI's price movement, with expectations for the token to enter a growth phase with a projected price range of $0.008031177 - $0.0098564445.

Macroeconomic Environment

-

Market Demand and Regulatory Policy: BLUAI's future price is primarily influenced by market demand, regulatory policy changes, and technological innovation. These factors form the foundation for both short-term price volatility and long-term value support.

-

Market Trends: Market trends serve as key drivers for price movements, working in conjunction with institutional investment flows to determine the token's trajectory.

Technology Development and Ecosystem Building

-

AI and Web3 Integration: BLUAI represents the convergence of artificial intelligence and Web3 technologies, positioning itself within the broader ecosystem of blockchain-based AI solutions. The token's listing on major trading platforms reflects the growing market recognition of this technological intersection.

-

Technical Indicators: Analysis of BLUAI's price movements incorporates technical indicators and fundamental metrics to produce reliable forecasts, with the 200-day moving average serving as a historically significant support and resistance level.

III. 2025-2030 BLUAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00367 - $0.00432

- Neutral Forecast: $0.00432

- Optimistic Forecast: $0.00635 (requiring sustained market sentiment and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with potential growth catalysts emerging

- Price Range Predictions:

- 2026: $0.00464 - $0.00650 (23% potential upside)

- 2027: $0.00468 - $0.00757 (37% potential upside)

- Key Catalysts: Ecosystem expansion, increased adoption metrics, strategic partnerships, and positive market sentiment rotation toward emerging tokens

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00466 - $0.00857 (56% appreciation by 2028, assuming steady market conditions and incremental adoption growth)

- Optimistic Scenario: $0.00689 - $0.00796 (77% appreciation by 2029, assuming accelerated mainstream adoption and breakthrough utility applications)

- Transformational Scenario: $0.00781 - $0.00844 (81% appreciation by 2030, assuming revolutionary protocol enhancements, institutional inflows, and paradigm-shifting market developments)

- 2030-12-31: BLUAI projected at $0.00844 maximum valuation (sustained growth trajectory maintained through decade)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00635 | 0.00432 | 0.00367 | 0 |

| 2026 | 0.0065 | 0.00533 | 0.00464 | 23 |

| 2027 | 0.00757 | 0.00592 | 0.00468 | 37 |

| 2028 | 0.00857 | 0.00675 | 0.00466 | 56 |

| 2029 | 0.00796 | 0.00766 | 0.00689 | 77 |

| 2030 | 0.00844 | 0.00781 | 0.00492 | 81 |

Bluwhale AI (BLUAI) Professional Investment Strategy and Risk Management Report

IV. BLUAI Professional Investment Strategy and Risk Management

BLUAI Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Investors with 12+ month investment horizons who believe in AI-driven decentralized finance infrastructure and Web3 adoption

- Operational Recommendations:

- Accumulate BLUAI during periods of market weakness, particularly when price pulls back below $0.005

- Hold through volatility cycles, as the project is in early adoption phase with significant growth potential across its 3.6 million user base

- Participate in staking opportunities when available to generate yield on holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.004094 (all-time low) and $0.03763 (all-time high) to identify reversal zones

- Volume Analysis: Track 24-hour trading volume patterns around $155,858 to confirm breakout movements and identify liquidity zones

- Wave Trading Key Points:

- Capitalize on the 30-day decline of -41.66% as a potential accumulation phase before recovery

- Use the 7-day -12.37% correction as a tactical entry point for mean reversion trades

BLUAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 5-15% of portfolio allocation (subject to hedge positioning)

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance BLUAI holdings with established blockchain assets and stablecoins to reduce concentration risk

- Position Sizing: Implement strict position limits based on individual risk tolerance, never exceeding loss-bearing capacity

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 wallet for active trading and staking participation

- Cold Storage Strategy: Transfer long-term holdings to secure offline storage to minimize exchange counterparty risk

- Security Considerations: Enable two-factor authentication, use unique passwords, never share private keys, and regularly audit wallet permissions

V. BLUAI Potential Risks and Challenges

BLUAI Market Risk

- Extreme Volatility: The token has experienced -41.66% decline over 30 days, indicating significant price swings that could result in substantial losses

- Low Liquidity Depth: With only $155,858 in 24-hour volume, large trades could face substantial slippage and price impact

- Early-stage Token Risk: As a recently launched token (TGE October 21, 2025), BLUAI lacks extended price history and established market support levels

BLUAI Regulatory Risk

- Evolving Regulatory Landscape: AI-powered financial services in decentralized networks face uncertain regulatory treatment across different jurisdictions

- Compliance Requirements: As the project scales to serve financial services for millions of users, increasing regulatory scrutiny and compliance obligations may impact operations

- Institutional Adoption Barriers: Banking partnerships with UOB and SBI Holdings could be jeopardized by adverse regulatory developments affecting decentralized finance

BLUAI Technical Risk

- Multi-chain Dependency Risk: Operating across multiple blockchains (BSC and SUI) increases technical complexity and potential vulnerabilities across different network implementations

- Smart Contract Risk: Potential bugs or exploits in AI agent deployment infrastructure could compromise user funds or network security

- AI Model Risk: The quality and reliability of AI agents deployed on the network directly impacts user experience and adoption rates

VI. Conclusion and Action Recommendations

BLUAI Investment Value Assessment

Bluwhale AI represents a compelling intersection of artificial intelligence, decentralized finance, and Web3 infrastructure. With backing from major financial institutions (UOB, SBI Holdings) and top-tier blockchain ecosystems (Sui, Arbitrum, Tezos, Cardano), the project demonstrates institutional confidence in its vision. The current valuation of $43.12 million (fully diluted) with 12.28% circulating supply suggests the token remains in early price discovery. However, the -41.66% monthly decline and limited trading liquidity indicate significant volatility and execution risks. Long-term investors should view BLUAI as a high-risk, high-reward opportunity dependent on achieving mass adoption of AI-powered financial services.

BLUAI Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% portfolio allocation) through Gate.com, focus on understanding the Bluwhale ecosystem before increasing exposure, and prioritize secure storage practices

✅ Experienced Investors: Consider 3-5% portfolio allocation with active monitoring of technical levels, participate in staking when available, and use dollar-cost averaging during volatility phases

✅ Institutional Investors: Conduct comprehensive due diligence on Bluwhale's AI agent infrastructure, evaluate partnerships with UOB and SBI Holdings, and structure positions with appropriate hedge ratios

BLUAI Trading Participation Methods

- Spot Trading: Purchase BLUAI directly on Gate.com using BNB (BSC chain) or SUI (SUI chain) for immediate ownership

- Staking Programs: Participate in network staking to earn yield on holdings and support protocol security (when available)

- DCA Strategy: Execute systematic purchases over time on Gate.com to reduce timing risk and average entry prices

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Bluzelle reach $1?

Based on current technical analysis and market forecasts, Bluzelle is projected to reach a peak of approximately $0.153777 by 2034. Reaching $1 is unlikely given current market dynamics and price projections, which remain significantly below that level.

Which AI can predict crypto prices?

Advanced AI models like machine learning algorithms and neural networks can predict crypto prices by analyzing historical data, market trends, and trading volumes. These AI systems process vast datasets to identify patterns and forecast price movements effectively.

What is Bluzelle (BLUAI) and what problem does it solve?

Bluzelle (BLUAI) is a blockchain platform providing secure, decentralized data storage and management. It solves centralized data storage problems by offering a decentralized network of nodes for secure data access, storage, and management across multiple blockchains.

What are the main factors that could affect Bluzelle's price in the future?

Key factors include market adoption by enterprises, regulatory changes, overall crypto market sentiment, trading volume, technological developments, and macroeconomic conditions affecting the broader digital asset ecosystem.

How does Bluzelle compare to other decentralized database solutions?

Bluzelle offers superior blockchain integration, high availability, and low latency for smart contracts. Its scalable architecture and efficient data retrieval distinguish it from competitors like Swarm, providing better performance for decentralized applications.

2025 SWAN Price Prediction: Expert Analysis and Future Market Outlook for Decentralized Finance Token

2025 Crypto Assets Market Analysis: Web3 Development and Blockchain Trends

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Who is Behind the Quantum Financial System

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

QFS Crypto Explained: What the Quantum Financial System Means for Digital Assets

Pi Network Prepares to Launch PiBank Digital Banking and Pi Smart Contracts for Financial Revolution

What is an NFT?

How to Buy Solana: A Step-By-Step Guide

What is Bitcoin and How Does It Work?

PEPE Price Outlook: Analysis and Key Factors