2025 DGMA Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: DGMA's Market Position and Investment Value

daGama (DGMA) is an RWL (Real World Locations) platform that leverages blockchain and AI technology to provide authentic information and trusted recommendations. As of 2025, DGMA has achieved a market capitalization of $43,288,000 with a circulating supply of approximately 50,885,255.93 tokens, maintaining a price around $0.06184. This innovative asset, characterized as a "Post and Earn" mechanism platform, is playing an increasingly critical role in rebuilding trust in online reviews and location-based recommendations within a global community.

The current market dynamics show DGMA experiencing a 24-hour price decline of 5.06%, though this reflects broader market volatility. The token has demonstrated resilience with an all-time high of $0.16689 reached on October 15, 2025, indicating strong market interest in its real-world location verification ecosystem.

This article will comprehensively analyze DGMA's price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for the medium to long term.

daGama (DGMA) Market Analysis Report

I. DGMA Price History Review and Current Market Status

DGMA Historical Price Trajectory

Based on available data as of December 24, 2025, daGama's price movement shows the following key milestones:

- October 15, 2025: All-time high (ATH) reached at $0.16689, representing peak market valuation during the period

- September 25, 2025: All-time low (ATL) established at $0.028, marking the lowest valuation point in the token's trading history

- Recent Performance: From ATH to current levels, DGMA has experienced a significant correction of approximately 62.9% from its peak value

DGMA Current Market Status

Price Performance (As of December 24, 2025 at 20:25 UTC):

DGMA is trading at $0.06184 with the following 24-hour metrics:

| Metric | Value |

|---|---|

| Current Price | $0.06184 |

| 24H Change | -5.06% |

| 1H Change | +0.24% |

| 7D Change | -5.1% |

| 30D Change | -5.19% |

| 1Y Change | -46.15% |

| 24H High | $0.0677 |

| 24H Low | $0.06109 |

Market Capitalization Overview:

- Market Cap (Current): $3,146,744.23

- Fully Diluted Valuation (FDV): $43,288,000.00

- Market Cap to FDV Ratio: 7.27%

- Market Dominance: 0.0013%

Supply Metrics:

- Circulating Supply: 50,885,255.93 DGMA

- Total Supply: 700,000,000 DGMA

- Max Supply: 700,000,000 DGMA

- Circulating Supply Percentage: 7.27%

Trading Activity:

- 24H Trading Volume: $1,419,920.90

- Number of Holders: 2,417

- Market Ranking: #1,835

Technical Details:

- Blockchain: Ethereum (ERC-20)

- Contract Address: 0x4bdfa27ce379d7601da1d15bd637a1cf895ff8fb

- Exchanges Listed: 1

Click to view current DGMA market price

DGMA Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates intense market pessimism and heightened risk aversion among investors. During such periods, market volatility tends to increase significantly, and asset prices may face downward pressure. However, extreme fear often presents opportunities for contrarian investors. Experienced traders typically view such conditions as potential buying opportunities, as markets historically recover from panic-driven lows. Investors should remain cautious yet alert to emerging opportunities on Gate.com, while ensuring proper risk management strategies are in place during this volatile period.

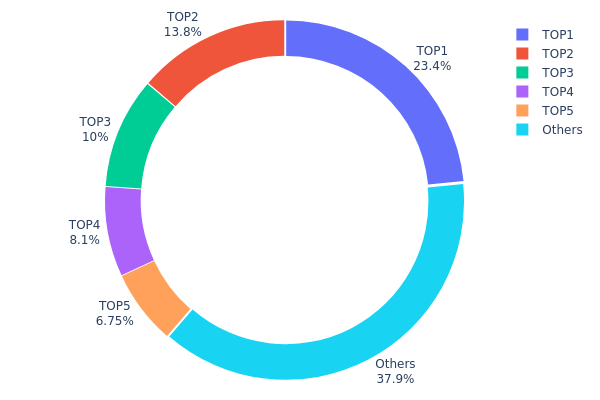

DGMA Address Holdings Distribution

The address holdings distribution represents the concentration of DGMA tokens across different wallet addresses on the blockchain. This metric is crucial for assessing market structure, decentralization levels, and potential systemic risks associated with token concentration. By analyzing the top holders and their respective shareholdings, we can evaluate the token's vulnerability to price manipulation and market volatility.

The current DGMA holdings data reveals a moderately concentrated distribution pattern. The top five addresses collectively control approximately 62.07% of the total token supply, with the largest holder accounting for 23.42% alone. The first address maintains a particularly dominant position with 163,955.56K tokens, while the second-largest holder commands 13.80% of the circulating supply. This concentration level suggests that a relatively small number of entities have significant influence over DGMA's market dynamics. However, the presence of "Others" representing 37.93% of holdings indicates that a substantial portion of tokens remains distributed across numerous smaller addresses, which provides a degree of decentralization balance.

From a market structure perspective, this distribution pattern presents both opportunities and risks. While the top holders' substantial positions could indicate strong institutional or long-term holder interest, the concentration also raises considerations regarding potential price volatility and market depth. The 23.42% held by the leading address represents a level of concentration that merits monitoring, as significant liquidations or accumulation activities from such positions could materially impact market price discovery. The relatively diversified "Others" segment, however, demonstrates that DGMA maintains a reasonably distributed token base, which enhances overall market stability compared to more severely concentrated tokens. This structure suggests a moderate level of decentralization, with the token ecosystem displaying neither excessive concentration risks nor complete fragmentation across holders.

Click to view current DGMA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe93f...0c2844 | 163955.56K | 23.42% |

| 2 | 0xaf44...9bc109 | 96622.17K | 13.80% |

| 3 | 0x717d...a9c7da | 70000.00K | 10.00% |

| 4 | 0xa315...35921c | 56700.00K | 8.10% |

| 5 | 0xc214...9353bf | 47250.00K | 6.75% |

| - | Others | 265472.27K | 37.93% |

II. Core Factors Influencing DGMA's Future Price

Machine Learning Technology Integration

- AI-Driven Innovation: DGMA represents an innovative approach utilizing machine learning methods within the blockchain ecosystem, which distinguishes it from traditional cryptocurrency projects and creates unique value propositions.

Institutional and Whale Dynamics

- Institutional Holdings: Large institutional holdings and trading behavior have significant impact on price movements. Institutional participation level remains a critical factor for price stability and growth trajectory.

- Market Sentiment from Major Players: Whale movements and their trading actions directly influence price volatility, particularly during early trading phases following token launches.

Macroeconomic Environment

- Cryptocurrency Market Correlation: Short-term price fluctuations are primarily influenced by overall market sentiment, especially the performance of Bitcoin and Ethereum. DGMA's price tends to move in correlation with broader cryptocurrency market trends.

- Liquidity and Trading Dynamics: Trading pair liquidity depth directly determines price stability and transaction efficiency. Early-stage trading volume performance plays a crucial role in establishing price foundations.

Market Sentiment and Adoption Factors

- Investor Confidence: Investor sentiment and confidence have direct impacts on DGMA price movements. Market announcements regarding widespread adoption or major technological breakthroughs can significantly influence price direction.

- Profit-Taking Pressure: Following token launches, airdrop profit-taking pressure and buy-side demand create short-term price volatility dynamics that require careful monitoring.

- Regulatory and Technical Development: Price value may experience significant fluctuations due to market conditions, investor sentiment, regulatory developments, and technological progress.

III. 2025-2030 DGMA Price Forecast

2025 Outlook

- Conservative Prediction: $0.05082 - $0.06198

- Neutral Prediction: $0.06198

- Optimistic Prediction: $0.08243 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Perspective

- Market Phase Expectation: Gradual appreciation phase with consolidation patterns, characterized by incremental growth and market maturation

- Price Range Forecast:

- 2026: $0.05054 - $0.09387

- 2027: $0.05148 - $0.10712

- 2028: $0.07226 - $0.10078

- Key Catalysts: Ecosystem expansion, increased adoption metrics, improved liquidity conditions on platforms like Gate.com, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09239 - $0.10968 (assumes stable market conditions and continued project development)

- Optimistic Scenario: $0.10712 - $0.12042 (assumes accelerated adoption and positive market sentiment)

- Transformative Scenario: $0.12042+ (extreme favorable conditions including major partnerships, technological breakthroughs, and sustained bull market dynamics)

- December 24, 2025: DGMA trading at $0.06198 (neutral market positioning with moderate bullish potential through 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08243 | 0.06198 | 0.05082 | 0 |

| 2026 | 0.09387 | 0.07221 | 0.05054 | 16 |

| 2027 | 0.10712 | 0.08304 | 0.05148 | 34 |

| 2028 | 0.10078 | 0.09508 | 0.07226 | 53 |

| 2029 | 0.10968 | 0.09793 | 0.05778 | 58 |

| 2030 | 0.12042 | 0.10381 | 0.09239 | 67 |

daGama (DGMA) Professional Investment Report

IV. DGMA Professional Investment Strategy and Risk Management

DGMA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community participants and believers in the RWL (Real World Locations) ecosystem

- Operational recommendations:

- Accumulate DGMA tokens during market downturns, leveraging the current -5.06% 24-hour decline as a potential entry opportunity

- Hold tokens through platform maturation phases as the ecosystem expands its global community of contributors

- Reinvest rewards earned from platform participation into additional DGMA positions

(2) Active Trading Strategy

- Price movement analysis:

- Monitor the 24-hour price range ($0.06109 - $0.0677) for intraday trading opportunities

- Track the all-time high of $0.16689 (October 15, 2025) as a resistance level for potential recovery targets

- Observe the all-time low of $0.028 (September 25, 2025) as a support level and potential accumulation zone

- Wave operation key points:

- Identify short-term reversals when price approaches the all-time low support level

- Consider resistance breakouts when trading volume exceeds the current 24-hour average of $1,419,920.90

DGMA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 2-3% of portfolio allocation

- Active investors: 5-8% of portfolio allocation

- Professional investors: 10-15% of portfolio allocation

(2) Risk Hedging Solutions

- Dollar-cost averaging (DCA): Distribute purchases over multiple months to reduce timing risk and smooth out price volatility

- Portfolio diversification: Balance DGMA positions with stable and established assets to mitigate concentration risk

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 wallet for frequent trading and platform interaction

- Security considerations: Never share private keys or seed phrases; enable two-factor authentication on all trading accounts; regularly audit wallet transactions for unauthorized activity

V. DGMA Potential Risks and Challenges

DGMA Market Risk

- Price volatility: DGMA has experienced a -46.15% decline over one year and -5.06% in the past 24 hours, indicating significant price instability

- Low market liquidity: With only 1 exchange listing and 24-hour trading volume of approximately $1.42 million, liquidity constraints may limit entry and exit opportunities

- Market dominance pressure: At 0.0013% market dominance, DGMA operates in an extremely competitive environment with limited market influence

DGMA Regulatory Risk

- Jurisdictional uncertainty: Regulatory frameworks for location-based blockchain platforms and "Post and Earn" mechanisms remain underdeveloped in many regions

- Compliance challenges: Data privacy regulations (such as GDPR) may impose additional requirements for a platform collecting real-world location information

- Token classification ambiguity: Regulatory agencies may classify DGMA tokens differently across jurisdictions, affecting trading and holding permissions

DGMA Technology Risk

- Smart contract vulnerabilities: As an ERC-20 token on Ethereum, potential vulnerabilities in contract code could expose user funds to exploitation

- Platform scalability: The multi-level anti-fake verification system may face performance challenges as the global community grows

- Dependence on external data: Reliance on AI technology for authenticity verification introduces operational risks if algorithms fail or produce false positives

VI. Conclusion and Action Recommendations

DGMA Investment Value Assessment

daGama presents a speculative investment opportunity focused on a novel Real World Locations platform combining blockchain, AI, and community-driven recommendations. The project's "Post and Earn" mechanism aligns user incentives with platform growth, which has demonstrated early market interest with 2,417 token holders. However, significant challenges persist: the project commands only 0.0013% market dominance, trades on a single exchange with modest liquidity, and has experienced substantial year-over-year price depreciation. Success depends on achieving substantial user adoption, maintaining content authenticity through its anti-fake system, and navigating complex regulatory landscapes governing location data and token economics. The current valuation reflects high-risk, high-reward characteristics typical of early-stage blockchain projects.

DGMA Investment Recommendations

✅ Beginners: Start with small positions (1-2% of crypto allocation) through Gate.com's user-friendly interface; utilize dollar-cost averaging over 3-6 months to reduce timing risk; focus on understanding the platform's core value proposition before increasing exposure

✅ Experienced investors: Conduct thorough technical analysis using on-chain metrics and trading volume patterns; consider tactical accumulation during support level tests near the all-time low; evaluate the project roadmap and team execution capabilities regularly

✅ Institutional investors: Request detailed information on the project's tokenomics, roadmap milestones, and competitive positioning; assess the platform's ability to achieve network effects and user retention; evaluate regulatory compliance frameworks before institutional allocation

DGMA Trading Participation Methods

- Direct purchase via Gate.com: Create an account, complete KYC verification, and trade DGMA directly through the platform's spot trading interface

- Participation through platform rewards: Engage with the daGama RWL platform to earn DGMA tokens via the "Post and Earn" mechanism by sharing authentic location-based recommendations

- Smart contract interaction: Directly interact with the DGMA smart contract (0x4bdfa27ce379d7601da1d15bd637a1cf895ff8fb) on Ethereum for advanced users seeking programmatic trading or integration opportunities

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose.

FAQ

What is DGMA and what is its current market price?

DGMA is DaGama World, a cryptocurrency token. Its current market price is $0.07616 per DGMA as of December 24, 2025, with a growing trading volume in the market.

What factors could influence DGMA price in the future?

DGMA price could be influenced by supply and demand dynamics, investor sentiment, market speculation, regulatory changes, trading volume, and broader economic trends in the crypto market.

Will DGMA reach $1 in the next 12 months?

DGMA is not expected to reach $1 in the next 12 months. Based on current price predictions, DGMA would require significant growth and is projected to reach $1 around 2046.

What is the price prediction for DGMA by 2025?

Based on market analysis, DGMA price is predicted to range between $0.060891 and $0.080116 by 2025. This forecast reflects current market trends and technical indicators as of December 2025.

How does DGMA compare to similar projects in terms of price potential?

DGMA has demonstrated strong price potential ranging from $0.028 to $0.137, outperforming comparable projects like ADA in the current market cycle. Its innovative technology and market positioning suggest competitive upside potential going forward.

2025 TAO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Ecosystem

2025 FET Price Prediction: Bullish Trends and Key Factors Driving Fetch.ai's Future Value

Is Bittensor (TAO) a good investment?: Analyzing the potential and risks of this AI-powered cryptocurrency

Is Act I: The AI Prophecy (ACT) a Good Investment?: Analyzing Risks and Potential Returns in the Emerging AI Token Market

What is AITECH: Exploring the Frontier of Artificial Intelligence Technology

2025 IQPrice Prediction: Analyzing Market Trends and Growth Potential for the Next Bull Cycle

Is Web3 Dead?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community