2025 DMC Price Prediction: Expert Analysis and Market Forecast for the Digital Media Chain Token

Introduction: DMC's Market Position and Investment Value

DeLorean (DMC) serves as the official Web3 token of the DeLorean Motor Company, representing a unique convergence of automotive innovation and blockchain technology. As the fundamental asset of the DeLorean ecosystem, DMC has emerged as a bridge connecting tokenized electric vehicles with on-chain vehicle reservation, trading, and analytics systems. As of December 2025, DMC has achieved a market capitalization of approximately $3.32 million, with a circulating supply of 2.71 billion tokens trading at around $0.001226. This distinctive asset, often recognized as the "tokenized automotive revolution," is increasingly playing a critical role in the digital transformation of vehicle ownership, maintenance tracking, and transparent asset management through immutable blockchain records.

This comprehensive analysis will examine DMC's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development milestones, and macroeconomic factors to provide investors with data-driven price forecasts and actionable investment strategies.

I. DMC Price History Review and Market Status

DMC Historical Price Evolution Trajectory

DeLorean (DMC) reached its all-time high of $0.014002 on June 24, 2025, representing a significant peak in investor sentiment and market valuation. The token subsequently experienced a notable decline, reaching its all-time low of $0.001082 on October 10, 2025. This substantial drawdown from peak to trough reflects a correction of approximately 92.3%, highlighting the volatility characteristic of emerging blockchain-based projects in their early market phases.

DMC Current Market Status

As of December 24, 2025, DMC is trading at $0.001226, reflecting a 12.3% recovery from its all-time low established in October. The token's current market capitalization stands at $3.32 million with a fully diluted valuation of $15.69 million, positioning it at rank 1800 in the overall cryptocurrency market by market capitalization.

The 24-hour trading volume reached $120,811.49, indicating moderate liquidity in the market. Recent price performance shows short-term pressure: the token declined 0.24% over the past hour, 3.38% over the last 24 hours, and 4.37% over the past week. Over the 30-day period, DMC has experienced a more pronounced decline of 37.94%, reflecting broader market headwinds affecting the asset class.

With a circulating supply of approximately 2.71 billion tokens against a total supply of 12.8 billion tokens, the circulating tokens represent 21.16% of the total supply. DMC is currently listed on 17 cryptocurrency exchanges, providing market participants with multiple trading venues. The token operates on the Sui blockchain, leveraging its infrastructure for transactions and smart contract functionality.

Market sentiment indicators suggest extreme fear conditions with a VIX reading of 24, reflecting heightened market uncertainty and risk aversion among investors.

Click to view current DMC market price

DMC Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates heightened market anxiety and significant risk aversion among investors. During such periods, market volatility tends to increase, presenting both challenges and opportunities. Cautious investors may consider dollar-cost averaging strategies, while experienced traders might explore selective opportunities. It's crucial to maintain a disciplined approach and avoid panic-driven decisions. Monitor key support levels and market developments closely to identify potential turning points as sentiment normalizes.

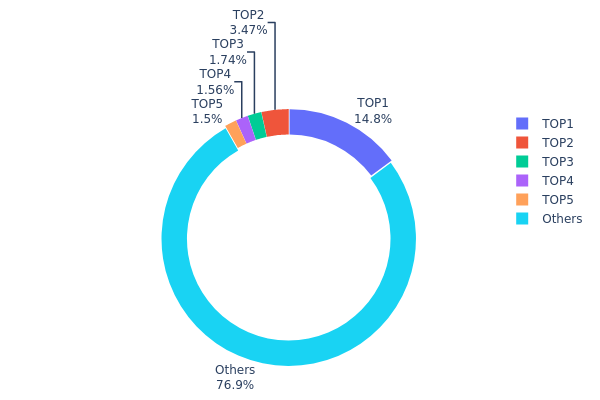

DMC Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across the blockchain network by displaying the cumulative holdings of top addresses and their respective percentages of total supply. This metric serves as a critical indicator for assessing the decentralization level, market structure stability, and potential vulnerability to price manipulation within the DMC ecosystem.

Analysis of the current holding distribution reveals a moderately concentrated ownership structure. The top address commands 14.82% of total supply, while the top five addresses collectively hold approximately 23.08% of all DMC tokens in circulation. This level of concentration, while notable, does not indicate severe over-centralization at the top tier. The majority of the token supply—76.92%—remains distributed among a broader base of addresses, suggesting a relatively healthy dispersal of ownership across the network. The distribution pattern demonstrates a gradual decline in holdings across the top five addresses, indicating no single entity possesses dominant control.

The current address distribution presents moderate implications for market dynamics. While the top holder's substantial position could theoretically influence price movements through large-scale transactions, the significant portion held by the "Others" category provides meaningful market depth and potential resistance to manipulation. This distributed structure enhances market resilience and suggests a relatively mature token ecosystem with diverse stakeholder participation. The balance between concentrated holdings among key addresses and broader community ownership indicates that DMC maintains a reasonable degree of decentralization, supporting both network security and market stability while preserving opportunities for organic price discovery through competitive market forces.

Click to view current DMC holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8784...fcd2b1 | 1896977.98K | 14.82% |

| 2 | 0x35de...7bc835 | 443539.08K | 3.46% |

| 3 | 0x3a15...0b36b7 | 223100.18K | 1.74% |

| 4 | 0x22d6...2d008f | 200000.01K | 1.56% |

| 5 | 0x9cd9...326af9 | 192009.20K | 1.50% |

| - | Others | 9844373.56K | 76.92% |

II. Core Factors Affecting DMC's Future Price

Supply Mechanism

-

Production Capacity Expansion: DMC production capacity in China reached 147.6 million tons as of June 2022, growing 17.5% from end of 2021, with an additional 2 million tons of capacity planned for the second half of 2022. The 2019-2021 compound annual growth rate was 47.8%.

-

Historical Pattern: In 2022, DMC supply grew rapidly with cumulative production reaching 459,000 tons in the first half (up 44.4% year-over-year), while production in the organic silicone sector reached 1.6784 million tons cumulatively by November 2022 (up 29.58% year-over-year). This rapid supply growth, combined with weakening downstream demand, led to significant price declines in 2022.

-

Current Impact: As of 2025, the organic silicone industry achieved production reduction consensus in November, building on existing reduction measures from April. This supply contraction became a core driver of DMC price increases in Q4, with prices rising over 23% during the period. However, 2023-2025 saw industry overcapacity issues, with domestic monomer operating capacity reaching 540 million tons in early 2024 and 680 million tons by early 2025 (a 25% increase), causing DMC prices to fall to enterprise complete cost levels.

Downstream Demand Drivers

-

Primary Applications: DMC's main downstream sectors are polycarbonate (PC) at 35% and lithium battery electrolyte at 25%. PC production capacity surged with a 2017-2021 compound annual growth rate of 31.8%, reaching 265 million tons by 2021. Electrolyte shipments accelerated dramatically, reaching 20.1 million tons in the first half of 2021 alone (up 152% year-over-year).

-

Growth Catalysts: Under China's "dual carbon" targets, the lithium battery industry and new energy vehicle sectors experienced rapid development, maintaining high growth momentum for electrolyte demand and subsequently driving DMC consumption upward.

-

Inventory Dynamics: As of July 1, 2022, total DMC inventory stood at 5,000 tons, down 21.9% weekly and 51.8% from early May, representing historically median levels. Export volumes grew 16.2% year-over-year in May 2022, reflecting strong international demand.

Three、2025-2030 DMC Price Forecast

2025 Outlook

- Conservative Forecast: $0.00065 - $0.00122

- Neutral Forecast: $0.00122

- Bullish Forecast: $0.00179 (requires sustained market interest and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation, characterized by increased institutional adoption and ecosystem expansion

- Price Range Forecast:

- 2026: $0.00134 - $0.00167

- 2027: $0.00132 - $0.00179

- Key Catalysts: Technology upgrades, partnership announcements, increased trading volume on platforms like Gate.com, and growing adoption within the DeFi ecosystem

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00152 - $0.00211 (assumes steady network growth and moderate market expansion)

- Bullish Scenario: $0.00200 - $0.00218 (assumes accelerated adoption, successful protocol upgrades, and favorable macroeconomic conditions)

- Transformational Scenario: Above $0.00218 (extreme positive conditions including major institutional inflows, significant use case expansion, and market cycle peak)

- 2030-12-31: DMC reaches approximately $0.00218 at projected peak (anticipated cumulative gain of 59% from 2025 baseline)

Note: These forecasts are based on predictive models and should be considered alongside current market conditions and individual risk tolerance. Investors are advised to conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00179 | 0.00122 | 0.00065 | 0 |

| 2026 | 0.00167 | 0.00151 | 0.00134 | 22 |

| 2027 | 0.00179 | 0.00159 | 0.00132 | 29 |

| 2028 | 0.00211 | 0.00169 | 0.001 | 38 |

| 2029 | 0.002 | 0.0019 | 0.00126 | 55 |

| 2030 | 0.00218 | 0.00195 | 0.00152 | 59 |

DeLorean (DMC) Professional Investment Strategy and Risk Management Report

IV. DMC Professional Investment Strategy and Risk Management

DMC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Brand enthusiasts, long-term technology believers, and investors seeking exposure to tokenized vehicle ecosystems

- Operational Recommendations:

- Accumulate DMC tokens during market pullbacks, particularly during periods of high volatility below the 30-day moving average

- Monitor the development progress of DeLorean's tokenized electric vehicle launch and on-chain reservation system milestones

- Set a medium-term holding period of 12-24 months to capture potential value appreciation as the protocol ecosystem matures

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price zones at $0.001082 (historical low) and $0.014002 (all-time high) for entry and exit decisions

- Volume Analysis: Monitor the 24-hour trading volume of approximately $120,811 to assess liquidity conditions and trend strength

- Wave Trading Key Points:

- Execute short-term trades around resistance levels when positive sentiment indicators emerge

- Use the recent 24-hour price decline of -3.38% as a potential buying opportunity for mean reversion strategies

DMC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation to DMC

- Active Investors: 3-5% portfolio allocation to DMC

- Professional Investors: 5-10% portfolio allocation to DMC

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Distribute DMC purchases evenly over multiple entry points to reduce timing risk and smooth out price volatility impacts

- Position Sizing: Maintain strict position limits aligned with personal risk tolerance, never exceeding 10% of total portfolio value in any single speculative token

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 wallet is recommended for active trading, providing secure asset management with easy accessibility

- Cold Storage Strategy: For long-term holdings, consider transferring DMC to secure SUI network wallets with hardware backup capabilities

- Security Precautions: Never share private keys or recovery phrases, enable two-factor authentication on all exchange accounts, and regularly verify wallet addresses before transfers

V. DMC Potential Risks and Challenges

DMC Market Risk

- Early-stage Project Volatility: DMC is a relatively new token in the market (published December 24, 2025), exhibiting high volatility with a 30-day decline of -37.94%, characteristic of early-stage cryptocurrency projects

- Liquidity Risk: With limited trading volume of approximately $120,811 in 24 hours and presence on only 17 exchanges, liquidity conditions may constrain large position entries or exits

- Market Sentiment Risk: Low market dominance of 0.00049% indicates minimal market recognition, making DMC susceptible to sentiment-driven price swings and potential sudden downturns

DMC Regulatory Risk

- Unclear Legal Status of Tokenized Vehicles: The regulatory framework for tokenized electric vehicles and on-chain vehicle ownership remains largely undefined in most jurisdictions

- Compliance Uncertainty: DeLorean Motors' integration with Web3 protocols may face regulatory scrutiny regarding vehicle ownership, title transfer, and liability in various countries

- Policy Changes: Future cryptocurrency or vehicle industry regulations could substantially impact DMC's utility and adoption rates

DMC Technology Risk

- SUI Network Dependency: DMC operates on the Sui blockchain; any technical issues, security vulnerabilities, or network disruptions could directly impact token functionality

- Protocol Implementation Risk: The success of DeLorean's on-chain reservation and marketplace system depends on flawless technical execution and seamless integration with real-world vehicle operations

- Scalability Concerns: As adoption grows, the DeLorean Protocol must maintain performance standards for handling increasing transaction volumes on the Sui network

VI. Conclusion and Action Recommendations

DMC Investment Value Assessment

DeLorean (DMC) represents a high-risk, high-potential-reward opportunity at the intersection of automotive innovation and blockchain technology. The project's unique value proposition—creating the world's first tokenized electric vehicle ecosystem—offers compelling long-term narrative potential. However, the token's early-stage status, minimal market penetration (ranked 1800 by market cap), significant recent price decline (-37.94% in 30 days), and limited trading liquidity present substantial challenges. The fully diluted valuation of $15.69 million against a total supply of 12.8 billion tokens indicates considerable downside risk if adoption fails to materialize. Investors should approach DMC primarily as a speculative position within a diversified portfolio rather than a core holding.

DMC Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% of portfolio) using dollar-cost averaging on Gate.com platform, focusing on understanding the DeLorean ecosystem before increasing exposure. Monitor protocol development announcements closely.

✅ Experienced Investors: Consider 2-5% allocations with active management strategies, utilizing technical analysis around key support levels ($0.001082) and resistance levels ($0.014002). Implement stop-loss orders at 20-25% below entry points to manage downside risk.

✅ Institutional Investors: Conduct deep due diligence on DeLorean Motors' vehicle development timeline, regulatory approvals, and partnership agreements before considering meaningful allocations. Consider involvement primarily through direct partnerships with DeLorean Labs rather than public token markets.

DMC Trading Participation Methods

- Gate.com Exchange: Register on Gate.com to access DMC trading pairs with spot trading and marginal leverage options for active traders

- SUI Network Direct Purchase: Use Sui network-compatible wallets to participate in potential ecosystem activities when the DeLorean marketplace and reservation systems launch

- Community Participation: Engage with DeLorean Labs through their official Discord and social channels to stay informed about protocol developments and future opportunities

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the prediction for the DeLorean coin?

Based on market analysis and technical indicators, DeLorean coin is predicted to reach approximately $0.0118 by 2030. Expert forecasts suggest potential growth driven by increasing adoption and market developments in the crypto space.

What factors influence DMC (DeLorean coin) price movements?

DMC price movements are influenced by market sentiment, trading volume, technological developments, user adoption rates, and broader cryptocurrency market trends.

Is DMC a good investment for the future?

DMC shows strong potential as a future investment with growing adoption in the web3 ecosystem. Its technology and market demand suggest promising long-term value appreciation opportunities for investors.

2025 ATA Price Prediction: Analyzing Market Trends and Growth Potential for Automata Network

2025 RLC Price Prediction: Will RLC Reach $10 in the Next Bull Run?

2025 STOS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 PPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for Investors

2025 SQR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 LIY Price Prediction: Navigating Market Trends and Potential Growth Factors

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua

What is PSY: A Comprehensive Guide to the Global Phenomenon and Cultural Impact of the South Korean Artist