2025 FOREST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: FOREST's Market Position and Investment Value

Forest Protocol (FOREST) is an innovative launchpad and AMM protocol enabling creators to launch Playable Tokens—instantly deployable mini-apps with built-in economic flywheels. Built by a team with over 10 years of gaming and application development experience and backed by a robust network of partner studios, FOREST has emerged as a key player in the Web3 gaming and publishing ecosystem. As of December 25, 2025, FOREST's market capitalization has reached $33,000,000, with a circulating supply of approximately 81,000,000 tokens trading at around $0.033 per token. This innovative protocol is establishing itself as a cornerstone infrastructure for bringing top gaming and product teams fully on-chain.

This comprehensive analysis will examine FOREST's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants seeking exposure to the evolving Web3 gaming sector.

Forest Protocol (FOREST) Market Analysis Report

I. FOREST Price History Review and Current Market Status

FOREST Historical Price Evolution Trajectory

Based on available data, FOREST was launched on September 1, 2025 at an initial price of $0.02. The token subsequently experienced significant price appreciation, reaching its all-time high (ATH) of $0.09454 on October 13, 2025, representing a gain of approximately 372% from the launch price. Since the ATH, FOREST has experienced a notable correction, declining to current trading levels.

FOREST Current Market Status

As of December 25, 2025, FOREST is trading at $0.033, down 0.87% over the past 24 hours. The token shows modest intraday strength with a 1-hour gain of 0.33%, but displays significant weakness over intermediate timeframes, declining 22.06% over 7 days and 22.39% over 30 days. From its all-time high, FOREST has corrected approximately 65.1%, reflecting the broader market volatility experienced since October 2025.

Key Market Metrics:

| Metric | Value |

|---|---|

| Current Price | $0.033 |

| 24h Trading Range | $0.03238 - $0.03345 |

| 24h Trading Volume | $12,351.73 |

| Market Capitalization | $2,673,000 |

| Fully Diluted Valuation | $33,000,000 |

| Circulating Supply | 81,000,000 FOREST (8.1% of total) |

| Total Supply | 1,000,000,000 FOREST |

| Token Holders | 4,078 |

| Market Dominance | 0.0010% |

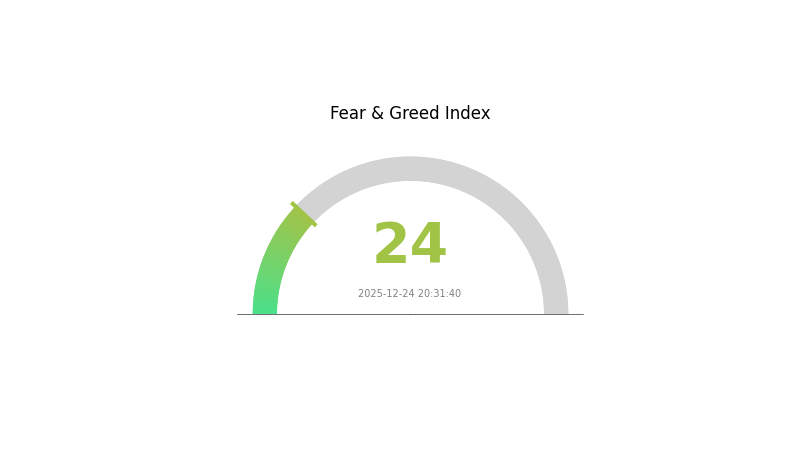

The market sentiment indicator shows "Extreme Fear" (VIX: 24), suggesting heightened market anxiety and potential volatility conditions. FOREST maintains a relatively illiquid trading environment with limited exchange availability (7 exchanges) and low daily volumes, characteristics typical of emerging altcoins.

Click to view current FOREST market price

FOREST Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates significant market pessimism and heightened investor anxiety. During such periods, volatility tends to increase substantially, and selling pressure dominates. However, contrarian investors often view extreme fear as a potential buying opportunity, as markets historically recover from panic-driven lows. Risk management and careful position sizing remain crucial during this volatile phase. Monitor market developments closely before making investment decisions.

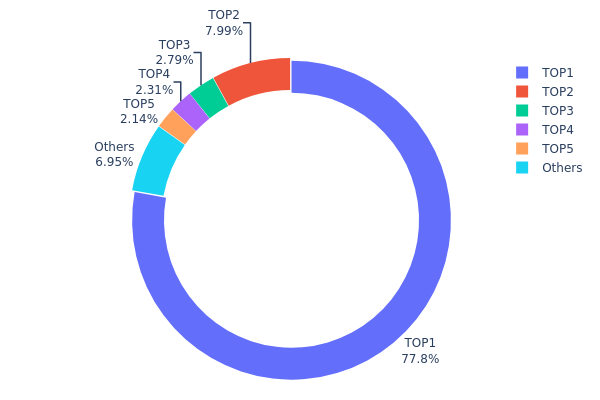

FOREST Holdings Distribution

The address holdings distribution chart illustrates the concentration of FOREST tokens across different wallet addresses on the blockchain. This metric is critical for assessing token decentralization, market structure integrity, and potential vulnerability to large-scale token movements that could impact price stability and market confidence.

FOREST currently exhibits significant concentration risk, with the top holder controlling 77.82% of the total token supply. This extreme centralization is further amplified when considering the top five addresses, which collectively hold 92.93% of all tokens in circulation. Such pronounced concentration raises concerns about the token's decentralization credentials and creates substantial counterparty risk. The second-largest holder maintains a notably smaller position at 7.99%, indicating a dramatic disparity in wealth distribution that deviates substantially from an ideal decentralized model.

The current holding structure presents considerable implications for market dynamics and price discovery mechanisms. The dominant position of the primary address suggests limited liquidity outside of this single entity's control, which could constrain organic market movements and amplify volatility during any significant token transfer events. Furthermore, this concentration profile indicates potential governance centralization risks, as token-weighted voting mechanisms would be heavily influenced by the largest stakeholder. The remaining 6.97% distributed among other addresses demonstrates minimal market participation from smaller holders, suggesting a token ecosystem still in early consolidation phases with limited organic adoption patterns at this stage.

Click here to view the current FOREST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb785...582c54 | 389600.00K | 77.82% |

| 2 | 0x92f2...b9fd73 | 40000.00K | 7.99% |

| 3 | 0xf060...6f4aa0 | 13943.91K | 2.78% |

| 4 | 0xfc89...0bdec3 | 11542.06K | 2.30% |

| 5 | 0xb6c6...c5dc94 | 10721.71K | 2.14% |

| - | Others | 34791.82K | 6.97% |

II. Core Factors Influencing FOREST's Future Price

Supply Mechanism

- Halving Mechanism: FOREST adopts a halving mechanism similar to Bitcoin, with block rewards reducing periodically. This deflationary design is built into the protocol's core architecture.

- Historical Pattern: Past halving events typically trigger decreased supply inflation, which historically has supported upward price pressure as the rate of new token issuance slows.

- Current Impact: With a total token supply of 1,000,000,000 FOREST and current circulation of 81,000,000 tokens (as of October 2025), the significant difference between circulating and total supply indicates substantial inflation potential in the medium term. Future halvings will progressively reduce this inflationary pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Forest Protocol has secured backing from notable institutional investors including Mechanism Capital, TreasureDAO, Cherubic Ventures, Comma3, and PWMC. Angel investors include Twitch co-founder Kevin Lin, alongside prominent figures such as Dingaling, MrBlock, and Andrew Kang.

- Enterprise Adoption: Forest Protocol's incubator and AMM (Automated Market Maker) infrastructure support Playable Token initiatives, expanding the application domain and use cases for the ecosystem.

Macroeconomic Environment

- Regulatory Environment: Global cryptocurrency regulatory frameworks and macroeconomic factors such as interest rate policies from major central banks directly impact the price trajectories of all crypto assets, including FOREST.

- Market Sentiment: Institutional adoption levels and mainstream market demand play crucial roles in determining future price movements. As regulatory clarity improves globally, institutional participation typically increases.

Technology Development and Ecosystem Building

- Ecosystem Infrastructure: Forest Protocol's incubator and AMM support mechanisms are designed to foster ecosystem growth and attract development activity, which can drive long-term value proposition and adoption rates.

III. FOREST Price Forecast 2025-2030

2025 Outlook

- Conservative Prediction: $0.02904

- Neutral Prediction: $0.033

- Optimistic Prediction: $0.04092

2026-2027 Medium-term Outlook

- Market Phase Expectations: Recovery and consolidation phase with gradual upward momentum

- Price Range Predictions:

- 2026: $0.02476 - $0.051

- 2027: $0.03079 - $0.06509

- Key Catalysts: Ecosystem development initiatives, increased adoption, positive market sentiment recovery

2028-2030 Long-term Outlook

- Base Case Scenario: $0.0469 - $0.07581 (steady market expansion and mainstream adoption)

- Optimistic Scenario: $0.07776 - $0.10101 (accelerated ecosystem growth and institutional participation)

- Transformative Scenario: $0.10101+ (breakthrough developments in underlying technology and widespread integration)

Price Performance Summary (2025-2030):

- Cumulative Growth: 142% potential increase from base price

- Average Annual Growth Rate: 16.8%

- Volatility Range: Between $0.02476 (low) and $0.10101 (high) across the forecast period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04092 | 0.033 | 0.02904 | 0 |

| 2026 | 0.051 | 0.03696 | 0.02476 | 12 |

| 2027 | 0.06509 | 0.04398 | 0.03079 | 33 |

| 2028 | 0.07581 | 0.05454 | 0.0469 | 65 |

| 2029 | 0.09515 | 0.06517 | 0.04432 | 97 |

| 2030 | 0.10101 | 0.08016 | 0.07776 | 142 |

Forest Protocol (FOREST) Investment Analysis Report

IV. FOREST Professional Investment Strategy and Risk Management

FOREST Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Growth-oriented investors with moderate-to-high risk tolerance seeking exposure to gaming and Web3 infrastructure platforms

- Operational Recommendations:

- Accumulate during price consolidation periods, particularly during market-wide corrections

- Hold through ecosystem development milestones, especially as Zeeverse user adoption scales

- Monitor quarterly updates on total active players and token utility expansion within the protocol

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Crossover: Use 50-day and 200-day moving averages to identify trend reversals; buy when 50-day MA crosses above 200-day MA

- Relative Strength Index (RSI): Monitor oversold conditions (RSI below 30) for entry points and overbought conditions (RSI above 70) for exit signals

- Wave Operation Key Points:

- Capitalize on the 24-hour price volatility range of $0.03238-$0.03345

- Consider support levels near the historical low of $0.02 and resistance at the all-time high of $0.09454

FOREST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% maximum allocation of total crypto portfolio

- Active Investors: 3-5% allocation, with staged entry over 3-6 months

- Professional Investors: 5-8% allocation with systematic rebalancing quarterly

(2) Risk Hedging Solutions

- Profit-Taking Strategy: Distribute sale targets at 20%, 50%, and 100% gains to secure realized profits while maintaining upside exposure

- Dollar-Cost Averaging (DCA): Invest fixed amounts at regular intervals to reduce timing risk and average entry price

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for active trading and ecosystem participation

- Cold Storage Option: Hardware-secured storage solutions for long-term holdings

- Security Considerations: Enable two-factor authentication on all exchange accounts, never share private keys or seed phrases, use unique passwords for each platform, and verify website URLs before accessing wallets

V. FOREST Potential Risks and Challenges

FOREST Market Risk

- Price Volatility: FOREST has experienced -22.06% decline over 7 days and -35.91% over the past year, indicating significant volatility compared to market averages

- Liquidity Concentration: With only 7 exchange listings and $12,351.73 in 24-hour trading volume, market liquidity remains relatively limited, potentially amplifying price swings

- Market Capitalization Dependency: Current market cap of $33,000,000 with only 8.1% circulating supply ratio creates concentration risk as supply unlocks occur

FOREST Regulatory Risk

- Blockchain Regulatory Uncertainty: Gaming tokens and playable assets face evolving regulatory frameworks across jurisdictions, potentially impacting project operations

- Securities Classification Risk: Gaming-related tokens may face classification as securities in certain markets, leading to compliance costs or trading restrictions

- Cross-Border Compliance: As Forest Protocol expands globally, regulatory requirements vary significantly by region

FOREST Technical Risk

- Platform Dependency: As a launchpad protocol, technical vulnerabilities or smart contract exploits could significantly impact user confidence

- Adoption Scaling: Achieving sustainable growth beyond the flagship Zeeverse project requires successful execution of new token launches and creator adoption

- Ecosystem Competition: Numerous gaming and launchpad platforms create competitive pressure; failure to differentiate could limit token utility

VI. Conclusion and Action Recommendations

FOREST Investment Value Assessment

Forest Protocol presents a unique opportunity within the gaming and Web3 infrastructure sector, combining a permissionless launchpad model with demonstrated ecosystem traction through Zeeverse. The project benefits from experienced team leadership (10+ years in gaming), institutional backing from reputable funds (Mechanism Capital, TreasureDAO, Cherubic Ventures), and celebrity angel investors. However, investors must acknowledge the significant execution risk associated with early-stage gaming platforms, market volatility (-35.91% over one year), and limited trading liquidity. The protocol's success depends on sustained creator adoption beyond its flagship project and the continued growth of Telegram mini-game registrations.

FOREST Investment Recommendations

✅ Beginners: Start with small position sizing (0.5-1% of crypto allocation) through dollar-cost averaging on Gate.com; focus on understanding the Zeeverse ecosystem and protocol mechanics before increasing exposure ✅ Experienced Investors: Implement a core-satellite strategy with 3-5% core position supplemented by tactical trading around identified support/resistance levels; monitor ecosystem announcements quarterly ✅ Institutional Investors: Structure positions through staged accumulation, engage with protocol governance (where applicable), and conduct due diligence on unreleased token supply dynamics

FOREST Trading Participation Methods

- Direct Spot Trading: Purchase FOREST tokens on Gate.com spot market using BNB, USDT, or other trading pairs

- Telegram Mini-Game Integration: Earn rewards through Zeeverse Telegram mini-game, which may provide token incentives for ecosystem participants

- Protocol Participation: Engage directly with Playable Token launches on the Forest Protocol platform to evaluate upcoming projects

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their own risk tolerance and financial situation. It is recommended to consult with a professional financial advisor. Never invest more than you can afford to lose.

FAQ

How much is Forest crypto worth?

As of December 24, 2025, Forest crypto is worth $0.000301 per token. The 24-hour trading volume is $1,590.81, with a 1.87% price increase in the last 24 hours.

What factors influence FOREST price predictions?

FOREST price predictions are influenced by market demand, trading volume, ecosystem development, tokenomics, macroeconomic conditions, and regulatory changes in the crypto industry.

What will FOREST price be in 2025?

FOREST is projected to average $0.0462 in 2025, with a potential high of $0.05359 and low of $0.03095, based on comprehensive market analysis and trend forecasting.

Is FOREST a good investment for long-term growth?

FOREST shows strong long-term growth potential, backed by increasing demand for sustainable forestry products and alignment with global environmental trends. Its tokenomics and ecosystem development support positive price appreciation over time.

2025 PIXEL Price Prediction: Expert Analysis and Market Forecast for Google's Revolutionary AI Chip Token

2025 PORTAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 ELIX Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 TICO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2025 TEVA Price Prediction: Expert Analysis and Market Forecast for Teva Pharmaceutical Industries

2025 LOE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua

What is PSY: A Comprehensive Guide to the Global Phenomenon and Cultural Impact of the South Korean Artist