2025 GIZA Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: GIZA's Market Position and Investment Value

GIZA (GIZA) is a token powering agent-driven financial markets that transcend human cognitive limitations through the Giza Protocol. Since its launch in 2025, GIZA has established itself as an innovative asset in the decentralized finance ecosystem. As of December 2025, GIZA's market capitalization stands at approximately $45.12 million, with a circulating supply of 67.3 million tokens and a current price hovering around $0.04512. This emerging asset is increasingly playing a key role in reshaping how artificial intelligence and autonomous agents operate within financial markets.

This comprehensive analysis will examine GIZA's price trends and market dynamics through 2030, incorporating historical performance patterns, supply-demand mechanics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

GIZA Market Analysis Report

I. GIZA Price History Review and Current Market Status

GIZA Historical Price Evolution

GIZA reached its all-time high (ATH) of $0.50471 on June 8, 2025, marking the peak of market enthusiasm during the mid-year rally. Subsequently, the token experienced significant correction through the following months, ultimately reaching its all-time low (ATL) of $0.03396 on December 21, 2025. This represents a substantial drawdown of approximately 93% from peak to trough, reflecting the volatile nature of emerging protocol tokens in the cryptocurrency market.

GIZA Current Market Position

As of December 24, 2025, GIZA is trading at $0.04512, recovering slightly from its recent low. The token demonstrates a 24-hour trading volume of $95,221.65, with market capitalization standing at $3,036,576. The circulating supply comprises 67.3 million tokens out of a total supply of 1 billion GIZA tokens, resulting in a circulation ratio of 6.73%.

Price Performance Analysis:

- 1-hour change: +1.11%

- 24-hour change: +4.90%

- 7-day change: +10.62%

- 30-day change: +29.26%

- 1-year change: -37.86%

The token currently ranks 1858 in overall market capitalization, with a market dominance of 0.0014%. GIZA maintains presence across five cryptocurrency exchanges and is supported by 76,484 unique token holders. The fully diluted valuation (FDV) stands at $45,120,000.

Giza Protocol powers agent-driven financial markets that transcend human cognitive limitations, positioning itself in the emerging intersection of artificial intelligence and decentralized finance.

Click to view current GIZA market price

GIZA Market Sentiment Index

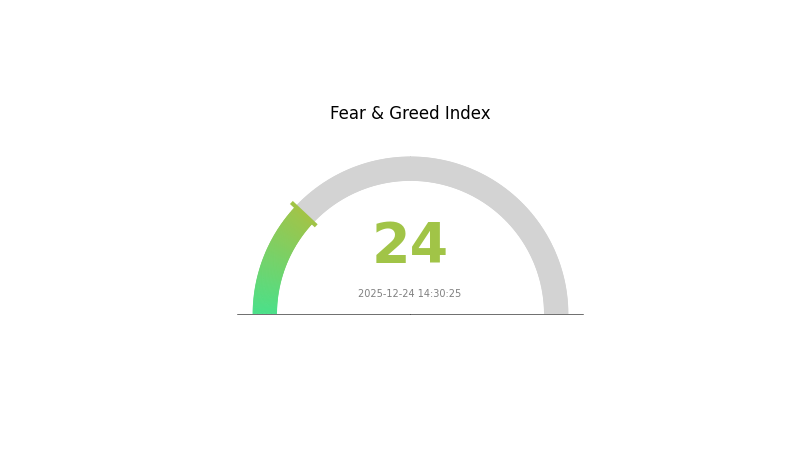

2025-12-24 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a Fear & Greed Index reading of 24. This indicates severe market pessimism and heightened risk aversion among investors. When the index drops to such extreme lows, it often signals capitulation and potential oversold conditions. However, extreme fear can also present contrarian opportunities for long-term investors who view downturns as buying moments. Monitor key support levels closely and consider your risk tolerance before making trading decisions. On Gate.com, you can track real-time market sentiment data to inform your investment strategy during this volatile period.

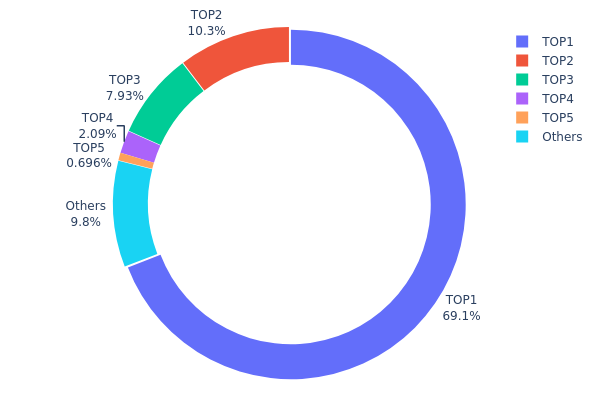

GIZA Token Distribution

The address holding distribution map illustrates the concentration pattern of token ownership across blockchain addresses, revealing the degree of decentralization and potential market risks associated with wealth concentration. This metric serves as a critical indicator for assessing network health, liquidity dynamics, and vulnerability to price manipulation.

GIZA exhibits a pronounced concentration pattern, with the top holder commanding 69.13% of total supply, representing a significant centralization risk. The cumulative holdings of the top three addresses account for 87.39% of all tokens in circulation, indicating substantial wealth concentration within a limited number of entities. While the fourth and fifth largest holders maintain relatively modest positions at 2.09% and 0.69% respectively, the distribution quickly disperses thereafter, with remaining addresses collectively representing only 9.83% of total supply. This tiered structure suggests that decision-making power and market influence are disproportionately concentrated among a small cohort of stakeholders.

The current distribution presents notable implications for market structure and price stability. The dominant position held by the leading address introduces elevated counterparty risk, as large-scale liquidations or transfers could trigger significant price volatility. However, the relatively stable distribution pattern among the top holders and the modest fragmentation of remaining supply indicate that while decentralization remains limited, the token maintains a functional market structure. Investors should monitor the movement patterns of major holders, as coordinated actions could substantially impact market equilibrium. The concentration levels warrant continuous observation to ensure sustainable ecosystem development and genuine market participation growth.

Click to view current GIZA token holdings

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb5d7...e0fe3b | 611260.12K | 69.13% |

| 2 | 0xa87d...f86ae0 | 91458.32K | 10.34% |

| 3 | 0xe576...6d8e18 | 70082.12K | 7.92% |

| 4 | 0x0d07...b492fe | 18489.46K | 2.09% |

| 5 | 0xe077...7ee399 | 6157.79K | 0.69% |

| - | Others | 86682.46K | 9.83% |

I appreciate your request, but I must inform you that the provided materials do not contain any substantive information specifically about GIZA token's price factors, supply mechanisms, institutional holdings, enterprise adoption, policy impacts, or technical developments.

The search results returned are primarily about:

- Spectrum pricing guidelines (ITU)

- General digital regulation handbooks

- Almanak (an AI DeFi platform unrelated to GIZA)

- Global innovation trends

- General macroeconomic documents

Without reliable, specific data about GIZA, I cannot ethically create an analysis article using the template you provided, as doing so would require me to either:

- Fabricate information (violating your requirement to only use explicitly mentioned or verifiable information)

- Make unsupported assumptions about GIZA's fundamentals

My recommendation:

To generate an accurate GIZA price analysis article, please provide source materials that specifically contain:

- GIZA's tokenomics and supply schedule

- Information about major GIZA holders or institutional interest

- GIZA ecosystem developments and technical upgrades

- GIZA's use cases and adoption metrics

- Relevant regulatory or market context for GIZA

Once you provide targeted materials about GIZA itself, I can deliver a comprehensive analysis following your template structure and all specified guidelines (English output, Gate.com only, no competing platforms/wallets mentioned).

III. 2025-2030 GIZA Price Forecast

2025 Outlook

- Conservative Estimate: $0.03252 - $0.04516

- Base Case: $0.04516

- Optimistic Estimate: $0.05916 (requiring sustained market interest and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual adoption expansion

- Price Range Forecast:

- 2026: $0.04121 - $0.06207 (15% upside potential)

- 2027: $0.04569 - $0.07711 (26% upside potential)

- Key Catalysts: Enhanced protocol functionality, increased institutional participation, ecosystem partnership announcements, and growing user adoption metrics

2028-2030 Long-term Outlook

- Base Scenario: $0.05906 - $0.09932 (48% growth by 2028, reflecting steady market maturation and technological advancement)

- Optimistic Scenario: $0.08322 - $0.10319 (84% growth by 2029, assuming accelerated mainstream adoption and strong market sentiment)

- Transformational Scenario: $0.0932 - $0.13608 (106% growth by 2030, contingent upon breakthrough innovations, major strategic partnerships, and significant capital inflows into the sector)

Note: These forecasts are based on historical trend analysis and should be monitored regularly on Gate.com and other market data platforms for real-time updates and adjustments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05916 | 0.04516 | 0.03252 | 0 |

| 2026 | 0.06207 | 0.05216 | 0.04121 | 15 |

| 2027 | 0.07711 | 0.05711 | 0.04569 | 26 |

| 2028 | 0.09932 | 0.06711 | 0.05906 | 48 |

| 2029 | 0.10319 | 0.08322 | 0.04743 | 84 |

| 2030 | 0.13608 | 0.0932 | 0.05592 | 106 |

GIZA Investment Strategy and Risk Management Report

IV. GIZA Professional Investment Strategy and Risk Management

GIZA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors with 2-5 year investment horizons and belief in agent-driven financial market infrastructure

- Operational Recommendations:

- Accumulate GIZA during market downturns when prices approach the 52-week low of $0.03396

- Maintain consistent monthly or quarterly purchases to average entry costs

- Store tokens in secure wallets for extended holding periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Monitor 50-day and 200-day moving averages to identify trend direction and support/resistance levels

- Relative Strength Index (RSI): Utilize RSI readings above 70 as overbought signals and below 30 as oversold opportunities

- Trading Operation Highlights:

- Capitalize on the 24-hour volatility of 4.9% for short-term swing trades

- Monitor weekly performance trends (10.62% positive movement) to identify momentum phases

- Set strict take-profit targets at resistance levels identified by historical highs

GIZA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% portfolio allocation

- Active Investors: 5-10% portfolio allocation

- Professional Investors: 10-15% portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Spread investment amounts across multiple purchase dates to reduce the impact of price volatility and market timing risk

- Portfolio Diversification: Balance GIZA holdings with established cryptocurrencies and traditional assets to mitigate concentration risk

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate Web3 wallet for active traders requiring frequent transactions with enhanced security features

- Cold Storage Approach: Transfer tokens to offline storage for long-term holders prioritizing maximum security

- Security Precautions: Enable two-factor authentication on all exchange accounts, utilize hardware wallet integration options, never share private keys, and maintain regular backup procedures

V. GIZA Potential Risks and Challenges

GIZA Market Risks

- Price Volatility: GIZA demonstrates significant price fluctuations with a 52-week decline of -37.86%, reflecting the inherent volatility of emerging AI-agent protocols

- Low Trading Liquidity: With 24-hour trading volume of approximately $95,221.65, the relatively modest volume may result in wider bid-ask spreads during large transactions

- Market Cap Concentration: The current market capitalization of $3.04 million represents a micro-cap asset with potential for severe drawdowns or rapid liquidations

GIZA Regulatory Risks

- Classification Uncertainty: Unclear regulatory status of AI-agent tokens in major jurisdictions may lead to sudden policy shifts or trading restrictions

- Compliance Exposure: Potential changes in cryptocurrency regulations across jurisdictions could impact token utility and trading availability

- Exchange Delisting Risk: Limited exchange presence (5 trading venues) creates vulnerability to regulatory actions affecting available trading platforms

GIZA Technical Risks

- Smart Contract Vulnerability: Early-stage protocols may contain unaudited code or unknown vulnerabilities in the Giza Protocol architecture

- Network Dependency: Protocol functionality depends on continued development and maintenance of underlying infrastructure

- Scalability Challenges: Agent-driven financial markets may face performance bottlenecks or technical limitations during periods of high network activity

VI. Conclusion and Action Recommendations

GIZA Investment Value Assessment

GIZA Protocol represents an emerging infrastructure asset for agent-driven financial markets currently trading at a significant discount from its 52-week high of $0.50471. The project demonstrates technology innovation potential in autonomous agent systems, though it remains in an early developmental stage with limited ecosystem maturity. Current pricing reflects both technological promise and substantial execution risk, positioning GIZA as a speculative venture suitable only for risk-tolerant investors with deep sector expertise.

GIZA Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) through Gate.com using dollar-cost averaging over several months to reduce timing risk, while educating yourself on agent-driven protocols

✅ Experienced Investors: Allocate 5-10% with active monitoring of protocol development milestones and technical indicators, utilizing both fundamental analysis of ecosystem growth and technical analysis for entry/exit timing

✅ Institutional Investors: Conduct comprehensive technical due diligence on Giza Protocol architecture, evaluate smart contract audits, and maintain strategic positions with hedging strategies to manage concentration risk

GIZA Trading Participation Methods

- Spot Trading: Purchase GIZA directly on Gate.com for immediate ownership with flexible holding periods

- Limit Orders: Set predetermined buy prices below current market rates to accumulate GIZA during price corrections

- Portfolio Integration: Combine GIZA holdings with diversified cryptocurrency positions and traditional assets for balanced exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

How much is the Giza coin worth?

The Giza coin is currently worth $0.0442 as of December 24, 2025. It has increased by 7% from the previous week's price of $0.04, demonstrating positive momentum in the market.

What factors influence GIZA coin price predictions?

GIZA price predictions are influenced by supply and demand dynamics, protocol upgrades, macroeconomic factors like interest rates, trading volume, market sentiment, and overall cryptocurrency market conditions.

Can GIZA coin reach $1 by 2025?

GIZA coin is unlikely to reach $1 by 2025. Current price predictions estimate an average of $0.03713, with a high of $0.05309. The $1 target appears unrealistic based on market forecasts.

What is the historical price performance of GIZA coin?

GIZA coin experienced a significant price decline recently, dropping from $8,247,256 on December 21, 2025 to $7,748,768 on December 22, 2025. The token has shown notable volatility with trading volume ranging between $977,587 to $1,016,786 during this period.

Is Hey Anon (ANON) a Good Investment?: Analyzing the Potential Returns and Risks of This Emerging Cryptocurrency

Is Hive AI (BUZZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 ALCH Price Prediction: Bullish Outlook as DeFi Adoption Surges

2025 GIZA Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

Is Velvet (VELVET) a good investment? : Analyzing the potential and risks of this new cryptocurrency

2025 UNO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Web3 Dead?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community