2025 HOLO Price Prediction: Expert Analysis and Market Forecast for Holochain's Future Growth

Introduction: HOLO's Market Position and Investment Value

Holoworld AI (HOLO) is building the decentralized hub for consumer AI — a launchpad, app store, and open marketplace for AI-native IPs and companies. Since its founding in 2022 in Silicon Valley, the project has established itself as a notable player in the emerging AI infrastructure sector, backed by prominent investors including Polychain Capital, South Park Commons, Nascent, Quantstamp, and Arweave. As of December 2025, HOLO has achieved a market capitalization of approximately $136.19 million, with a circulating supply of around 347.38 million tokens trading at approximately $0.0665 per token. This innovative asset is playing an increasingly critical role in bridging decentralized technology with consumer-grade artificial intelligence applications.

This article will provide a comprehensive analysis of HOLO's price trends and market dynamics through 2030, combining historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasting and practical investment strategies for investors seeking exposure to the AI infrastructure sector.

HOLO Market Analysis Report

I. HOLO Price History Review and Current Market Status

HOLO Historical Price Evolution

Based on available data from December 20, 2025, HOLO has experienced significant volatility since its inception:

- All-Time High (ATH): $0.88 on September 11, 2025

- All-Time Low (ATL): $0.04289 on October 10, 2025

- Year-to-Date Performance: -86.77% decline from highest levels

The token demonstrates substantial price compression, having declined from its ATH of $0.88 to the current level of $0.0665, representing an 86.77% loss over the past year. The 102-day interval between ATH and ATL highlights the extreme volatility characteristic of this asset.

HOLO Current Market Stance

Price Information (As of December 20, 2025)

- Current Price: $0.0665

- 24-Hour Change: -1.72%

- 7-Day Change: -8.97%

- 30-Day Change: -26.46%

- 1-Hour Change: -0.18%

Market Capitalization & Supply Metrics

- Market Capitalization: $23,100,519.03

- Fully Diluted Valuation (FDV): $136,192,000.00

- Circulating Supply: 347,376,226 HOLO (16.96% of total supply)

- Total Supply: 2,048,000,000 HOLO

- Max Supply: 2,048,000,000 HOLO

- Market Dominance: 0.0042%

Trading Activity

- 24-Hour Trading Volume: $831,911.17

- Volume-to-Market Cap Ratio: 3.60%

- Listed on 25 exchanges

- Active Holders: 9,441

Price Range (24-Hour)

- 24-Hour High: $0.07034

- 24-Hour Low: $0.06551

Market Sentiment

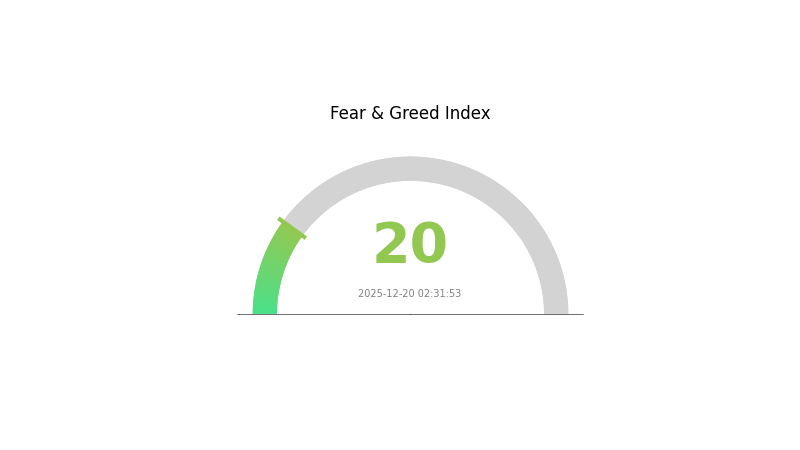

The current market environment is characterized as "Extreme Fear" with a VIX reading of 20, indicating heightened risk aversion across crypto markets. HOLO is trading near the lower bound of its daily range, reflecting continued downward pressure in the short term.

Check current HOLO market price

Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates significant market pessimism and risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. Market volatility is expected to remain elevated, and traders should exercise caution while considering the potential for rebounds during such oversold conditions. Monitor key support levels closely and manage risk appropriately on Gate.com.

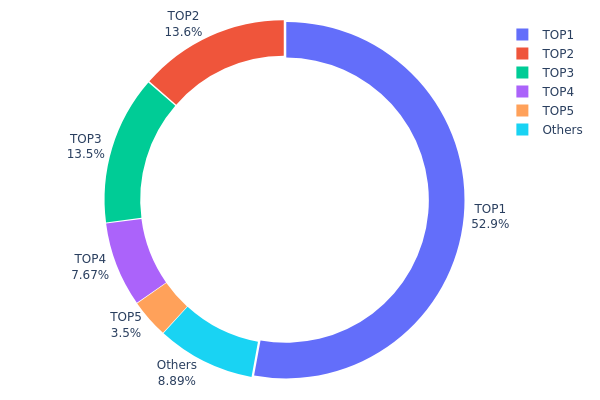

HOLO Holdings Distribution

The holdings distribution map illustrates how HOLO tokens are allocated across on-chain addresses, providing critical insights into the token's concentration levels and market structure. By examining the top holders and their respective ownership percentages, analysts can assess the degree of decentralization, potential systemic risks, and the overall health of the token's ecosystem.

HOLO demonstrates a pronounced concentration pattern, with the top holder commanding 52.89% of the total supply, representing a significant centralization risk. The cumulative holdings of the top five addresses account for 91.1% of the circulating tokens, leaving only 8.9% distributed among remaining holders. This extreme concentration is particularly evident in the first address, which alone controls more than half of all HOLO tokens. Such distribution patterns raise concerns about the token's decentralization credentials and suggest substantial influence concentrated within a limited number of stakeholders.

The current holdings architecture presents meaningful implications for market dynamics and price stability. With over 91% of tokens controlled by five major addresses, the potential for coordinated actions or large-scale liquidations could trigger significant volatility. The concentrated ownership structure may also constrain price discovery mechanisms and increase susceptibility to manipulation. However, such concentration is not uncommon among utility tokens, particularly during early-stage development phases where foundational entities retain substantial reserves for ecosystem development, incentive programs, and liquidity management. The stability of these holdings over time and their lock-up mechanisms would be critical factors in determining whether this concentration represents a temporary or permanent market structure characteristic.

Click to view current HOLO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1c0f...86bccd | 1083189.47K | 52.89% |

| 2 | 0x8b48...e12f2a | 278528.00K | 13.60% |

| 3 | 0xe572...63046a | 275575.47K | 13.45% |

| 4 | 0xbcad...7d1272 | 156981.12K | 7.66% |

| 5 | 0x6fc3...2a65d7 | 71680.00K | 3.50% |

| - | Others | 182045.94K | 8.9% |

II. Core Factors Influencing HOLO's Future Price

Supply Mechanism

-

Token Supply Dynamics: Holo maintains a limited and controlled supply, with circulating supply of 175.2 billion HOT and total issuance of 177.6 billion HOT. Supply constraints combined with increasing demand tend to drive price appreciation, while expanded supply or declining demand exerts downward pressure.

-

Current Impact: The constrained supply structure supports potential price appreciation as adoption increases, particularly if demand from the creator economy and AI-driven applications accelerates.

Machine Learning and Institutional Investment

- Venture Capital Support: Holoworld secured $6.5 million in Series A funding led by Polychain Capital, demonstrating institutional confidence in the project's potential and providing financial backing for ecosystem development.

Technological Development and Ecosystem Building

-

Q4 2025 Protocol Upgrade: The platform plans to introduce creator tools in Q4 2025, which is expected to enhance HOLO adoption rates and expand the ecosystem's utility within the AI-driven content creation space.

-

Holochain Infrastructure: Holochain's underlying technology offers enhanced scalability, efficiency, privacy, and control, along with fault tolerance, flexibility, and reduced development costs—all supporting ecosystem expansion and developer adoption.

-

AI-Native Applications: Holoworld functions as an app marketplace enabling creators to build, publish, and monetize AI-driven interactive worlds, virtual characters, and experiences, positioning HOLO at the intersection of AI innovation and creator economics.

III. 2025-2030 HOLO Price Forecast

2025 Outlook

- Conservative Forecast: $0.0538 - $0.0664

- Neutral Forecast: $0.0665 - $0.0864

- Optimistic Forecast: $0.0864 (subject to positive market sentiment and ecosystem development momentum)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental adoption growth and technology maturation in the Holochain ecosystem

- Price Range Forecast:

- 2026: $0.0642 - $0.0925

- 2027: $0.0591 - $0.0887

- Key Catalysts: Expansion of Holochain developer community, increased dApp deployments on the platform, growing enterprise partnerships, and mainstream adoption of distributed computing solutions

2028-2030 Long-term Outlook

- Base Case Scenario: $0.0632 - $0.1255 (assuming steady ecosystem growth, moderate institutional interest, and successful mainnet implementations)

- Optimistic Scenario: $0.1283 - $0.1453 (assuming accelerated enterprise adoption, significant technological breakthroughs, and expanded use cases across multiple industries)

- Transformative Scenario: $0.1634 (assuming Holochain becomes a dominant distributed computing infrastructure, capturing substantial market share from traditional cloud services, and achieving mainstream integration across Web3 and institutional sectors)

Note: Price predictions are derived from quantitative modeling based on historical performance patterns and market cycle analysis. Actual market outcomes may vary significantly based on regulatory developments, competitive dynamics, and broader macroeconomic conditions. Investors should conduct independent due diligence and consider risk management strategies when trading on platforms such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0864 | 0.06646 | 0.05383 | 0 |

| 2026 | 0.09248 | 0.07643 | 0.0642 | 14 |

| 2027 | 0.08868 | 0.08445 | 0.05912 | 26 |

| 2028 | 0.12552 | 0.08657 | 0.06319 | 30 |

| 2029 | 0.14528 | 0.10604 | 0.08695 | 59 |

| 2030 | 0.16336 | 0.12566 | 0.10807 | 88 |

Holoworld AI (HOLO) Professional Investment Strategy and Risk Management Report

IV. HOLO Professional Investment Strategy and Risk Management

HOLO Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Crypto enthusiasts with 2+ years of investment experience, believers in AI-native decentralized infrastructure, and those with medium to high risk tolerance

- Operation Recommendations:

- Accumulate HOLO during market downturns, particularly when price drops below $0.06, as this represents entry opportunities given the project's backing from top-tier venture capital firms

- Hold for a minimum of 12-24 months to capture potential growth in the AI launchpad and marketplace ecosystem

- Periodically review project development milestones and community growth metrics to validate your investment thesis

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key levels at $0.0665 (current price), $0.04289 (all-time low), and $0.07034 (24-hour high) to identify optimal entry and exit points

- Moving Averages: Use 50-day and 200-day moving averages to identify trend direction and potential reversal zones

- Wave Trading Key Points:

- Execute buy orders when price approaches support levels with increased trading volume

- Take partial profits at resistance levels, especially during upward momentum periods when 24-hour volume exceeds average

HOLO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 3-8% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Combine HOLO holdings with established cryptocurrencies and stablecoins to reduce portfolio volatility and mitigate project-specific risks

- Dollar-Cost Averaging (DCA): Implement regular, equal-amount purchases over time to reduce the impact of price volatility and eliminate timing risk

(3) Secure Storage Solutions

- Cold Storage Recommendation: For holdings exceeding $5,000, transfer HOLO to cold storage solutions to minimize smart contract vulnerability and hacking risks

- Hot wallet Strategy: Maintain smaller trading amounts on Gate.com for active trading, ensuring quick access while keeping most assets in cold storage

- Security Precautions: Enable two-factor authentication, use hardware security keys, regularly audit token approvals, and never share private keys or seed phrases with anyone

V. HOLO Potential Risks and Challenges

HOLO Market Risks

- Price Volatility: HOLO has experienced significant price fluctuations, declining 86.77% over the past year and 26.46% in the last month, indicating high volatility and substantial downside exposure

- Liquidity Constraints: With 24-hour trading volume of approximately $831,911 and a market cap of $23.1 million, liquidity may be insufficient for large-scale institutional entries or exits

- Market Sentiment Dependency: As an early-stage AI infrastructure project, HOLO's price is highly sensitive to broader cryptocurrency market sentiment and AI sector trends

HOLO Regulatory Risks

- Jurisdictional Uncertainty: Regulatory treatment of AI-native tokens and decentralized marketplaces remains undefined in most jurisdictions, creating potential legal compliance challenges

- Evolving Compliance Standards: Changes in international cryptocurrency and AI regulations could impact HOLO's operations, tokenomics, or market accessibility

- Token Classification Risk: Regulatory agencies may reclassify HOLO as a security, triggering compliance requirements or trading restrictions

HOLO Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 and SPL-20 token, HOLO is exposed to potential security issues within its underlying blockchain protocols and smart contract implementations

- Scaling Challenges: The decentralized marketplace infrastructure must handle increased transaction volumes and user growth without compromising performance or security

- Cross-Chain Bridge Risks: Operating on multiple blockchains introduces technical complexities and potential security vulnerabilities in cross-chain token transfers and interoperability

VI. Conclusion and Action Recommendations

HOLO Investment Value Assessment

Holoworld AI represents an intriguing investment opportunity within the AI infrastructure sector, specifically targeting consumer-grade AI with a decentralized launchpad and marketplace model. The project demonstrates strong institutional backing from renowned venture capital firms including Polychain Capital, Nascent, and Quantstamp, combined with strategic individual investors from OpenAI and entertainment sectors, validating its credibility and vision.

However, the significant price decline of 86.77% over the past year, combined with modest market liquidity ($831,911 daily volume) and early-stage project maturity, signals substantial execution risk. Success depends heavily on achieving meaningful adoption of its AI-native IP launchpad and marketplace, competitive differentiation from existing platforms, and navigating evolving regulatory frameworks around both AI and cryptocurrency.

HOLO Investment Recommendations

✅ Beginners: Start with micro-positions representing 0.5-1% of your portfolio using dollar-cost averaging over 3-6 months. Execute purchases on Gate.com during market corrections and maintain strict position sizing discipline. Prioritize learning about the project's ecosystem and use case before expanding your allocation.

✅ Experienced Investors: Allocate 2-5% of portfolio to HOLO with a 12-24 month investment horizon. Combine long-term core holdings with smaller tactical trading positions. Monitor project development milestones, marketplace adoption metrics, and regulatory announcements closely to validate your thesis.

✅ Institutional Investors: Conduct comprehensive due diligence on team execution capabilities, competitive positioning, and market addressability before allocating 3-8% of a diversified crypto strategy. Consider engaging with the Holoworld team directly to assess development roadmap and partnership pipeline.

HOLO Trading Participation Methods

- Gate.com Spot Trading: Execute buy/sell orders directly on Gate.com with competitive fees, supporting both BEP-20 (BSC) and SPL-20 (Solana) versions for maximum flexibility

- Gradual Accumulation: Utilize Gate.com's recurring buy feature to implement systematic dollar-cost averaging strategies, automating purchases at predetermined intervals

- Portfolio Rebalancing: Use Gate.com's convenient interface to adjust HOLO allocations quarterly based on portfolio performance and evolving market conditions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. Consult with professional financial advisors before investing. Never invest more than you can afford to lose.

FAQ

Will HOLO coin reach $1?

Based on current market analysis and projections, HOLO is unlikely to reach $1. Most forecasts suggest the coin will peak around $0.002685 by 2050, making a dollar valuation highly improbable given current supply and market dynamics.

Does HOLO coin have a future?

Yes, HOLO coin has promising potential. As a utility token for distributed hosting on the Holochain network, it benefits from growing demand for decentralized infrastructure. With continuous development and increasing adoption of peer-to-peer applications, HOLO is well-positioned for future growth in the Web3 ecosystem.

Will HOLO rise again?

HOLO has demonstrated strong upward potential historically and may rise again. With growing market adoption and investor interest, HOLO is positioned for potential future growth as market conditions evolve.

What are HOLO's future prospects?

HOLO has strong potential driven by its distributed hosting marketplace for peer-to-peer applications. With increasing adoption of decentralized infrastructure and growing demand for cost-efficient hosting solutions, HOLO is positioned for significant growth. The platform's agent-centric design and lightweight fee structure make it attractive for developers, supporting long-term value appreciation.

What is HOLO coin and what problem does it solve?

Holo (HOT) is a peer-to-peer platform for distributed applications using cloud storage infrastructure. It solves the challenge of decentralized app development and deployment by providing a P2P market for hosting and running distributed applications efficiently.

What are the risks of investing in HOLO coin?

HOLO carries high volatility risk due to market fluctuations. Regulatory uncertainty in crypto markets poses additional challenges. Technology and adoption risks exist as the project develops. Past performance does not guarantee future results.

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

2025 TAO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Ecosystem

2025 FET Price Prediction: Bullish Trends and Key Factors Driving Fetch.ai's Future Value

Is Bittensor (TAO) a good investment?: Analyzing the potential and risks of this AI-powered cryptocurrency

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

Is Web3 Dead?

Is cryptocurrency mining legal in Algeria?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is the CROSS Token? An In-Depth Guide to Crypto Gaming

What is OpenSea? Complete Guide to the Leading NFT Marketplace