2025 MILK Price Prediction: Analyzing Market Trends and Factors Shaping the Future of Dairy Commodities

Introduction: MILK's Market Position and Investment Value

Milkyway (MILK), as the first and largest liquid staking and restaking protocol in the modular ecosystem, has established itself as a significant player in the cryptocurrency market. As of 2025, MILK's market capitalization has reached $5,664,319, with a circulating supply of approximately 238,900,000 tokens, and a price hovering around $0.02371. This asset, often referred to as the "pioneer of modular liquid staking," is playing an increasingly crucial role in the field of decentralized finance and modular blockchain ecosystems.

This article will provide a comprehensive analysis of MILK's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MILK Price History Review and Current Market Status

MILK Historical Price Evolution

- 2025 April: MILK reached its all-time high of $0.2919, marking a significant milestone for the project

- 2025 October: The price hit its all-time low of $0.01779, indicating a substantial market correction

- 2025 November: MILK is experiencing a bearish trend, with the price currently at $0.02371

MILK Current Market Situation

MILK is currently trading at $0.02371, showing a 24-hour decline of 2.35%. The token has seen significant volatility over the past year, with a 89.67% decrease in value. In the short term, MILK has shown some positive movement with a 1.5% increase in the last hour. However, the weekly and monthly trends remain negative, with declines of 12.36% and 31.92% respectively. The current market capitalization stands at $5,664,319, ranking MILK at 1490 in the cryptocurrency market. With a circulating supply of 238,900,000 MILK tokens out of a total supply of 1,000,000,000, the project has a circulating ratio of 19.91%. The 24-hour trading volume is $201,973.25, indicating moderate market activity.

Click to view current MILK market price

MILK Market Sentiment Index

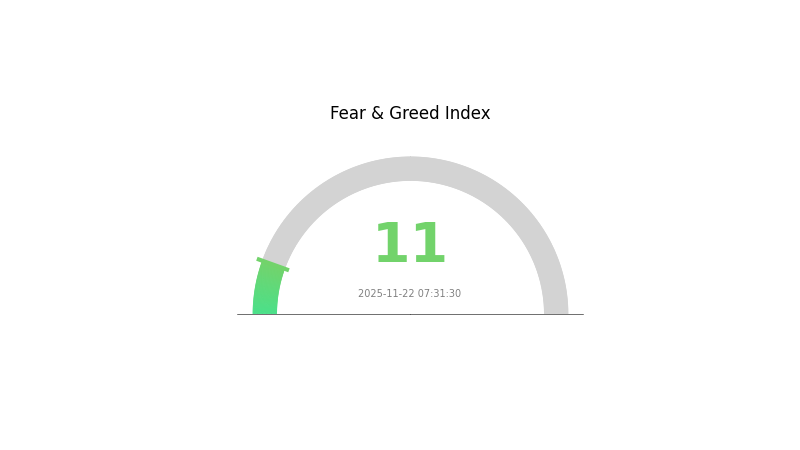

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This indicates a pessimistic outlook among investors, potentially signaling oversold conditions. Historically, such extreme fear has often preceded market reversals. However, caution is advised as underlying factors driving this sentiment should be carefully evaluated. Savvy traders might view this as an opportunity to accumulate, while others may prefer to wait for signs of stabilization before making moves.

MILK Holdings Distribution

The address holdings distribution data for MILK is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific data on top holders and their respective percentages, it's challenging to assess the level of centralization or decentralization in MILK's ownership structure.

In the absence of this crucial information, we cannot draw definitive conclusions about the potential impact on market structure, price volatility, or the risk of market manipulation. The lack of transparency in holdings distribution also makes it difficult to evaluate the overall stability of MILK's on-chain structure or its degree of decentralization.

For investors and analysts, this data gap underscores the importance of conducting thorough due diligence and seeking additional sources of information to form a complete picture of MILK's market dynamics and ownership landscape.

Click to view the current MILK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting MILK's Future Price

Supply Mechanism

- Gradual Release: MILK tokens are released gradually over time, which helps maintain a stable supply.

- Historical Pattern: Past supply changes have shown a correlation with price movements, often leading to short-term volatility.

- Current Impact: The ongoing gradual release is expected to provide a steady inflow of tokens, potentially stabilizing the price in the long term.

Institutional and Whale Dynamics

- Institutional Holdings: Several crypto investment firms have added MILK to their portfolios, indicating growing institutional interest.

Macroeconomic Environment

- Inflation Hedging Properties: MILK has shown some resistance to inflationary pressures, making it an attractive option for investors seeking to protect their wealth.

Technological Development and Ecosystem Building

- Network Upgrade: A planned upgrade to the MILK network is set to improve transaction speeds and reduce fees, potentially increasing adoption.

- Ecosystem Applications: Several DApps are being developed on the MILK blockchain, including decentralized finance (DeFi) platforms and NFT marketplaces, which could drive demand for the token.

III. MILK Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01729 - $0.02369

- Neutral forecast: $0.02369 - $0.03127

- Optimistic forecast: $0.03127 (requires significant market adoption and positive sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.01689 - $0.04311

- 2028: $0.03142 - $0.05382

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.04047 - $0.05059 (assuming steady market growth and adoption)

- Optimistic scenario: $0.05621 - $0.06172 (assuming strong market performance and increased utility)

- Transformative scenario: $0.06172+ (assuming breakthrough innovations and mass adoption)

- 2030-12-31: MILK $0.05059 (projected average price, subject to market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03127 | 0.02369 | 0.01729 | 0 |

| 2026 | 0.03078 | 0.02748 | 0.01979 | 15 |

| 2027 | 0.04311 | 0.02913 | 0.01689 | 22 |

| 2028 | 0.05382 | 0.03612 | 0.03142 | 52 |

| 2029 | 0.05621 | 0.04497 | 0.04047 | 89 |

| 2030 | 0.06172 | 0.05059 | 0.0344 | 113 |

IV. MILK Professional Investment Strategies and Risk Management

MILK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MILK tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

MILK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Use to limit potential losses on volatile trades

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MILK

MILK Market Risks

- High volatility: MILK price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Competition: Other liquid staking protocols may impact market share

MILK Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on DeFi projects

- Compliance challenges: May face difficulties adapting to new regulatory requirements

- Cross-border restrictions: Possible limitations on global accessibility

MILK Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: May face challenges as the network grows

- Dependency on underlying blockchain: Vulnerabilities in the base layer could impact MILK

VI. Conclusion and Action Recommendations

MILK Investment Value Assessment

MILK offers potential long-term value as a pioneering liquid staking protocol in the modular ecosystem. However, it faces short-term risks due to market volatility and regulatory uncertainties.

MILK Investment Recommendations

✅ Beginners: Consider small, gradual investments to gain exposure ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

MILK Participation Methods

- Spot trading: Buy and hold MILK tokens on Gate.com

- Staking: Participate in liquid staking to earn passive income

- DeFi integration: Explore yield farming opportunities with MILK tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will the price of milk be in 2025?

Based on market trends and expert predictions, the price of MILK is expected to reach $0.15 by 2025, showing significant growth potential in the crypto market.

What is the future of milk prices?

Milk prices are expected to rise due to increasing demand and production costs. Analysts predict a 5-10% increase in the next 2-3 years, driven by global population growth and changing dietary habits.

Are milk prices coming down?

Based on current market trends, milk prices are expected to stabilize or slightly decrease in the coming months due to improved supply and production efficiencies.

What is the future of the milk market?

The milk market is expected to grow steadily, driven by increasing global demand, innovative dairy products, and sustainable farming practices. Technological advancements in production and distribution will likely enhance efficiency and quality.

2025 FISPrice Prediction: Analyzing Market Trends and Future Potential for FIS Token in the Evolving DeFi Landscape

HAEDAL vs GMX: Comparing Next-Generation Trading Protocols in DeFi Ecosystem

Is pSTAKE Finance (PSTAKE) a good investment?: Analyzing the potential returns and risks in the liquid staking sector

2025 VNOPrice Prediction: Analyzing Market Trends and Growth Potential for VNO in the Coming Year

FST vs SNX: A Comparative Analysis of Two Leading Decentralized Finance Protocols

2025 FIS Price Prediction: Analyzing Market Trends and Potential Growth Factors

Pi Network Prepares to Launch PiBank Digital Banking and Pi Smart Contracts for Financial Revolution

What is an NFT?

How to Buy Solana: A Step-By-Step Guide

What is Bitcoin and How Does It Work?

PEPE Price Outlook: Analysis and Key Factors