2025 TRIO Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

Introduction: TRIO's Market Position and Investment Value

OrdinalsBot (TRIO), as a pioneering platform in the Bitcoin Ordinals ecosystem, has served over 110,000 wallets since its inception. As of 2025, TRIO's market cap has reached $49,446.15, with a circulating supply of approximately 1,547,126 tokens, and a price hovering around $0.03196. This asset, hailed as the "first automated inscription service" in the Bitcoin Ordinals space, is playing an increasingly crucial role in transforming Bitcoin into a thriving ecosystem of decentralized applications and immutable on-chain records.

This article will comprehensively analyze TRIO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. TRIO Price History Review and Current Market Status

TRIO Historical Price Evolution

- 2024: Initial launch, price peaked at $9.8 on April 16

- 2025: Significant market downturn, price dropped to an all-time low of $0.03114 on November 28

TRIO Current Market Situation

As of November 30, 2025, TRIO is trading at $0.03196, experiencing a 2.31% decrease in the last 24 hours. The token has seen a substantial decline of 98.76% over the past year, reflecting a bearish trend in the market. With a current market cap of $49,446.15 and a fully diluted valuation of $671,160, TRIO ranks 5711th in the cryptocurrency market. The trading volume in the last 24 hours stands at $41,119.35, indicating moderate market activity. The circulating supply is 1,547,126 TRIO, which represents 7.37% of the total supply of 21,000,000 tokens.

Click to view the current TRIO market price

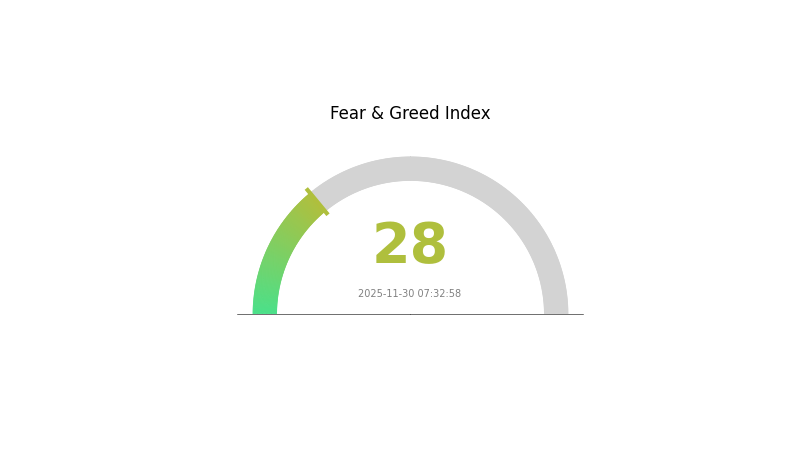

TRIO Market Sentiment Indicator

2025-11-30 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index at 28. This suggests investors are cautious and may be hesitant to make bold moves. Such sentiment often presents potential buying opportunities for contrarian investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

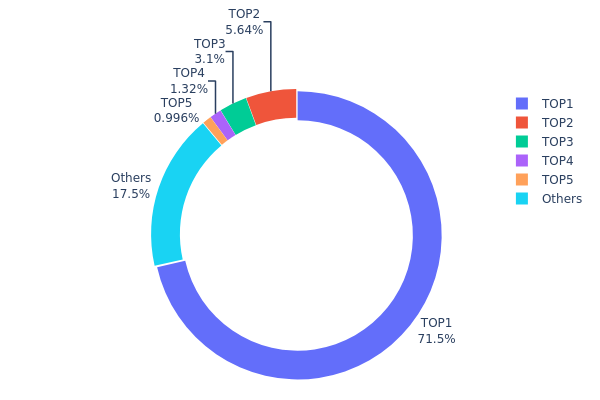

TRIO Holdings Distribution

The address holdings distribution data for TRIO reveals a highly concentrated ownership structure. The top address holds a staggering 71.46% of the total supply, with 15,007.46K TRIO tokens. This extreme concentration raises significant concerns about centralization and potential market manipulation. The second largest holder possesses 5.64% of the supply, while the third holds 3.10%. Collectively, the top five addresses control 82.5% of all TRIO tokens, leaving only 17.5% distributed among other holders.

This level of concentration poses substantial risks to the market structure and price stability of TRIO. With a single address controlling over 70% of the supply, there is a heightened risk of price volatility and market manipulation. Such a distribution severely undermines the principles of decentralization and could potentially deter wider adoption and investment. The current on-chain structure suggests a lack of equitable distribution, which may impact liquidity and overall market health.

Click to view the current TRIO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1pw9...w5sya8 | 15007.46K | 71.46% |

| 2 | bc1qwf...dquw2g | 1185.13K | 5.64% |

| 3 | 16G1xY...Vp9Wxh | 651.24K | 3.10% |

| 4 | bc1p64...yt6x2e | 276.71K | 1.31% |

| 5 | bc1pt8...z58whk | 209.13K | 0.99% |

| - | Others | 3670.34K | 17.5% |

II. Key Factors Influencing TRIO's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, TRIO may potentially serve as a hedge against inflation in certain economic conditions. However, its effectiveness as an inflation hedge would depend on various factors and market dynamics.

Technical Development and Ecosystem Building

- Ecosystem Applications: While specific details are not provided, it's likely that TRIO, as a cryptocurrency, has associated decentralized applications (DApps) or ecosystem projects that contribute to its utility and adoption. The growth and success of these applications could impact TRIO's future price.

III. TRIO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.0201 - $0.03191

- Neutral forecast: $0.03191 - $0.04

- Optimistic forecast: $0.04 - $0.04723 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.03572 - $0.07144

- 2028: $0.0437 - $0.0856

- Key catalysts: Increased adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.06691 - $0.07964 (assuming steady market growth)

- Optimistic scenario: $0.07964 - $0.08655 (assuming strong market performance)

- Transformative scenario: $0.08655+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: TRIO $0.08521 (potential peak before stabilization)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04723 | 0.03191 | 0.0201 | 0 |

| 2026 | 0.05698 | 0.03957 | 0.03205 | 23 |

| 2027 | 0.07144 | 0.04827 | 0.03572 | 51 |

| 2028 | 0.0856 | 0.05986 | 0.0437 | 87 |

| 2029 | 0.08655 | 0.07273 | 0.06691 | 127 |

| 2030 | 0.08521 | 0.07964 | 0.05415 | 149 |

IV. TRIO Professional Investment Strategy and Risk Management

TRIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and belief in Bitcoin's future

- Operation suggestions:

- Accumulate TRIO tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Determine overbought/oversold conditions

- Key points for swing trading:

- Monitor Bitcoin price movements as they may impact TRIO

- Set strict stop-loss orders to manage risk

TRIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for TRIO

TRIO Market Risks

- High volatility: TRIO price may experience significant fluctuations

- Limited liquidity: May face challenges in buying or selling large amounts

- Market sentiment: Heavily influenced by overall crypto market trends

TRIO Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on BRC-20 tokens

- Legal status: Lack of clear classification for inscriptions in many jurisdictions

- Cross-border restrictions: Possible limitations on international trading of TRIO

TRIO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the BRC-20 standard

- Scalability issues: Bitcoin network congestion may affect TRIO transactions

- Wallet compatibility: Limited support from some cryptocurrency wallets

VI. Conclusion and Action Recommendations

TRIO Investment Value Assessment

TRIO represents a novel asset class within the Bitcoin ecosystem, offering potential long-term value as the Ordinals ecosystem grows. However, it carries significant short-term risks due to market volatility and regulatory uncertainties.

TRIO Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the market ✅ Experienced investors: Allocate a small portion of portfolio, closely monitor market trends ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified crypto strategy

TRIO Trading Participation Methods

- Spot trading: Buy and sell TRIO on supported exchanges like Gate.com

- DeFi platforms: Explore emerging decentralized exchanges supporting BRC-20 tokens

- OTC trading: For large transactions, consider over-the-counter deals with trusted counterparties

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Trio Petroleum a good stock to buy?

Based on current market trends and potential growth in the oil sector, Trio Petroleum could be a promising investment. However, thorough research and consideration of your financial goals are advised before making any investment decisions.

What will TRX be worth in 5 years?

Based on market trends and potential growth, TRX could reach $0.50 to $1 in 5 years. However, cryptocurrency prices are highly volatile and unpredictable.

Is Trilogy Metals a buy?

Yes, Trilogy Metals could be a good buy. The company's strong copper and zinc projects in Alaska show potential for growth as demand for these metals increases in the green energy transition.

What is the future prediction for tril stock?

TRIO's price is expected to rise significantly by 2026, potentially reaching $0.15-$0.20 due to increased adoption and market growth in the Web3 sector.

2025 PIZZA Price Prediction: Analyzing Market Trends and Factors Influencing the Future of Cryptocurrency

Is SATS (SATS) a good investment?: Analyzing the Potential and Risks of the Lightning Network Token

Bitcoin Price Prediction 2030

Heikin-Ashi Charts Most Underrated Tool

2025 Guide for UK Traders on Bitcoin to Pound Exchange

why is crypto crashing and will it recover ?

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?

Is cryptocurrency mining legal in Algeria?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is the CROSS Token? An In-Depth Guide to Crypto Gaming