2025 VAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of VAI

Vaiot (VAI) is a blockchain-based platform that combines artificial intelligence with distributed ledger technology to develop intelligent virtual assistants (IVA) for consumers and enterprises. Since its inception in 2021, the project has established itself as an innovative solution in the AI and blockchain convergence space. As of December 2025, VAI's market capitalization has reached approximately $3,168,000, with a circulating supply of around 394.6 million tokens and a current price of $0.00792. As a utility token powering the Vaiot ecosystem, VAI plays an essential role in incentivizing platform usage and supporting critical infrastructure such as the VAI-driven Payback program and foundational VAIBC technology.

This article will provide a comprehensive analysis of VAI's price trajectory and market dynamics, examining historical performance patterns, supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period ahead.

Vaiot (VAI) Market Analysis Report

I. VAI Price History Review and Current Market Status

VAI Historical Price Evolution

- April 2, 2021: Launch period, VAI reached its all-time high of $3.6

- March 9, 2022: Market downturn, VAI dropped to its all-time low of $0.00016773

- December 24, 2025: Current trading price stands at $0.00792

VAI Current Market Situation

As of December 24, 2025, VAI is trading at $0.00792, reflecting a 24-hour decline of -2.67%. Over the past hour, the token has shown a marginal gain of 0.1%, while the 7-day performance presents a positive trend with a 3.52% increase. However, the broader perspective reveals significant weakness, with a 30-day loss of -24.91% and a devastating one-year decline of -90%.

The 24-hour trading range spans from $0.007884 to $0.00833, with a 24-hour trading volume of approximately $14,552.70. The token's market capitalization stands at $3,125,232, with a fully diluted valuation of $3,168,000. VAI maintains a circulating supply of 394,600,000 tokens out of a maximum supply of 400,000,000 tokens (circulating ratio: 98.65%).

With a market dominance of 0.00010%, VAI ranks at position 1837 in the global cryptocurrency market. The token is held across 15,439 addresses, indicating a distributed holder base. Current market sentiment reflects extreme fear (VIX: 24).

Click to view current VAI market price

VAI Market Sentiment Index

2025-12-24 Fear & Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index at 24. This indicates severe market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases as panic selling accelerates. For risk-tolerant investors, extreme fear can present contrarian buying opportunities, as historical data suggests recovery often follows extreme sentiment readings. However, it is essential to exercise caution and implement proper risk management strategies. Monitor key support levels and consider dollar-cost averaging to mitigate downside risks during this volatile period.

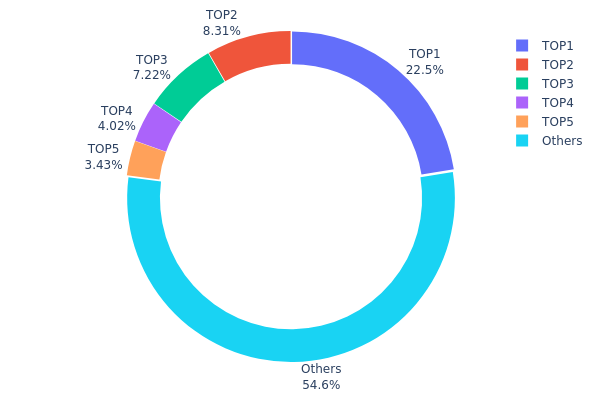

VAI Holdings Distribution

An address holdings distribution map illustrates the concentration of token ownership across the blockchain network by displaying the quantity and percentage of holdings for the largest addresses. This metric serves as a critical indicator for assessing market structure, identifying potential concentration risks, and evaluating the decentralization level of a cryptocurrency asset.

Current VAI holdings data reveals a moderate concentration pattern with notable implications for market dynamics. The top five addresses collectively hold approximately 45.4% of total supply, with the largest holder commanding 22.45%. While this concentration level suggests meaningful influence, the distribution is not severely skewed, as the remaining 54.6% is dispersed across numerous addresses. The top address's substantial stake warrants monitoring for potential price impact, though the secondary layer of holders—addresses 2 through 5 holding between 3.43% and 8.30% each—provides some counterbalance to singular whale dominance.

The current address distribution reflects a blockchain ecosystem in transition between emerging decentralization and institutional consolidation. The presence of multiple substantial holders reduces the risk of extreme market manipulation by any single entity, yet the top five addresses maintaining nearly half the supply indicates that significant price movements could be triggered by coordinated or individual whale activity. This structure suggests VAI maintains reasonable resilience against extreme volatility while remaining susceptible to shifts in large holder sentiment, typical of moderately mature digital assets where institutional participation coexists with broader community participation.

View current VAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8dac...91ae18 | 89837.64K | 22.45% |

| 2 | 0x9642...2f5d4e | 33233.59K | 8.30% |

| 3 | 0x40ec...5bbbdf | 28865.61K | 7.21% |

| 4 | 0x446b...d027ba | 16065.75K | 4.01% |

| 5 | 0x58ed...a36a51 | 13731.53K | 3.43% |

| - | Others | 218265.88K | 54.6% |

II. Core Factors Influencing VAI's Future Price

Supply Mechanism

-

Dynamic Fee Mechanism: VAI implements a dual-fee structure consisting of a base rate that users always pay, combined with a variable rate dependent on VAI's current market price. This mechanism encourages users to mint or burn VAI during price fluctuations, thereby promoting price stability.

-

Lending and Borrowing Demand: VAI's total supply is directly influenced by user lending and borrowing activities on the Venus protocol. As cryptocurrency values fluctuate in the market, users may choose to engage in lending to acquire additional capital, which directly drives increased VAI issuance.

-

Current Impact: Market demand for stablecoins and supply conditions play critical roles in determining VAI's price trajectory. The protocol's design incentivizes price stabilization through algorithmic adjustments.

Regulatory Environment

- Regulatory Changes: Regulatory developments impact VAI's value, as changes in cryptocurrency policy frameworks globally can influence demand for decentralized stablecoins and user participation in the Venus protocol ecosystem.

III. 2025-2030 VAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00677 - $0.00797

- Base Case Forecast: $0.00797

- Optimistic Forecast: $0.01036 (requiring positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with steady appreciation driven by ecosystem development and institutional interest

- Price Range Forecast:

- 2026: $0.00642 - $0.01265 (15% upside potential)

- 2027: $0.01058 - $0.01331 (37% cumulative gain)

- 2028: $0.01174 - $0.01659 (52% cumulative gain)

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, increased platform utility, and broader market recovery momentum

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01334 - $0.0165 range by 2029, with 81% cumulative appreciation from 2025 baseline (assuming sustained ecosystem growth and moderate market conditions)

- Optimistic Scenario: $0.01435 average by 2029 moving toward $0.01542 by 2030 (assuming accelerated adoption and positive regulatory environment)

- Transformative Scenario: $0.02205 by 2030 (94% total appreciation from 2025, requiring breakthrough technological advancement, major exchange integration on Gate.com, and substantial increase in total value locked)

- 2030-12-31: VAI approaching $0.02205 level (potential milestone achievement indicating substantial long-term value recognition)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01036 | 0.00797 | 0.00677 | 0 |

| 2026 | 0.01265 | 0.00917 | 0.00642 | 15 |

| 2027 | 0.01331 | 0.01091 | 0.01058 | 37 |

| 2028 | 0.01659 | 0.01211 | 0.01174 | 52 |

| 2029 | 0.0165 | 0.01435 | 0.01334 | 81 |

| 2030 | 0.02205 | 0.01542 | 0.01311 | 94 |

VAIOT (VAI) Professional Investment Analysis Report

I. Executive Summary

VAIOT is combining artificial intelligence and blockchain technology to develop intelligent virtual assistants (IVA) for consumers and enterprises. The VAI token serves as the native digital currency of the VAIOT platform, designed to incentivize users to adopt VAIOT solutions. The platform's Payback program, powered by VAI, is essential to the proper functioning of the underlying VAIBC technology.

Key Metrics (As of December 24, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.00792 |

| Market Capitalization | $3,125,232 |

| Fully Diluted Valuation | $3,168,000 |

| Circulating Supply | 394,600,000 VAI |

| Total Supply | 400,000,000 VAI |

| 24h Trading Volume | $14,552.70 |

| Market Rank | 1,837 |

| Total Holders | 15,439 |

II. Price Performance Analysis

Historical Price Movements

- All-Time High: $3.6 (April 2, 2021)

- All-Time Low: $0.00016773 (March 9, 2022)

- Current Price vs ATH: -99.78% decline

Recent Price Trends

| Timeframe | Change | Amount |

|---|---|---|

| 1 Hour | +0.1% | +$0.000007912 |

| 24 Hours | -2.67% | -$0.000217265 |

| 7 Days | +3.52% | +$0.000269304 |

| 30 Days | -24.91% | -$0.002627343 |

| 1 Year | -90% | -$0.071280 |

III. Market Position & Network Health

Liquidity Assessment

- Circulating supply represents 98.65% of maximum supply, indicating substantial token circulation

- Available on 4 major exchange platforms

- 24-hour trading volume of $14,552.70 reflects relatively low liquidity compared to market cap

Blockchain Presence

VAI token is deployed on:

- Ethereum (ETH): Contract

0xD13cfD3133239a3c73a9E535A5c4DadEE36b395c - Polygon (MATIC): Contract

0xD13cfD3133239a3c73a9E535A5c4DadEE36b395c

IV. VAI Professional Investment Strategy & Risk Management

VAI Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Risk-tolerant investors with belief in AI-blockchain integration utility and long-term adoption of intelligent virtual assistants

- Operational Recommendations:

- Dollar-cost averaging approach: Regular purchases at fixed intervals to reduce timing risk

- Position sizing: Allocate only a small percentage of portfolio given extreme price volatility and market rank position

- Extended holding horizon: Minimum 2-3 year commitment to weather market cycles

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points established during the 99%+ drawdown from ATH

- Volume Profile Analysis: Track trading volume patterns to identify breakout opportunities

-

Swing Trading Considerations:

- Price volatility opportunity: The 90% annual decline presents potential for tactical rebounds during market recoveries

- Risk management critical: Use strict stop-loss orders given extreme price swings

VAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-0.5% of portfolio

- Aggressive Investors: 0.5-2% of portfolio

- Institutional Investors: Risk-adjusted allocation with strict due diligence (typically 0-1%)

(2) Risk Mitigation Strategies

- Portfolio Hedging: Maintain diversified holdings across multiple asset classes to offset VAI concentration risk

- Position Sizing: Implement strict position limits to cap maximum drawdown impact

- Diversification: Balance speculative positions with stable-value assets

(3) Secure Storage Solutions

- Self-Custody Option: Utilize hardware-grade security practices for private key management

- Exchange Storage: Gate.com provides institutional-grade custody for trading purposes

- Security Considerations:

- Never share private keys or recovery phrases

- Verify contract addresses on blockchain explorers before transactions

- Enable multi-signature authentication where available

- Maintain regular backups of recovery information

V. VAI Potential Risks & Challenges

Market Risks

- Extreme Price Volatility: 99.78% decline from ATH demonstrates exceptional drawdown risk; further value deterioration possible

- Low Liquidity: Trading volume of ~$14,500 daily creates significant slippage risk for large positions

- Limited Trading Pairs: Availability on only 4 exchanges restricts accessibility and liquidity depth

Regulatory Risks

- Cryptocurrency Regulatory Uncertainty: Global regulatory frameworks for AI-integrated tokens remain undefined

- Jurisdictional Compliance: Restrictions in major markets could limit platform adoption and token utility

- Future Restrictions: Government intervention in AI or blockchain sectors could impact VAIOT's operational model

Technology Risks

- Smart Contract Risk: Potential vulnerabilities in VAIBC underlying technology

- Platform Adoption Uncertainty: Success dependent on enterprise and consumer adoption of intelligent virtual assistants

- Competitive Landscape: Emerging competitors in AI-blockchain space could diminish VAI token utility

VI. Conclusion & Action Recommendations

VAI Investment Value Assessment

VAIOT presents a high-risk, speculative opportunity focused on AI-blockchain integration for virtual assistants. The token has experienced extreme depreciation from its 2021 peak, reflecting market skepticism regarding utility realization. The project's value proposition depends on successful enterprise adoption of its IVA solutions and sustained token economics through the Payback program. Current market metrics suggest limited near-term momentum, though the platform's underlying technology addresses potentially valuable use cases. Any investment requires exceptional risk tolerance and conviction in long-term AI-blockchain convergence.

VAI Investment Recommendations

✅ Beginners: Not recommended. High volatility and market uncertainties make this unsuitable for inexperienced investors. If participating, limit exposure to <0.1% of total portfolio and prioritize education on smart contract interactions.

✅ Experienced Investors: Consider small speculative positions (0.5-1.5% of portfolio) only if aligned with thematic AI-blockchain conviction. Implement strict stop-loss orders at 15-20% below entry price.

✅ Institutional Investors: Conduct comprehensive due diligence on VAIOT team, technology roadmap, and revenue model before consideration. Position sizing should reflect high-risk classification with governance oversight.

VAI Trading Participation Methods

- Spot Trading on Gate.com: Direct VAI purchase using fiat or other cryptocurrencies with real-time price execution

- Limit Orders: Set predetermined buy prices during downtrends to optimize entry points

- Gradual Accumulation: Implement dollar-cost averaging through periodic purchases to reduce timing risk

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions aligned with personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Could VeChain hit $1?

VeChain reaching $1 would require a 35x increase from current levels. While unlikely by 2030, enterprise adoption and carbon credit migration could drive significant growth, potentially reaching $0.50 more realistically.

What will VeChain be worth in 2025?

VeChain is projected to experience steady growth through 2025. Based on current market analysis and technical forecasts, VET is expected to reach price levels between $0.025-$0.035 by end of 2025, representing significant appreciation from current valuations.

Will VeChain hit $5?

VeChain hitting $5 depends on sustained enterprise adoption, technological advancement, and favorable market conditions. With growing partnerships and real-world use cases, a $5 target remains achievable long-term, though significant growth is required from current levels.

2025 QUBIC Price Prediction: Analyzing Market Trends and Growth Potential in the Emerging Cryptocurrency Sector

2025 LUNAI Price Prediction: Potential Growth Trajectory and Market Analysis for the Next Bull Cycle

2025 FET Price Prediction: Navigating the Future of Fetch.ai's Token in a Dynamic Crypto Landscape

2025 AIX Price Prediction: Emerging Trends and Market Factors Shaping the Future of AIX Cryptocurrency

2025 NIKO Price Prediction: Analyzing Market Trends and Future Prospects for the Automotive Stock

2025 DOAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Is Web3 Dead?

Is cryptocurrency mining legal in Algeria?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is the CROSS Token? An In-Depth Guide to Crypto Gaming

What is OpenSea? Complete Guide to the Leading NFT Marketplace