2025 WXTM Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of WXTM

WXTM, the wrapped token of XTM on Ethereum, represents a 1:1 ratio bridge to the Tari ecosystem. Tari is a Layer 1 blockchain protocol built in Rust with an innovative approach to scaling its on-chain user base to millions of users and providing a native app distribution platform that gives developers access to every user. As of December 24, 2025, WXTM's market capitalization has reached $41.20 million, with a circulating supply of approximately 1.58 billion tokens, trading at around $0.001962. This asset has garnered support from industry-leading investors including Blockchain Capital, Pantera, Trinity Ventures, Redpoint, CMT Digital, Collab Currency, DRW, Slow Ventures, and other prominent backers.

This article will provide a comprehensive analysis of WXTM's price trends through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. WXTM Price History Review and Market Status

WXTM Historical Price Evolution Trajectory

- July 30, 2025: WXTM reached its all-time high of $0.012681, representing peak market valuation during the early trading period.

- October 1, 2025: WXTM declined to its all-time low of $0.001319, marking the lowest price point in its trading history.

- December 24, 2025: WXTM is currently trading at $0.001962, reflecting a 27.47% decline over the past 30 days.

WXTM Current Market Status

As of December 24, 2025, WXTM is trading at $0.001962, with a 24-hour trading volume of $13,918.56. The token has experienced a 1.45% decline in the last 24 hours, while showing a 1.14% gain in the past hour. Over the 7-day period, WXTM has decreased by 6.21%, and the 30-day performance shows a more significant decline of 27.47%.

The total market capitalization stands at approximately $41.20 million, with a circulating supply of 1.58 billion WXTM tokens out of a maximum supply of 21 billion tokens. This represents a circulating ratio of 7.52%. The token maintains a market dominance of 0.0013%, with 1,077 token holders currently recorded. WXTM ranks 1,847 among all cryptocurrencies by market capitalization.

In the 24-hour trading range, WXTM fluctuated between $0.001903 (low) and $0.00202 (high). The current fully diluted valuation (FDV) sits at $41.20 million, with the market cap representing 7.52% of the FDV.

View the current WXTM market price

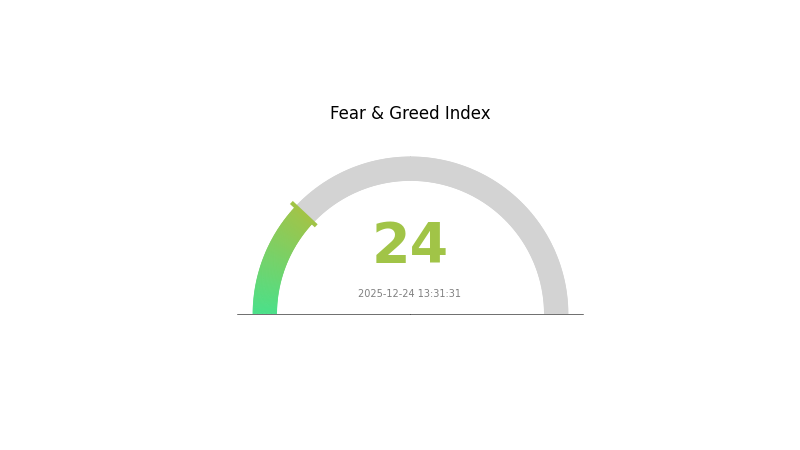

WXTM Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and risk aversion among investors. During such periods, market volatility tends to increase, and prices often reach lower levels. Experienced traders may view this as a potential buying opportunity, as extreme fear typically precedes market recovery. However, investors should remain cautious and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com to stay informed about price movements and sentiment shifts in the crypto market.

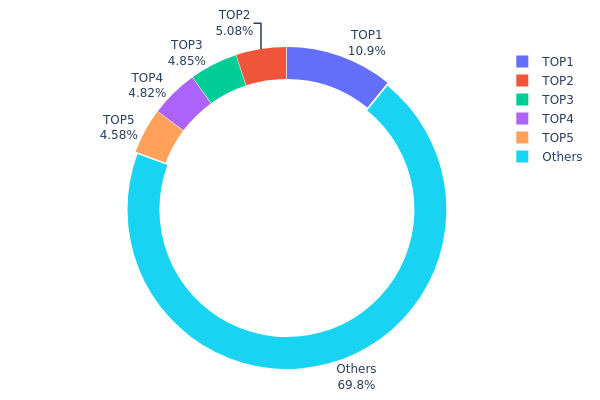

WXTM Holdings Distribution

The holdings distribution map illustrates the concentration of WXTM tokens across blockchain addresses, providing critical insight into the token's decentralization status and ownership structure. By analyzing the proportion of tokens held by top addresses relative to total supply, this metric reveals potential concentration risks and market dynamics that may influence price stability and governance resilience.

Current analysis demonstrates moderate concentration characteristics in WXTM's holder base. The top five addresses collectively control approximately 30.17% of circulating supply, with the largest holder commanding 10.85% of total tokens. While this concentration level is not considered excessive by industry standards, it warrants attention given the cumulative influence of major stakeholders. The remaining 69.83% distributed among other addresses suggests a reasonably fragmented ownership structure, indicating a broader base of token holders and reducing systemic risk from individual entity decisions.

The existing address distribution presents a balanced market structure with limited immediate manipulation vulnerability. However, the concentration among top-tier holders does create potential for coordinated market movements, particularly during periods of high volatility or strategic reallocation events. The substantial proportion held by dispersed smaller holders provides a stabilizing force against extreme price swings, while the moderate concentration among large addresses suggests a healthy balance between decentralization and sufficient stakeholder commitment to long-term protocol development. This distribution pattern reflects a maturing token ecosystem with neither excessive centralization nor extreme fragmentation.

Click to view current WXTM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5ade...ff34f5 | 74798.74K | 10.85% |

| 2 | 0xe92e...c5a03f | 34999.00K | 5.07% |

| 3 | 0x736e...8e95ec | 33452.70K | 4.85% |

| 4 | 0x017b...4b280a | 33216.23K | 4.82% |

| 5 | 0x0d07...b492fe | 31561.67K | 4.58% |

| - | Others | 481035.86K | 69.83% |

II. Core Factors Affecting WXTM's Future Price

Macro Economic Environment

-

Market Demand and Volatility: WXTM's future price is primarily influenced by overall market demand and cryptocurrency market volatility. High market fluctuations represent a significant risk factor that investors must carefully consider.

-

Regulatory Policy Impact: Technology development and regulatory policies play crucial roles in determining WXTM's price trajectory. Changes in regulatory frameworks across different jurisdictions can substantially affect market sentiment and asset valuations.

Market Competition and Risk Factors

Market competition remains intense in the cryptocurrency sector. WXTM operates in a highly competitive landscape where numerous projects vie for market share and user adoption, which may constrain price appreciation potential.

Investors should exercise caution when considering WXTM investments, as the combination of high competition and market volatility creates elevated risk conditions. Thorough due diligence and risk management strategies are essential before making investment decisions.

Three. 2025-2030 WXTM Price Forecast

2025 Outlook

- Conservative Forecast: $0.00145-$0.00196

- Base Case Forecast: $0.00196

- Optimistic Forecast: $0.00283 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Consolidation phase with gradual accumulation, transitioning toward growth recovery as adoption metrics improve

- Price Range Forecast:

- 2026: $0.00177-$0.00266 (22% potential upside)

- 2027: $0.00162-$0.00331 (28% potential upside)

- 2028: $0.00204-$0.00385 (48% potential upside)

- Key Catalysts: Ecosystem expansion, institutional adoption milestones, technological upgrades, and increased integration with major trading platforms including Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00244-$0.00504 (72% potential upside by 2029)

- Optimistic Scenario: $0.00337-$0.0051 (114% potential upside by 2030, assuming accelerated market recovery and sustained institutional interest)

- Transformational Scenario: $0.0051+ (assumes breakthrough adoption, major partnership announcements, and favorable macroeconomic conditions)

- 2030-12-24: WXTM $0.0051 (potential market stabilization point with 114% cumulative gains from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00283 | 0.00196 | 0.00145 | 0 |

| 2026 | 0.00266 | 0.00239 | 0.00177 | 22 |

| 2027 | 0.00331 | 0.00253 | 0.00162 | 28 |

| 2028 | 0.00385 | 0.00292 | 0.00204 | 48 |

| 2029 | 0.00504 | 0.00338 | 0.00244 | 72 |

| 2030 | 0.0051 | 0.00421 | 0.00337 | 114 |

MinoTari (WXTM) Professional Investment Strategy and Risk Management Report

IV. WXTM Professional Investment Strategy and Risk Management

WXTM Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Institutional investors, long-term believers in Layer 1 blockchain adoption, and those seeking exposure to Tari's ecosystem development

- Operational Recommendations:

- Accumulate during market downturns when WXTM trades below historical averages, leveraging the current -27.47% 30-day decline

- Hold through development milestones and ecosystem expansion announcements

- Participate in staking or governance opportunities as the Tari ecosystem matures

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range of $0.001903 (low) to $0.00202 (high), with all-time high at $0.012681 and all-time low at $0.001319

- Moving Averages: Track both short-term (7-day: -6.21% decline) and medium-term (30-day: -27.47% decline) trends to identify reversal points

- Wave Trading Key Points:

- Entry opportunities present when price recovers from recent lows, supported by positive 1-hour momentum (+1.14%)

- Exit signals should be triggered near resistance levels or when 24-hour volatility exceeds typical ranges

- Consider scale-in and scale-out approaches given current price volatility

WXTM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Active Investors: 3-8% of total crypto portfolio allocation

- Professional Investors: 5-15% of total crypto portfolio allocation, with emphasis on stage-based entry strategies

(2) Risk Hedging Solutions

- Diversification Approach: Balance WXTM exposure with established Layer 1 protocols to mitigate concentration risk in emerging blockchain platforms

- Dollar-Cost Averaging (DCA): Deploy capital systematically over time rather than lump-sum investments, given the -27.47% monthly decline and market volatility

(3) Secure Storage Solutions

- Exchange Custody: Maintain liquid positions on Gate.com for active trading and monitoring

- Self-Custody Approach: For long-term holdings, transfer WXTM to secure Ethereum-compatible wallets where you control private keys

- Security Considerations: Verify the official contract address (0xfd36fa88bb3fea8d1264fc89d70723b6a2b56958) before any transfers; enable multi-signature authentication for large holdings; avoid phishing attempts targeting Tari community members

V. WXTM Potential Risks and Challenges

WXTM Market Risk

- Liquidity Risk: With only 1,077 token holders and $13,918.56 in 24-hour volume, WXTM faces potential liquidity constraints during sudden market movements, making rapid exit difficult at stable prices

- Price Volatility Risk: Significant downward pressure observed over 30 days (-27.47%) indicates market uncertainty; the token's fully diluted valuation ($41.2M) against total supply (21B tokens) creates price discovery challenges

- Market Cap Concentration Risk: At only 0.0013% market dominance among cryptocurrencies, WXTM remains highly susceptible to micro-cap volatility and sentiment swings

WXTM Regulatory Risk

- Wrapped Token Compliance: As a 1:1 wrapped token of XTM on Ethereum, regulatory changes affecting either the Ethereum network or the underlying Tari protocol could impact WXTM's status and tradability

- Jurisdiction-Specific Restrictions: Different jurisdictions may impose restrictions on Layer 1 blockchain tokens or wrapped asset trading, limiting market access for certain investors

- Smart Contract Audit Risk: Although WXTM is ERC20-based on Ethereum, changes to the wrapping mechanism or underlying Tari protocol could introduce unforeseen technical risks

WXTM Technical Risk

- Blockchain Dependency Risk: WXTM's functionality depends entirely on Ethereum network stability and transaction capacity; network congestion or security breaches could impair token transfers

- Smart Contract Risk: While ERC20 is a battle-tested standard, any modifications to the wrapped token contract or bridge mechanisms could introduce vulnerabilities

- Protocol Development Risk: As Tari is still developing its ecosystem and scaling solutions, technical delays or unsuccessful network upgrades could negatively impact investor confidence and WXTM valuation

VI. Conclusion and Action Recommendations

WXTM Investment Value Assessment

WXTM represents exposure to Tari, an ambitious Layer 1 blockchain protocol backed by prominent venture investors including Blockchain Capital, Pantera, and Trinity Ventures. The project's focus on scaling to millions of users with a native app distribution platform addresses real blockchain adoption challenges. However, current market metrics reveal early-stage risks: the token ranks #1847 globally with modest liquidity, substantial 30-day declines (-27.47%), and concentrated holder base (1,077 addresses). The project's long-term value proposition depends on successful ecosystem development, developer adoption, and competitive differentiation in the crowded Layer 1 landscape. Investors should view WXTM as a high-risk, high-potential-reward allocation suitable only for those with extended time horizons and elevated risk tolerance.

WXTM Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of crypto portfolio) through dollar-cost averaging on Gate.com; focus on understanding the Tari protocol and ecosystem roadmap before increasing exposure; avoid leveraged trading.

✅ Experienced Investors: Implement 3-8% portfolio allocation with defined entry/exit strategies; use technical analysis to identify accumulation zones near support levels; monitor ecosystem development and investor sentiment; maintain stop-loss discipline at 10-15% below entry prices.

✅ Institutional Investors: Consider 5-15% allocation as part of Layer 1 protocol diversification strategy; establish partnerships or research agreements to gain deeper protocol insights; evaluate risk-adjusted returns against market cap and liquidity metrics; prepare contingency plans for regulatory changes affecting wrapped tokens.

WXTM Trading Participation Methods

- Spot Trading on Gate.com: Execute buy and sell orders for WXTM with full transparency on pricing and liquidity; leverage real-time charts and technical indicators to optimize entry and exit timing

- Accumulation via DCA: Set automatic recurring purchases on Gate.com at weekly or monthly intervals to reduce timing risk and average down during market volatility

- Long-term Staking (Future): Monitor Tari protocol announcements for staking opportunities that may provide yield on WXTM holdings while supporting network security

Cryptocurrency investment carries extreme risk, and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. We strongly recommend consulting with professional financial advisors before investing. Never invest more capital than you can afford to lose completely. Past performance is not indicative of future results. Regulatory changes may materially affect token valuations and tradability.

FAQ

Does XTM have a future?

XTM shows promising potential with growing adoption and development. Strong community support and continuous innovation position it well for long-term growth in the crypto market.

What is WXTM and what is its current market position?

WXTM (Wrapped MinoTari) is a cryptocurrency token currently trading at $0.000233. It maintains a minimal market capitalization with relatively low trading volume, positioning it as an emerging asset in the crypto market with significant growth potential.

What factors influence WXTM price movements?

WXTM price movements are influenced by market sentiment, trading volume, technological developments, and user adoption rates. Network activity and investor confidence also drive price dynamics.

Is WXTM a good investment for 2025?

WXTM shows promising potential with projected growth to $0.00229537 in 2025. Strong fundamentals and increasing adoption make it an attractive option for investors seeking exposure to emerging blockchain projects with significant upside potential.

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 SAGA Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Blockchain Ecosystem

Is Kaspa (KAS) a good investment?: Analyzing the potential of this high-throughput blockchain project

FOXY vs APT: Comparing Modern Threat Detection Systems in Enterprise Security Environments

Is Web3 Dead?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community