2025 XRP Price Prediction: Potential Surge to $5 Amid Growing Institutional Adoption

Introduction: XRP's Market Position and Investment Value

XRP (XRP) has established itself as a leading digital asset in the cryptocurrency market since its inception in 2012, achieving significant milestones in the realm of cross-border payments and financial technology. As of 2025, XRP boasts a market capitalization of $137.89 billion, with a circulating supply of approximately 60.11 billion tokens and a price hovering around $2.294. This asset, often hailed as the "bridge currency for global transactions," is playing an increasingly crucial role in revolutionizing international money transfers and facilitating seamless financial operations.

This article will provide a comprehensive analysis of XRP's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem developments, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. XRP Price History Review and Current Market Status

XRP Historical Price Evolution

- 2013: XRP launched, price started at $0.005874

- 2018: Bull market peak, price reached all-time high of $3.65

- 2020: Market downturn, price dropped to $0.15

- 2023: Market recovery, price surpassed $1

XRP Current Market Situation

As of November 14, 2025, XRP is trading at $2.294, ranking 4th by market capitalization. The 24-hour trading volume is $189,961,285, with a market cap of $137,885,915,049. XRP has experienced a 24-hour price decrease of 8.21%, with the day's high at $2.526 and low at $2.245. The current price represents a significant 232.79% increase over the past year, despite an 8.16% decline in the last 30 days. The total supply of XRP is 99,985,774,127, with 60,107,199,237 in circulation. The market sentiment appears cautious, as indicated by the extreme fear reading on the market emotion index.

Click to view the current XRP market price

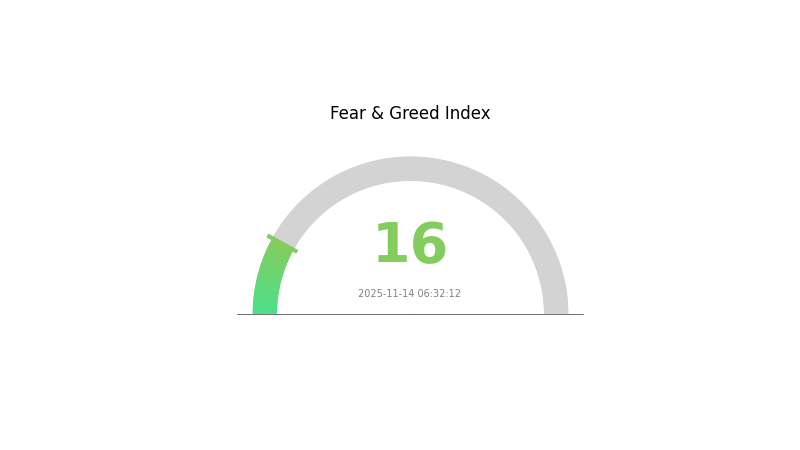

XRP Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The XRP market is currently gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often presents unique opportunities for savvy investors. While the majority may be panicking, historically, such extreme fear has sometimes preceded significant market rebounds. However, it's crucial to approach with caution and conduct thorough research. Gate.com offers comprehensive tools and analysis to help navigate these turbulent market conditions. Remember, market sentiment can shift rapidly, so stay informed and trade wisely.

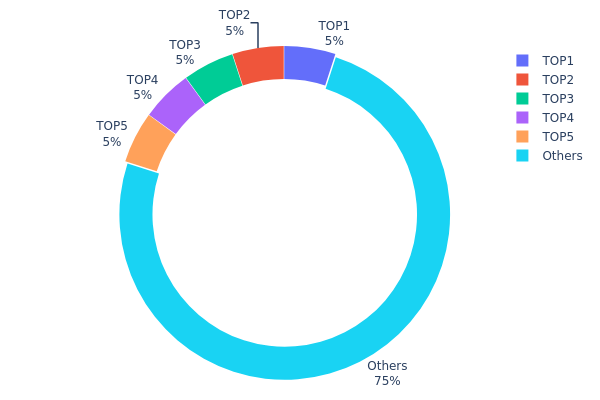

XRP Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of XRP ownership. According to the data, the top 5 addresses each hold approximately 5% of the total XRP supply, collectively accounting for 25% of all tokens. The remaining 75% is distributed among other addresses.

This distribution pattern suggests a moderate level of concentration in XRP holdings. While the top addresses hold significant portions, the fact that 75% is spread among other holders indicates a degree of decentralization. However, the equal distribution among the top 5 addresses (each at 5%) is noteworthy and may warrant further investigation into potential coordinated actions or institutional holdings.

The current distribution structure could have implications for market dynamics. The presence of large holders may contribute to increased price volatility if they decide to make significant moves. However, the substantial portion held by smaller addresses could act as a stabilizing force, potentially mitigating the impact of large transactions. Overall, this distribution reflects a balance between centralized and decentralized ownership, which could contribute to the long-term stability of the XRP ecosystem.

Click to view the current XRP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | rB3WNZ...oqscPn | 5000000.23K | 5.00% |

| 2 | r9UUEX...M6HiYp | 5000000.22K | 5.00% |

| 3 | rDdXiA...CFWeCK | 5000000.22K | 5.00% |

| 4 | rMhkqz...6bDyb1 | 5000000.21K | 5.00% |

| 5 | r9NpyV...BdsEN3 | 5000000.20K | 5.00% |

| - | Others | 74999998.92K | 75% |

II. Key Factors Influencing XRP's Future Price

Supply Mechanism

- Escrow Release: Ripple releases 1 billion XRP from escrow each month, with unused tokens returned.

- Historical Pattern: Previous releases have had minimal direct impact on XRP price.

- Current Impact: Monthly releases are expected to continue, maintaining a predictable supply increase.

Institutional and Whale Dynamics

- Institutional Holdings: Some financial institutions are exploring XRP for cross-border payments.

- Corporate Adoption: Several banks and payment providers are testing or using Ripple's technology.

- National Policies: Regulatory clarity in various countries continues to shape XRP's adoption.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies on digital currencies may influence XRP's role.

- Inflation Hedge Properties: XRP is not typically considered a strong inflation hedge.

- Geopolitical Factors: International regulations on cryptocurrency transfers could affect XRP usage.

Technical Development and Ecosystem Building

- XRPL Upgrades: Ongoing improvements to the XRP Ledger enhance scalability and functionality.

- Ecosystem Applications: DeFi projects and NFT platforms are being developed on the XRP Ledger.

III. XRP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.19 - $2.00

- Neutral prediction: $2.00 - $2.50

- Optimistic prediction: $2.50 - $3.35 (requires favorable regulatory clarity)

2027-2028 Outlook

- Market phase expectation: Potential bull market consolidation

- Price range forecast:

- 2027: $2.47 - $3.56

- 2028: $2.27 - $3.85

- Key catalysts: Increased institutional adoption, expansion of Ripple's payment network

2029-2030 Long-term Outlook

- Base scenario: $3.57 - $4.05 (assuming steady growth in cross-border payment solutions)

- Optimistic scenario: $4.05 - $4.53 (given widespread adoption by major financial institutions)

- Transformative scenario: $4.53 - $5.27 (extreme favorable conditions such as global regulatory approval)

- 2030-12-31: XRP $4.05 (potential steady-state value)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.35216 | 2.296 | 1.19392 | 0 |

| 2026 | 3.21945 | 2.82408 | 1.86389 | 23 |

| 2027 | 3.56568 | 3.02177 | 2.47785 | 31 |

| 2028 | 3.85366 | 3.29372 | 2.27267 | 43 |

| 2029 | 4.53859 | 3.57369 | 2.60879 | 55 |

| 2030 | 5.27298 | 4.05614 | 2.71761 | 76 |

IV. XRP Professional Investment Strategies and Risk Management

XRP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate XRP during market dips

- Set price targets for partial profit-taking

- Store in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor XRP's correlation with Bitcoin and overall market sentiment

- Pay attention to Ripple's partnerships and regulatory developments

XRP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for XRP

XRP Market Risks

- Volatility: XRP price can experience significant fluctuations

- Liquidity: Potential issues during high-stress market conditions

- Competition: Other cryptocurrencies and traditional payment systems

XRP Regulatory Risks

- SEC lawsuit: Ongoing legal battle with the US Securities and Exchange Commission

- Global regulatory uncertainty: Varying cryptocurrency regulations across different jurisdictions

- Banking partnerships: Potential impact on existing and future partnerships due to regulatory changes

XRP Technical Risks

- Network security: Potential vulnerabilities in the XRP Ledger

- Centralization concerns: Ripple's influence on XRP's development and distribution

- Scalability challenges: Maintaining performance as network usage increases

VI. Conclusion and Action Recommendations

XRP Investment Value Assessment

XRP presents a unique value proposition in the cross-border payments sector, with potential for long-term growth. However, regulatory uncertainty and market volatility pose significant short-term risks.

XRP Investment Recommendations

✅ Beginners: Start with small positions and focus on education about XRP and the broader crypto market ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider XRP as part of a diversified crypto portfolio

XRP Trading Participation Methods

- Spot trading: Buy and sell XRP on reputable exchanges like Gate.com

- Derivative trading: Utilize futures or options contracts for advanced trading strategies

- Staking: Participate in XRP staking programs where available for passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What price will XRP reach in 2025?

Based on market trends and expert predictions, XRP could potentially reach $3 to $5 by 2025, driven by increased adoption and partnerships in the financial sector.

Will XRP reach $100 dollars?

While ambitious, XRP reaching $100 is unlikely in the near future. A more realistic target might be $5-$10 within the next 5 years, depending on market conditions and XRP's adoption in cross-border payments.

What will XRP be worth in 2030?

Based on current trends and market projections, XRP could potentially reach $10 to $15 by 2030, driven by increased adoption in cross-border payments and partnerships with major financial institutions.

Will XRP reach $20 USD?

While ambitious, XRP reaching $20 is possible in the long term with increased adoption and favorable market conditions. However, it would require significant growth from current levels.

Crypto Crash or Just a Correction?

2025 XRP Price Prediction: Analyzing Regulatory Impacts and Market Adoption on Future Valuation

2025 XRP Price Prediction: Bull Run or Bear Market - Analyzing Potential Scenarios for Ripple's Cryptocurrency

How Does On-Chain Data Reveal XRP's Market Position in 2025?

How Does Crypto Competitor Analysis Impact Market Share in 2025?

The Great Reshaping: How Binance, OKX, and Gate Are Redefining the CEX Landscape in 2025

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua

What is PSY: A Comprehensive Guide to the Global Phenomenon and Cultural Impact of the South Korean Artist