Can Limitless become the "number one player" in the prediction market?

@ trylimitless remains one of the most serious attempts to turn prediction markets into a real trading economy, a space long promised by crypto but rarely executed at scale.

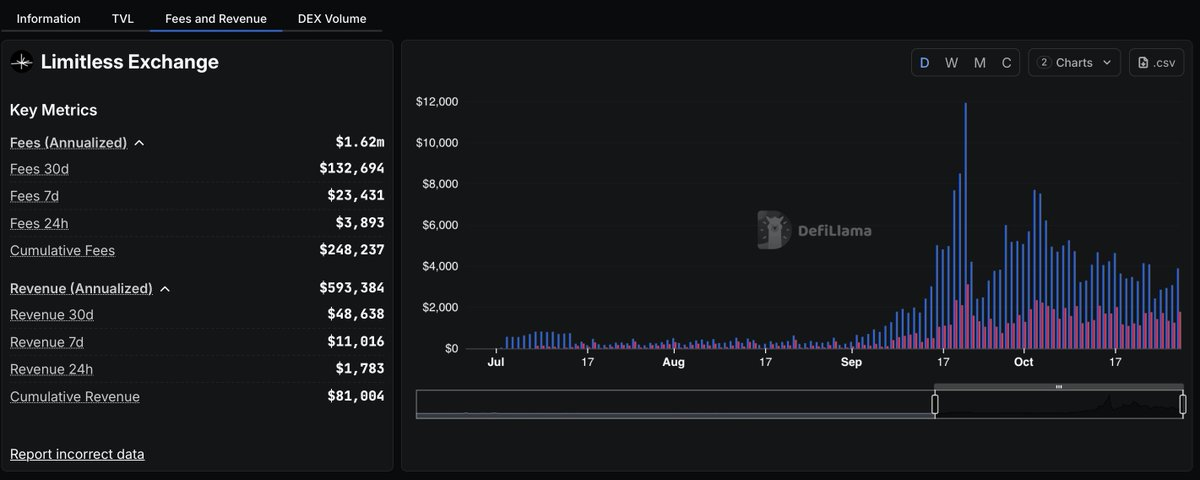

Since launching on Base, Limitless has processed over $515 million in cumulative trading volume, with traders earning daily rewards for providing liquidity inside the order book. The protocol itself generates roughly $1.9 million in annualized fees and ~$600 thousand in annualized revenue.

That’s more throughput than most mid-tier DEXes, suggesting that on-chain speculation is finally finding its product-market fit.

Built by veterans from trading and DeFi, Limitless combines a central-limit-order-book (CLOB) with full on-chain settlement, letting users speculate on outcomes like “Will BTC close above $65 K?” with professional-grade execution — not the clunky AMM UX that crippled earlier prediction markets.

The Thesis

The pitch is simple: Prediction markets should feel like trading, not gambling.

Limitless gives them that form, order books, depth, spreads, leaderboards, and incentives, while keeping everything transparent on Base. Each market is effectively a binary options contract that settles fully on-chain. The design lets users:

- Trade hourly, daily, and weekly events

- Provide limit orders and earn liquidity rewards

Earn points and leaderboard bonuses (Season 2 live now through Jan 26)

The result? A high-frequency, short-duration trading ecosystem that feels more like Deribit or Binance than Polymarket, but runs entirely on-chain.

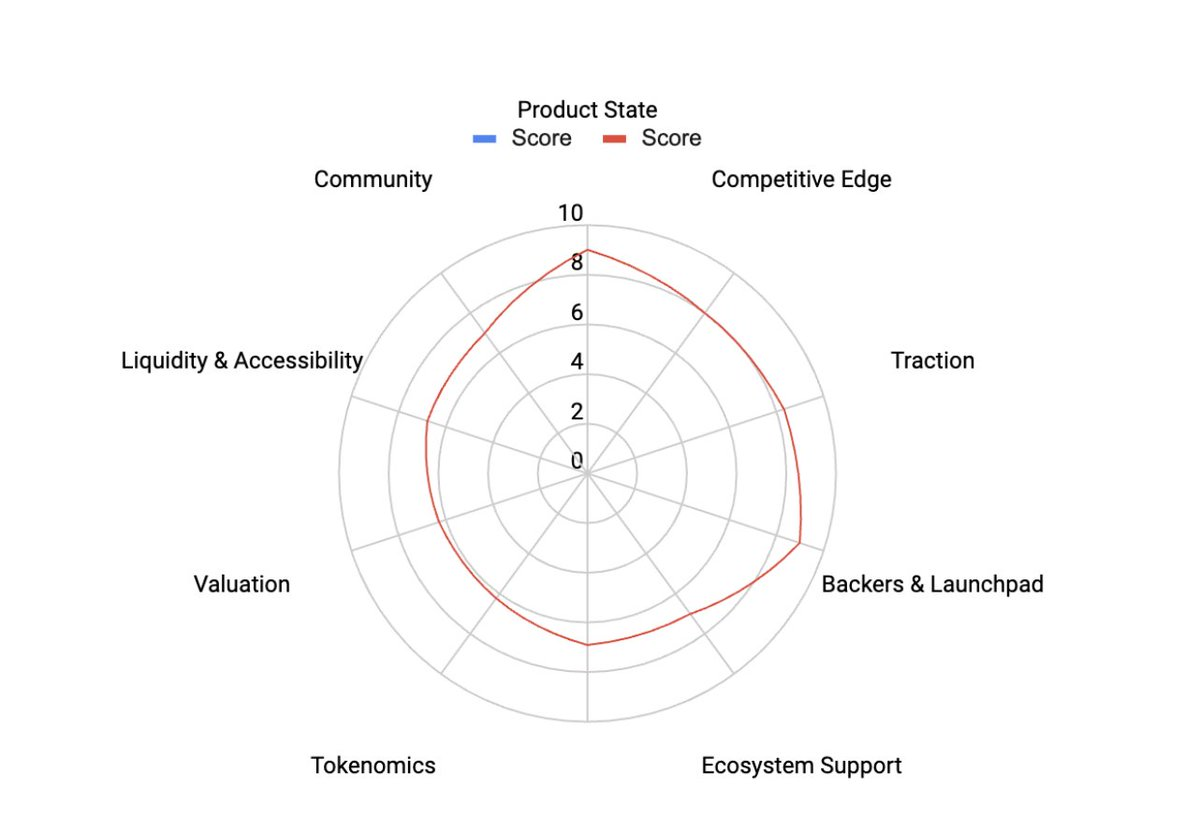

The Muur Framework

Product: Score: 8.3 / 10

Limitless is live on Base mainnet with full on-chain CLOB trading and a confirmed BNB Chain expansion.

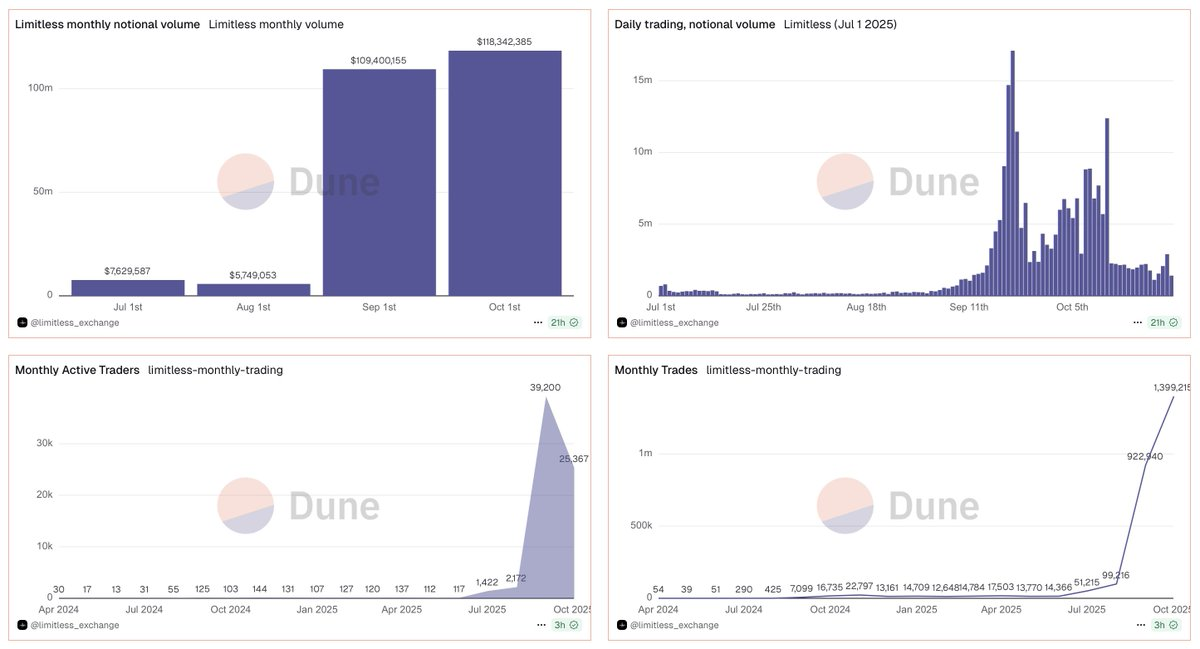

Dune data shows a clear breakout:

That’s $515M+ total notional, ≈ 1.18M monthly trades, and ~39K monthly active traders. With 1-minute starts, fast resolutions, and on-chain settlement, Limitless has achieved genuine product-market fit in a sector long stuck in experimentation.

Tokenomics — Score: 6.2 / 10

Launch & Sale

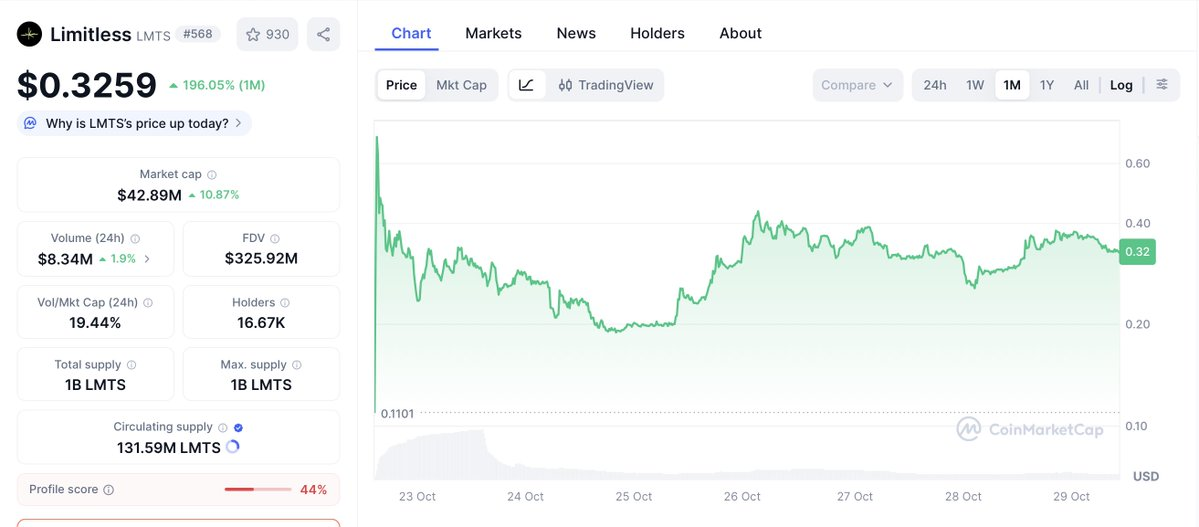

- TGE on Oct 22 2025 via @ KaitoAI Launchpad (20M LMTS @ $0.05 → ~$75M FDV). *

~$1 M raised with ~$201 M in pledges (~200× oversubscription). *

Token Supply

Total 1B LMTS

- Circulating at TGE 13.16%

- Team 25%

- Ecosystem 24.37%

- Treasury 13%

- Liquidity 10%

- Kaito 1.37%

Echo 1.26% *

Kaito/Echo: 50% at TGE / 50% after 6 months.

Utilities: Live staking for fee reductions + perks; ecosystem rewards; and fee-funded buybacks planned to return trading value to holders. Governance to follow.

Market Performance

Post-launch volatility was severe (-58 % drawdown) after reports that a team-controlled wallet deployed a “concentrated liquidity MM” on Aerodrome.

The team confirmed tokens remain locked and that the wallet was used to stabilize price, not offload inventory, but the event shook confidence. Subsequent on-chain buybacks helped partially restore trust.

Takeaway: Sound structure and utilities, but credibility must be rebuilt through transparent market-making and buyback disclosures.

Backers & Ecosystem — Score: 9.0 / 10

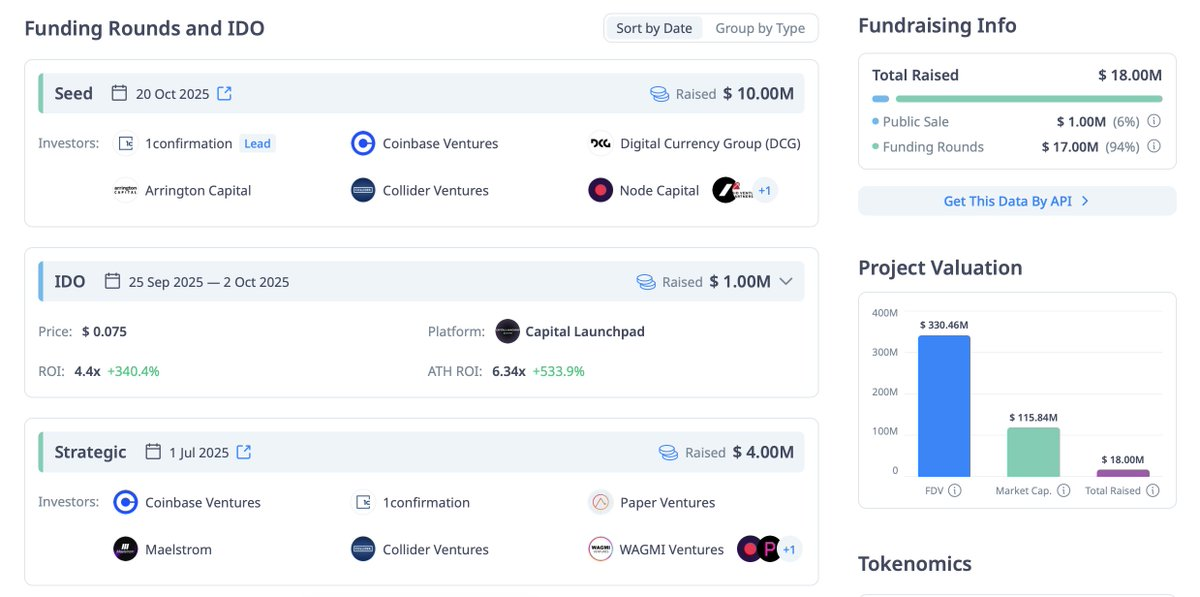

$10M seed round (Oct 2025) led by 1confirmation, joined by F-Prime, DCG, Coinbase Ventures, Arrington Capital, Maelstrom (Arthur Hayes), Collider, Paper, Node, WAGMI.

Built natively on Base, Limitless benefits from Coinbase’s distribution halo and has live liquidity on Aerodrome, plus airdrops via Wallchain Epochs and Atlantis World.

A BNB Chain deployment expands reach to a new user base.

Traction — Score: 8.3 / 10

- $515M cumulative trading volume

- $109M monthly for two straight months

- 1.18M monthly trades / 39 K active traders

1.1M TGE thread views

Those figures place Limitless among the top performing on-chain exchanges by activity, rare for a prediction market.

Community & Narrative — Score: 7.0 / 10

Limitless has built a performance-driven trader community centered on leaderboards and seasons rather than memes.

Sentiment dipped after the MM-wallet incident but rebounded as the team disclosed wallet behavior and buybacks.

Narrative heat remains solid within the Base SpecFi movement — “perps for events” is emerging as the next wave of on-chain speculation.

Market Context — Score Adjustment: +0.3

Macro conditions are risk-on (Greed ≈ 70); Base continues to attract liquidity; and the prediction-market narrative is accelerating.

Limitless occupies a less crowded lane than Polymarket or Kalshi, targeting high-frequency trading rather than macro bets.

Investment Thesis

- Real product, real revenue — $515 M+ volume with visible fee streams

- Architectural edge: first on-chain CLOB prediction exchange to scale

- Tier-1 backers: 1confirmation, F-Prime, DCG, Coinbase Ventures, Arrington

- Token flywheel potential: staking + buybacks link trading to token demand

- Network expansion: Base + BNB → cross-ecosystem liquidity

Execution Watch

- Publish a clear market-making policy (wallets, parameters, reporting cadence).

- Automate and disclose fee buybacks to validate value capture.

Secure first CEX listing and grow depth to reduce range-bound volatility.

At 7.78 / 10, Limitless is a Conviction Build — Execution Watch.

A live, revenue-producing prediction exchange with world-class backers and a transparent product, now tasked with proving that its token economy can match its volume.

If the team restores confidence through consistent on-chain disclosures and sustains its $100 M+ monthly run-rate, Limitless won’t just make prediction markets work — it will make them liquid.

Disclaimer:

- This article is reprinted from [ stacy _muur ]. All copyrights belong to the original author [ stacy _muur ]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?