Ethereum Staking Sees a Key Reversal as Inflows Double Outflows

As 2025 draws to a close, Ethereum is experiencing a crucial shift: the validator “entry queue” has reversed and now exceeds the “exit queue.”

This signals that, after months of market volatility, the capital seeking to stake ETH and become validators now significantly outpaces the amount looking to unstake and exit.

This shift is more than just a change in numbers—it reflects broader shifts in market sentiment and network fundamentals. It marks a gradual easing of sustained selling pressure and suggests that, with renewed institutional confidence, the Pectra upgrade, and DeFi deleveraging, Ethereum is entering a new phase of enhanced security and capital accumulation.

Reversal in the Ethereum Validator Queue

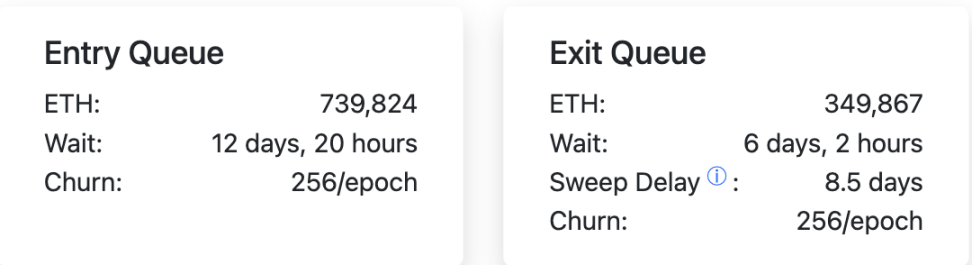

According to the latest Ethereum Validator Queue data, about 739,824 ETH are currently queued to enter the network, with an estimated wait time of 12 days and 20 hours. The exit queue holds just 349,867 ETH, which would take around six days to clear.

Currently, total ETH staked on Ethereum stands at approximately 35.5 million ETH, representing 29.27% of total supply, with 983,600 active validators.

What Is the Validator Queue and Why Is It Important?

Under Ethereum’s Proof of Stake (PoS) protocol, to maintain consensus stability, nodes cannot freely enter or exit. Instead, the Churn Limit mechanism regulates these flows.

Currently, the maximum number of validators that can join (activate) or exit per epoch (about 6 minutes and 24 seconds) is capped at 256 ETH, equating to roughly 57,600 ETH processed daily.

- Entry Queue: The waiting channel for staking 32 ETH to become a validator. Growth in this queue signals robust demand for staking and confidence in long-term returns.

- Exit Queue: The waiting channel for withdrawing staked funds. Growth here usually indicates selling pressure, liquidity needs, or deleveraging activity.

As such, the validator queue is both an indicator of network health and a barometer of market sentiment.

How Did the Validator Queue Change in 2025?

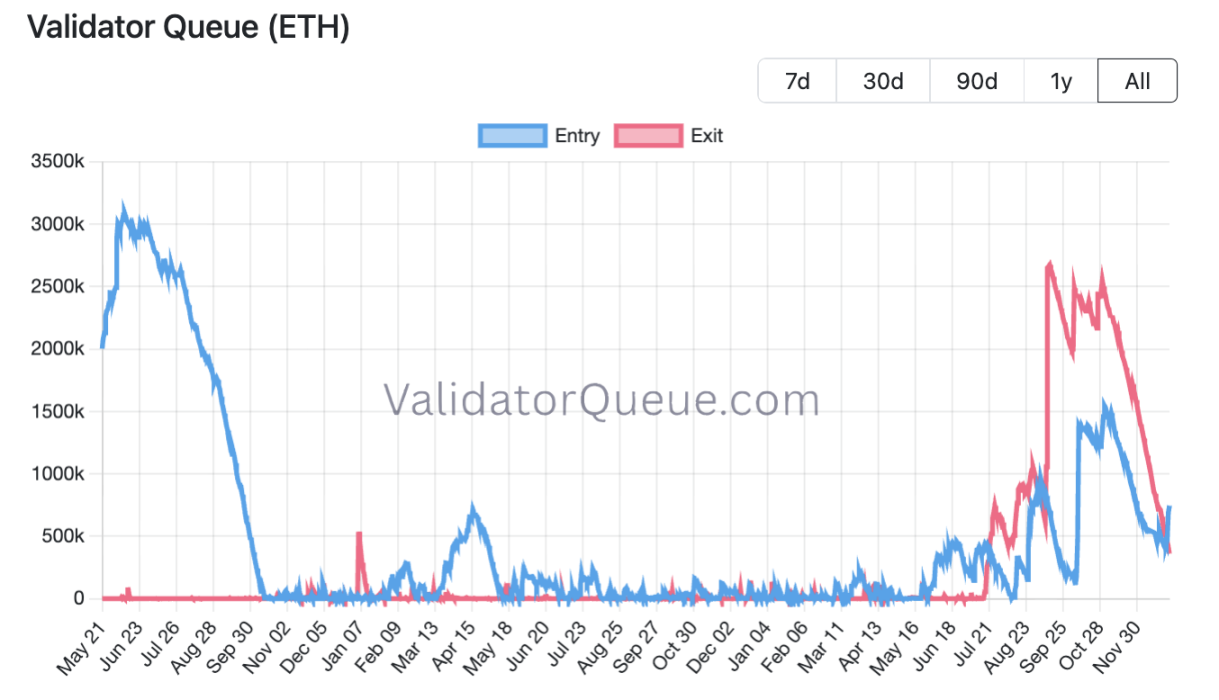

Throughout 2025, Ethereum’s validator queue saw significant fluctuations:

- First half through autumn: The exit queue repeatedly hit record highs, driven by institutional rotation, profit-taking, DeFi deleveraging (such as stETH liquidations triggered by spiking Aave lending rates), and isolated security events (such as Kiln’s full validator exit in September). In mid-September, the exit queue peaked at 2.67 million ETH, with wait times reaching 46 days.

- September–October: The entry queue briefly overtook the exit queue, but the exit queue soon regained dominance.

- November: The entry queue climbed above 1.5 million ETH, while the exit queue at one point exceeded 2.5 million ETH.

- Late December: The entry queue reversed again, with about 739,824 ETH now waiting to enter, and only 349,867 ETH in the exit queue.

Four Core Drivers Behind the December Reversal

This reversal is no coincidence—it’s the result of capital flows, technological upgrades, and macroeconomic factors converging:

Major Staking by Treasury Firms Like BitMine

Just days before the reversal (December 25–27), BitMine staked a total of 342,560 ETH (about $1 billion), directly driving the queue’s turnaround.

BitMine also previously announced plans to launch the Made in America Validator Network (MAVAN) in Q1 2026, highlighting its long-term commitment to Ethereum staking.

At the same time, another leading treasury firm, SharpLink, has staked nearly all its ETH holdings, further fueling capital inflows.

Despite ongoing challenges for crypto treasury firms—with some slowing ETH accumulation or even selling (as seen with ETHZilla)—large-scale commitments from major players like BitMine and SharpLink have helped stabilize Ethereum’s staking ecosystem.

Pectra Upgrade Improves Staking Experience

The Pectra upgrade, implemented in May 2025 via EIP-7251, brought key improvements: raising the maximum effective validator balance from 32 ETH to 2,048 ETH, enabling reward compounding and validator consolidation. This reduces operational costs for institutions running thousands of validator nodes and makes staking more accessible for large capital.

Kiln Restaking Reopens

After a mass validator exit following a security incident in September 2025, Kiln’s restaking timeline remains unclear. However, Beaconcha.in data shows Kiln now holds a 1.68% share of Ethereum’s staking ecosystem.

DeFi Deleveraging Nears Completion

Earlier, in June and July, rising Aave lending rates forced the unwinding of stETH leveraged strategies, triggering a wave of selling. Now, as deleveraging winds down, exit demand has faded and inflows are taking the lead.

Institutions Accumulate at Lows

With the market consolidating, some institutions remain bullish on ETH’s long-term value. Trend Research plans to invest another $1 billion in ETH. On December 25, after verification with Jack Yi, it was confirmed that Trend Research, led by Jack Yi, began accumulating ETH in November at an average cost of around $3,150 per ETH. Its 645,000 ETH position is currently showing an unrealized loss of about $143 million. After the next $1 billion investment, the average cost is expected to be around $3,050.

Summary

The reversal of Ethereum’s validator entry queue surpassing the exit queue marks the first net staking inflow since July. This is more than a numerical milestone—it’s a key signal of renewed market confidence. Whether this trend will persist remains to be seen.

While the Ethereum spot ETF has yet to see significant net inflows, on-chain fundamentals are clearly improving. As SharpLink Gaming Co-CEO Joseph Chalom noted this month, the surge in stablecoins, tokenized RWAs, and rising interest from sovereign wealth funds could drive Ethereum’s TVL to grow tenfold by 2026.

As 2025 ends, is Ethereum ready to build momentum for 2026? Only time will tell.

Disclaimer:

- This article is republished from [Foresight News], with copyright belonging to the original author [KarenZ]. For any concerns regarding this republication, please contact the Gate Learn team for prompt resolution in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless otherwise noted, reproduction, distribution, or plagiarism of the translated article is prohibited.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

Our Across Thesis

What is Neiro? All You Need to Know About NEIROETH in 2025

An Introduction to ERC-20 Tokens