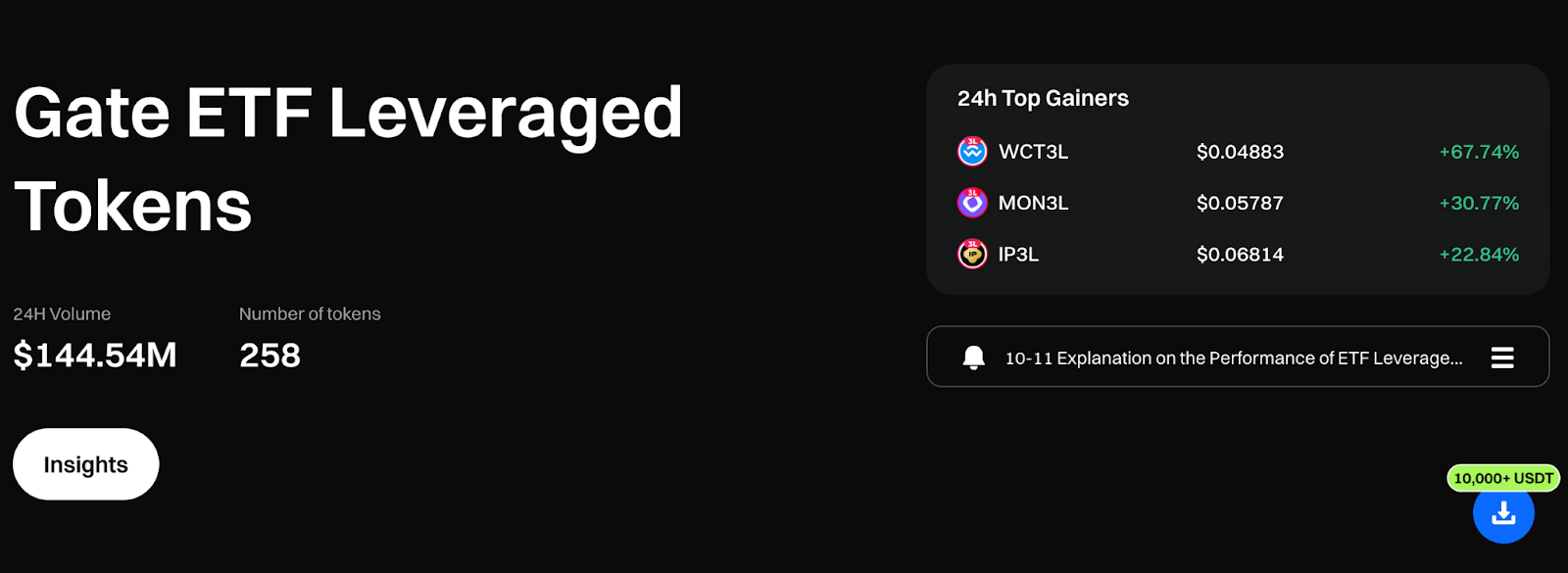

Gate Leveraged ETFs: A Tactical Framework for Trading Efficiency in Volatile Markets

ETFs Are Evolving into Trading Instruments

Traditionally, ETFs have served as tools to reduce trading frequency, valued for their ability to diversify risk and smooth out volatility. They have been well-suited for long-term strategies that seek average returns over time. However, as market dynamics accelerate and prices shift direction more frequently in short periods, waiting for trends to extend is no longer the top choice for most traders.

In today’s highly volatile markets, the ability to deploy capital quickly and scale positions efficiently has become more important than simply holding for the long term. As a result, the role of ETFs is shifting—from passive allocation vehicles to tradable units that enable direct execution of trading strategies.

Leveraged ETFs: Built for Short-Term Market Cycles

Leveraged ETFs weren’t created to replace spot or derivatives trading, but to bridge the gap between the two. When market direction becomes clear in a short window, single-exposure products often can’t fully capture a trader’s insights, while full derivatives trading brings higher barriers for learning and risk management.

The core design of leveraged ETFs is to preserve the familiar spot trading experience while increasing the impact of price swings on capital efficiency. As a result, more traders now use leveraged ETFs as strategy amplifiers, not just as investment products.

Core Operating Principles of Gate Leveraged ETF Tokens

Gate leveraged ETF tokens derive their risk exposure from corresponding perpetual contract positions. However, the system automatically manages all contract-level details. For users, these tokens function as straightforward, tradable assets.

During trading, users don’t need to manage:

- Margin ratios

- Liquidation prices

- Borrowing and funding rates

- Timing for position adjustments

This allows traders to focus on the fundamentals: choosing the right direction and timing their entries and exits.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Fixed Leverage Through Continuous Rebalancing

Leveraged ETFs are dynamic products. To keep actual exposure within the target range, the system rebalances the underlying contract positions at set intervals. These adjustments are seamless for users but are critical for maintaining the leveraged structure over time. For this reason, leveraged ETFs aren’t just simple leverage multipliers—they’re dynamic, actively managed strategy systems.

Accessing Leverage Without Derivatives Trading

For many traders, the real psychological challenge isn’t leverage itself, but the complex, real-time risk management required in derivatives markets. Leveraged ETFs don’t eliminate risk, but they simplify risk exposure by tying it directly to price movements. Volatility is reflected in the token’s net asset value, not through forced liquidations or margin calls. This keeps strategy execution focused on market judgment, not on sudden position management issues.

Amplifying Trends and Efficiency Together

In trending or one-sided markets, leveraged ETFs can multiply price movements, allowing capital to be used more efficiently in the same timeframe. The rebalancing mechanism can also produce a compounding amplification effect in continuous trends. Because trading is similar to spot trading, leveraged ETFs are often used as transitional tools before fully adopting leverage strategies—they boost efficiency without requiring a full leap into complex derivatives markets.

Structural Constraints and Key Risks

Leveraged ETFs aren’t suitable for every market environment. In choppy or range-bound markets, rebalancing can erode returns, leading to outcomes that may differ from intuitive expectations. Final returns aren’t simply “underlying asset movement × leverage factor”—adjustment paths, transaction costs, and volatility all play a role. As such, leveraged ETFs are generally not recommended for long-term holding.

Why a Daily Management Fee Is Necessary

Gate leveraged ETFs charge a daily management fee of 0.1% to cover structural costs essential for ongoing product operation, including:

- Contract opening and closing fees

- Perpetual contract funding rates

- Hedging and position adjustment costs

- Slippage during rebalancing

This fee isn’t an extra burden—it’s a necessary condition for the stable operation of leveraged ETFs and is standard practice in the market.

Leveraged ETFs: Strategic Tools, Not Passive Assets

Leveraged ETFs are not meant to replace spot allocation, but to complement the strategic toolkit. They’re best suited for strategies with clear market views, defined entry and exit plans, and a tolerance for short-term volatility—not for long-term buy-and-hold. Only by understanding their structure, costs, and the right scenarios for use can leveraged ETFs truly enhance trading efficiency.

Conclusion

Leveraged ETFs don’t make trading easier—they make strategy execution more direct. They magnify price swings and the significance of every trading decision. For traders who can keep up with the market and actively manage risk, Gate leveraged ETFs offer a powerful way to boost capital efficiency. But ignoring their structure and volatility costs can lead to taking on more risk than anticipated.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution