GUSD: Bridging Stability and Yield for the Next Generation of On-Chain Assets

The New Era of Stablecoins: From Storing Value to Creating Value

In the past, stablecoins primarily served as tools for risk mitigation or means of payment, with users holding them for price stability and transactional convenience. Now, GUSD redefines this paradigm, transforming stablecoins from passive stores of value into on-chain assets that automatically generate yield.

GUSD’s core philosophy is simple: every stablecoin should have cash flow value. Holding GUSD is like owning a digital asset that accrues interest over time, enabling a new model of capital management that generates returns while maintaining stability.

RWA Backing: Making Returns Real and Predictable

The yield from GUSD is not arbitrary; it is backed by Real World Assets (RWA), including U.S. short-term Treasuries and high-grade financial notes. These low-risk assets provide reliable interest income, ensuring that returns are authentic and sustainable.

This structure makes the interest mechanisms of traditional finance transparent and blockchain-based, allowing GUSD to maintain its peg to the U.S. dollar while continuously generating robust yields. Unlike stablecoins backed by cash or bank deposits, GUSD acts as a yield-bearing dollar, combining stability with growth potential.

Flexible Entry Mechanisms

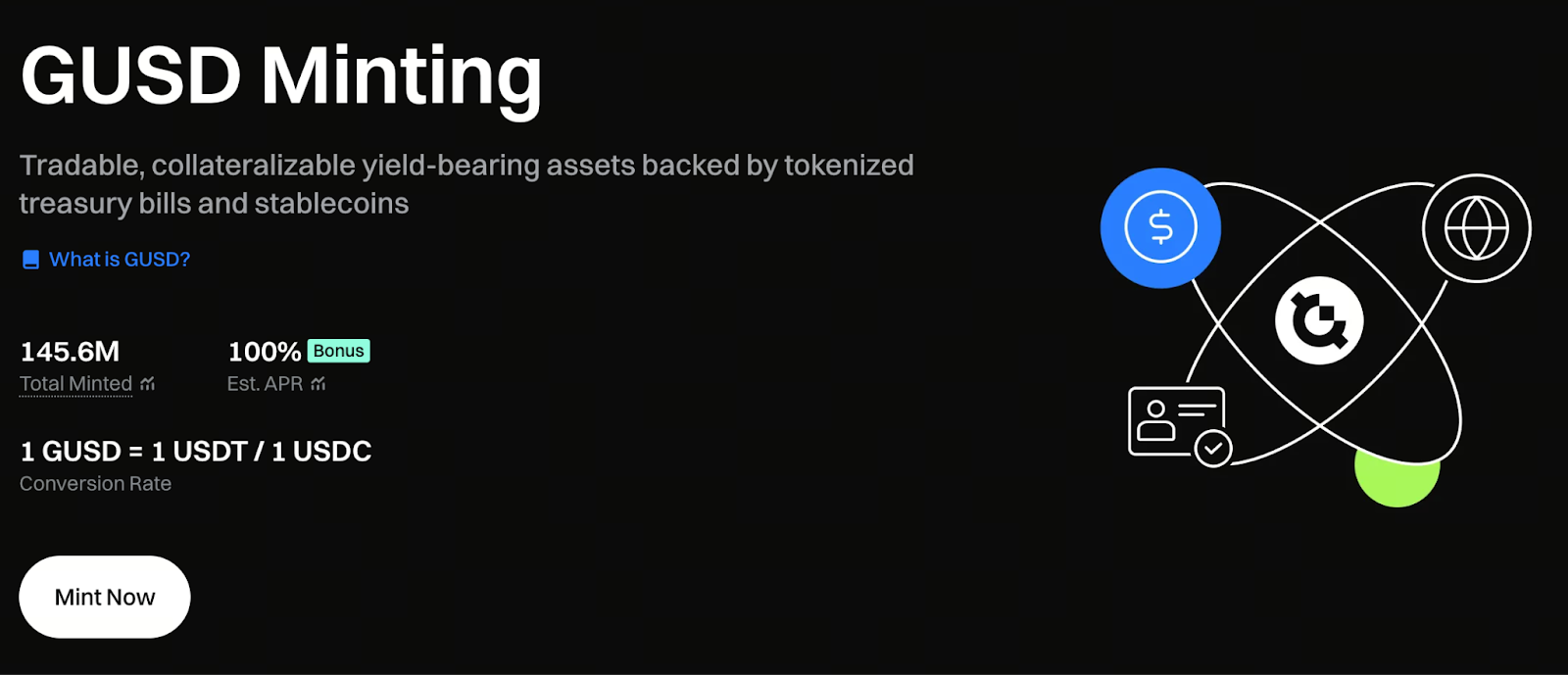

To meet users’ diverse capital needs, GUSD offers two entry options:

- Exchange Swap: Instantly exchange USDT or other stablecoins for GUSD on supported exchanges—ideal for short-term liquidity management.

- On-Chain Minting: If you hold USDT or USDC, you can mint GUSD 1:1 via smart contracts and participate directly in RWA yield allocation—suited for long-term investors.

This dual approach allows users to choose strategies that best fit their needs, balancing liquidity and efficiency.

Mint GUSD today and earn daily annualized yield: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Yield Mechanism

GUSD employs an accrual interest and maturity settlement model. For example, minting GUSD with 100 USDT at a 20% annual yield allows you to redeem approximately 120 USDC at maturity.

This design, similar to bond interest accrual, enables natural growth of returns over time and eliminates the complexity of daily compounding. It also provides DeFi users with a return experience closer to traditional finance.

Building a Multi-Tiered Ecosystem

GUSD is more than a stablecoin—it’s a key building block of the on-chain financial ecosystem. Its use cases continue to expand:

- Staking and Lock-Up Rewards: Holders earn additional yield.

- Limited-Time Airdrops and Promotions: Encouraging early adoption and community engagement.

- Multi-Functional Integrations: Enables lending, wealth management, launchpool participation, margin trading, and more to maximize asset utilization.

Through these applications, GUSD evolves beyond the stablecoin definition, becoming a flexible financial instrument with appreciation potential.

Three Key Advantages of GUSD

- Time-Accrued Value: The longer you hold, the greater the return—ideal for long-term strategies.

- High Liquidity Architecture: Supports both exchange swaps and on-chain minting for seamless fund movement.

- Robust Application Ecosystem: From payments and wealth management to investments, enhancing capital efficiency.

If GUSD continues to maintain transparent reserve disclosures and regular audits, its market credibility will further improve.

Liquidity and Operational Guidance

GUSD is designed for easy redemption and can typically be converted to USDC or USDT with minimal hassle. However, cross-chain or cross-platform transactions may involve fees or time delays. Users should verify current market liquidity and fee rates before transacting to ensure the best trading experience.

Risk Disclosure

This article is for informational purposes only and does not constitute investment advice or solicitation. Before engaging with GUSD or other yield-generating stablecoins, users should fully understand product features and risks, and consult a professional financial advisor. Some users may face regional restrictions; please comply with platform policies.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

By integrating RWA yield models and transparent on-chain settlement, GUSD exemplifies the fusion of traditional finance and DeFi. As Web3 financial infrastructure advances, yield-generating stablecoins are emerging as the new mainstream in crypto asset allocation. For users seeking stability, transparency, and continuous returns, GUSD is not just a stablecoin—it’s a pivotal tool for ushering in the era of autonomous asset appreciation.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution