Pump.fun Litigation Annual Review: Mysterious Informant, Inside Records, and Unveiled Answers

In January 2025, the meme coin market hit its peak of mania. With U.S. President Trump launching the TRUMP token, an unprecedented wave of speculation swept the sector, and the “100x coin” riches myth dominated market attention.

At the same time, a lawsuit was quietly initiated against the Pump.fun platform.

Fast forward to recent days.

Pump.fun’s co-founder and Chief Operating Officer Alon Cohen has not posted on social media for over a month. For Alon—normally active and always “surfing the web”—this silence is striking. Data shows Pump.fun’s weekly trading volume plummeted from a January high of $3.3 billion to just $481 million now, a decline of more than 80%. Meanwhile, PUMP’s price fell to $0.0019, about a 78% drawdown from its historical peak.

Looking back to July 12, just months earlier, the landscape was dramatically different. Pump.fun’s public sale, priced uniformly at $0.004 per token, sold out in 12 minutes and raised roughly $600 million, sending sentiment soaring.

The contrast between the exuberance at the start of the year and today’s downturn is stark.

Throughout these changes, the buyback program is the only constant. The Pump.fun team continues to execute daily buybacks as planned. So far, total buybacks have reached $216 million, absorbing around 15.16% of the circulating supply.

Meanwhile, the lawsuit that was overlooked during the market frenzy now quietly grows.

It All Started with $PNUT Losses

The story begins in January 2025.

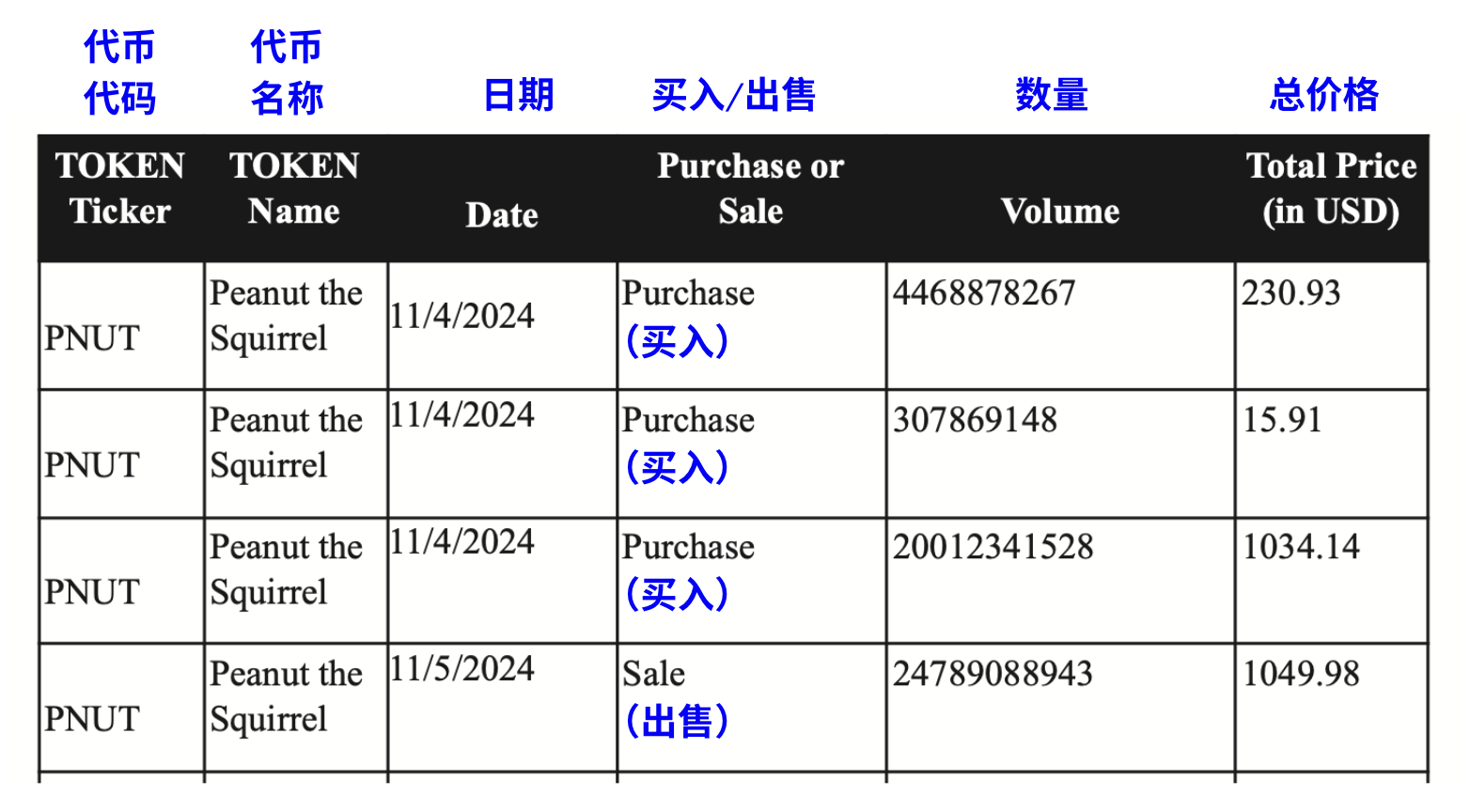

On January 16, investor Kendall Carnahan filed a lawsuit (Case No.: Carnahan v. Baton Corp.) in the U.S. District Court for the Southern District of New York, targeting Pump.fun and its three founders. Carnahan’s claim was straightforward: after buying $PNUT tokens and incurring losses, he accused Pump.fun of selling unregistered securities, in violation of the U.S. Securities Act of 1933.

Court documents revealed Carnahan’s actual loss was just $231.

Only two weeks later, on January 30, another investor, Diego Aguilar, filed a similar lawsuit (Case No.: Aguilar v. Baton Corp.). Unlike Carnahan, Aguilar bought a wider array of tokens—including $FRED, $FWOG, $GRIFFAIN, and other meme coins issued on Pump.fun. Aguilar’s suit was broader, representing all investors who had purchased unregistered tokens on the platform.

At that point, the two cases proceeded separately, but the defendants were identical:

Pump.fun’s operator Baton Corporation Ltd and its three founders: Alon Cohen (COO), Dylan Kerler (CTO), and Noah Bernhard Hugo Tweedale (CEO).

Cases Merged, $240,000 Loss Investor Appointed Lead Plaintiff

The two independent lawsuits quickly drew the court’s attention. Judge Colleen McMahon of the Southern District of New York saw a problem: both cases targeted the same defendants, platform, and alleged violations. Why try them separately?

On June 18, 2025, Judge McMahon directly questioned the plaintiffs’ legal team:

Why are there two separate lawsuits for the same issue? She required the attorneys to justify why the cases shouldn’t be merged.

Plaintiffs’ lawyers initially tried to argue for keeping the cases separate—one focused on $PNUT, the other on all Pump.fun tokens, suggesting two different lead plaintiffs.

But the judge wasn’t convinced. This “divide and conquer” approach would waste judicial resources and could result in conflicting rulings. The crux: all plaintiffs face the same core issue—accusing Pump.fun of selling unregistered securities and alleging they’re victims of a single fraudulent system.

On June 26, Judge McMahon ruled to merge the two cases. Under the Private Securities Litigation Reform Act (PSLRA), she appointed Michael Okafor—who, according to court records, lost about $242,000 in Pump.fun transactions, far more than other plaintiffs—as lead plaintiff.

With this, previously separate investors formed a unified front.

Focus Shifts to Solana Labs and Jito

Just a month after the cases merged, plaintiffs dropped a bombshell.

On July 23, 2025, plaintiffs filed a Consolidated Amended Complaint, dramatically expanding the defendant list. This time, the focus wasn’t just Pump.fun and its three founders—it targeted the core players of the Solana ecosystem.

New defendants:

- Solana Labs, Solana Foundation, and their executives (Solana defendants): Plaintiffs allege Solana’s involvement went far beyond providing blockchain technology. Court documents reveal close technical coordination and communication between Pump.fun and Solana Labs, exceeding a typical developer-platform relationship.

- Jito Labs and its executives (Jito defendants): Plaintiffs claim Jito’s MEV technology enabled insiders to pay extra to ensure their transactions were executed first, allowing them to buy tokens before regular users and profit via risk-free arbitrage.

Plaintiffs’ strategy is clear: they aim to prove Pump.fun, Solana, and Jito didn’t operate independently but formed a tight-knit community of interests. Solana provided blockchain infrastructure, Jito supplied MEV tools, and Pump.fun ran the platform. Together, they created a system that looked decentralized but was actually manipulated.

Core Allegations: More Than Just “Losing Money”

Many might assume this is just a group of investors angry about meme coin losses. But a close reading of the hundreds of pages of court filings shows plaintiffs allege a meticulously designed fraud.

First Allegation: Sale of Unregistered Securities

This is the legal foundation of the case.

Plaintiffs argue all meme tokens issued on Pump.fun are investment contracts. Under the Howey Test, these tokens qualify as securities. Yet, defendants never filed registration statements with the SEC and publicly sold these tokens, violating Sections 5, 12(a)(1), and 15 of the Securities Act of 1933.

Pump.fun sold tokens through a “bonding curve” mechanism but failed to disclose required risk information, financials, or project background—essential for registered securities offerings.

Note: The Howey Test is a legal standard set by the U.S. Supreme Court in the 1946 SEC v. W.J. Howey Co. case, used to determine if a transaction or plan constitutes an “investment contract.” If it meets the criteria, the asset is a “security” subject to SEC regulation and registration/disclosure requirements under the Securities Act of 1933 and Securities Exchange Act of 1934.

Second Allegation: Operation of an Illegal Gambling Enterprise

Plaintiffs call Pump.fun a “meme coin casino.” They argue users buying tokens with SOL are essentially “placing bets,” with outcomes driven by luck and speculation, not actual utility. The platform acts as the “house,” taking a 1% fee from each transaction, like a casino rake.

Third Allegation: Wire Fraud and False Advertising

Pump.fun advertises “fair launch,” “no presale,” and “rug-proof,” creating the impression of a level playing field. In reality, plaintiffs say this is a total lie.

Court filings state Pump.fun secretly integrated Jito Labs’ MEV technology. Insiders aware of the “tricks” and willing to pay extra “tips” could use “Jito bundles” to buy tokens ahead of regular users, then sell for profit after prices rose—classic front-running.

Fourth Allegation: Money Laundering and Unlicensed Money Transmission

Plaintiffs accuse Pump.fun of receiving and transferring large sums without any money transmitter license. Court documents claim the platform even helped North Korean hacker group Lazarus Group launder stolen funds. For example, hackers issued a meme token called “QinShihuang” on Pump.fun, using the platform’s high traffic and liquidity to mix illicit funds with legitimate retail transactions.

Fifth Allegation: Complete Lack of Investor Protection

Unlike traditional financial platforms, Pump.fun has no Know Your Customer (KYC) procedures, Anti-Money Laundering (AML) protocols, or even basic age checks.

Plaintiffs’ central argument: this isn’t a normal investment affected by market volatility, but a fraudulent system designed from the start to profit insiders and cause retail losses.

This expansion fundamentally changes the nature of the lawsuit. Plaintiffs now describe Pump.fun as part of a larger “criminal network,” not acting alone.

A month later, on August 21, plaintiffs submitted a RICO Case Statement, formally alleging all defendants formed a “racketeering organization,” running a manipulated “meme coin casino” under the guise of a “fair launch platform.”

Plaintiffs’ logic is clear: Pump.fun isn’t independent. Solana provides blockchain infrastructure, Jito supplies MEV technology, and together, the three form a tight community of interests, collectively defrauding regular investors.

But what evidence supports these claims? The answer came months later.

Key Evidence: Confidential Informant and Chat Logs

After September 2025, the case’s nature fundamentally changed.

Plaintiffs secured hard evidence.

A “confidential informant” provided the plaintiffs’ legal team with the first batch of internal chat logs—about 5,000 messages. These reportedly came from internal channels at Pump.fun, Solana Labs, and Jito Labs, documenting technical coordination and business interactions among the three.

This evidence was a breakthrough for plaintiffs. Previously, all allegations of technical collusion, MEV manipulation, and insider front-running were speculative, lacking direct proof.

These internal chat logs are said to show a “conspiratorial relationship” among the three parties.

A month later, on October 21, the informant provided a second batch—over 10,000 chat logs and related files. These reportedly detail:

- Pump.fun’s technical integration with Solana Labs

- How Jito’s MEV tools were embedded in Pump.fun’s trading system

- How the three discussed “optimizing” trade workflows (which plaintiffs interpret as market manipulation)

- How insiders exploited information advantages for trading

Plaintiffs’ attorneys stated in filings that these chat logs “reveal a carefully designed fraud network,” proving Pump.fun, Solana, and Jito’s relationship went far beyond a superficial “technical partnership.”

Application for Second Amended Complaint

Faced with this massive trove of new evidence, plaintiffs needed time to organize and analyze it. On December 9, 2025, the court approved plaintiffs’ request to submit a Second Amended Complaint, allowing the new evidence to be included.

But there was a challenge: over 15,000 chat logs had to be reviewed, screened, translated (some may not be in English), and analyzed—a massive workload. With Christmas and New Year holidays approaching, the plaintiffs’ legal team was pressed for time.

On December 10, plaintiffs filed a motion requesting an extension for the Second Amended Complaint deadline.

Just one day later, on December 11, Judge McMahon granted the extension. The new deadline: January 7, 2026. After the New Year, a Second Amended Complaint—potentially with even more explosive allegations—will be presented to the court.

Current Status of the Case

To date, the lawsuit has lasted nearly a year, but the real battle is just beginning.

On January 7, 2026, plaintiffs will submit the Second Amended Complaint with all new evidence. Then, we’ll see what those 15,000 chat logs actually reveal. Meanwhile, the defendants remain strikingly quiet. Pump.fun co-founder Alon Cohen has been silent on social media for over a month, and Solana and Jito executives have made no public statements regarding the suit.

Interestingly, despite the lawsuit’s growing scale and impact, the crypto market seems unfazed. Solana’s price hasn’t seen major swings due to the lawsuit, and while $PUMP continues to fall, it’s mostly due to the collapse of the meme coin narrative, not the lawsuit itself.

Epilogue

This lawsuit, triggered by meme coin trading losses, has evolved into a class action against the entire Solana ecosystem.

The case has moved far beyond “a few investors seeking redress for losses.” It tackles the crypto industry’s core questions: Is decentralization real or just a well-crafted illusion? Is a fair launch truly fair?

Yet, many key issues remain unresolved:

- Who is the confidential informant? A former employee, a competitor, or an undercover regulator?

- What’s actually in the 15,000 chat logs? Are they definitive evidence of collusion, or just normal business communications taken out of context?

- How will the defendants respond?

In 2026, as the Second Amended Complaint is filed and the case moves forward, we may finally get some answers.

Statement:

- This article is reprinted from [TechFlow]. Copyright belongs to the original author [June]. If you have objections to the reprint, please contact the Gate Learn team, which will handle the matter promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is referenced, translated articles may not be copied, distributed, or plagiarized.

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

Introduction to Raydium

What is Dogwifhat? All You Need to Know About WIF