Прогноз ціни CRAFT на 2025 рік: аналіз ринкових тенденцій та потенційних факторів зростання

Вступ: ринкові позиції CRAFT і його інвестиційна привабливість

TaleCraft (CRAFT) — PvP карткова гра у форматі play-to-earn, яка з моменту запуску стала помітним явищем у сфері блокчейн-ігор. Станом на 2025 рік ринкова капіталізація CRAFT становить $11 171,79, в обігу приблизно 7 006 896 токенів, а ціна тримається біля $0,0015944. Актив, відомий як «середньовічний метавсесвіт алхіміка», набуває дедалі більшої ваги у гейміфікованих NFT та екосистемах play-to-earn.

У цьому матеріалі здійснено комплексний аналіз цінових трендів CRAFT з 2025 по 2030 рік: враховано історичні закономірності, баланс попиту й пропозиції, розвиток екосистеми та макроекономічні чинники для надання професійних прогнозів і практичних інвестиційних стратегій.

I. Огляд історії ціни CRAFT і поточний ринок

Динаміка ціни CRAFT: історичний огляд

- 2021: Запуск проєкту, історичний максимум ціни — $16,6 (28 листопада)

- 2025: Ринковий спад, історичний мінімум — $0,00091571 (24 серпня)

- 2025: Відновлення, ціна зросла до $0,0015944 (4 листопада)

Поточна ринкова ситуація CRAFT

На 4 листопада 2025 року CRAFT котується за $0,0015944, що означає приріст на 16,47% за останню добу. Водночас за тиждень токен втратив 13,8%, а за 30 днів — 33,75%. З початку року падіння становить 53,40%.

Ринкова капіталізація CRAFT на зараз — $11 171,79, що відповідає 7 251 місцю серед криптовалют. Обсяг торгів за 24 години — $11 359,56, ринок демонструє помірну активність. В обігу — 7 006 896 токенів CRAFT з максимальних 30 000 000, коефіцієнт циркуляції — 23,36%.

Поточна ціна суттєво нижча від історичного максимуму $16,6, зафіксованого після старту у 2021 році. Попри добовий приріст, ринкові настрої залишаються стриманими, що підтверджують індекс страху та різкі втрати токена у довгостроковій перспективі.

Перегляньте поточну ринкову ціну CRAFT

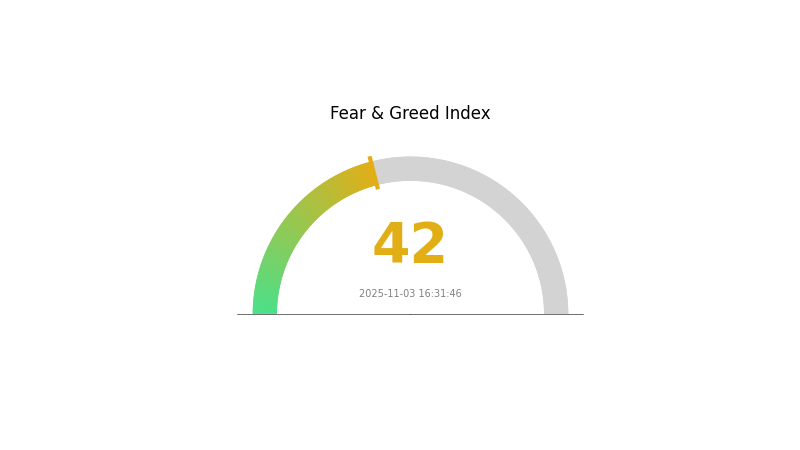

Індикатор ринкових настроїв CRAFT

03 листопада 2025 року, індекс страху та жадібності: 42 (Страх)

Перегляньте Індекс страху та жадібності

Ринкові настрої в криптосекторі залишаються стриманими: індекс страху та жадібності тримається на рівні 42, що відповідає зоні страху. Це свідчить про обережну поведінку інвесторів — причиною можуть бути коливання ціни або зовнішні економічні чинники. У такі періоди важливо ретельно аналізувати ринок і застосовувати стратегії контролю ризиків. Зміни настроїв можуть бути швидкими, а періоди страху здатні відкривати можливості для довгострокових учасників ринку.

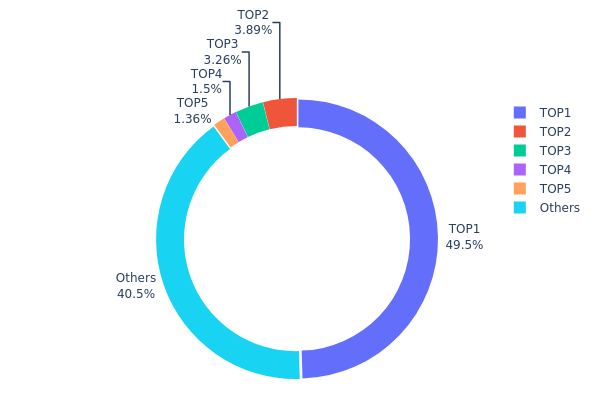

Розподіл токенів CRAFT

Розподіл токенів CRAFT за адресами демонструє високу концентрацію. Найбільший власник контролює близько 49,53% емісії — 14 388 750 токенів. Така концентрація створює ризики централізації та потенційних маніпуляцій. Чотири наступні найбільші адреси разом володіють ще 9,98% емісії, кожна — від 1,36% до 3,88%.

Решта адрес, позначених як «Інші», зосереджують 40,49% емісії. Отже, понад половину токенів контролюють лише п’ять адрес — це підвищує ризики волатильності та великих розпродажів, що може вплинути на стабільність ринку.

Структура власності вказує на суттєвий вплив великих гравців на ончейн-управління та ринкову динаміку CRAFT. Централізація не обов’язково означає зловмисні дії, але акцентує важливість моніторингу активності великих адрес і її впливу на ринок і розвиток екосистеми.

Перегляньте розподіл токенів CRAFT

| Топ | Адреса | Кількість токенів | Частка (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 14 388,75K | 49,53% |

| 2 | 0xffb3...18cac2 | 1 129,64K | 3,88% |

| 3 | 0x86d1...6e6c6b | 945,78K | 3,25% |

| 4 | 0x2077...874561 | 434,58K | 1,49% |

| 5 | 0x8686...429556 | 395,09K | 1,36% |

| - | Інші | 11 753,41K | 40,49% |

II. Ключові чинники впливу на ціну CRAFT у майбутньому

Макроекономічне середовище

-

Вплив монетарної політики: Рішення Федеральної резервної системи США щодо ставок впливають на ціну CRAFT. Підвищення ставок зазвичай стимулює перехід капіталу до менш ризикованих активів і може спричинити падіння ціни CRAFT. Зниження ставок або надлишкова ліквідність, навпаки, підтримують приплив коштів у криптовалюти й сприяють зростанню ціни.

-

Захист від інфляції: CRAFT може розглядатися інвесторами як інструмент хеджування інфляції, аналогічно до інших криптовалют. Поведінка активу в інфляційному середовищі впливає на інтерес учасників ринку.

-

Геополітичні чинники: Глобальні відносини та економічний фон можуть впливати на ціну CRAFT. Торговельні політики, наприклад тарифи, здатні впливати на крипторинок і, зокрема, на CRAFT.

Технічний розвиток і побудова екосистеми

- Ринкові настрої: Ціна CRAFT чутливо реагує на настрої інвесторів. Фактори FOMO (страх втратити можливість) і FUD (страх, невпевненість, сумніви) можуть провокувати різкі цінові рухи. Позитивні новини призводять до зростання, негативні — до розпродажів.

III. Прогноз ціни CRAFT на 2025–2030 роки

Прогноз на 2025 рік

- Консервативний діапазон: $0,0015 - $0,00158

- Нейтральний діапазон: $0,00158 - $0,00171

- Оптимістичний діапазон: $0,00171 - $0,00185 (за умови позитивних новин і розвитку проєкту)

Прогноз на 2027–2028 роки

- Очікувана ринкова фаза: потенційне зростання з підвищеною волатильністю

- Прогноз по цінах:

- 2027 рік: $0,00105 - $0,00208

- 2028 рік: $0,00122 - $0,00264

- Ключові драйвери: розширення екосистеми, загальні тренди крипторинку, технологічні прориви

Довгостроковий прогноз на 2029–2030 роки

- Базовий сценарій: $0,00232 - $0,00264 (за умов стабільного розвитку і прийняття ринку)

- Оптимістичний сценарій: $0,00264 - $0,00351 (при значних досягненнях проєкту та сприятливих ринкових умовах)

- Трансформаційний сценарій: $0,00351+ (у випадку проривних інновацій або масового прийняття)

- 31 грудня 2030 року: CRAFT $0,00351 (ймовірний максимум за оптимістичним прогнозом)

| Рік | Максимальна ціна (прогноз) | Середня ціна (прогноз) | Мінімальна ціна (прогноз) | Зміна (%) |

|---|---|---|---|---|

| 2025 | 0,00185 | 0,00158 | 0,0015 | 0 |

| 2026 | 0,00211 | 0,00171 | 0,0013 | 7 |

| 2027 | 0,00208 | 0,00191 | 0,00105 | 19 |

| 2028 | 0,00264 | 0,002 | 0,00122 | 25 |

| 2029 | 0,00297 | 0,00232 | 0,00139 | 45 |

| 2030 | 0,00351 | 0,00264 | 0,00182 | 65 |

IV. Професійні стратегії та управління ризиками для інвесторів CRAFT

Інвестиційна методологія CRAFT

(1) Стратегія довгострокового зберігання

- Цільова аудиторія: інвестори з високою схильністю до ризику і вірою у довгострокову перспективу ігрових токенів

- Практичні поради:

- Накопичуйте CRAFT під час ринкових спадів

- Беріть участь в екосистемі TaleCraft для додаткових винагород

- Зберігайте токени у безпечному некостодіальному гаманці

(2) Стратегія активної торгівлі

- Інструменти теханалізу:

- Ковзні середні: для визначення трендів і точок розвороту

- RSI (індекс відносної сили): для моніторингу перекупленості/перепроданості

- Ключові аспекти свінг-трейдингу:

- Слідкуйте за оновленнями гри та динамікою зростання користувачів

- Встановлюйте стоп-лоси для контролю ризиків

Система управління ризиками CRAFT

(1) Принципи розподілу активів

- Консервативні інвестори: 1–3% криптопортфеля

- Агресивні інвестори: 5–10% криптопортфеля

- Професійні інвестори: до 15% криптопортфеля залежно від прийнятного ризику

(2) Інструменти хеджування ризиків

- Диверсифікація: інвестуйте у різні ігрові токени та блокчейн-проєкти

- Стоп-лоси: використовуйте для обмеження можливих втрат

(3) Безпечні рішення для зберігання

- Рекомендований гарячий гаманець: Gate Web3 Wallet

- Холодне зберігання: апаратний гаманець для довгострокових активів

- Безпека: підключайте двофакторну автентифікацію, використовуйте складні паролі, уникайте фішингу

V. Основні ризики та виклики для CRAFT

Ринкові ризики CRAFT

- Висока волатильність: ціна CRAFT може суттєво коливатися

- Низька ліквідність: обмежені обсяги торгів зумовлюють прослизання при великих угодах

- Конкуренція: інші ігрові токени можуть впливати на ринкову частку CRAFT

Регуляторні ризики CRAFT

- Невизначеність регулювання: зміни у законодавстві про криптовалюти можуть зачепити CRAFT

- Регулювання ігор: нові норми для онлайн-ігор можуть вплинути на екосистему TaleCraft

- Оподаткування: зміни у податковому законодавстві стосовно криптовалют і геймінгових винагород

Технічні ризики CRAFT

- Уразливості смарт-контракту: ризики безпеки у вихідному коді токена

- Масштабованість: можливі технічні обмеження для гри TaleCraft при зростанні

- Перевантаження блокчейн-мережі: високі комісії чи затримки транзакцій у мережі Avalanche

VI. Висновки та рекомендації

Оцінка інвестиційної привабливості CRAFT

CRAFT — це актив із високим ризиком і потенційно високою винагородою в секторі ігрових токенів. Його унікальні геймплейні механіки й інтеграція NFT відкривають перспективи зростання, однак інвесторам варто враховувати волатильність і регуляторну невизначеність криптоігрової галузі.

Рекомендації щодо інвестування в CRAFT

✅ Для початківців: інвестуйте лише невелику частину портфеля, зосереджуйтесь на вивченні екосистеми TaleCraft ✅ Для досвідчених інвесторів: комбінуйте довгострокове зберігання і стратегічну торгівлю на ключові оновлення гри ✅ Для інституційних інвесторів: проводьте глибоку перевірку проєкту TaleCraft, розглядайте CRAFT у складі диверсифікованого портфеля ігрових токенів

Варіанти участі в торгівлі CRAFT

- Спот-торгівля: купуйте і продавайте CRAFT на Gate.com

- Стейкінг: беріть участь у стейкінг-програмах, якщо вони доступні у TaleCraft

- Участь у грі: отримуйте токени CRAFT, граючи в TaleCraft і взаємодіючи з NFT-маркетплейсом

Інвестиції у криптовалюту супроводжуються надзвичайно високим ризиком, і цей матеріал не є інвестиційною рекомендацією. Інвестор повинен приймати рішення відповідно до власної толерантності до ризику і консультуватися з професійними фінансовими експертами. Ніколи не інвестуйте більше, ніж готові втратити.

FAQ

Який прогноз MKR на 2025 рік?

За ринковим аналізом, діапазон прогнозу ціни MKR на 2025 рік — від $3 604 до $5 611.

Чи може COTI досягти $10?

Так, COTI має потенціал досягти $10. Вдосконалення конфіденційності, інтеграція з Ethereum Layer 2 і зростання ринкового прийняття створюють потужні драйвери для значного зростання ціни у майбутньому.

Чи може Fetch.ai досягти $100?

Так, Fetch.ai потенційно здатен досягти $100. Інноваційні AI-технології та розширення екосистеми сприяють довгостроковому зростанню ціни.

Чи може Solana досягти $1 000 у 2025 році?

Так, Solana може досягти $1 000 у 2025 році. Швидке зростання, ринкова експансія та технологічний прогрес роблять цю мету реалістичною, хоча волатильність ринку залишається визначальним фактором.

Чи варто інвестувати в GAMEE (GMEE)?: Огляд можливостей і ризиків цього токена для блокчейн-ігор

Прогноз ціни PLA на 2025 рік: аналіз ринкових тенденцій і технологічних новацій у галузі матеріалів для 3D-друку

Прогноз ціни GAME2 на 2025 рік: аналіз ринкових трендів і перспектив майбутньої вартості ігрового токена

Прогноз ціни BIGTIME на 2025 рік: аналіз перспектив зростання й ринкових факторів, які визначають майбутню вартість ігрового токена

ALU проти FLOW: Аналіз різних обчислювальних архітектур для сучасних застосувань машинного навчання

Чи варто інвестувати в ALICE (ALICE)?: Оцінка можливостей і ризиків цього геймінгового токена на поточному ринку криптовалют

Стейблкоїни у 2025 році: ринкова капіталізація становить 310 млрд доларів США, сфери використання розширюються у фінансовому секторі

Як рух коштів фонду токена BAN та рівень концентрації володіння цим токеном впливають на динаміку ринку?

Як SEC викрила криптовалютну аферу на 14 мільйонів доларів із підробленими платформами та групами в чатах

Чому Bitcoin відстав від золота та акцій Сполучених Штатів у 2025 році: огляд ринку

Сальвадор і Міжнародний валютний фонд ведуть подальші переговори щодо продажу Chivo Wallet та реформ політики щодо Bitcoin