2025 年 RIF 价格预测:深入分析影响 RIF Token 未来发展的趋势与关键因素

简介:RIF 的市场地位及投资价值

RIF Token(RIF)作为业界首个集成且易用的开放区块链基础设施框架,自 2018 年推出以来不断取得突破。截至 2025 年,RIF 的市值达到 47,580,000 美元,流通量约为 10 亿枚,价格维持在 0.04758 美元左右。作为“Rootstock Infrastructure Framework”,RIF 在区块链基础设施建设及去中心化服务领域扮演着日益关键的角色。

本文将通过历史价格趋势、市场供需、生态发展与宏观经济因素,系统分析 RIF 2025-2030 年的价格走势,为投资者提供专业预测与实用投资策略。

一、RIF 价格历史回顾及当前市场状况

RIF 历史价格走势

- 2019 年:首发年,6 月 12 日创下历史最低价 0.0091475 美元

- 2021 年:牛市高点,4 月 13 日达到历史最高价 0.455938 美元

- 2024-2025 年:市场回调,价格自高位回落至当前水平

RIF 当前市场状况

截至 2025 年 10 月 24 日,RIF 报价为 0.04758 美元,位列加密货币市场第 643 位。24 小时内涨幅 1.64%,成交量为 15,735.76 美元,市值 47,580,000 美元,市场占比 0.0012%。

RIF 近期表现分化:过去一周微涨 0.02%,但近 30 天及一年分别下跌 18.99% 和 48.38%。现价较历史高点低约 89.56%,显示出大幅调整。

当前流通量等同于总量和最大供应量(10 亿枚),不再有新增供应,未来价格将更受需求波动影响。

点击查看当前 RIF 市场价格

RIF 市场情绪指标

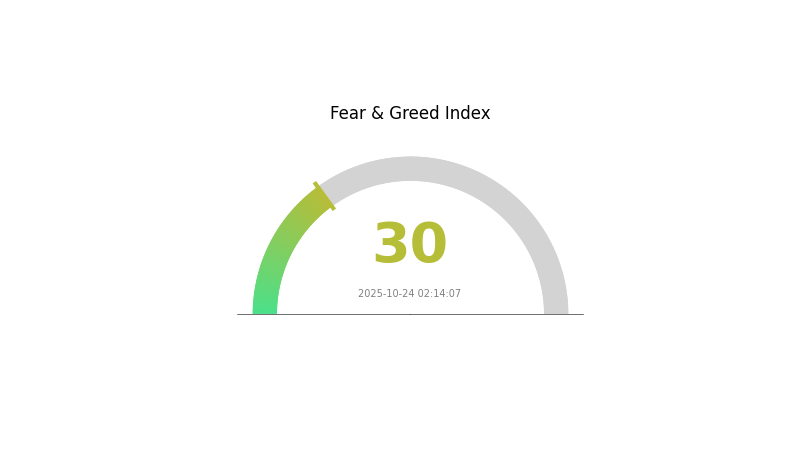

2025-10-24 恐惧与贪婪指数:30(恐惧)

点击查看当前 恐惧与贪婪指数

当前加密市场情绪偏向谨慎,恐惧与贪婪指数为 30,处于恐惧区间,说明投资者普遍观望,且部分人寻求低位买入机会。此阶段,保持信息敏锐和理性判断尤为重要。市场周期正常,恐惧往往预示后续复苏。理性投资者应加深研究,优化长期策略,合理控制风险。

RIF 持币分布情况

RIF 地址持币分布数据表明,持有结构高度去中心化,未见单一地址占据显著比例,代币分散在大量持有者之间,整体分布均衡。这种模式有利于生态稳定和公平。

缺乏大额集中持币可降低市场被个体操控风险,同时减少主力抛售造成的剧烈波动。分散式持有格局提升市场韧性,有助于增强投资者与用户信心。

整体来看,RIF 当前地址分布充分体现区块链项目倡导的去中心化原则,为生态长期可持续发展及系统性风险防控奠定坚实基础。

点击查看当前 RIF 持币分布

| Top | Address | Holding Qty | Holding (%) |

|---|

二、影响 RIF 未来价格的核心因素

供应机制

- 市场波动性: 加密货币市场及 RIF 具备高度波动性特征。

- 历史规律: RIF 价格波动属行业常态。

- 当前影响: 市场情绪和采用率直接决定 RIF 价格走势。

机构与大户行为

- 企业采用: 主流企业应用 RIF 有望带动价格提升。

- 国家政策: 各国监管政策变化将影响 RIF 市场表现。

宏观经济环境

- 地缘政治因素: 国际局势及全球经济条件影响 RIF 价格。

技术发展与生态建设

- 生态应用: Rootstock Infrastructure Framework 生态内重大 DApp 与项目不断落地,将提升 RIF 价值。

三、2025-2030 年 RIF 价格预测

2025 年展望

- 保守预期:0.02522 - 0.04000 美元

- 中性预期:0.04000 - 0.05000 美元

- 乐观预期:0.05000 - 0.06043 美元(需市场转好及 RIF 采用加速)

2027-2028 年展望

- 市场阶段:有望进入新一轮增长,波动性提升

- 价格区间预测:

- 2027 年:0.05631 - 0.08244 美元

- 2028 年:0.04706 - 0.07446 美元

- 关键驱动:生态扩展、技术进步及整体加密市场走势

2029-2030 年长期展望

- 基础情景:0.07000 - 0.08500 美元(采纳率及应用场景持续增长)

- 乐观情景:0.08500 - 0.09778 美元(生态加速扩展,市场环境利好)

- 突破情景:0.10000 美元以上(极度有利及技术突破下)

- 2030 年 12 月 31 日:RIF 0.08429 美元(潜在均价,较 2025 年增幅显著)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06043 | 0.04758 | 0.02522 | 0 |

| 2026 | 0.0621 | 0.054 | 0.04482 | 13 |

| 2027 | 0.08244 | 0.05805 | 0.05631 | 22 |

| 2028 | 0.07446 | 0.07024 | 0.04706 | 47 |

| 2029 | 0.09623 | 0.07235 | 0.04486 | 52 |

| 2030 | 0.09778 | 0.08429 | 0.06743 | 77 |

四、RIF 专业投资策略及风险管理

RIF 投资方法论

(1) 长线持有策略

- 适合对象:价值投资者及区块链技术拥护者

- 操作建议:

- 在市场低位分批建仓 RIF

- 设定分阶段止盈目标

- 资产存放于安全非托管钱包

(2) 主动交易策略

- 技术分析工具:

- 均线(MA):参考 50 日与 200 日均线判断趋势

- RSI 指标:监控超买和超卖信号

- 波段交易要点:

- 识别关键支撑与阻力区间

- 设置止损防范风险

RIF 风险管理框架

(1) 资产配置原则

- 保守型:1-3%

- 激进型:5-10%

- 专业型:10-15%

(2) 风险对冲举措

- 多元化:投资分散至多种加密资产

- 止损机制:自动卖出限损

(3) 安全存储方案

- 热钱包推荐:Gate Web3 钱包

- 冷存储:硬件钱包适合长期持有

- 安全措施:启用双重认证,强密码保护

五、RIF 潜在风险与挑战

RIF 市场风险

- 高波动性:价格剧烈变动是加密市场常态

- 流动性有限:大额交易可能遇到成交难题

- 竞争压力:其他区块链基础设施项目可能分流市场份额

RIF 合规风险

- 监管不确定:全球加密合规政策变化影响 RIF

- 跨境合规难题:国际交易涉及合规障碍

- 税务不明:各地区税务政策尚未明确

RIF 技术风险

- 智能合约风险:生态系统可能存在安全隐患

- 可扩展性挑战:网络负载增长或带来技术瓶颈

- 互操作性难题:与其他区块链集成存在障碍

六、结论与行动建议

RIF 投资价值评估

RIF 作为区块链基础设施代币具有长期增长潜力,但短期内仍面临市场波动与监管不确定性风险。

RIF 投资建议

✅ 新手投资者:建议定期小额投入,逐步熟悉市场

✅ 资深投资者:可平衡长期持有与主动交易

✅ 机构投资者:建议充分尽调,将 RIF 纳入多元化加密资产组合

RIF 交易参与方式

加密货币投资存在极高风险,本文不构成投资建议。投资者须根据自身风险承受能力谨慎决策,并建议咨询专业财经顾问。切勿投入超过自身可承受损失的资金。

常见问题

RIF 代币现价是多少?

截至 2025 年 10 月,RIF 价格约为 0.05 美元。近期小幅上涨,体现 Web3 基础设施代币持续受市场关注。

2030 年 1 枚 XRP 价值几何?

根据当前市场趋势与行业分析,2030 年 1 枚 XRP 预计价位在 9.5 至 10.8 美元之间。

Reef 加密货币有发展前景吗?

有,Reef 加密货币被业内普遍看好,专家预计到 2030 年价格将有明显增长,长期走势积极。

RIF 加密货币是什么?

RIF 是 RSK 平台的代币,用户可通过 RIFOS 框架访问多种服务,属 Rootstock Infrastructure Framework,支持去中心化应用。

2025 年 XCN 价格展望:XCN 代币能否在比特币减半后的牛市行情中再创新高?

2025 XCN价格预测:洞察加密市场变革下XCN的趋势与增长动因

2025 年 BICO 价格预测:市场趋势分析及专家对 Biconomy 未来的展望

2025 年 XCN 价格预测:深入解析 XCN 代币的市场走势与增长驱动因素

2025 ELF价格预测:剖析aelf加密货币的市场趋势及潜在增长动力

2025年ATS价格预测:采用率快速提升,市值持续扩张,市场前景乐观