Últimas publicações do Gate Square

gas_fee_therapist

Beyond NFTs: Why Semi-Fungible Tokens Are the Next Big Thing in Blockchain

The crypto world moves at lightning speed. One year everyone's talking about DeFi, the next it's NFTs everywhere. Now there's a new player entering the ring: semi-fungible tokens (SFTs). While most people have heard of NFTs by now, SFTs remain largely under the radar—but they might be about to

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Understanding Crypto APY: What Is APY In Crypto and How to Maximize Your Yields

When you're exploring passive income opportunities in cryptocurrency, one metric keeps popping up: APY. But what is APY in crypto, and why should it matter to your portfolio strategy? Let's cut through the noise and break down this powerful concept that separates smart crypto investors from the

IN-1,06%

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

回顾这一年的加密征程——从市场狂飙到大胆出击,每一步都值得铭记。即刻查看您的 #2025Gate年度账单 ,与 Gate 一起重温您的 2025 加密旅程,分享即领 20 USDT。 https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLUWU1LZAW&ref_type=126&shareUid=VVBDVF5fCQIO0O0O

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

沉睡20个月的鲸鱼被迫割肉 LIT多头爆仓损失76万美元

【区块律动】1月5日链上监测显示,有个休眠了超过20个月的大户突然出现,直接平掉了手里的LIT多头仓位。这一手交易亏得很惨,单笔就亏了76.7万美元。

更扎心的是这个鲸鱼的整体账户状况——累计利润从最高的300万美元,现在只剩42万美元。相当于之前的收益被打了个八折。这种从巨额浮盈到现实亏损的转变,反映出长期持有者在当前市场波动中面临的压力有多大。这类链上大户的动向往往能折射出市场参与者的真实态度。

更扎心的是这个鲸鱼的整体账户状况——累计利润从最高的300万美元,现在只剩42万美元。相当于之前的收益被打了个八折。这种从巨额浮盈到现实亏损的转变,反映出长期持有者在当前市场波动中面临的压力有多大。这类链上大户的动向往往能折射出市场参与者的真实态度。

LIT8,13%

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

这个项目的叙事上年跑到1200万的高度。现在价格回到USD1这个水位,有意思的是$FAFO这个关联叙事已经把它拉到了500万,而这个叙事本身就是和原项目有直接关联的。

现在就等着看原项目的叙事能否再次触发市场情绪。从去年的涨幅来看,一旦叙事兑现,市场反应往往很快。这种项目之间的叙事联动在加密市场里还挺常见的——一个触发点就能带动整个生态的价格波动。

目前价格点位回到USD1,如果要复现去年的那波行情,关键还是看叙事什么时候被重新激活。市场上这类基于社区和叙事驱动的项目,往往就是等待那个临界点。

现在就等着看原项目的叙事能否再次触发市场情绪。从去年的涨幅来看,一旦叙事兑现,市场反应往往很快。这种项目之间的叙事联动在加密市场里还挺常见的——一个触发点就能带动整个生态的价格波动。

目前价格点位回到USD1,如果要复现去年的那波行情,关键还是看叙事什么时候被重新激活。市场上这类基于社区和叙事驱动的项目,往往就是等待那个临界点。

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Crypto payments are heating up fast. Visa's crypto card network just logged a massive 525% spending surge throughout 2025, with net spend climbing from $14.6 million to $91.3 million according to on-chain data tracking. That's not just a number spike—it signals real adoption momentum as more users integrate digital assets into everyday transactions. Whether it's the growing card issuance or merchants accepting crypto settlements, the velocity shift tells you something's fundamentally shifting in how people move value.

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Unpacking Bitcoin's S2F Model: Scarcity Theory Meets Market Reality

Bitcoin's journey from $69,000 in late 2021 to today's price levels has left investors searching for predictive frameworks. Among the most debated tools is the Stock-to-Flow (S2F) model, which attempts to forecast BTC price movements by analyzing supply scarcity—but does the math actually work?

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Decoding Altcoin Season: Navigating Market Cycles and Trading Opportunities

The cryptocurrency market moves in waves, and one of the most significant phenomena traders watch for is the period when alternative coins begin to outperform Bitcoin. This cyclical pattern, commonly referred to as altseason, represents a fundamental shift in how capital flows through digital

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

AI-powered Polymarket bot turns $2k into $75k on Maduro arrest bet

AI-assisted bot scans Polymarket wallets and bet sizes to flag possible insider-style trades on political markets, helping its creator net $75k on a Maduro arrest bet.

Summary

Custom alert bot monitors Polymarket’s API for new wallets, oversized wagers and repeated Venezuela-focused positions t

Summary

Custom alert bot monitors Polymarket’s API for new wallets, oversized wagers and repeated Venezuela-focused positions t

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Understanding RSI Meaning in Crypto: A Complete Guide for Traders

What Does RSI Mean in Cryptocurrency Trading?

The Relative Strength Index (RSI) represents one of the most widely adopted momentum oscillators in technical analysis. For traders entering the cryptocurrency space, understanding RSI meaning is fundamental—this indicator measures the velocity of

The Relative Strength Index (RSI) represents one of the most widely adopted momentum oscillators in technical analysis. For traders entering the cryptocurrency space, understanding RSI meaning is fundamental—this indicator measures the velocity of

IN-1,06%

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

The bears are about to take their victory lap once we see this single digit pullback settle. After that? The real show begins.

This is the kind of consolidation pattern we've seen before at market inflection points. When the dust clears from these minor corrections, that's usually when momentum shifts and the next leg of the rally kicks in. Keep eyes peeled.

This is the kind of consolidation pattern we've seen before at market inflection points. When the dust clears from these minor corrections, that's usually when momentum shifts and the next leg of the rally kicks in. Keep eyes peeled.

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

RT @FofarPig: Fill out this form for $FOFAR airdrop 👇

Form →

Just 36 hours

Form →

Just 36 hours

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

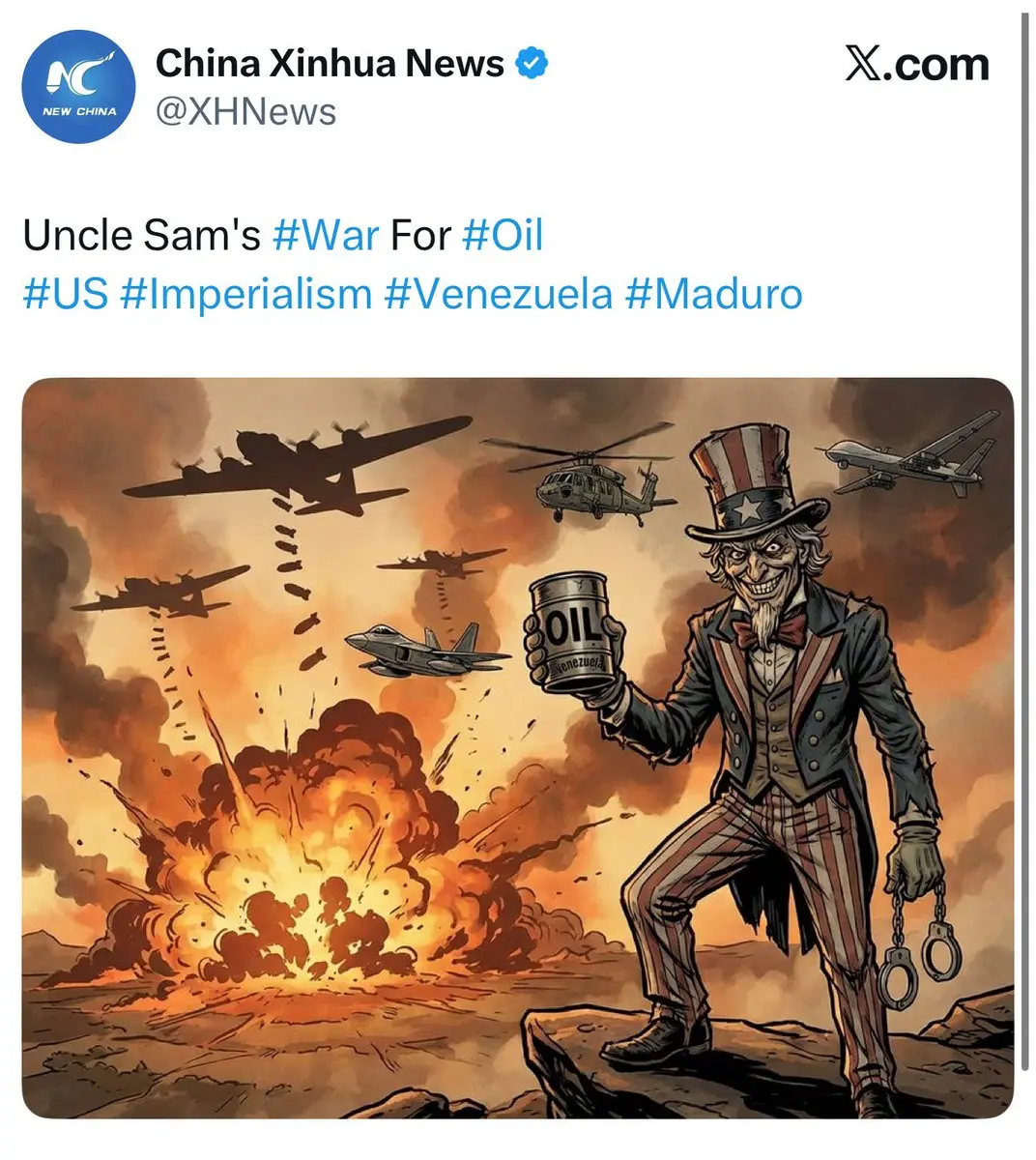

Chinese state-run media trolls the United States over the capture of Venezuelan President Nicolás Maduro.

- Recompensa

- curtir

- Comentário

- Repostar

- Compartilhar

Depositar mais

Tendências

Ver projetos128 Popularidade

573.7K Popularidade

72.8K Popularidade

4.98K Popularidade

5.5K Popularidade

Em alta na Gate Fun

Ver projetos- Cap. de M.:$3.62KHolders:10.00%

- Cap. de M.:$3.65KHolders:20.23%

- Cap. de M.:$3.65KHolders:20.23%

- Cap. de M.:$3.62KHolders:10.00%

- Cap. de M.:$3.63KHolders:10.00%

Marcar