2025 PALMPrice Prediction: Analyzing Market Trends, Sustainability Impacts, and Growth Potential in the Palm Oil Industry

Introduction: PALM's Market Position and Investment Value

PaLM AI (PALM), as a multi-platform AI chatbot utilizing Google's AI technology, has made significant strides since its inception. As of 2025, PALM's market capitalization has reached $21,033,276, with a circulating supply of approximately 77,129,726 tokens, and a price hovering around $0.2727. This asset, often referred to as the "accessible AI token," is playing an increasingly crucial role in the fields of conversational AI, coding assistance, and image generation.

This article will provide a comprehensive analysis of PALM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PALM Price History Review and Current Market Status

PALM Historical Price Evolution

- 2024: Project launch, price reached an all-time low of $0.0099 on April 12

- 2024: Significant growth, price surged to an all-time high of $1.81 on December 1

- 2025: Market correction, price declined from the peak to the current level

PALM Current Market Situation

As of October 5, 2025, PALM is trading at $0.2727, with a 24-hour trading volume of $1,684.78. The token has experienced a 1.58% decrease in the last 24 hours. PALM's market cap currently stands at $21,033,276, ranking it at 1072 in the overall cryptocurrency market. The circulating supply is 77,129,726.30 PALM tokens, which represents 77.13% of the total supply of 100,000,000 tokens. Over the past week, PALM has shown strong performance with a 45.98% increase, while it has decreased by 11.37% over the last 30 days. The token's price is down 45.58% compared to one year ago.

Click to view the current PALM market price

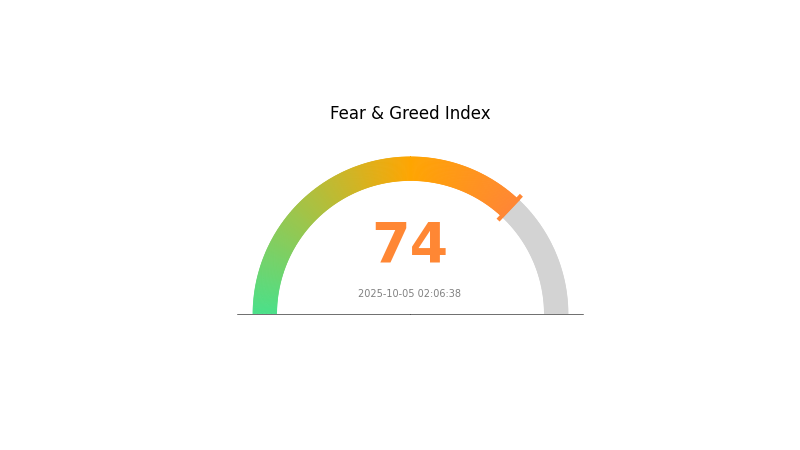

PALM Market Sentiment Indicator

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of heightened optimism, with the Fear and Greed Index reaching 74, indicating strong greed. This suggests that investors are feeling particularly bullish about the market's prospects. However, it's important to remember that extreme greed can often precede market corrections. Traders should exercise caution and consider diversifying their portfolios to mitigate potential risks. As always, thorough research and a balanced approach are key to navigating the volatile crypto landscape.

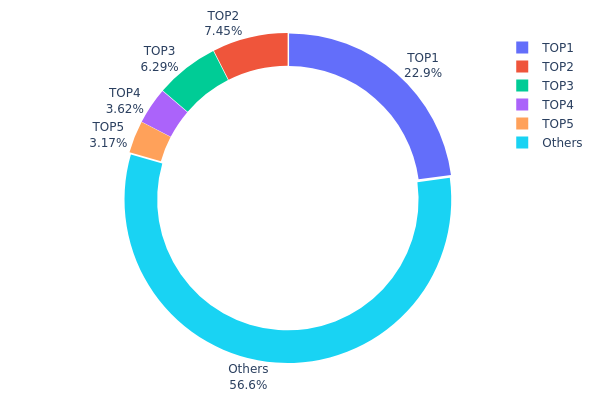

PALM Holdings Distribution

The address holdings distribution data for PALM reveals significant concentration among top holders. The largest address, likely a burn or project wallet, holds 22.87% of the total supply. The top five addresses collectively control 43.38% of PALM tokens, indicating a high degree of centralization.

This concentration pattern raises concerns about potential market manipulation and price volatility. With nearly half of the supply controlled by a few addresses, large-scale transactions could significantly impact PALM's market dynamics. The presence of a substantial burn address (22.87%) may reduce circulating supply, potentially affecting scarcity and price.

While 56.62% of tokens are distributed among other addresses, suggesting some level of decentralization, the overall structure points to a relatively centralized ecosystem. This concentration could impact governance decisions and the token's long-term stability, highlighting the need for careful monitoring of large holders' activities and potential redistribution efforts to enhance PALM's decentralization and market resilience.

Click to view the current PALM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 22870.27K | 22.87% |

| 2 | 0x9131...902a0d | 7454.41K | 7.45% |

| 3 | 0x3cc9...aecf18 | 6286.74K | 6.28% |

| 4 | 0x9642...2f5d4e | 3624.55K | 3.62% |

| 5 | 0xb0c4...92f707 | 3169.81K | 3.16% |

| - | Others | 56594.22K | 56.62% |

II. Key Factors Affecting Future PALM Prices

Supply Mechanism

- Weather Patterns: Weather conditions significantly impact palm oil production and supply.

- Historical Patterns: Past weather fluctuations have shown to cause volatility in palm oil prices.

- Current Impact: Anticipated weather patterns in 2025 are expected to influence supply and pricing.

Institutional and Major Player Dynamics

- Corporate Adoption: Major companies in food, cosmetics, and pharmaceutical industries continue to use palm oil extensively in their products.

Macroeconomic Environment

- Geopolitical Factors: Ongoing geopolitical tensions and logistical challenges are contributing to price volatility.

Technological Development and Ecosystem Building

- Sustainability Requirements: Increasing focus on sustainability is shaping the palm oil market, potentially affecting production methods and supply chains.

- Ecosystem Applications: The widespread use of palm oil in various industries, including food, cosmetics, and pharmaceuticals, continues to drive demand and influence pricing.

III. PALM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.2318 - $0.2727

- Neutral prediction: $0.2727 - $0.30

- Optimistic prediction: $0.30 - $0.32724 (requires significant market adoption)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.20398 - $0.33597

- 2027: $0.20668 - $0.4229

- Key catalysts: Increased adoption, technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.37043 - $0.42507 (assuming steady market growth)

- Optimistic scenario: $0.42507 - $0.59935 (assuming strong market performance)

- Transformative scenario: Above $0.59935 (extreme favorable conditions)

- 2030-12-31: PALM $0.59935 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.32724 | 0.2727 | 0.2318 | 0 |

| 2026 | 0.33597 | 0.29997 | 0.20398 | 10 |

| 2027 | 0.4229 | 0.31797 | 0.20668 | 16 |

| 2028 | 0.38525 | 0.37043 | 0.35562 | 35 |

| 2029 | 0.4723 | 0.37784 | 0.22293 | 38 |

| 2030 | 0.59935 | 0.42507 | 0.40807 | 55 |

IV. PALM Professional Investment Strategies and Risk Management

PALM Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Value investors and AI technology enthusiasts

- Operation suggestions:

- Accumulate PALM tokens during market dips

- Hold for at least 1-2 years to capture potential AI market growth

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- RSI (Relative Strength Index): Use for overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

PALM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Options strategies: Consider using options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. PALM Potential Risks and Challenges

PALM Market Risks

- High volatility: PALM price may experience significant fluctuations

- Competition: Increasing competition in the AI chatbot market

- Market sentiment: AI hype cycles may impact token value

PALM Regulatory Risks

- AI regulations: Potential new laws affecting AI development and deployment

- Token classification: Regulatory uncertainty regarding PALM's status as a security

- Cross-border restrictions: Varying regulations across jurisdictions

PALM Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token's underlying code

- Scalability challenges: Possible limitations in handling increased user demand

- AI performance issues: Risks associated with the chatbot's accuracy and reliability

VI. Conclusion and Action Recommendations

PALM Investment Value Assessment

PALM offers exposure to the growing AI chatbot market, leveraging Google's technology. While it presents long-term potential in the AI sector, short-term volatility and regulatory uncertainties pose significant risks.

PALM Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the AI token market ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider PALM as part of a diversified AI and blockchain portfolio

PALM Trading Participation Methods

- Spot trading: Purchase PALM tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options involving PALM tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future prediction for palm oil?

Palm oil market is expected to grow from $71.94 billion in 2024 to $90 billion by 2035, with significant CAGR, driven by increasing global demand.

What is Pepe's price prediction for 2025?

Pepe's price in 2025 is expected to reach $0.00001, showing potential growth. Market trends suggest a positive outlook, but always check latest data for accurate forecasts.

Why is the palm oil price falling?

Palm oil prices are falling due to lower Brent Crude oil prices, reduced demand from China and India, and increased ending stocks in Malaysia.

Which AI can predict crypto prices?

Incite AI is a leading tool for crypto price prediction. It uses advanced algorithms to analyze market trends and provide precise insights through a user-friendly interface.

2025 AI16ZPrice Prediction: Analyzing Market Trends and Future Valuation of the Revolutionary AI Technology

2025 AITECHPrice Prediction: Machine Learning Models Forecasting Market Trends and Investment Opportunities in the Tech Sector

2025 THINK Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 OGPU Price Prediction: Market Trends and Technological Advancements Shaping the Future of Graphics Processing

2025 AWE Price Prediction: Analyzing Market Trends and Factors Influencing Future Value

2025 GPUAI Price Prediction: Market Trends and Technological Advancements Shaping the Future of AI Hardware Costs

APRO Oracle: Oracle 3.0 Multi-Chain Data Infrastructure

Pi Network Prepares to Launch PiBank Digital Banking and Pi Smart Contracts for Financial Revolution

What is an NFT?

How to Buy Solana: A Step-By-Step Guide

What is Bitcoin and How Does It Work?