2025 THINK Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: THINK's Market Position and Investment Value

Think Protocol (THINK), as a foundation for a new agent-powered internet, has been making significant strides since its inception. As of 2025, THINK's market capitalization has reached $4,229,400, with a circulating supply of approximately 700,000,000 tokens, and a price hovering around $0.006042. This asset, often referred to as the "AI agent connector," is playing an increasingly crucial role in the field of artificial intelligence and open-source tools.

This article will provide a comprehensive analysis of THINK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. THINK Price History Review and Current Market Status

THINK Historical Price Evolution

- 2025: THINK reached its all-time high of $0.03576 on July 29, marking a significant milestone in its price history.

- 2025: The market experienced a substantial downturn, with THINK's price dropping to its all-time low of $0.005751 on October 11.

THINK Current Market Situation

As of October 12, 2025, THINK is trading at $0.006042, showing a slight recovery of 0.69% in the past 24 hours. However, the token has experienced significant losses over longer time frames, with a 18.09% decrease in the past week and a substantial 56.54% drop over the last 30 days. The current price represents a 89.38% decline from its peak a year ago.

THINK's market capitalization stands at $4,229,400, with a fully diluted valuation of $6,042,000. The token's circulating supply is 700,000,000 THINK, which is 70% of its total supply of 1,000,000,000 THINK. The 24-hour trading volume is relatively low at $75,656.87, indicating limited market activity.

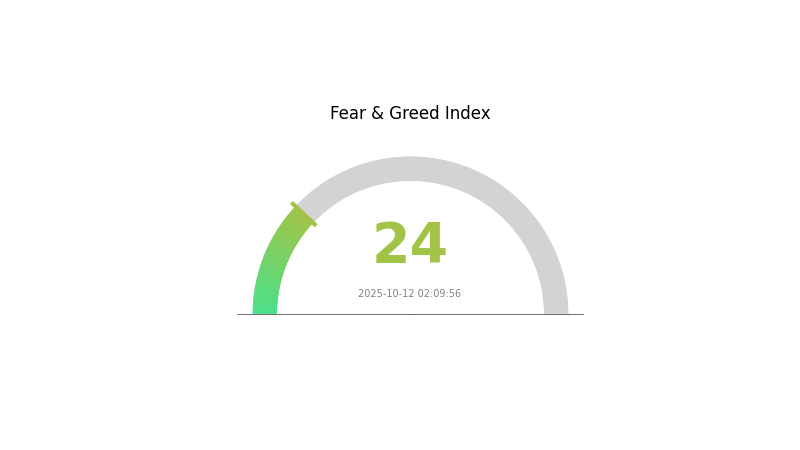

The overall crypto market sentiment is currently in a state of "Extreme Fear" with a VIX index of 24, which may be contributing to the bearish trend for THINK and other cryptocurrencies.

Click to view the current THINK market price

THINK Market Sentiment Indicator

2025-10-12 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear today, with the Fear and Greed Index at a low 24. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift quickly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these uncertain times.

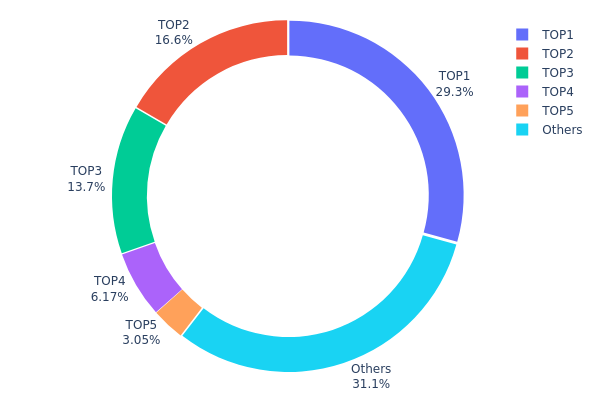

THINK Holdings Distribution

The address holdings distribution for THINK reveals a significant concentration of tokens among a few top addresses. The top address holds 29.33% of the total supply, with the top five addresses collectively controlling 68.88% of THINK tokens. This high concentration raises concerns about potential market manipulation and volatility.

Such a centralized distribution structure could have substantial implications for THINK's market dynamics. The large holdings by a few addresses may lead to increased price volatility if these major holders decide to sell or transfer significant portions of their tokens. Additionally, this concentration could potentially affect the token's governance and decision-making processes, depending on the project's structure.

While 31.12% of tokens are distributed among other addresses, the current holdings distribution suggests a relatively low level of decentralization for THINK. This concentration may impact the token's resilience to market shocks and its overall on-chain structural stability. Investors and stakeholders should monitor any significant changes in these top holdings, as they could signal important shifts in the token's market behavior and long-term prospects.

Click to view the current THINK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x43c3...290343 | 293351.25K | 29.33% |

| 2 | 0xd4a9...d2b8a2 | 166161.11K | 16.61% |

| 3 | 0x0807...87d101 | 137376.93K | 13.73% |

| 4 | 0xc202...799986 | 61705.71K | 6.17% |

| 5 | 0x1ab4...8f8f23 | 30454.42K | 3.04% |

| - | Others | 310950.58K | 31.12% |

II. Key Factors Influencing THINK's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have impacted price trends

- Current impact: Expected effects of the current supply changes

Institutional and Whale Dynamics

- National policies: Relevant policies at the national level

Macroeconomic Environment

- Monetary policy impact: Expectations of major central bank policies

- Geopolitical factors: Impact of international situations

Technological Development and Ecosystem Building

- Ecosystem applications: Major DApps/ecosystem projects

III. THINK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00381 - $0.00605

- Neutral prediction: $0.00605

- Optimistic prediction: $0.00641 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00451 - $0.00761

- 2028: $0.00459 - $0.00767

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.00916 (assuming steady market growth)

- Optimistic scenario: $0.00971 (assuming strong market performance)

- Transformative scenario: $0.01091 (assuming exceptional market conditions)

- 2030-12-31: THINK $0.00916 (51% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00641 | 0.00605 | 0.00381 | 0 |

| 2026 | 0.00723 | 0.00623 | 0.00567 | 3 |

| 2027 | 0.00761 | 0.00673 | 0.00451 | 11 |

| 2028 | 0.00767 | 0.00717 | 0.00459 | 18 |

| 2029 | 0.01091 | 0.00742 | 0.00438 | 22 |

| 2030 | 0.00971 | 0.00916 | 0.00541 | 51 |

IV. THINK Professional Investment Strategies and Risk Management

THINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operational suggestions:

- Accumulate THINK tokens during market dips

- Stay informed about project developments and AI industry trends

- Store tokens in a secure wallet with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor AI industry news for potential price catalysts

THINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Multi-signature wallet setup

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for THINK

THINK Market Risks

- High volatility: AI token market subject to rapid price swings

- Competition: Emerging AI projects may impact THINK's market share

- Adoption uncertainty: Potential challenges in widespread integration of AI agents

THINK Regulatory Risks

- AI regulation: Evolving legal frameworks may impact THINK's operations

- Token classification: Potential for regulatory bodies to classify THINK as a security

- Cross-border compliance: Varying international regulations on AI and cryptocurrencies

THINK Technical Risks

- Smart contract vulnerabilities: Potential for code exploits or bugs

- Scalability challenges: Possible network congestion as user base grows

- Interoperability issues: Challenges in integrating with diverse AI tools and protocols

VI. Conclusion and Action Recommendations

THINK Investment Value Assessment

THINK presents a high-risk, high-potential opportunity in the emerging AI-blockchain intersection. Long-term value lies in its vision for interoperable AI agents, while short-term risks include market volatility and regulatory uncertainties.

THINK Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Explore strategic partnerships and conduct deep due diligence

THINK Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Staking: Explore potential yield-generating opportunities if offered

- AI agent development: Engage with the THINK ecosystem by building on the protocol

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for NVDA in 2030?

In 2030, NVDA's price is predicted to reach $491 in a bull case, $241 in a base case, and $38 in a bear case, depending on AI's success.

Can AI predict crypto prices?

AI can predict crypto prices using advanced algorithms and data analysis, but predictions are not guaranteed. It's often used alongside human expertise for better results.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts reaching $139,249. Chainlink follows with a projected peak of $59.67.

What is the price prediction for Cann shares in 2025?

Based on market analysis, Cann shares are predicted to reach an average price of $0.0749 in 2025, with a potential high of $0.1313 and a low of $0.0185.

2025 AI16ZPrice Prediction: Analyzing Market Trends and Future Valuation of the Revolutionary AI Technology

2025 AITECHPrice Prediction: Machine Learning Models Forecasting Market Trends and Investment Opportunities in the Tech Sector

2025 OGPU Price Prediction: Market Trends and Technological Advancements Shaping the Future of Graphics Processing

2025 AWE Price Prediction: Analyzing Market Trends and Factors Influencing Future Value

2025 PALMPrice Prediction: Analyzing Market Trends, Sustainability Impacts, and Growth Potential in the Palm Oil Industry

2025 GPUAI Price Prediction: Market Trends and Technological Advancements Shaping the Future of AI Hardware Costs

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua

What is PSY: A Comprehensive Guide to the Global Phenomenon and Cultural Impact of the South Korean Artist

What is SWAN: A Comprehensive Guide to Swarm Intelligence and Adaptive Networks

What is AEG: A Comprehensive Guide to Aegis Energy Group and Its Impact on the Global Power Industry

The World's Leading Cryptocurrency Exchange