USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Why will 90% of prediction markets not survive until the end of 2026?

Author: Azuma, Odaily Planet Daily

In the past two days, there has been a lot of discussion on X about the formula Yes + No = 1 in prediction markets. The origin can be traced back to a detailed analysis of Polymarket's shared order book mechanism written by the influential DFarm (@DFarm\_club), which resonated emotionally with the community about the power of mathematics — the original article titled "A Comprehensive Explanation of Polymarket: Why Must YES + NO Equal 1?" is highly recommended.

In subsequent discussions, several influential figures, including Blue Fox (@lanhubiji), mentioned that Yes + No = 1 is another minimalist yet powerful formula innovation following x \ y = k, with the potential to unlock a trillion-dollar-scale information flow trading market. I fully agree with this, but

PANews·3h ago

Circle Mints $1B USDC on Solana as $2B Stablecoin Liquidity Floods Crypto

Circle mints $1B USDC on Solana, boosting on-chain liquidity within hours.

Circle and Tether minted nearly $2B stablecoins.

Solana is the preferred stablecoin settlement network.

Circle mints $1B USDC on Solana during a short window of intensified stablecoin issuance. The move coincides wi

SOL2,44%

CryptoFrontNews·01-03 04:16

South Korea's crypto regulation makes a major turnaround! Stablecoin legislation stalls, tech industry banks vie for dominance

The Korean cryptocurrency industry faces a turning point. According to Yonhap News Agency, the Digital Asset Basic Law, originally scheduled to be introduced this year, has been postponed to 2026 due to key regulatory disagreements. This stablecoin bill, promoted by President Lee Jae-myung, was originally seen as a milestone for Korea's crypto market, but now it has stalled over issues regarding "stablecoin issuer qualifications" and "reserve asset custody mechanisms." The power struggle between the Financial Services Commission and tech industry players over regulatory authority has put the legalization process of stablecoins in Korea on hold.

MarketWhisper·2025-12-31 00:35

$LIT Faces Heavy Selling Pressure As Whales Deploy Leveraged Shorts Worth $3M+ USDC

$LIT has attracted huge interest as per on-chain data, following the addition of multiple high-value traders, also known as whales, to open large short positions on the asset using the Hyperliquid derivatives platform. As the data provided by Onchain Lens show, these roles presuppose several

LIT1,48%

BlockChainReporter·2025-12-30 14:05

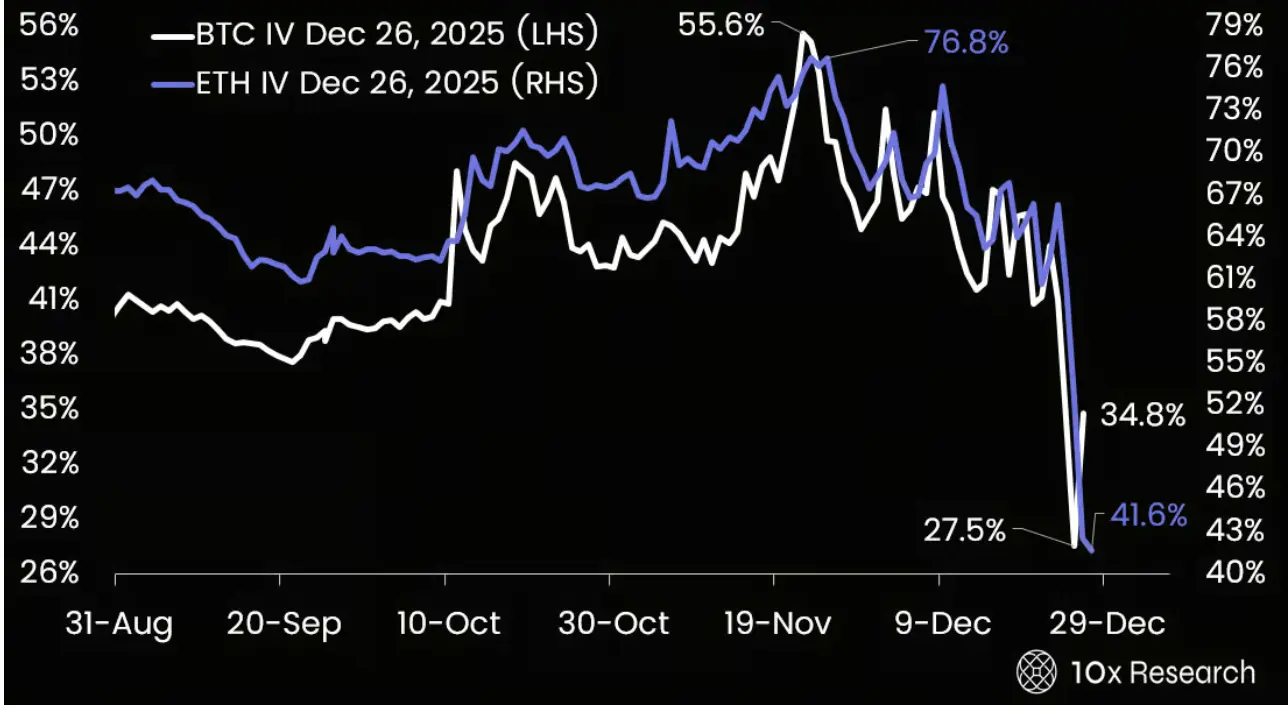

Bitcoin Liquidity Alert: The market appears calm, but 87% of traders may be standing on the "liquidation cliff"

The crypto market is entering the new year with cyclical low activity, seemingly calm on the surface but turbulent beneath. According to the latest market analysis report from 10x Research, despite Bitcoin and Ethereum trading volumes shrinking by over 30% from average levels and the total market capitalization slightly declining to $2.96 trillion, the derivatives market is sending a completely different signal: volatility is being extremely compressed, funding rates are quietly rising, and leverage positions remain high. This dangerous combination of "low liquidity and high leverage," coupled with continuous outflows of spot ETF funds and stablecoin withdrawals, makes the market structure unusually fragile. A small price fluctuation could trigger a chain reaction of liquidations, thereby determining the subsequent major directional choice.

MarketWhisper·2025-12-29 03:17

Pump.fun continues to transfer 50 million USDC to Kraken, PUMP token down 55% compared to the ICO price

Pump.fun recently transferred an additional 50 million USDC to Kraken, totaling 605 million USDC since mid-November. Despite selling ICO tokens at 0.004 USD, PUMP is now trading at 0.0018 USD, raising concerns about selling pressure and the project's long-term prospects.

TapChiBitcoin·2025-12-28 03:56

Christmas Eve disguised as Circle official releases new products, media rushing to report instead fuels the spread of fake news

Fake Christmas Eve news impersonating Circle introduces CircleMetals and fictitious tokens, misleading users to connect wallets. Circle urgently clarifies and denies, criticizing media for rushing and amplifying scam risks.

Fake news released on Christmas Eve, disguising as official products to mislead the market

-------------------

During Christmas Eve, a press release claiming that stablecoin issuer Circle launched a new platform called "CircleMetals," offering tokenized gold and silver trading, circulated on social media and multiple crypto information channels.

The press release states that users can perform 24-hour exchanges between $USDC and the so-called "$GLDC" gold token and "$SILC" silver token on the CircleMetals platform, claiming liquidity is sourced from COMEX.

CryptoCity·2025-12-26 03:06

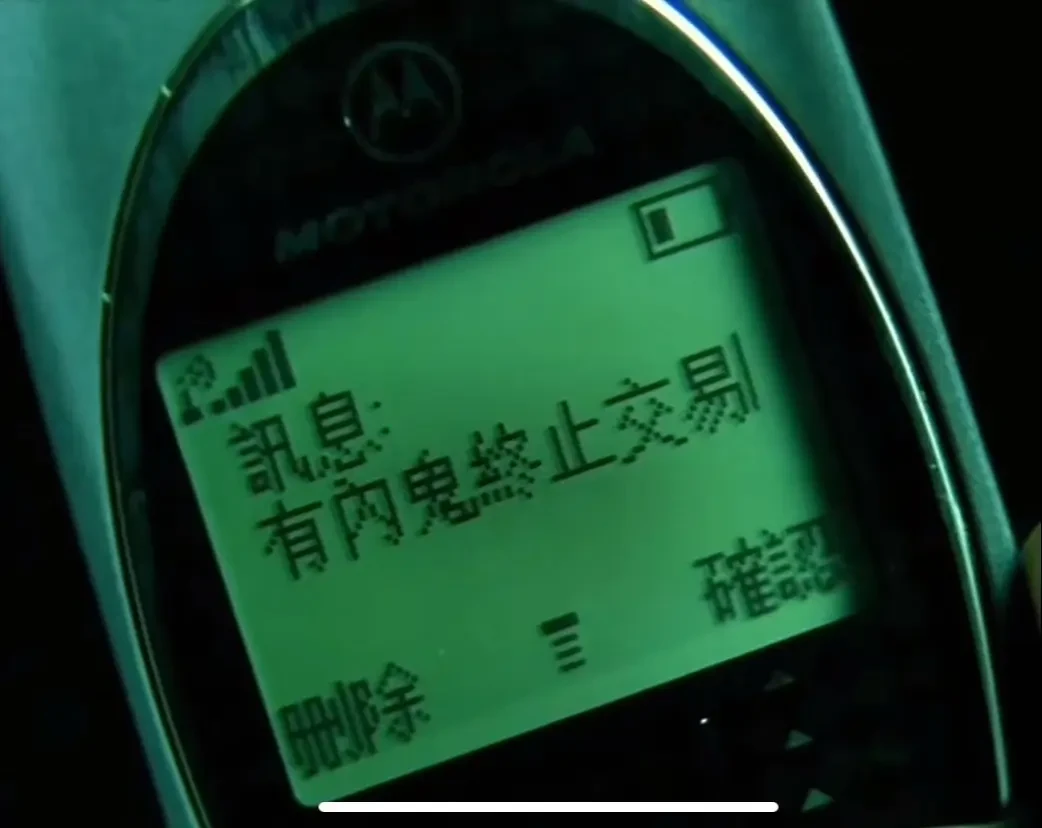

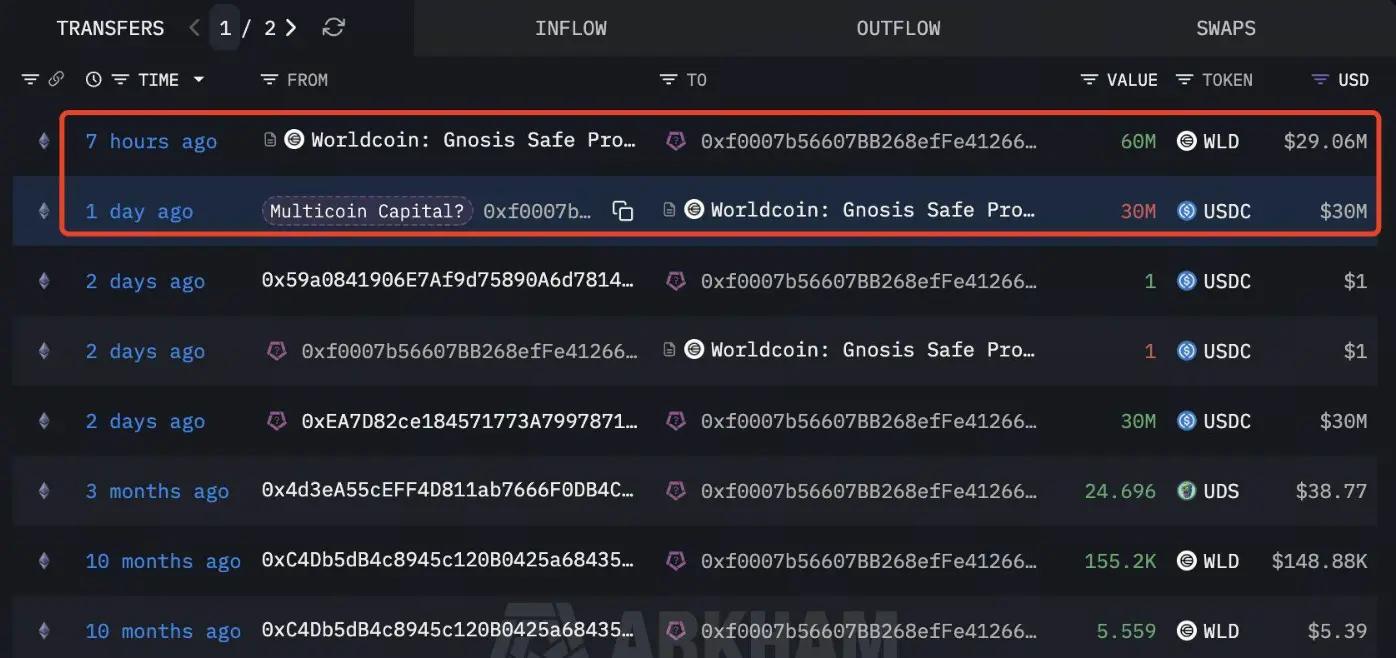

Institutions are boldly spending $30 million against the trend! Multicoin Capital OTC is rushing to acquire 60 million Worldcoin. What is their intention?

Renowned crypto venture capital firm Multicoin Capital recently made a one-time off-market purchase of 60 million WLD tokens from the Worldcoin project team, involving up to 30 million USDC. This transaction comes at a time when Worldcoin is facing multiple difficulties: its token price has dropped over 21% in the past month, on-chain active wallet addresses have sharply declined since the September peak, and global search interest has plummeted 94% from its high. Meanwhile, the project is facing increasingly severe regulatory scrutiny in countries like Thailand, with demands to delete millions of collected user biometric data. The institution's contrarian re-investment amid retail withdrawal and regulatory clouds has sparked deep reflections in the market on Worldcoin's long-term value and the future of the biometric identity track.

WLD2,61%

MarketWhisper·2025-12-26 01:46

Alchemy Pay and Coinbase Partner to Expand $USDC Access Via Bitget

Alchemy Pay partners with Coinbase to enhance access to the USDC stablecoin, offering zero ramp fees through Bitget. This collaboration aims to streamline fiat-to-crypto transactions, improving liquidity and making it easier for users to invest in digital assets.

BlockChainReporter·2025-12-25 14:54

Former CFTC Acting Chair Caroline Pham officially appointed as MoonPay Chief Legal Officer

Former CFTC Acting Chair Caroline Pham Joins MoonPay, Signaling Deep Integration of Regulation and Crypto Infrastructure, Paving the Way for Institutional Funds in 2026.

(Background recap: Binance US deposits and withdrawals revived! Partnered with MoonPay, USDT becomes the standard currency for buying and selling Crypto)

(Additional background: Crypto mansion showdown: MoonPay raises funds to buy a beach house, still losing to Curve founder's thousand-pingyuan estate)

Crypto payment provider MoonPay announced a major development in mid-December, with former CFTC Acting Chair Caroline Pham officially joining as Chief Legal Officer and Chief Administrative Officer. For the market, this is not just a job change, but the "regulators" are officially entering the scene.

Licenses, connections, and 2026

動區BlockTempo·2025-12-25 03:50

$USDT, $USDC, and $USDe Lead Top Stablecoins By Market Capitalization

The stablecoin sector continues to display notable traction across the globe. Particularly, $USDT, $USDC, and $USDe are leading the list of top stablecoins in terms of market capitalization. As per the data from Phoenix Group, the rising growth of the stablecoin world has pushed its total market cap

BlockChainReporter·2025-12-24 23:03

Circle enters the "tokenized precious metals" market! CircleMetals launches USDC exchange for tokenized gold and silver services

USD Stablecoin USDC Issuer Circle Announces Expansion of Its Digital Currency Platform into the "Tokenized Precious Metals" Market: Circle, through its new platform CircleMetals.com, launches services for direct exchange of USDC for tokenized gold (GLDC) and tokenized silver (SILC).

(Background: US OCC Green Light! Ripple, BitGo, Circle, and five other Crypto giants receive "Conditional Approval" for trust bank licenses)

(Additional background: Circle partners with Aleo to launch privacy stablecoin "USDCx," with transaction records and wallet addresses fully hidden)

Table of Contents

GLDC and SILC Focus on Instant Exchange and Precious Metal Exposure

Liquidity Link

動區BlockTempo·2025-12-24 16:05

Apex Fusion Integrates Stargate to Bring USDC Liquidity to Cardano

Apex Fusion's integration with Stargate enables native USDC transfers across Cardano and EVM networks, enhancing DeFi interoperability. This partnership commits $2.5 million in USDC liquidity, marking a significant milestone for stablecoin access and liquidity on Cardano.

Coinpedia·2025-12-23 17:18

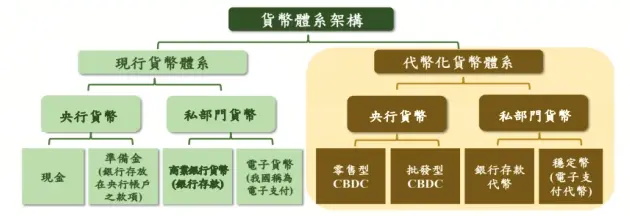

Taiwan's stablecoin may fall behind Japan! Chen Chong warns: tech companies won't wait for the Financial Supervisory Commission.

Chen Chong, Chairman of the New Generation Financial Foundation, sharply criticized Taiwan's stablecoin policy, stating that the Financial Supervisory Commission's "financial institution first" approach ignores market realities. Chen pointed out that the issuance of stablecoins in Taiwan should meet two major requirements: having a large scale of USD liquidity and a clear cross-border remittance payment demand on the business side. Observing the current situation, supply chain finance centered around large technology companies is the most powerful, but if Taiwan does not allow companies to issue, technology companies may turn to other countries.

MarketWhisper·2025-12-23 07:32

Circle Mints Another $500 Million USDC on Solana

Circle's $500M USDC mint on December 23, 2025—pushing Solana totals to $18B since October—confirms surging demand for efficient, regulated stablecoins.

CryptopulseElite·2025-12-23 05:52

Stablecoins will not drain banks! Cornell study: Deposit stickiness is extremely strong, banks are instead forced to upgrade.

Stablecoins will not destroy the banking system; instead, they will become a competitive force that drives banks to improve efficiency. Research shows that under the constraint of deposit stickiness, stablecoins have not triggered a massive outflow of deposits, but have instead compelled banks to offer better interest rates and services, becoming a catalyst for the self-renewal of the financial system. This article is sourced from a piece written by Forbes and organized, translated, and authored by BlockBeats.

(Background: Visa has launched USDC stablecoin settlement in the United States, with two banks cooperating to break the weekend vacuum)

(Background information: Digital banks no longer rely on traditional banking for profit; the real gold mine lies in stablecoins and identity verification)

Table of Contents

"Sticky Deposit" Theory

Competition is a characteristic, not a system flaw.

Regulatory aspect "unlock"

Efficiency Bonus

Upgrade of the US Dollar

Editor’s Note:

Will stablecoins impact silver?

動區BlockTempo·2025-12-22 18:30

Klarna Taps Coinbase for USDC-Based Institutional Funding - Unchained

Klarna partners with Coinbase to use the USDC stablecoin for short-term institutional funding, enhancing its financing mix without replacing traditional sources. This move gives Klarna access to new investor pools and improves capital efficiency.

UnchainedCrypto·2025-12-22 12:21

Whales Load Up on HYPE as Fresh USDC Flows Hit Hyperliquid

Recent whale activity shows strong interest in HYPE with two wallets depositing $5 million in USDC to accumulate tokens. This strategic accumulation suggests long-term confidence in Hyperliquid's governance token, potentially forecasting significant price rallies.

HYPE5,21%

Coinfomania·2025-12-22 09:13

Making money in the crypto world, and then what? Analysis of trader Vida's mindset after 00, aiming for the top twenty Chinese billionaires.

In the crypto assets market, stories of young trading prodigies becoming wealthy overnight only to quickly fall from grace are common. However, 25-year-old trader Vida deliberately distances himself from such narratives. He openly states that he has never considered himself a trading genius, nor does he stake his life on a lone hero-style high-leverage gamble.

People in the coin circle often do not regard money as money, and Vida always has a sense of awe towards money.

Vida positions himself as an entrepreneur and operator of a proprietary trading firm, rather than an independent trader working alone. He emphasizes that those who can truly survive in the market for the long term, and even reach the level of top players worth hundreds of millions of dollars, mostly rely on teamwork, information collaboration, and pack tactics, rather than individual heroism. He states bluntly: the market likes stories of striking it rich overnight, but reality often does not operate that way.

In his view, traders who can withstand severe fluctuations often reach a stage in life where they do not consider money as

DOGE7,63%

ChainNewsAbmedia·2025-12-21 16:39

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

CryptoDaily·2025-12-20 18:10

Klarna Partners With Coinbase to Raise USDC-Denominated Funding

_Klarna collaborates with Coinbase to raise USDC funding from institutional investors, diversifying capital sources and enhancing liquidity options globally._

Klarna, the global digital bank and payments platform, announced a strategic partnership with Coinbase to raise USDC-denominated short-te

LiveBTCNews·2025-12-20 17:50

Circle Drives USDC Expansion as Enterprise Platforms Shift From Trading to Real-World Usage

Circle Internet Financial is scaling USDC by embedding the dollar-backed stablecoin into real-world payments, treasury, and software platforms worldwide, accelerating enterprise adoption and positioning digital dollars as core financial infrastructure.

Circle Expands USDC Through Global

Coinpedia·2025-12-20 07:09

Citigroup remains optimistic about crypto stocks, Circle continues to be the top choice

Citigroup lowers price targets for many crypto stocks due to industry decline but remains optimistic in the long term. Circle's USDC is the top choice. Price targets for some stocks like BLSH and MSTR have also been lowered.

TapChiBitcoin·2025-12-20 04:57

Klarna partners with Coinbase to promote debt structure using USDC stablecoin funding

Klarna Group plc has partnered with Coinbase Global Inc. to integrate stablecoin-based funding into its capital-raising strategy, becoming one of the first digital banks to use USDC for liquidity. This collaboration will allow Klarna to attract institutional crypto-native investors, optimizing capital efficiency and reducing operational costs compared to traditional commercial paper markets.

TapChiBitcoin·2025-12-20 01:22

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

CryptoDaily·2025-12-19 18:05

Upside potential reaches 40%! Deutsche Bank's initial rating on Coinbase is Buy, with a target price of $340

Deutsche Bank released its latest report on Wednesday, giving Coinbase (stock ticker: COIN) a "Buy" rating for the first time and setting a target price of $340. Based on the current stock price, this implies a potential upside of 40%.

Deutsche Bank analyst Brian Bedell pointed out that as Coinbase actively promotes its "All-in-One Exchange" strategy, the platform's positioning is no longer just a cryptocurrency exchange but is moving towards a one-stop trading platform covering diverse assets, on-chain finance, and derivative applications.

Deutsche Bank stated that Coinbase's spectacular transformation is moving from slogans to actual practice. With new products being launched successively, the market size that Coinbase can reach will continue to expand, laying the foundation for growth in the coming years.

Coinbase earlier announced the launch of a series of

区块客·2025-12-19 07:11

Are virtual currencies and stablecoins in Taiwan taxable? Finance Minister: We'll wait for the Financial Supervisory Commission's classification before commenting.

The controversy over whether virtual currencies and stablecoins in Taiwan should be taxed resurfaced on December 17 at the Legislative Yuan. Minister of Finance Chuang Cui-yun responded to legislator Lai Shih-bao's inquiry, stating that the Financial Supervisory Commission's regulations related to virtual assets are currently under review. We must wait for the relevant laws to be enacted to determine whether virtual currencies are classified as payment tools or securities, which will then determine the appropriate taxation method. Lai Shih-bao stated that virtual currency trading volume is significant, and the Ministry of Finance should actively consider taxation.

MarketWhisper·2025-12-19 06:56

Upside potential reaches 40%! Deutsche Bank's initial rating on Coinbase is Buy, with a target price of $340

Deutsche Bank released its latest report on Wednesday, giving Coinbase (stock ticker: COIN) a "Buy" rating for the first time and setting a target price of $340. Based on the current stock price, this implies a potential upside of 40%.

Deutsche Bank analyst Brian Bedell pointed out that as Coinbase actively promotes its "All-in-One Exchange" strategy, the platform's positioning is no longer just a cryptocurrency exchange but is moving towards a one-stop trading platform covering diverse assets, on-chain finance, and derivative applications.

Deutsche Bank stated that Coinbase's spectacular transformation is moving from slogans to actual practice. With new products being launched successively, the market size that Coinbase can reach will continue to expand, laying the foundation for growth in the coming years.

Coinbase earlier announced the launch of a series of

区块客·2025-12-19 05:49

Intuit partners with Circle to bring USDC into TurboTax and QuickBooks

Intuit has partnered with Circle to integrate USDC stablecoin across its product ecosystem, enhancing financial services like tax payments. This collaboration aims to provide faster, cost-effective transactions but details about the blockchain implementation will be revealed in 2026.

TapChiBitcoin·2025-12-19 00:33

Intuit to Integrate USDC Stablecoin Across TurboTax, QuickBooks

Intuit has partnered with Circle for a multi-year agreement to integrate USDC into its products, enhancing tax refunds and payments. The blockchain for USDC settlement is not yet disclosed.

Decrypt·2025-12-18 19:03

How USDC and USDT Affect Crypto Casino Bankroll Stability

If you’ve ever opened your wallet before a casino session and thought, “Wait, why is my bankroll up or down already?”, you’re not alone. That little moment of confusion usually isn’t about your gameplay at all, it’s about your coin.

Stablecoins are becoming the antidote to that noise, and the

CryptoNinjas·2025-12-18 15:42

Coinbase turns brands into stablecoin issuers with USDC-backed ‘Custom Stablecoins’

Coinbase's new Custom Stablecoins lets brands mint compliant, USDC-backed digital dollars on Coinbase Business, tapping 100M+ wallets and new revenue streams.

Summary

Coinbase's Custom Stablecoins lets businesses issue branded, USDC-backed tokens with issuance, custody, and compliance handled b

Cryptonews·2025-12-18 09:06

Visa partners with Circle and Solana to provide USDC settlement services to US banks

Global payments giant Visa announced on Tuesday the official launch of stablecoin settlement services in the United States, symbolizing that traditional financial institutions' interest in blockchain payment channels has shifted from "wait-and-see" to "practical application."

According to Visa's statement, this service allows U.S. financial institutions to use the USD stablecoin USDC issued by Circle for backend cash flow and clearing operations on the Solana blockchain. The initial participating banks include Cross River Bank, known for its fintech services, and Lead Bank, which has received investment from well-known venture capital firm a16z.

Visa also announced that this service will continue to expand in scale through 2026. Rubail Birwadker, Head of Global Growth Products and Strategic Partnerships at Visa, stated:

> The reason Visa is expanding its stablecoin settlement business is because

SOL2,44%

区块客·2025-12-18 05:54

Visa Launches USDC Settlement on Solana for U.S. Banks – Bridging Traditional Finance and Blockchain

Visa announced the rollout of a new service enabling select U.S. banks to settle VisaNet payments directly in USDC stablecoin on the Solana blockchain.

CryptopulseElite·2025-12-18 05:45

Visa Opens USDC Stablecoin Settlement: Traditional Payment Giants Embrace the New Era of the U.S. "Digital Dollar"

Global payments giant Visa announced on December 17th that it will open its network’s stablecoin settlement capabilities to US financial institutions, allowing transactions and settlements using USDC issued by Circle via the Solana blockchain. This move marks the first time stablecoins have achieved full commercial application within the mainstream banking system in the United States, representing a key market breakthrough following the signing of the federal stablecoin framework by the Trump administration in July 2025, which provided a clear regulatory pathway. Cross River Bank and Lead Bank have become the first institutions to adopt this service. Although Visa’s network annualized stablecoin settlement volume has exceeded $3.5 billion, compared to the $17 trillion in total transactions processed last year, this emerging business line has enormous potential, indicating that the integration of traditional finance and crypto assets is accelerating rapidly.

MarketWhisper·2025-12-18 03:16

A Brief Discussion on Visa Supporting Stablecoin Settlement

Visa recently announced support for the stablecoin USDC for settlement, meaning that card issuers and merchants can directly settle payments using stablecoins. This change marks an acceleration in the trend of stablecoins being accepted as real currency, although it is currently only available to some partners.

金色财经_·2025-12-18 02:45

Visa partners with U.S. banks to enable USDC settlement! A seven-day window revolutionizes traditional payments

Visa announces that US banks issuing cards and acquiring banks can now settle VisaNet debts using Circle's USDC stablecoin, marking the first time this functionality has been implemented in the United States. Cross River Bank and Lead Bank become the first US banks to settle with Visa using USDC via the Solana blockchain. This service extends the traditional five-business-day settlement cycle to a seven-day window.

MarketWhisper·2025-12-18 01:40

Load More