12.23 Bitcoin Ethereum evening strategy!

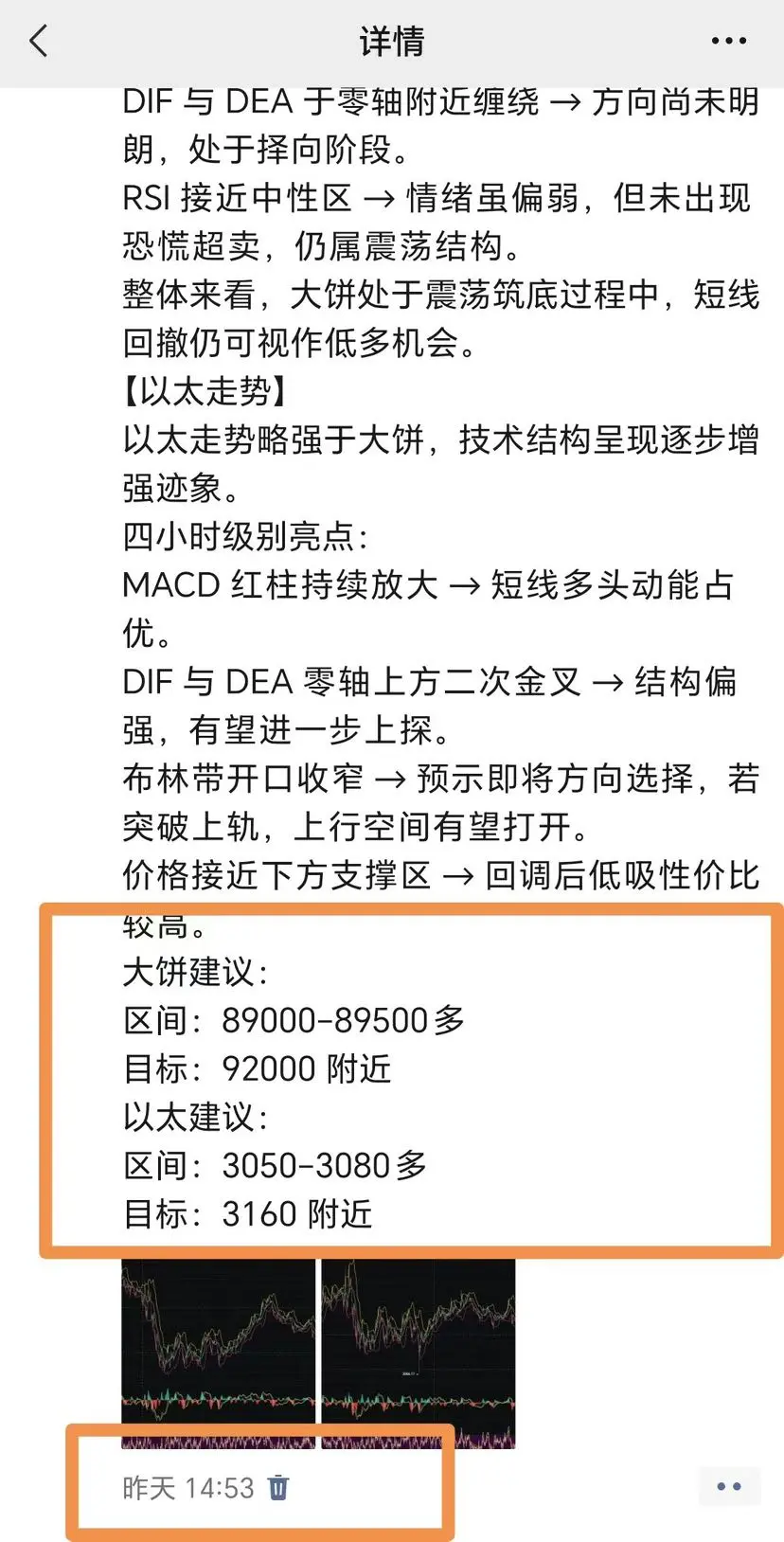

Short Bitcoin at 88000-88500, target 87000-86000, defense at 89500! $BTC

Short Ethereum at 2970-3000, target 2900-2850, defense at 3050!

The strategy is time-sensitive and is subject to real-time guidance in private!

Follow Beichen, lock in clear strategies and practical results. Team slots are limited, and if you're truly looking for a breakthrough❓ Action is the only answer❗️❗️

View OriginalShort Bitcoin at 88000-88500, target 87000-86000, defense at 89500! $BTC

Short Ethereum at 2970-3000, target 2900-2850, defense at 3050!

The strategy is time-sensitive and is subject to real-time guidance in private!

Follow Beichen, lock in clear strategies and practical results. Team slots are limited, and if you're truly looking for a breakthrough❓ Action is the only answer❗️❗️