Wanru,TheGoldHuntingQueen

No content yet

Wanru,TheGoldHuntingQueen

The current pattern is clear. We have repeatedly highlighted the risks of a downward trend and emphasized the release rhythm of subsequent downward momentum. Due to the influence of the US stock market being closed in the past two days, market trading has been relatively light, and volatility has somewhat contracted. Short-term operations will become a better choice in the near term.

Previously, the framework continued to oscillate and consolidate near the lower Bollinger Band, with multiple contending in a critical phase. The support and resistance at the upper and lower bounds of the range

View OriginalPreviously, the framework continued to oscillate and consolidate near the lower Bollinger Band, with multiple contending in a critical phase. The support and resistance at the upper and lower bounds of the range

- Reward

- like

- Comment

- Repost

- Share

On the market data, the price has closed with two consecutive bearish candles, indicating that short positions are increasingly dominating the pattern. The Bollinger Bands are expanding, with the middle band and lower band showing signs of turning downwards, suggesting that downward pressure is increasing. From the technical indicator MACD, the fast and slow lines have formed a death cross above the zero line, with the red energy bars continuing to increase in higher trade volumes, indicating that long positions are gradually losing momentum and short positions are accumulating, while the down

View Original

- Reward

- like

- Comment

- Repost

- Share

BTC is overall in a relatively strong oscillating upward structure. Recently, there have been multiple attempts to break through the previous high followed by pullbacks, but during the decline, the lows show a gradual upward trend, indicating that long positions are continuously supporting during the retracement, and the support area below is effective, without any obvious signs of weakening.

In terms of technical indicators, the price of Gag is maintained above the middle band of the Bollinger Bands, which are showing a converging and upward lifting pattern. This structure typically suggest

View OriginalIn terms of technical indicators, the price of Gag is maintained above the middle band of the Bollinger Bands, which are showing a converging and upward lifting pattern. This structure typically suggest

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

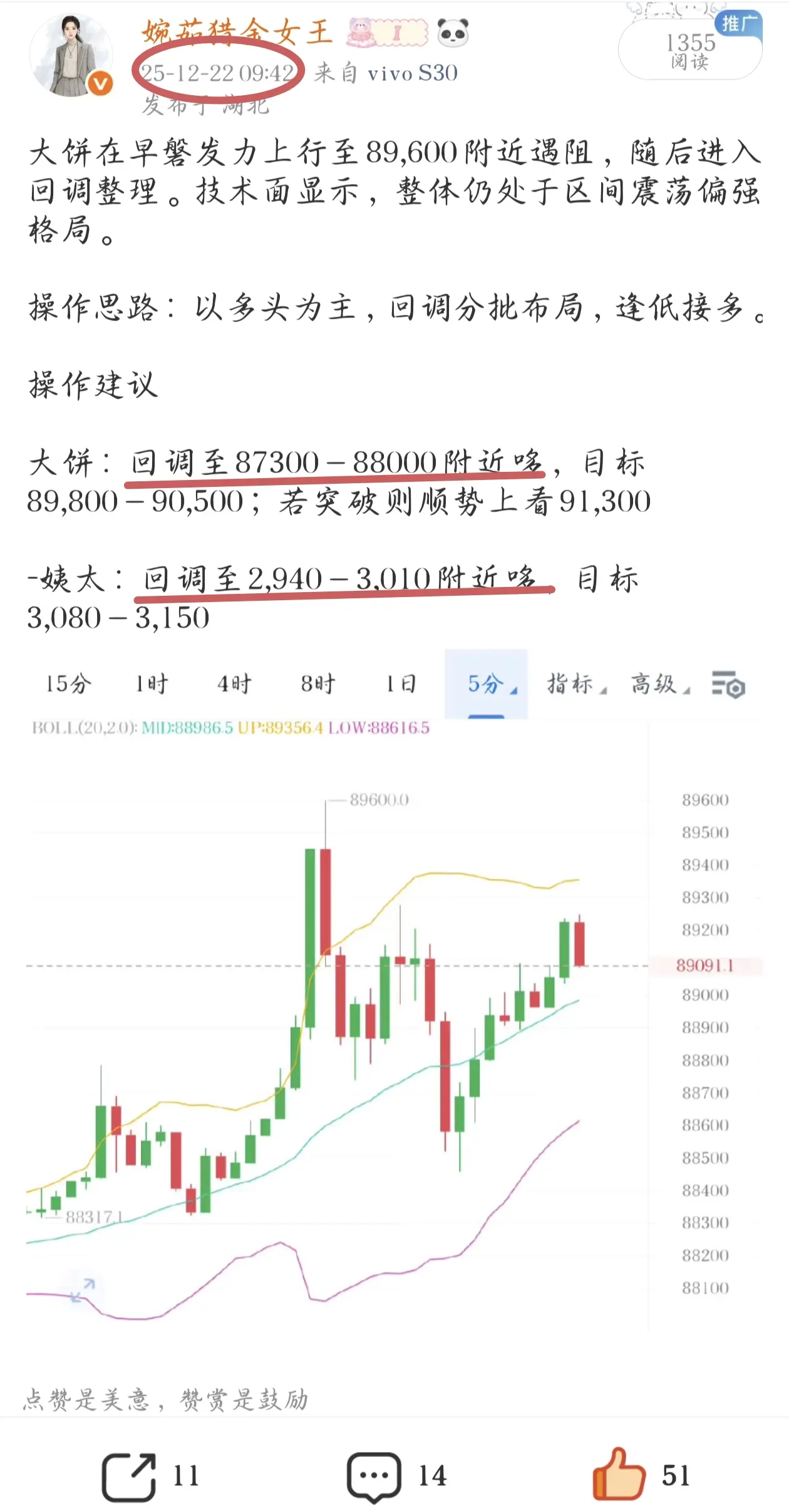

BTC made a strong push upward to around 89600 near the early session but encountered resistance, and then entered a pullback adjustment. The technical indicators show that overall it is still in a strong range-bound pattern.

Operational approach: Focus on long positions, accumulate in batches during pullbacks, and buy on dips.

Operation Suggestions

BTC: Pullback to around 87300–88000, target 89800–90500; if it breaks through, look up to 91300.

- Auntie: pullback to around 2940–3010, target 3080–3150

View OriginalOperational approach: Focus on long positions, accumulate in batches during pullbacks, and buy on dips.

Operation Suggestions

BTC: Pullback to around 87300–88000, target 89800–90500; if it breaks through, look up to 91300.

- Auntie: pullback to around 2940–3010, target 3080–3150

- Reward

- like

- Comment

- Repost

- Share

On December 22, the People's Bank of China kept the one-year and five-year LPR at 3% and 3.5% respectively, unchanged for seven consecutive months. The FTSE China A50 index futures opened with a rise of 0.15%.

Domestic futures main contracts showed a mixed performance in the morning: platinum and palladium rose nearly or exceeded 5%, PX, PTA, and Shanghai silver rose over 3%, short fiber, pulp, and bottle flakes rose over 2%; PVC, plastics, and canola oil fell over 1%.

Japanese government bond yields rose in early Tokyo trading, influenced by fiscal policy risks and expectations for go

View OriginalDomestic futures main contracts showed a mixed performance in the morning: platinum and palladium rose nearly or exceeded 5%, PX, PTA, and Shanghai silver rose over 3%, short fiber, pulp, and bottle flakes rose over 2%; PVC, plastics, and canola oil fell over 1%.

Japanese government bond yields rose in early Tokyo trading, influenced by fiscal policy risks and expectations for go

- Reward

- like

- Comment

- Repost

- Share

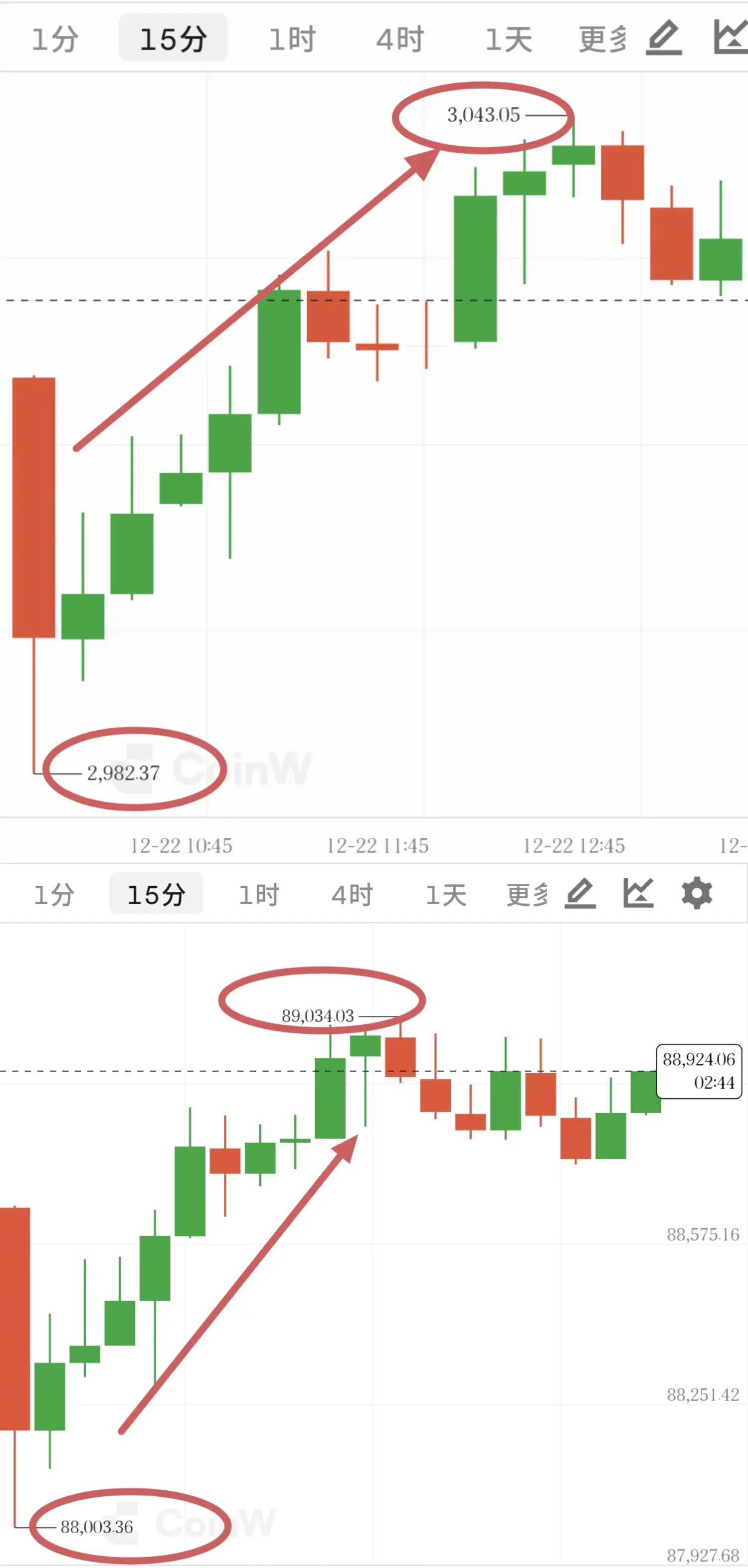

The Silk Road was fulfilled as scheduled, with Bitcoin at 1122 points, Auntie at 58 points, and the US stock market opening high in the evening, resolving the battle in 5 minutes. This wave of stability on the roots of Youyou and Luodie, a perfect day. Keep going!

View Original

- Reward

- like

- Comment

- Repost

- Share

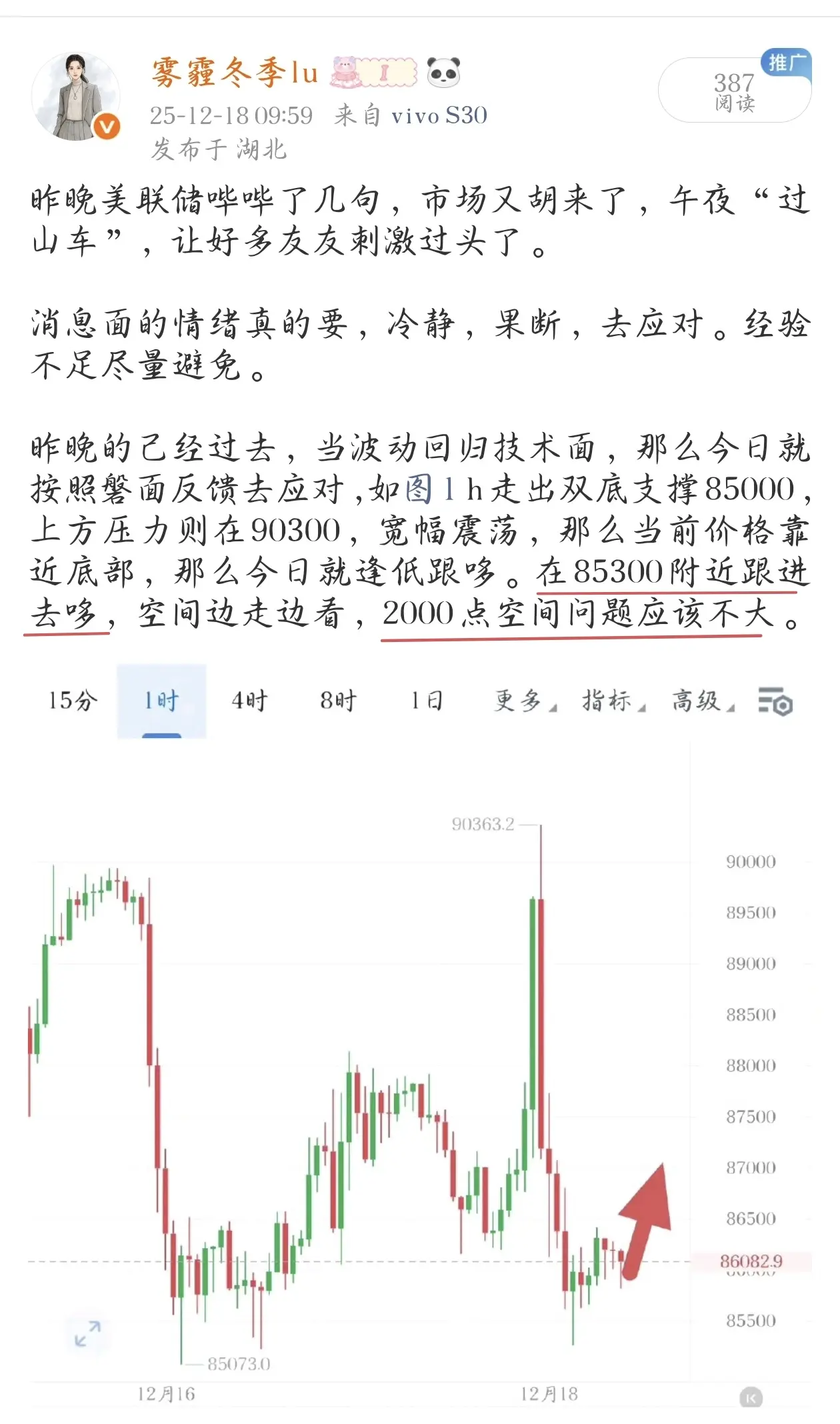

12.19 Evening Recommendations

After the news was released in the afternoon, the market for Bitcoin officially entered a phase of correction where the negative factors have been exhausted. At this point, it is advisable to rely on pullbacks to strategically position for a bullish trend.

From a technical perspective, the 4-hour chart for Bitcoin shows a low-level golden cross, indicating an initial signal of a short-term rebound. However, it remains in a weak zone, suggesting that the bullish momentum has not yet fully stabilized, and the strength of the rebound should not be overestimated.

The

View OriginalAfter the news was released in the afternoon, the market for Bitcoin officially entered a phase of correction where the negative factors have been exhausted. At this point, it is advisable to rely on pullbacks to strategically position for a bullish trend.

From a technical perspective, the 4-hour chart for Bitcoin shows a low-level golden cross, indicating an initial signal of a short-term rebound. However, it remains in a weak zone, suggesting that the bullish momentum has not yet fully stabilized, and the strength of the rebound should not be overestimated.

The

- Reward

- like

- Comment

- Repost

- Share

December 19th Jinshi Data News, financial website Investinglive analyst Justin Low pointed out that the market is skeptical of Bank of Japan Governor Kazuo Ueda's statements, and the next rate hike threshold will be higher than this time. Although Ueda did not rule out the possibility of a rate hike, he did not explicitly say that there will be another hike in March, emphasizing that policy still "depends on data." As a result, the USD/JPY rose intraday, reaching a high of 156.44.

View Original

- Reward

- like

- Comment

- Repost

- Share

Price and Trend: 1-hour V-shaped rebound followed by consolidation, breaking above the middle band of Bollinger Bands; daily/4-hour charts remain bearish, facing resistance from short-term moving averages.

Moving Average System: 1-hour breaks through short-term moving averages; daily EMA is downward, with price under the moving averages.

MACD: 1-hour MACD shows a bullish crossover below the zero line, DIF crosses above DEA, indicating bullish momentum release; daily MACD shows a death cross with green bars, indicating bearish pressure persists.

RSI: 1-hour around 58 (bullish); daily around 43

Moving Average System: 1-hour breaks through short-term moving averages; daily EMA is downward, with price under the moving averages.

MACD: 1-hour MACD shows a bullish crossover below the zero line, DIF crosses above DEA, indicating bullish momentum release; daily MACD shows a death cross with green bars, indicating bearish pressure persists.

RSI: 1-hour around 58 (bullish); daily around 43

ETH-0.74%

- Reward

- like

- Comment

- Repost

- Share

The Bank of Japan's December rate hike of 25 basis points has been fully priced in by the market, with institutional disagreements centered on the pace of subsequent rate hikes.

Wells Fargo: A further 25 basis point increase in Q3 next year, with the policy rate possibly reaching 1% by the end of the year.

ANZ Bank: The next rate hike is delayed until April 2026, pending observation of wage growth trends.

JPMorgan Chase: Raising rates approximately every six months, depending on the government's macroeconomic stance.

Morningstar: Clear signs of wage growth need to wait until March next year, w

View OriginalWells Fargo: A further 25 basis point increase in Q3 next year, with the policy rate possibly reaching 1% by the end of the year.

ANZ Bank: The next rate hike is delayed until April 2026, pending observation of wage growth trends.

JPMorgan Chase: Raising rates approximately every six months, depending on the government's macroeconomic stance.

Morningstar: Clear signs of wage growth need to wait until March next year, w

- Reward

- like

- Comment

- Repost

- Share

Bearish dominance in Bitcoin, weak rebound; a rebound is a Kundan window, and losing it will accelerate the decline.

A rebound to around 86,500 is a Kundan; the initial target is 84,000, and if the support breaks, continue to watch 83,000.

A rebound to around 86,500 is a Kundan; the initial target is 84,000, and if the support breaks, continue to watch 83,000.

BTC-0.44%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin surges higher, testing resistance and breaking through the 88,800 mark. Ethereum moves in sync, breaking past 2,940. The two leading cryptocurrencies continue to oscillate and build momentum, with the potential to replicate last night's strong rally. Bitcoin aims for the 90,000 psychological level, while Ethereum is close to challenging the 3,000 mark!

Bullish momentum remains strong! Bitcoin reaches 88,800, and Ethereum climbs to 2,940. Both are currently in the high-level testing phase. If the momentum from last night's rapid advance continues, Bitcoin could easily hit 90,000, and Et

View OriginalBullish momentum remains strong! Bitcoin reaches 88,800, and Ethereum climbs to 2,940. Both are currently in the high-level testing phase. If the momentum from last night's rapid advance continues, Bitcoin could easily hit 90,000, and Et

- Reward

- like

- Comment

- Repost

- Share

There are no empty waits for the market, nor empty hopes for the broadcast. Keep going, keep pushing, push push push!

View Original- Reward

- like

- Comment

- Repost

- Share

Direction determines Orange Worship, position determines space, and trend is king. #GateLaunchpadKDK认购上线

View Original

- Reward

- like

- Comment

- Repost

- Share