CryptoWorldDirector

No content yet

CryptoWorldDirector

"Market Analysis on 1.4: The Wolf Has Finally Arrived, But Your U Is Gone"

After a New Year's holiday, the market maker finally couldn't hold back and started to act. We revealed the plot in late December: a sharp rise to the MA50 followed by a pullback, with a narrow-range rally in January. The current trend is upward, and based on the current indicators, the OBV line has broken through the moving average, which is also changing direction. The hourly tunnel has been forming a golden cross for over two months and is about to do so again. The daily moving averages are also about to cross, and M

View OriginalAfter a New Year's holiday, the market maker finally couldn't hold back and started to act. We revealed the plot in late December: a sharp rise to the MA50 followed by a pullback, with a narrow-range rally in January. The current trend is upward, and based on the current indicators, the OBV line has broken through the moving average, which is also changing direction. The hourly tunnel has been forming a golden cross for over two months and is about to do so again. The daily moving averages are also about to cross, and M

- Reward

- like

- Comment

- Repost

- Share

"12.31 Market Analysis: Thank You for Your Company This Year, The Big Market Will Continue Next Year"

This is the last market analysis of 2025. Since the beginning of 2025, Director Ke has insisted on analyzing daily trend lines and key intraday support and resistance levels for everyone every trading day. This is probably one of the few bloggers in the entire market to do so. There have been correct judgments as well as incorrect ones, precise entries and missed points. But overall, our accuracy on the daily trend is still good. Several weekly trend judgments were also correct, helping B frie

View OriginalThis is the last market analysis of 2025. Since the beginning of 2025, Director Ke has insisted on analyzing daily trend lines and key intraday support and resistance levels for everyone every trading day. This is probably one of the few bloggers in the entire market to do so. There have been correct judgments as well as incorrect ones, precise entries and missed points. But overall, our accuracy on the daily trend is still good. Several weekly trend judgments were also correct, helping B frie

- Reward

- 3

- 1

- Repost

- Share

ILovePudding :

:

Experienced driver, guide me 📈"12.30 Market Analysis: Tired of Analyzing, Just Say Which Side (With Entry Points)"

Yesterday's market plunged straight down after touching the MA50 on the daily chart. The previously good trend was suddenly reversed. It seems that the bottoming process starting in January is still very tough, with no clear upward or downward direction. So in the next few days, if you want to trade, you can only watch some key levels to see if they hold. Today, I will just provide the levels and the trading ideas.

$BTC Bitcoin support at 85550-85750, resistance at 89000-89450. If you think a crash is coming,

View OriginalYesterday's market plunged straight down after touching the MA50 on the daily chart. The previously good trend was suddenly reversed. It seems that the bottoming process starting in January is still very tough, with no clear upward or downward direction. So in the next few days, if you want to trade, you can only watch some key levels to see if they hold. Today, I will just provide the levels and the trading ideas.

$BTC Bitcoin support at 85550-85750, resistance at 89000-89450. If you think a crash is coming,

- Reward

- like

- Comment

- Repost

- Share

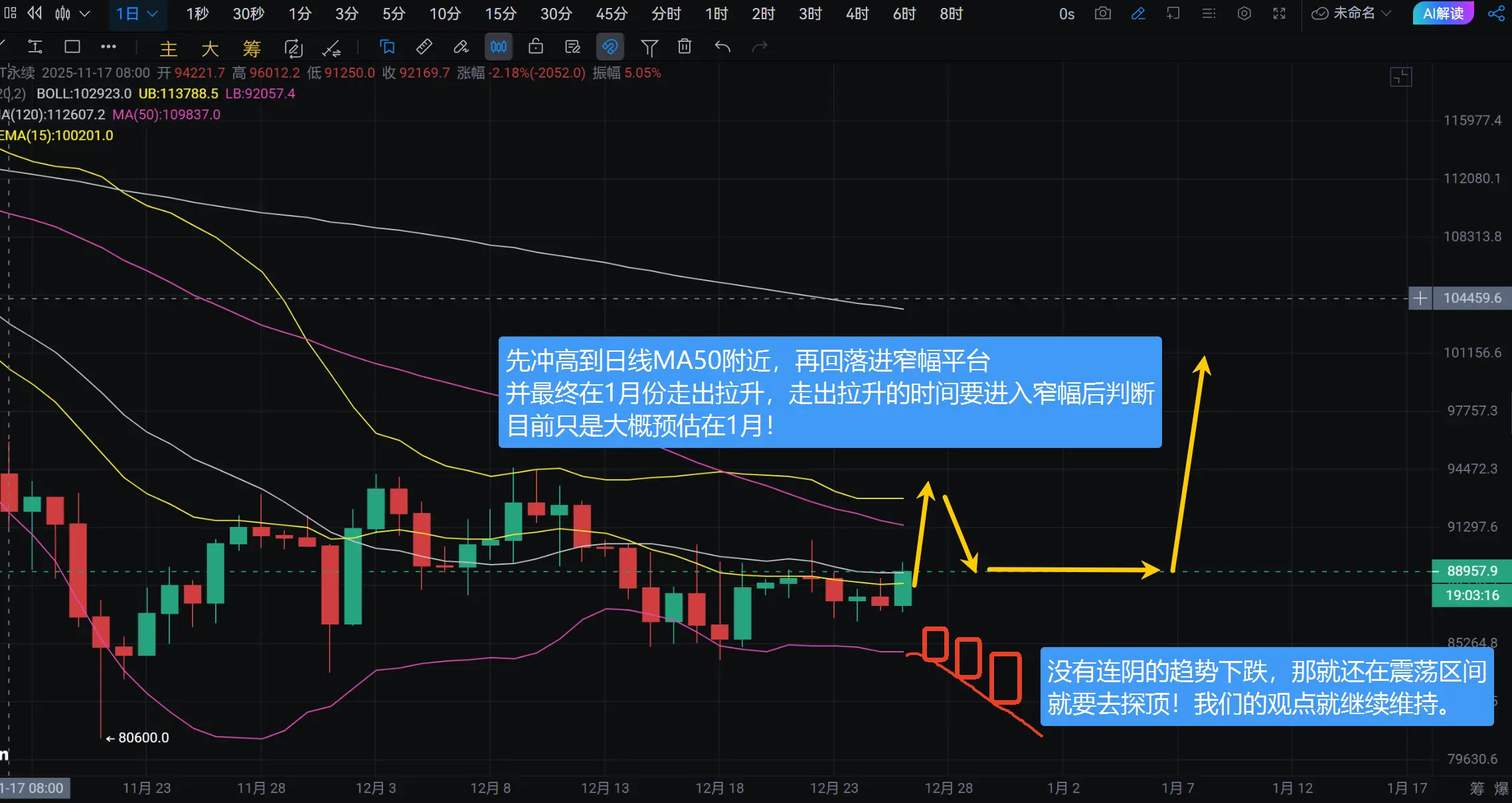

【Recent market outlook remains unchanged: there is still potential for a rally and weekly false breakout】

Before the $BTC daily chart shows no signs of consecutive downward candles, the current trend is still in a consolidation zone, and a top test is expected. Therefore, the market outlook remains: the daily will first surge to the MA50 and then pull back, followed by a narrow-range platform. In January, after completing the narrow range, combined with the weekly false breakout, a strong upward move is expected. Trading requires unity of knowledge and action. Before making a mistake, you mus

Before the $BTC daily chart shows no signs of consecutive downward candles, the current trend is still in a consolidation zone, and a top test is expected. Therefore, the market outlook remains: the daily will first surge to the MA50 and then pull back, followed by a narrow-range platform. In January, after completing the narrow range, combined with the weekly false breakout, a strong upward move is expected. Trading requires unity of knowledge and action. Before making a mistake, you mus

BTC1,25%

- Reward

- like

- Comment

- Repost

- Share

12.26 Market Analysis: Hold on, the dawn of the bulls is about to reappear!》

It's another quick move, friends. I don't know if you managed to defend against it, but the market has finally returned above 88,000. Since our judgment was correct, we will continue with the original view: the daily chart first surges to the MA50 and then pulls back, followed by a narrow-range platform. In January, it will complete the narrow range and, together with the weekly chart's baiting move, will produce a strong rally. As long as there is no trend of consecutive bearish candles on the daily chart, this expec

View OriginalIt's another quick move, friends. I don't know if you managed to defend against it, but the market has finally returned above 88,000. Since our judgment was correct, we will continue with the original view: the daily chart first surges to the MA50 and then pulls back, followed by a narrow-range platform. In January, it will complete the narrow range and, together with the weekly chart's baiting move, will produce a strong rally. As long as there is no trend of consecutive bearish candles on the daily chart, this expec

- Reward

- like

- Comment

- Repost

- Share

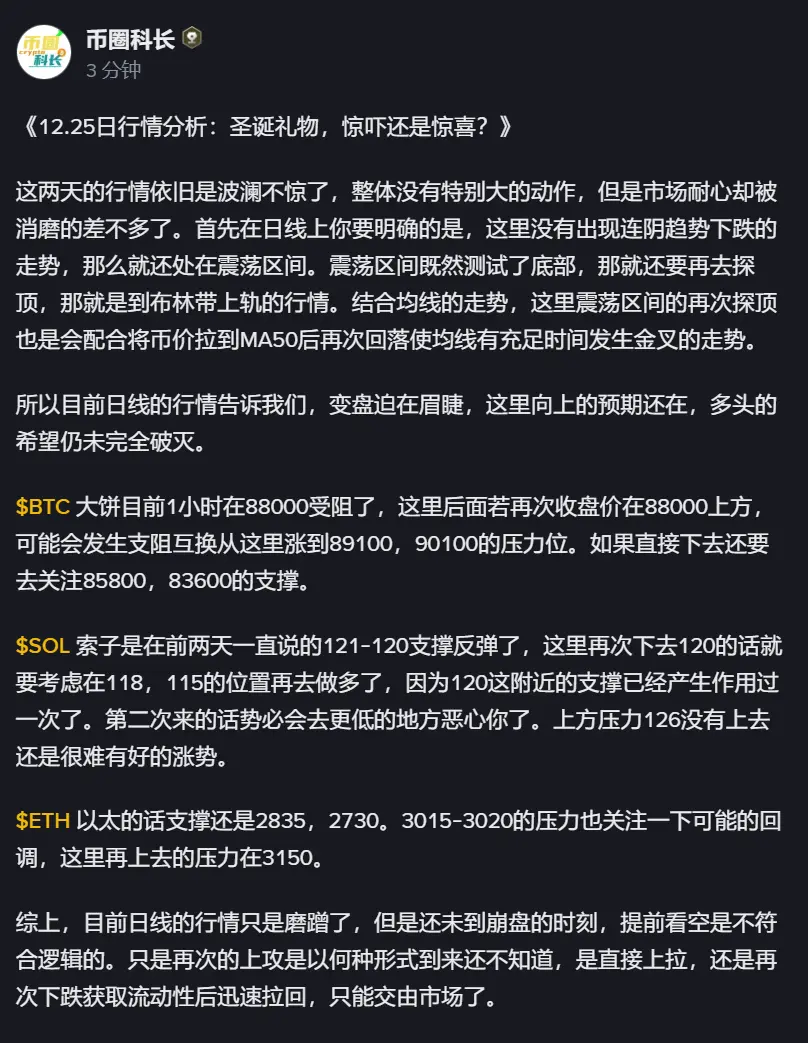

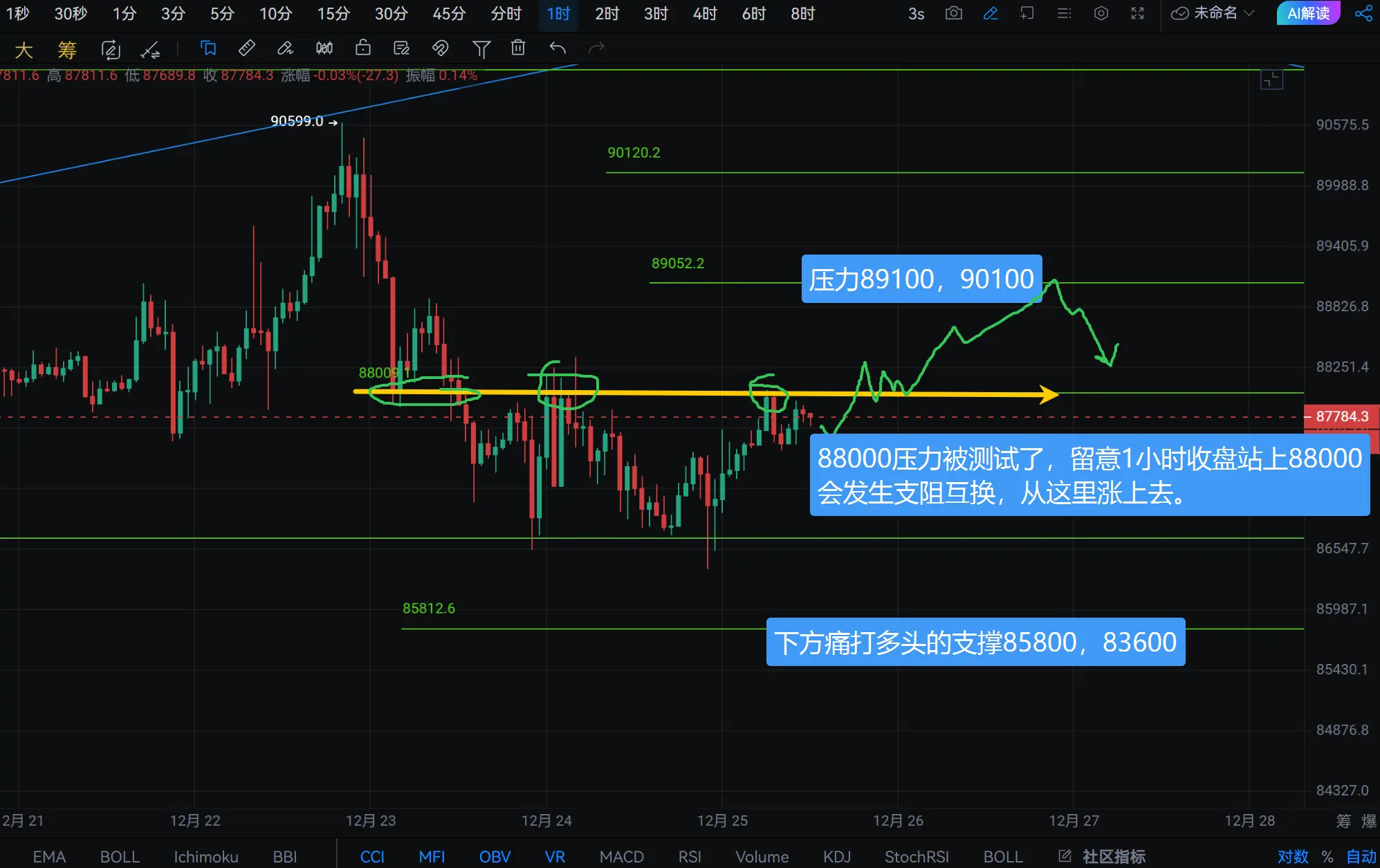

"12.25 Market Analysis: Christmas Gift, Shock or Surprise?"

The recent market has remained relatively calm, with no significant movements overall, but market patience is almost exhausted. First, on the daily chart, you need to be clear that there is no continuous downward trend, so it is still in a consolidation range. Since the consolidation range has tested the bottom, it should also test the top, which is the upper band of the Bollinger Bands. Combining the moving average trends, the repeated top testing within this range will also coordinate with pushing the price to the MA50 and then pull

View OriginalThe recent market has remained relatively calm, with no significant movements overall, but market patience is almost exhausted. First, on the daily chart, you need to be clear that there is no continuous downward trend, so it is still in a consolidation range. Since the consolidation range has tested the bottom, it should also test the top, which is the upper band of the Bollinger Bands. Combining the moving average trends, the repeated top testing within this range will also coordinate with pushing the price to the MA50 and then pull

- Reward

- 8

- 4

- 1

- Share

CryptoSpecto :

:

Christmas Bull Run! 🐂View More

"Market Analysis on December 24: Will Christmas Eve be Peaceful? The Dealer Will Not Rest Until Goals are Achieved"

Yesterday's market situation can be seen as a prediction. Bitcoin dropped and triggered the stop-losses of long positions set at previous lows, while also obtaining liquidity. The support we provided at 86500 rebounded nearly 2000 points, successfully taking profits. Today, if it drops again, we need to pay attention to the purpose of the market makers, which is to hit the stop-losses of previous long positions and wear down the patience of the market.

However, there is not m

View OriginalYesterday's market situation can be seen as a prediction. Bitcoin dropped and triggered the stop-losses of long positions set at previous lows, while also obtaining liquidity. The support we provided at 86500 rebounded nearly 2000 points, successfully taking profits. Today, if it drops again, we need to pay attention to the purpose of the market makers, which is to hit the stop-losses of previous long positions and wear down the patience of the market.

However, there is not m

- Reward

- like

- Comment

- Repost

- Share

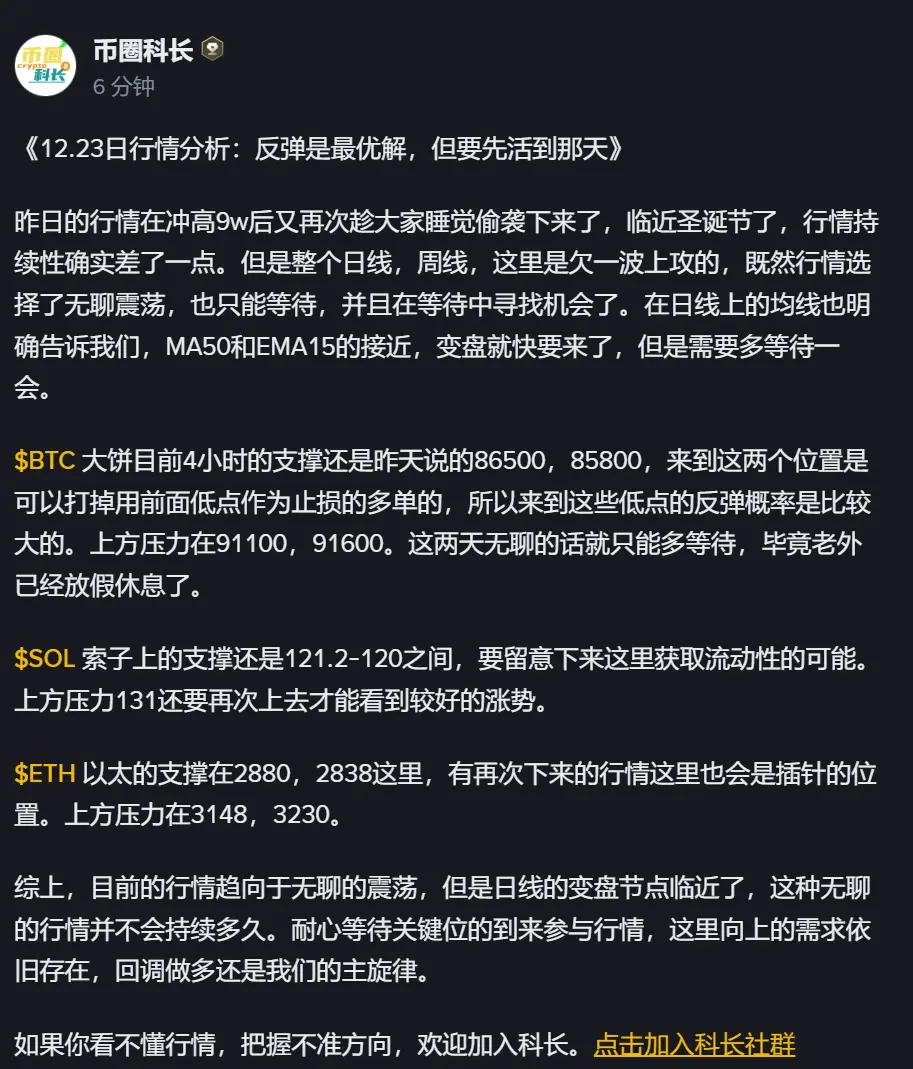

"Market Analysis on December 23: Rebound is the Optimal Solution, but You Must Survive Until That Day"

Yesterday's market made a high of 90k and then launched another surprise attack while everyone was sleeping. With Christmas approaching, the market's sustainability is indeed a bit lacking. However, on the daily and weekly charts, there is indeed a need for a wave of upward attack. Since the market has chosen to be in a boring consolidation, we can only wait and look for opportunities during the wait. The moving averages on the daily chart also clearly indicate that the proximity of M

View OriginalYesterday's market made a high of 90k and then launched another surprise attack while everyone was sleeping. With Christmas approaching, the market's sustainability is indeed a bit lacking. However, on the daily and weekly charts, there is indeed a need for a wave of upward attack. Since the market has chosen to be in a boring consolidation, we can only wait and look for opportunities during the wait. The moving averages on the daily chart also clearly indicate that the proximity of M

- Reward

- like

- Comment

- Repost

- Share

Analysis of Market on December 22: Welcoming the New Year's Red Envelope Market

The market has basically been sideways these past two days. With the third bottom test completed last week, the coin price has stabilized above 88-87, announcing that the daily chart's triple bottom is successful. As the OBV moving averages gradually flatten and the positions of the MA50 and EMA15 on the daily chart are getting closer, there is still an expectation for a rise and a change in trend by the end of the month.

The upward change here requires a bullish candle to force the OBV to break through the

View OriginalThe market has basically been sideways these past two days. With the third bottom test completed last week, the coin price has stabilized above 88-87, announcing that the daily chart's triple bottom is successful. As the OBV moving averages gradually flatten and the positions of the MA50 and EMA15 on the daily chart are getting closer, there is still an expectation for a rise and a change in trend by the end of the month.

The upward change here requires a bullish candle to force the OBV to break through the

- Reward

- like

- 1

- Repost

- Share

GateUser-4407ea99 :

:

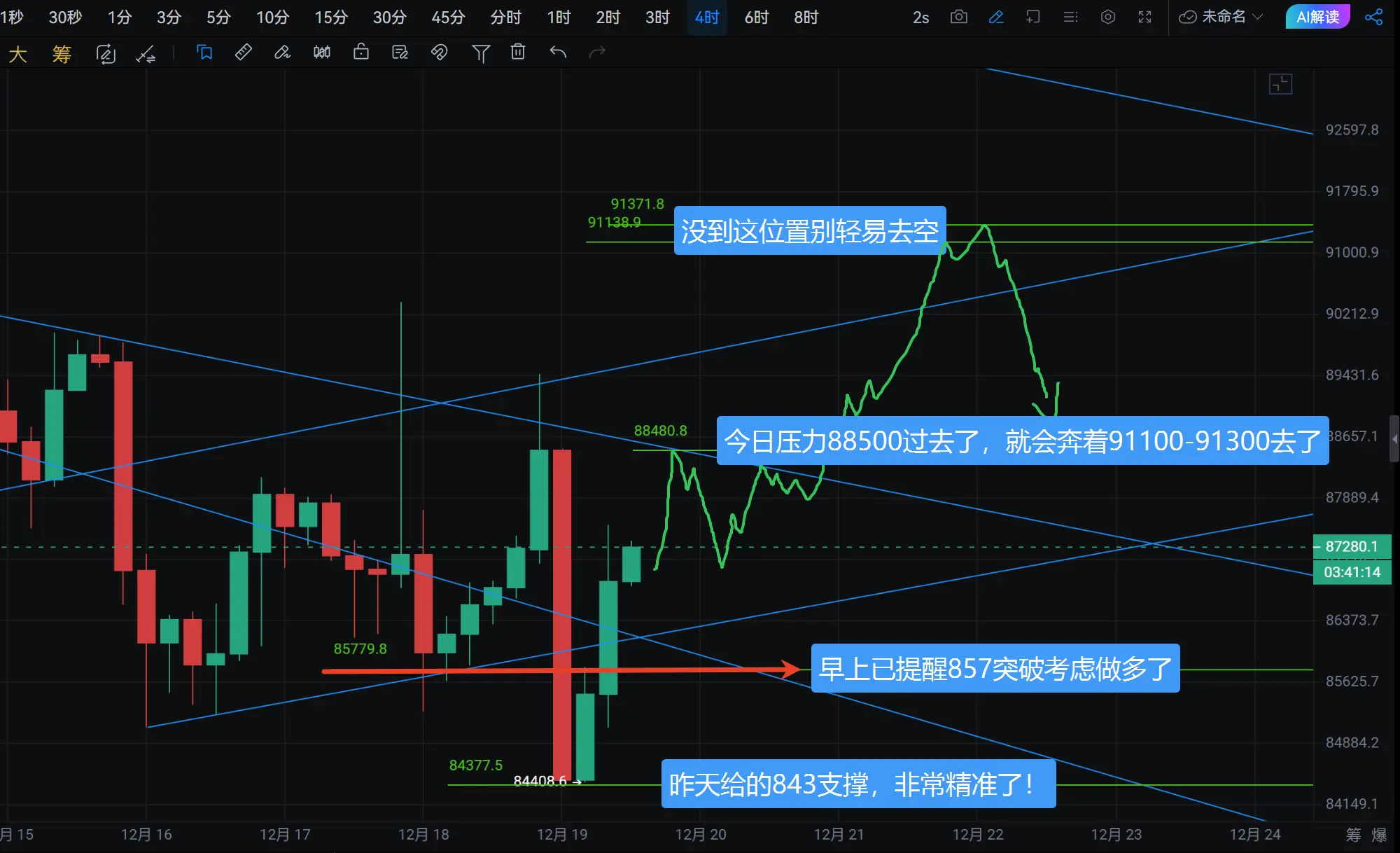

hi"12.19 Market Analysis: The Ultimate Painting Gate, The Ultimate Enjoyment"

If you missed yesterday's analysis, you missed out on a billion. Our analysis yesterday indicated a rebound to test the bearish candle. Bitcoin's resistance is at 89,600, support at 84,300. SOL's resistance is at 129, support at 117. Bitcoin was off by 100 points, and SOL precisely reached 129. We first chased the long position to take profits and then stopped watching. Unexpectedly, it fell to several support levels overnight. Some brave B friends entered the market precisely, and others chased longs with us this morn

View OriginalIf you missed yesterday's analysis, you missed out on a billion. Our analysis yesterday indicated a rebound to test the bearish candle. Bitcoin's resistance is at 89,600, support at 84,300. SOL's resistance is at 129, support at 117. Bitcoin was off by 100 points, and SOL precisely reached 129. We first chased the long position to take profits and then stopped watching. Unexpectedly, it fell to several support levels overnight. Some brave B friends entered the market precisely, and others chased longs with us this morn

- Reward

- like

- Comment

- Repost

- Share

"12.18 Market Analysis: Sharp Rise and Fall, Rebound Testing the Bearish Candle is Necessary"

Yesterday's market was very exciting. Our support at 86,200 was held, and the expected profit-taking level above 90,000 has also been reached. However, most people guessed the beginning but not the ending, and the market directly fell back to the starting point. This left a large bearish candle on the 1-hour chart. In previous similar situations, this kind of candle often requires testing again. On our daily indicators, it is still clear that the manipulative players are actively controlling the marke

View OriginalYesterday's market was very exciting. Our support at 86,200 was held, and the expected profit-taking level above 90,000 has also been reached. However, most people guessed the beginning but not the ending, and the market directly fell back to the starting point. This left a large bearish candle on the 1-hour chart. In previous similar situations, this kind of candle often requires testing again. On our daily indicators, it is still clear that the manipulative players are actively controlling the marke

- Reward

- 1

- Comment

- Repost

- Share

"12.17 Market Analysis: Bottoming Out Completed, This Week's Task is Only Rebound"

Yesterday's market completed the step of stopping the decline and rebounding. At yesterday's close, VR showed a unilateral upward trend, indicating that we are now in the phase of blood-sucking bread, where the big players maliciously suppress the coin price and have completed the accumulation phase. The remaining task for this week is for OBV to break above the moving average, change the direction of the moving average, and complete the bottom formation. This type of trend only requires 1-2 bullish candles on t

View OriginalYesterday's market completed the step of stopping the decline and rebounding. At yesterday's close, VR showed a unilateral upward trend, indicating that we are now in the phase of blood-sucking bread, where the big players maliciously suppress the coin price and have completed the accumulation phase. The remaining task for this week is for OBV to break above the moving average, change the direction of the moving average, and complete the bottom formation. This type of trend only requires 1-2 bullish candles on t

- Reward

- like

- Comment

- Repost

- Share

"12.16 Market Analysis: Where Is the Faith in the Bullish Army, and How Do Daily Chart Patterns Support the Uptrend"

I'm exhausted from the decline, I'm exhausted from the decline. The expected start of the rally this week seems to have changed, leading to new expectations for the trend: if we still want to be bullish here, what kind of daily chart movement is needed to support it, and which levels are critical? If it can't bounce back to certain levels, when will the trend start to decline?

$BTC First, on the daily chart, the support levels below Bitcoin are at 83,500 and 82,200. If the dail

View OriginalI'm exhausted from the decline, I'm exhausted from the decline. The expected start of the rally this week seems to have changed, leading to new expectations for the trend: if we still want to be bullish here, what kind of daily chart movement is needed to support it, and which levels are critical? If it can't bounce back to certain levels, when will the trend start to decline?

$BTC First, on the daily chart, the support levels below Bitcoin are at 83,500 and 82,200. If the dail

- Reward

- like

- Comment

- Repost

- Share

"12.15 Market Analysis: The Daily Chart Urgently Needs to Break Higher, and This Week Requires Accelerated Movement."

Over the weekend, the market again consolidated and then dropped. The few pinpoint levels I provided last Friday saw some rebounds, but not significantly. Only SOL's 127.5 was relatively precise; the other rebounds at BTC's 88600 and ETH's 3060 were weak and unconvincing. On the daily chart for BTC, the OBV needs to break above the moving average to change its trend direction. These two are very close now, indicating that a trend reversal is imminent. Moreover, there is no sign

View OriginalOver the weekend, the market again consolidated and then dropped. The few pinpoint levels I provided last Friday saw some rebounds, but not significantly. Only SOL's 127.5 was relatively precise; the other rebounds at BTC's 88600 and ETH's 3060 were weak and unconvincing. On the daily chart for BTC, the OBV needs to break above the moving average to change its trend direction. These two are very close now, indicating that a trend reversal is imminent. Moreover, there is no sign

- Reward

- like

- Comment

- Repost

- Share

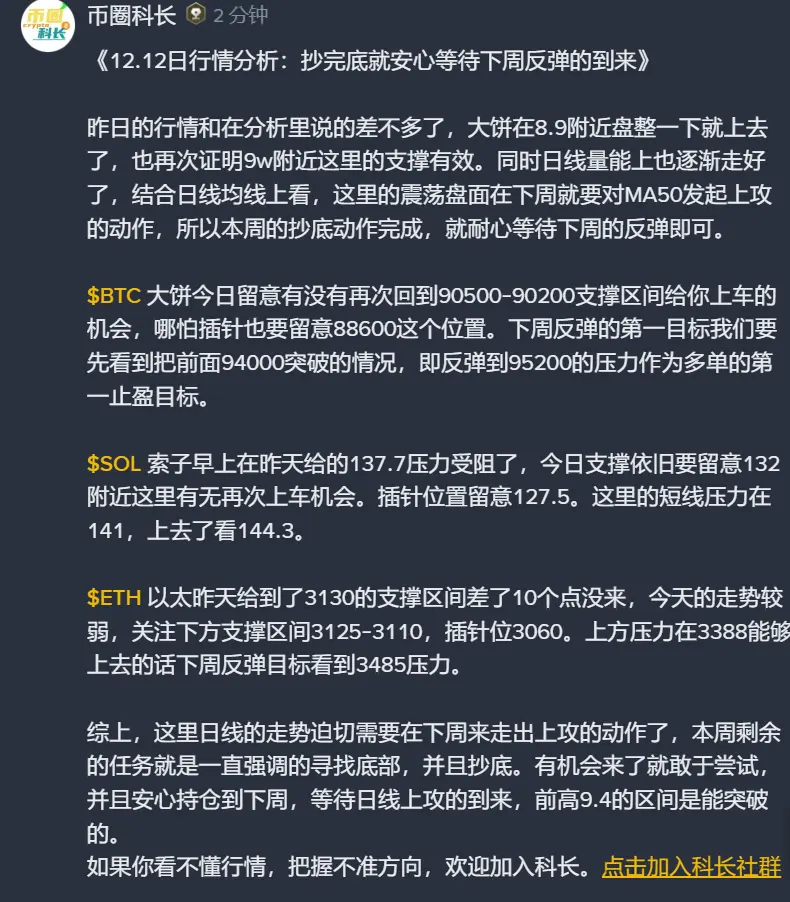

"Market Analysis for December 11: Establishing a Bottoming Range, Preparing for a Rebound Next Week"

Yesterday, driven by news sentiment, the three major cryptocurrencies all moved down from their pressure levels. Bitcoin's support was at 94,250, SOL at 141.7, and Ethereum at 3444. Since the top range has been established, the remaining time this week is for setting the bottom, and after the indicators are repaired next week, a rebound is expected to begin. Therefore, the task for the rest of this week is clear: a small cheat sheet for reference.

$BTC Bitcoin's support today is still at 88,70

View OriginalYesterday, driven by news sentiment, the three major cryptocurrencies all moved down from their pressure levels. Bitcoin's support was at 94,250, SOL at 141.7, and Ethereum at 3444. Since the top range has been established, the remaining time this week is for setting the bottom, and after the indicators are repaired next week, a rebound is expected to begin. Therefore, the task for the rest of this week is clear: a small cheat sheet for reference.

$BTC Bitcoin's support today is still at 88,70

- Reward

- 1

- Comment

- Repost

- Share

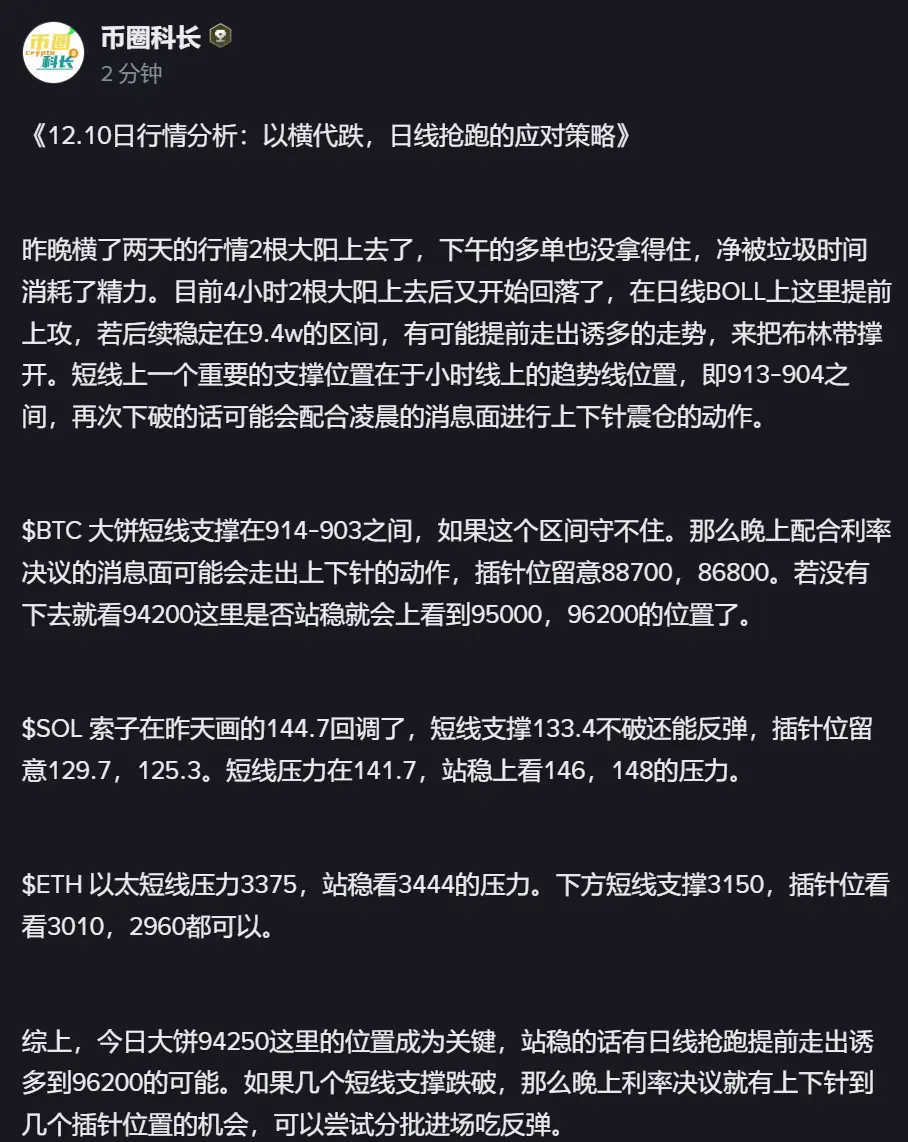

"12.10 Market Analysis: Coping Strategies for Replacing Falls with Horizontal and Rushing on the Daily Line"

Last night, the market for two days went up, and the long order in the afternoon was not held, and the energy was consumed by the garbage time. At present, after 4 hours and 2 big yangs went up, it began to fall back again, and if it stabilized in the range of 9.4w in the future, it is possible to get out of the bullish trend in advance to open the Bollinger bands. An important support position on the short-term line is the trend line position on the hourly line, that is, between 913-90

View OriginalLast night, the market for two days went up, and the long order in the afternoon was not held, and the energy was consumed by the garbage time. At present, after 4 hours and 2 big yangs went up, it began to fall back again, and if it stabilized in the range of 9.4w in the future, it is possible to get out of the bullish trend in advance to open the Bollinger bands. An important support position on the short-term line is the trend line position on the hourly line, that is, between 913-90

- Reward

- like

- Comment

- Repost

- Share

"December 9 Market Analysis: Continued Consolidation, Time to Buy the Bottom"

Yesterday’s market volatility was not significant. On the daily chart, further consolidation is needed to allow for indicator correction and to prepare for the market in January. The opportunity for another pullback here is the time for us to build positions, as we need to prepare in December for the final bull trap on the weekly chart in January—meaning after this pullback, we should complete our position building in advance.

At the same time, after another drop, it will also be the last chance for spot holders who

View OriginalYesterday’s market volatility was not significant. On the daily chart, further consolidation is needed to allow for indicator correction and to prepare for the market in January. The opportunity for another pullback here is the time for us to build positions, as we need to prepare in December for the final bull trap on the weekly chart in January—meaning after this pullback, we should complete our position building in advance.

At the same time, after another drop, it will also be the last chance for spot holders who

- Reward

- 1

- Comment

- Repost

- Share

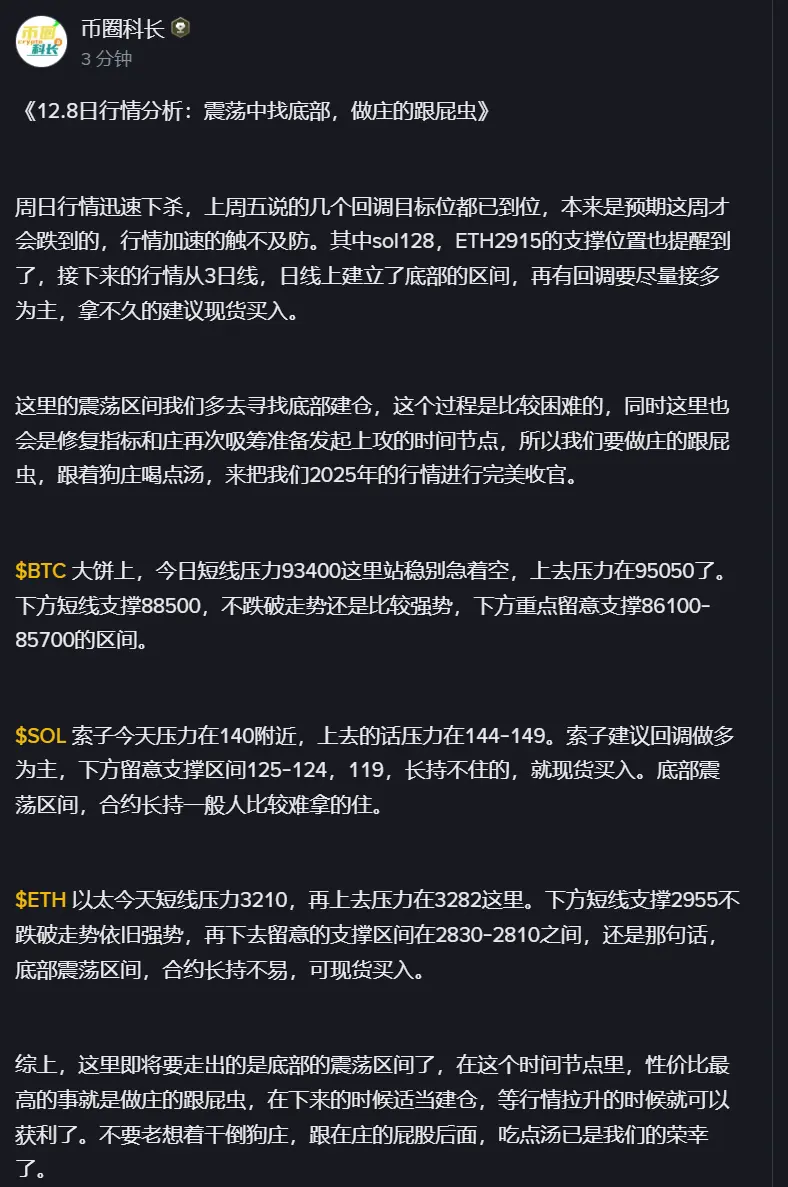

12.8 Market Analysis: Finding the Bottom in Consolidation, Be the Whale’s Follower

The market plunged rapidly on Sunday, and all the retracement targets mentioned last Friday have been reached. Originally, it was expected to hit these levels later this week, but the market accelerated unexpectedly. The SOL 128 and ETH 2915 support levels were also highlighted. Looking ahead, both the 3-day and daily charts have established a bottom range. If there are further pullbacks, it’s best to go long; for those who can’t hold for long, spot buying is recommended.

In this consolidation range, we should f

The market plunged rapidly on Sunday, and all the retracement targets mentioned last Friday have been reached. Originally, it was expected to hit these levels later this week, but the market accelerated unexpectedly. The SOL 128 and ETH 2915 support levels were also highlighted. Looking ahead, both the 3-day and daily charts have established a bottom range. If there are further pullbacks, it’s best to go long; for those who can’t hold for long, spot buying is recommended.

In this consolidation range, we should f

BTC1,25%

- Reward

- like

- Comment

- Repost

- Share

December 5 Market Analysis: After Testing the Top, No Need to Fear Bottom Testing Next Week

This week's peak-testing task is coming to an end. The pattern here has completed, and needs to align with indicators as the retracement process begins next week. The consolidation range after this retracement will be the period when major players accumulate positions. Therefore, there’s no need to fear this decline; after another push upward, the daily BOLL will enter a narrow range platform. Once it enters, a new trend is expected to start, likely in early January.

- Reward

- 2

- Comment

- Repost

- Share

"Outlook for 2026 Market: The Final Rebound Triggers the Start of a Major Bear Market"

Today, I'm discussing the weekly chart outlook, hoping everyone can form an overall expectation for the market. On the weekly chart of $BTC , there is a converging pattern that needs to play out after 2026. This is the final rebound, forming the right shoulder pattern on the weekly level. Once completed, the market will enter a sideways phase after a drop, and then a sharp decline will begin, marking the arrival of a major bear market. The expected timeframe for this downturn to start is between Q1 and Q2. S

Today, I'm discussing the weekly chart outlook, hoping everyone can form an overall expectation for the market. On the weekly chart of $BTC , there is a converging pattern that needs to play out after 2026. This is the final rebound, forming the right shoulder pattern on the weekly level. Once completed, the market will enter a sideways phase after a drop, and then a sharp decline will begin, marking the arrival of a major bear market. The expected timeframe for this downturn to start is between Q1 and Q2. S

BTC1,25%

- Reward

- like

- Comment

- Repost

- Share