TakeProfitAsTheMainFocus.

January 6th BTCÐ Contract Spot Strategy

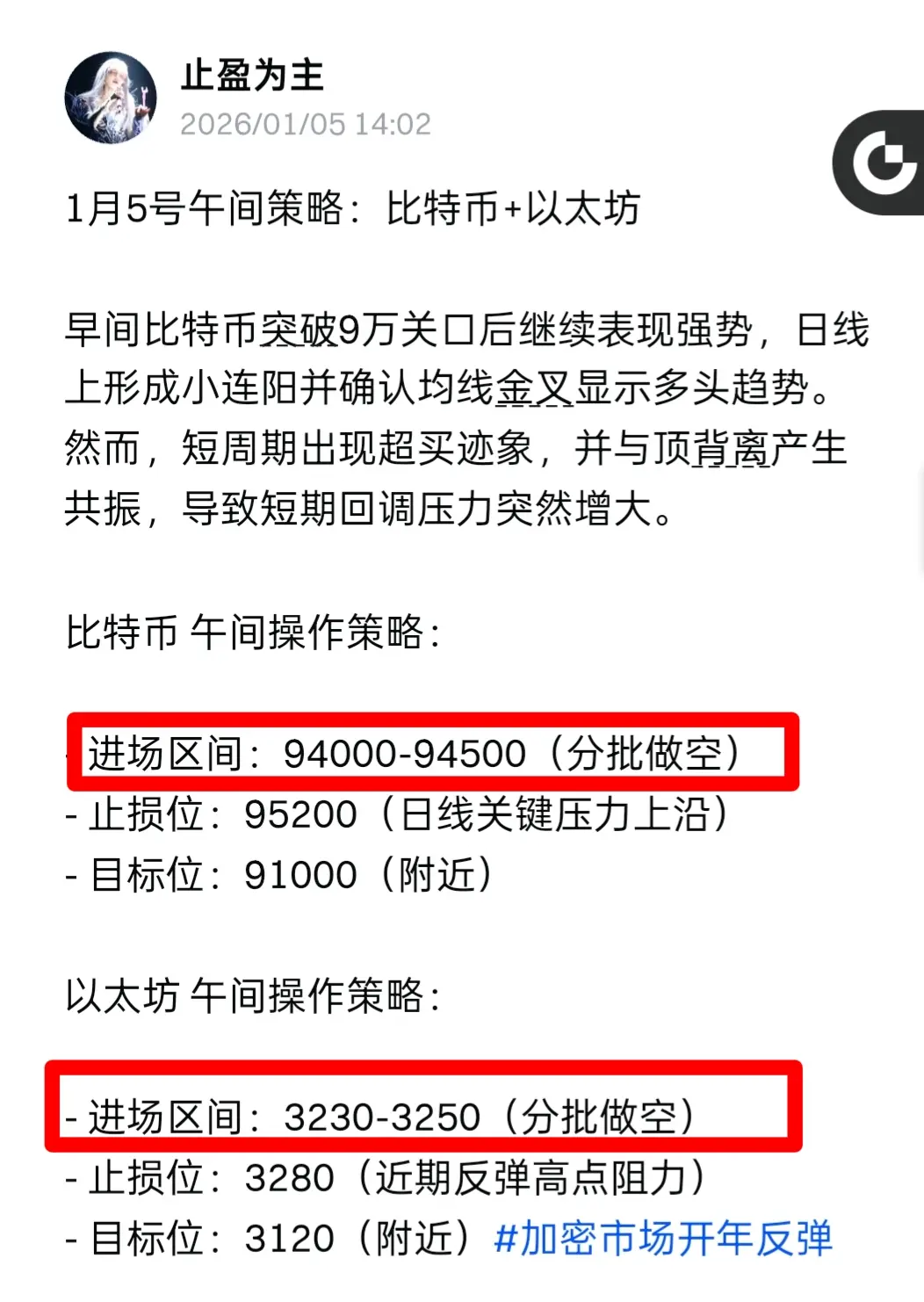

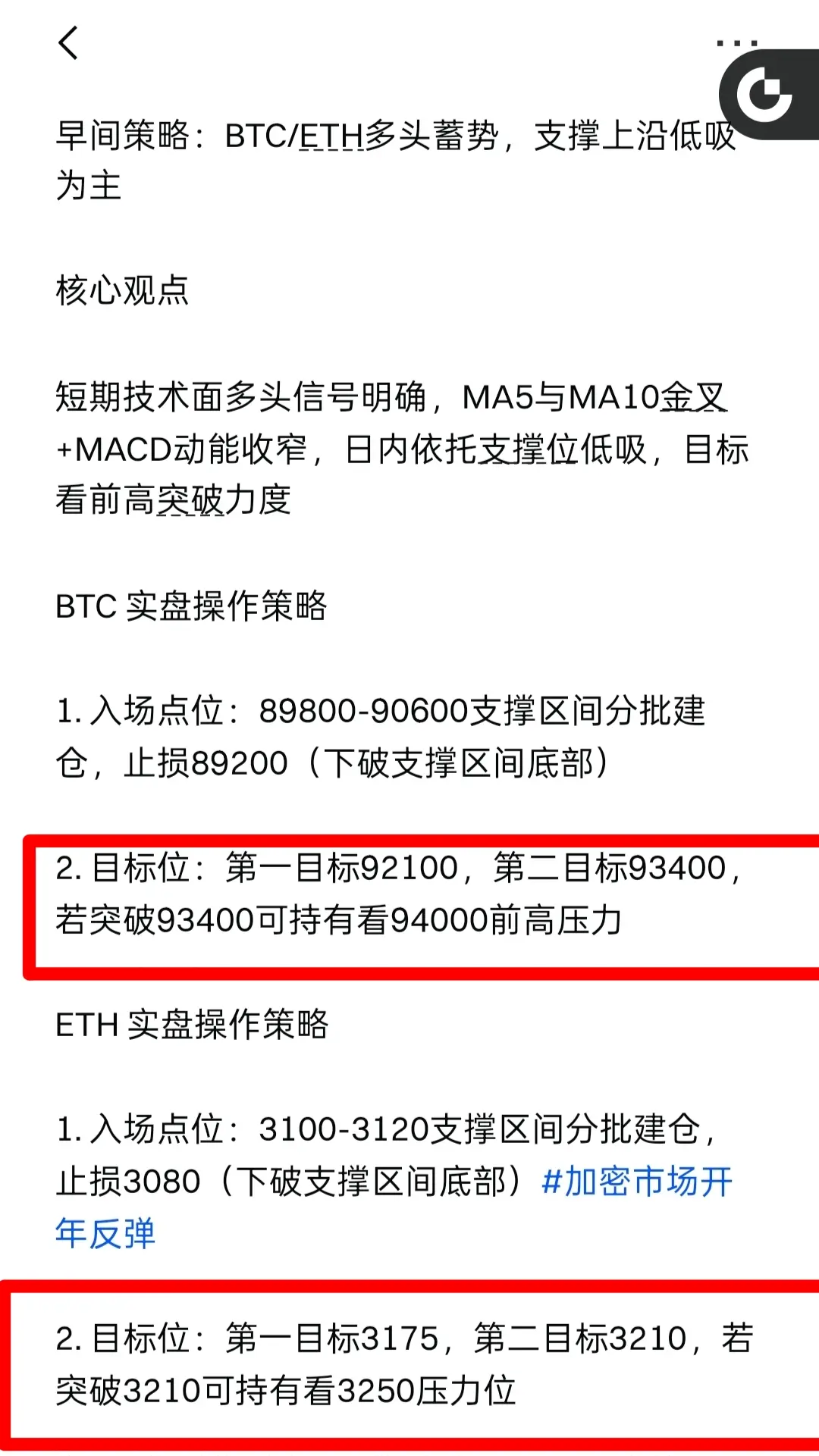

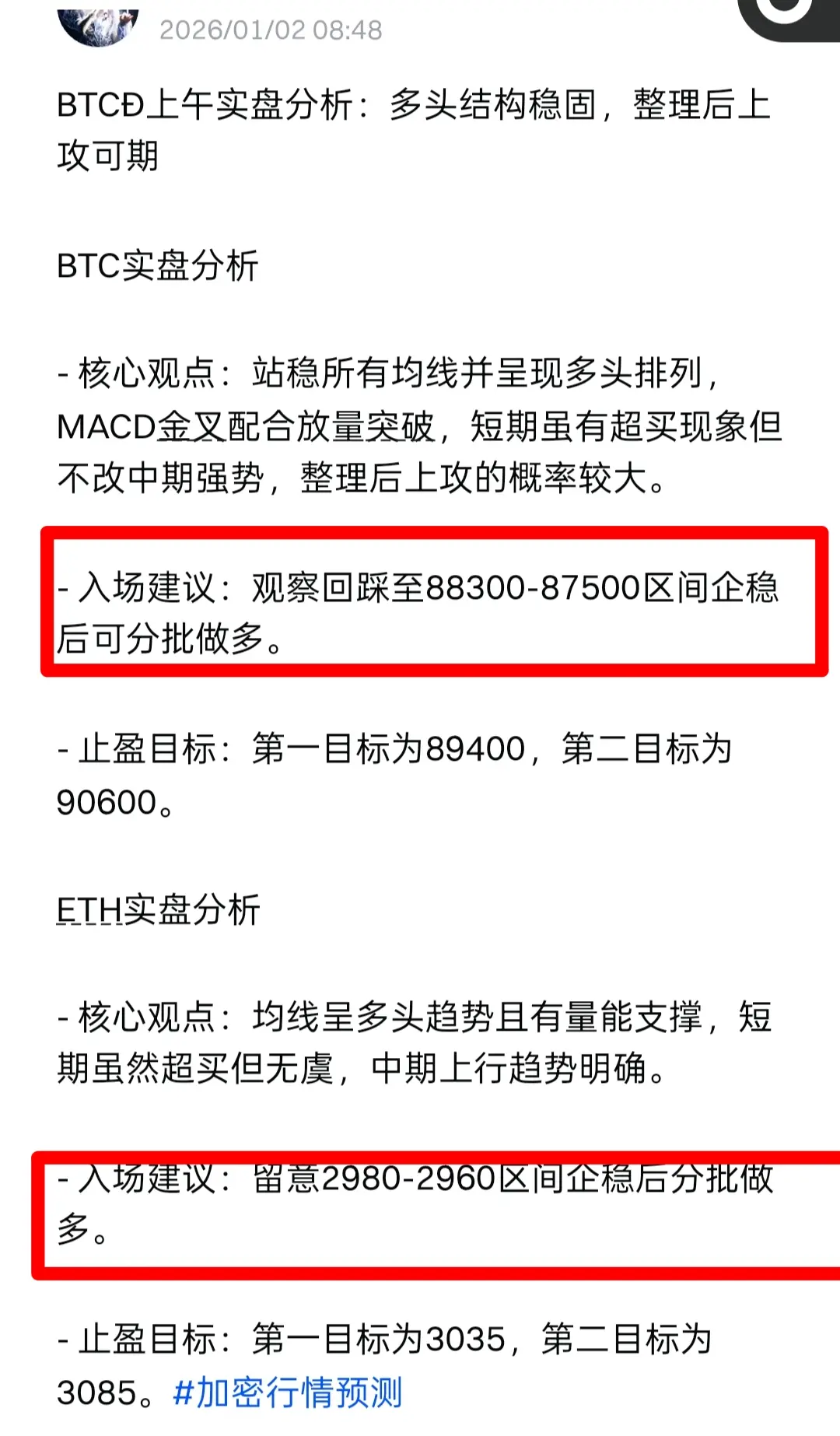

Short-term multiple indicators turning bearish, upward momentum weakening. Focus on shorting rebounds, with light long positions only after support stabilizes for a tentative entry.

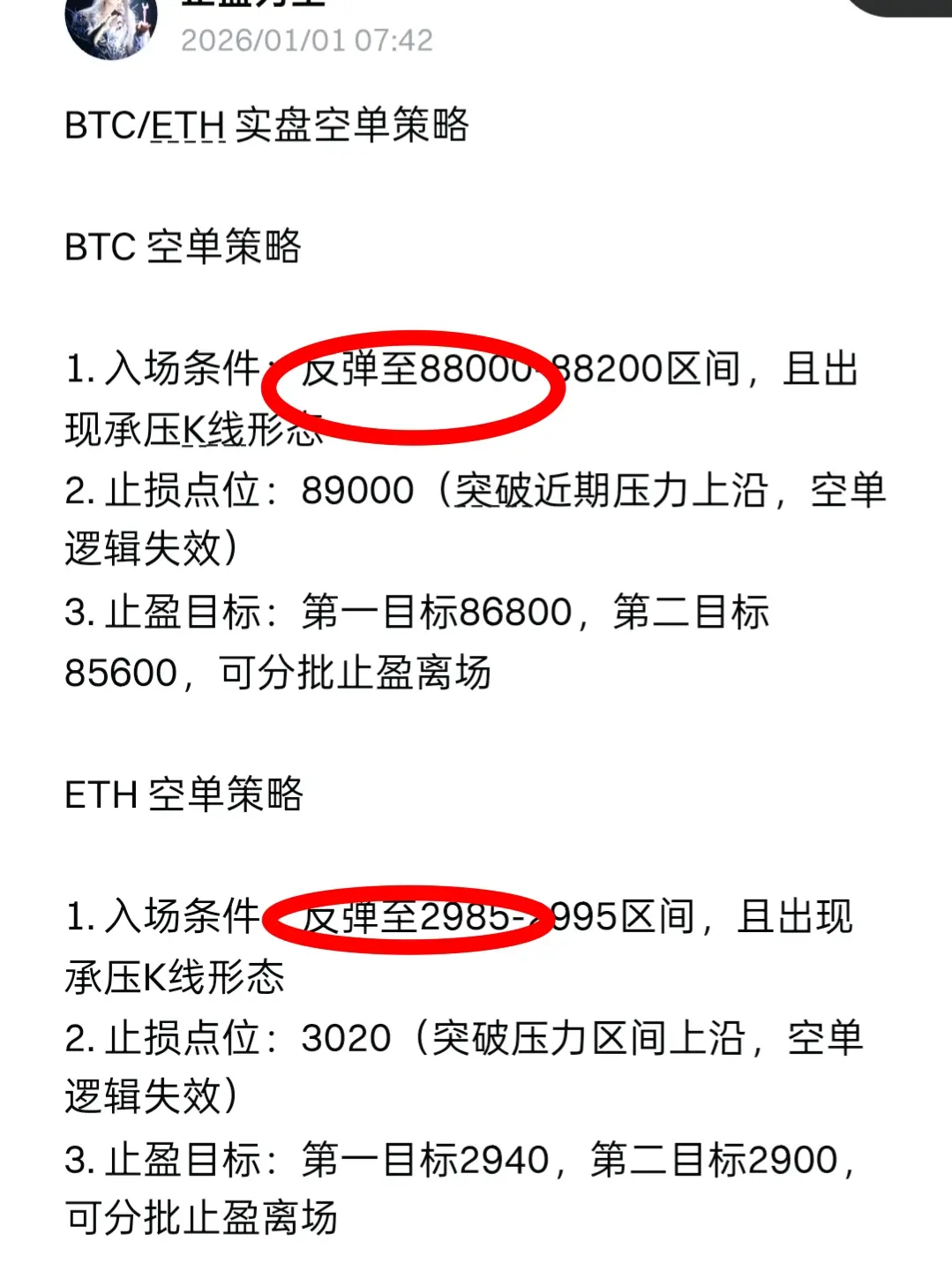

BTC Contract

1. Short on rebound

Entry: 94500-94800

Target: 93000→92000, watch for breakdown below 91200

Stop loss: above 95100

2. Long on pullback

Entry: 92800-93000 (stability signal)

Target: 94000→94500

Stop loss: below 92500

ETH Contract

1. Short on rebound

Entry: 3250-3270

Target: 3185→3135, watch for breakdown below 3100

Stop loss: above 3290

2. Long on pullback

Entry:

View OriginalShort-term multiple indicators turning bearish, upward momentum weakening. Focus on shorting rebounds, with light long positions only after support stabilizes for a tentative entry.

BTC Contract

1. Short on rebound

Entry: 94500-94800

Target: 93000→92000, watch for breakdown below 91200

Stop loss: above 95100

2. Long on pullback

Entry: 92800-93000 (stability signal)

Target: 94000→94500

Stop loss: below 92500

ETH Contract

1. Short on rebound

Entry: 3250-3270

Target: 3185→3135, watch for breakdown below 3100

Stop loss: above 3290

2. Long on pullback

Entry: