51QuantitativeStrategy

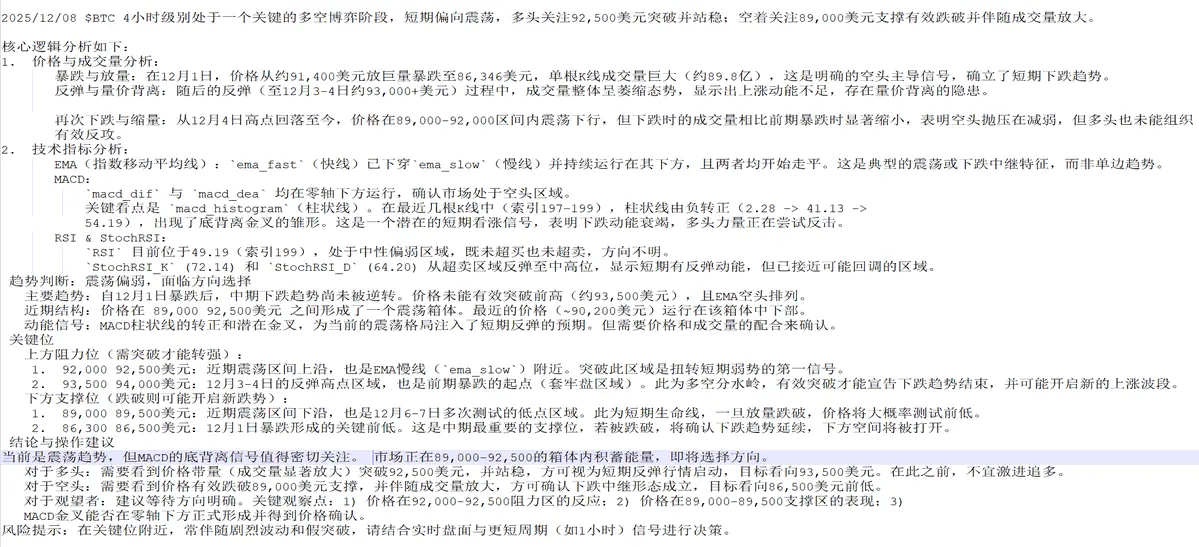

December 19, 2025 $BTC The current market is in a clear downtrend. Brief rebound attempts have been suppressed by the bears, and technical indicators (MACD, RSI) along with price structure all support a downward trend.

Resistance levels (need to break through to ease downward pressure):

1. Recent high resistance: $88,533 (highest point of the 197th K-line). This is the starting point of the recent strong sell-off and a key resistance.

2. Moving average resistance/psychological level: $87,200 - $87,900 area (near the slow EMA and previous small platform).

3. Strong resistance: $89,

Resistance levels (need to break through to ease downward pressure):

1. Recent high resistance: $88,533 (highest point of the 197th K-line). This is the starting point of the recent strong sell-off and a key resistance.

2. Moving average resistance/psychological level: $87,200 - $87,900 area (near the slow EMA and previous small platform).

3. Strong resistance: $89,

BTC-0.99%