- Corporate and whale demand outweighs outflows from exchange-traded funds.

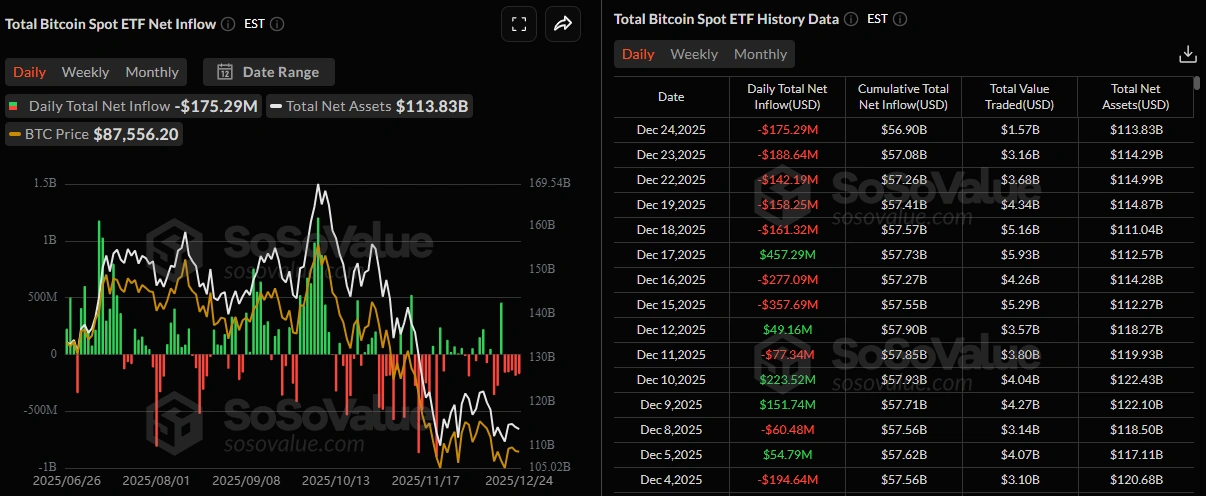

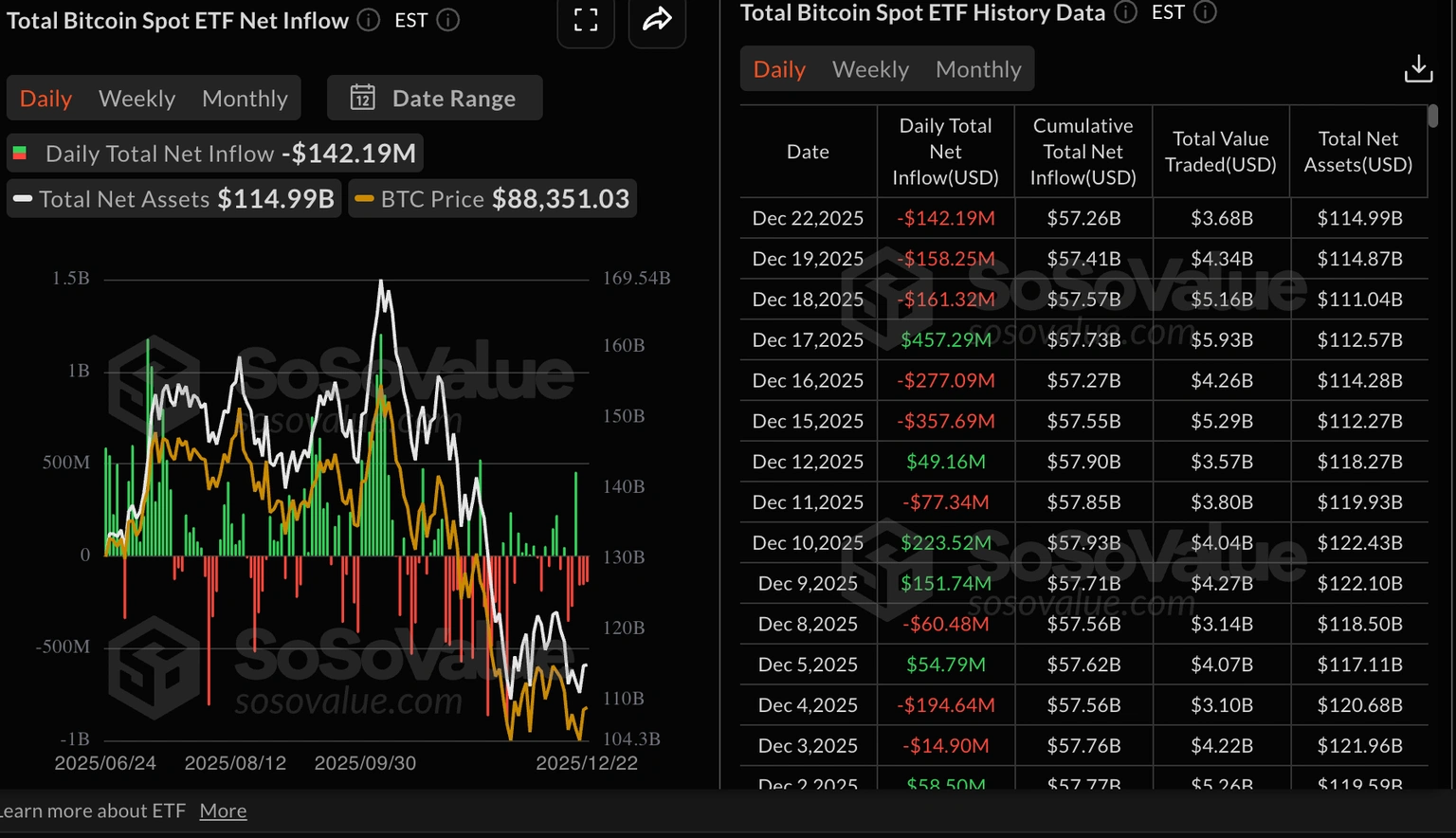

Institutional demand for Bitcoin continues to decline, as evidenced by seven consecutive days of outflows from US spot Bitcoin ETFs. Data shows net outflows of $19.29 million on Monday, in addition to $782 million of total outflows recorded last week. If institutional demand for Bitcoin continues to decrease, it could lead to increased selling pressure.

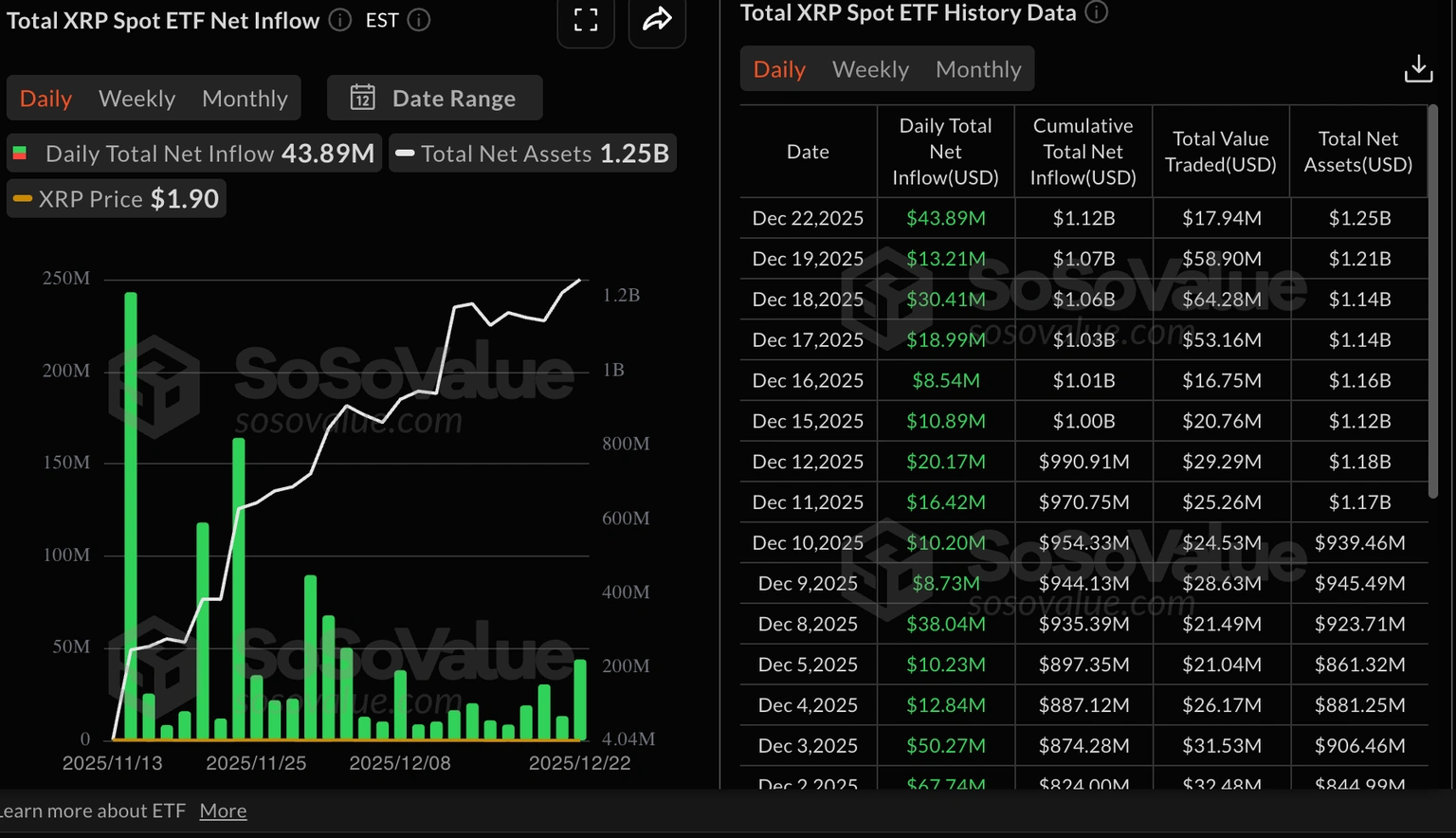

Bitcoin ETF data (BTC) in the United States. Source: Sosovalue

According to Arkham Intelligence’s blockchain analytics platform, BlackRock deposited more than 2,200 Bitcoin on Coinbase Prime. This reduction in the fund’s holdings by the largest provider of Bitcoin ETFs, based on assets under management, reflects a loss of confidence and may increase selling pressure.

BlackRock holdings data. Source: Arkham Intelligence.

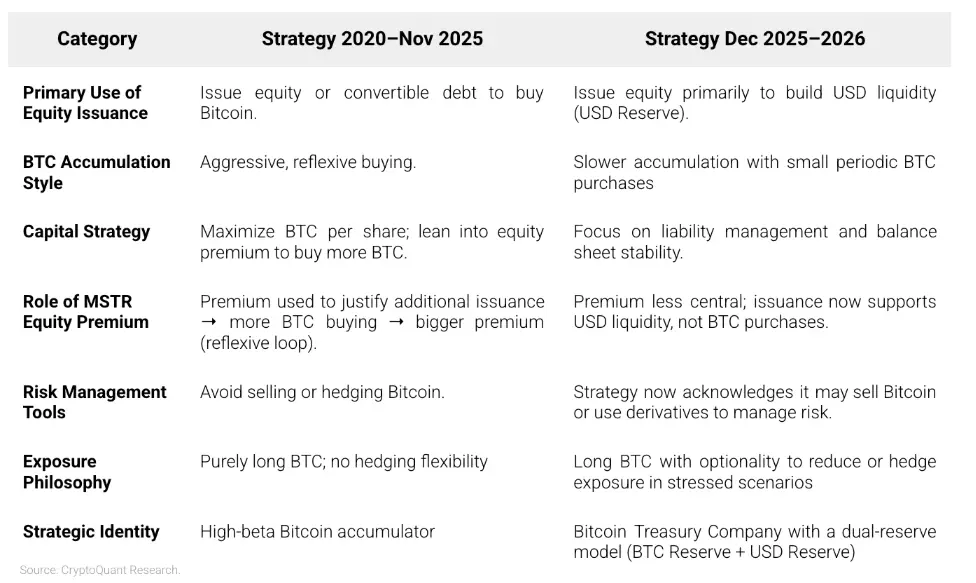

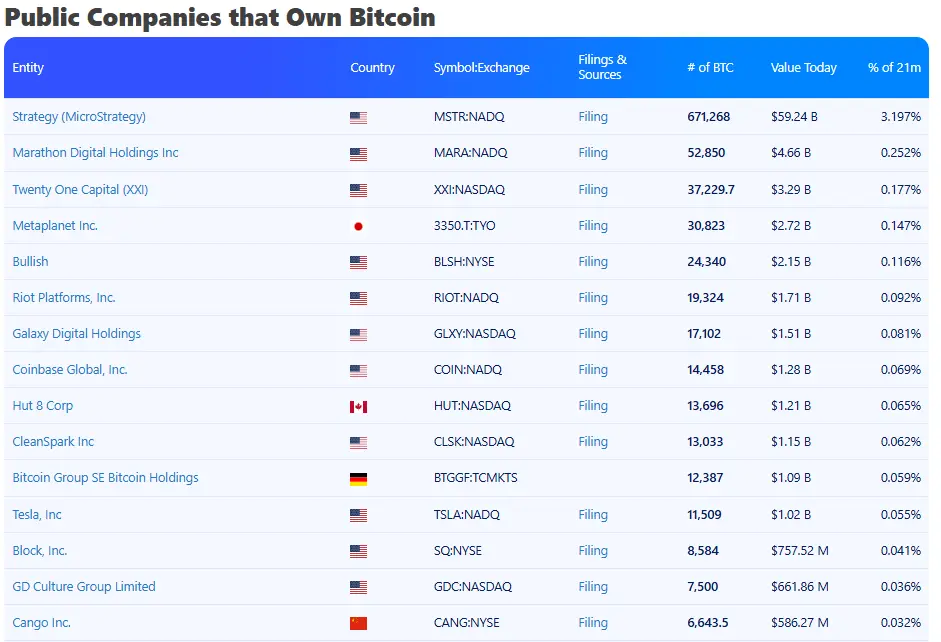

On the corporate front, MicroStrategy acquired 1,229 Bitcoin last week, bringing its total holdings to 672,497 Bitcoin with an average price of $74,997. Additionally, MicroPlanet purchased 4,279 Bitcoin over the past three months, currently holding 35,102 Bitcoin with an average price of $104,679. This overall stability in corporate confidence in Bitcoin indicates a trend toward buying during price dips.

In a positive development, large wallet investors, known as whales, are withdrawing Bitcoin from trading platforms, indicating renewed demand. According to Lookonchain, two newly created wallets withdrew 2,201 Bitcoin from Binance, which may suggest market optimism for a rebound at the start of the new year.

Institutional demand for Bitcoin continues to decline, as evidenced by seven consecutive days of outflows from US spot Bitcoin ETFs. Data shows net outflows of $19.29 million on Monday, in addition to $782 million of total outflows recorded last week. If institutional demand for Bitcoin continues to decrease, it could lead to increased selling pressure.

Bitcoin ETF data (BTC) in the United States. Source: Sosovalue

According to Arkham Intelligence’s blockchain analytics platform, BlackRock deposited more than 2,200 Bitcoin on Coinbase Prime. This reduction in the fund’s holdings by the largest provider of Bitcoin ETFs, based on assets under management, reflects a loss of confidence and may increase selling pressure.

BlackRock holdings data. Source: Arkham Intelligence.

On the corporate front, MicroStrategy acquired 1,229 Bitcoin last week, bringing its total holdings to 672,497 Bitcoin with an average price of $74,997. Additionally, MicroPlanet purchased 4,279 Bitcoin over the past three months, currently holding 35,102 Bitcoin with an average price of $104,679. This overall stability in corporate confidence in Bitcoin indicates a trend toward buying during price dips.

In a positive development, large wallet investors, known as whales, are withdrawing Bitcoin from trading platforms, indicating renewed demand. According to Lookonchain, two newly created wallets withdrew 2,201 Bitcoin from Binance, which may suggest market optimism for a rebound at the start of the new year.