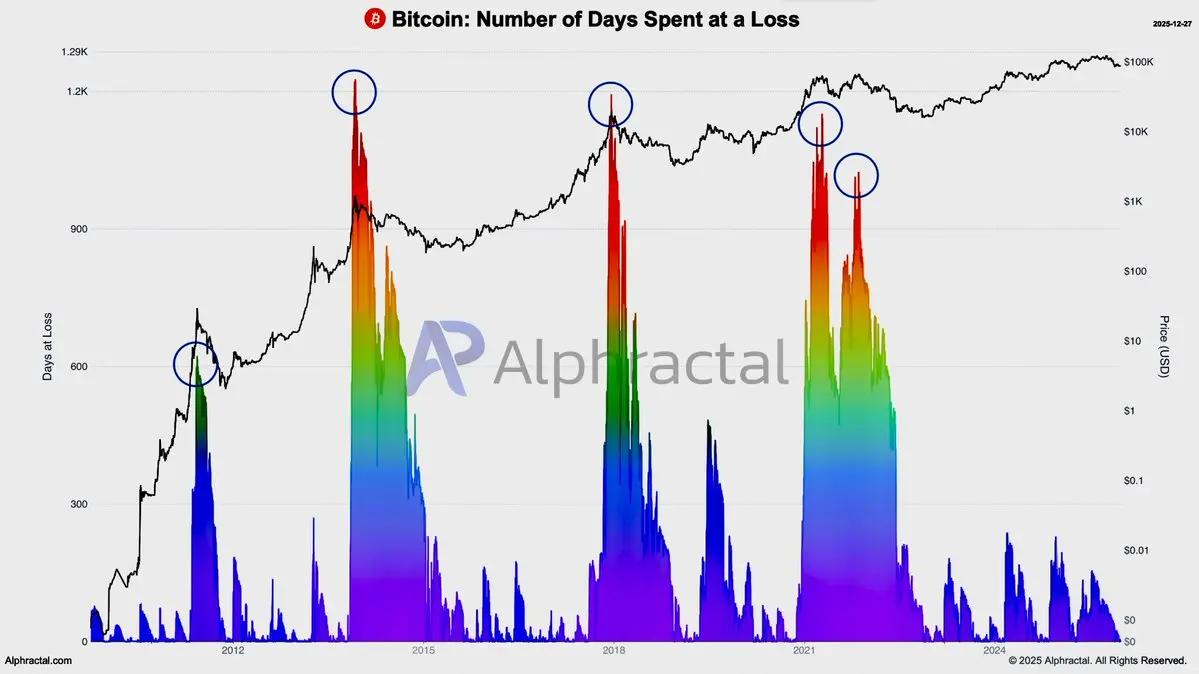

#CryptoMarketPrediction Right now, the crypto market is not in a state of panic, nor is it in a state of confidence. It’s in a state of evaluation and that distinction matters more than most people realize.

Price action across major assets shows hesitation rather than aggression. We’re not seeing impulsive sell-offs followed by strong bounces, nor are we seeing confident breakouts with follow-through. Instead, the market is moving in ranges, testing levels, and reacting sharply to short-term liquidity while failing to build sustained momentum in either direction.

This tells me one thing clearl