MingDragonX

No content yet

MingDragonX

0

0

As the crypto market moves into 2026, the conversation is no longer about which network replaces the other, but how different architectures capture value in different ways. The developments of 2025 made one thing clear: Ethereum and Solana are no longer competing on the same dimension. They are optimizing for different economic realities.

Ethereum enters the future as a settlement layer of trust. Its strength lies in security, decentralization, and its deep integration with institutional finance, DeFi primitives, and enterprise-grade applications. With much of its transaction volume migrating

Ethereum enters the future as a settlement layer of trust. Its strength lies in security, decentralization, and its deep integration with institutional finance, DeFi primitives, and enterprise-grade applications. With much of its transaction volume migrating

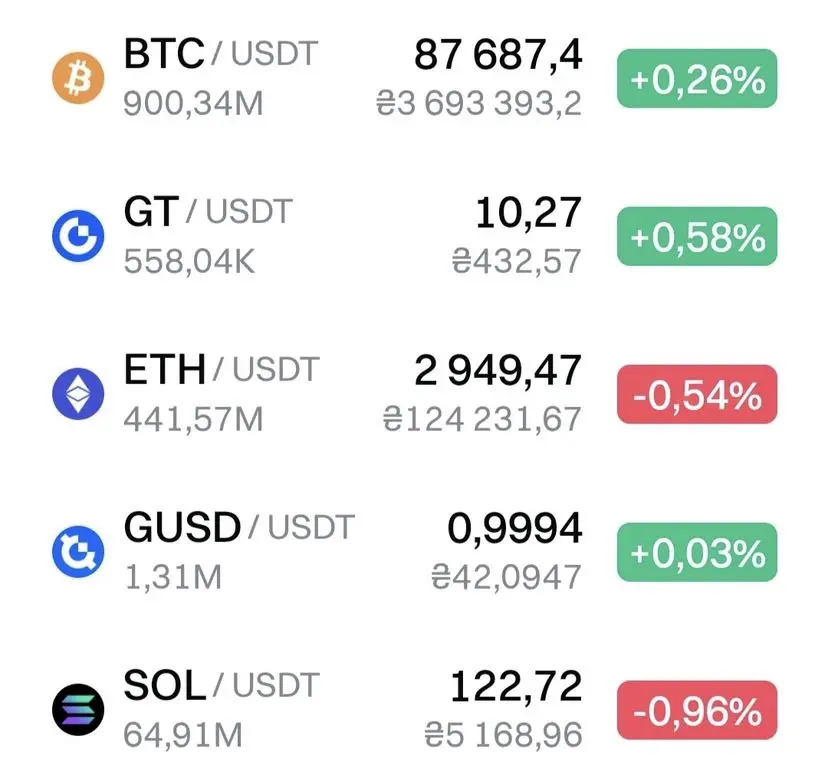

BTC0.22%

MC:$5.29KHolders:2

0.03%

- Reward

- 1

- Comment

- Repost

- Share

#CreatorETFs Creator ETFs represent a shift in how digital value is packaged and accessed within crypto markets. Instead of concentrating exposure in single creator tokens or isolated projects, these instruments introduce a portfolio-based approach to creator-led innovation. The result is a structure that balances participation in high-growth narratives with risk distribution across multiple assets.

At their core, Creator ETFs reflect the maturation of the creator economy within blockchain ecosystems. Creators are no longer only cultural figures; they are economic actors supported by tokens, N

At their core, Creator ETFs reflect the maturation of the creator economy within blockchain ecosystems. Creators are no longer only cultural figures; they are economic actors supported by tokens, N

- Reward

- 2

- Comment

- Repost

- Share

#CreatorETFs By the end of 2025, it has become clear that the creator economy is no longer a niche or experimental segment of the digital world. It has matured into a structured, revenue-generating economy supported by platforms, tools, data infrastructure, and global distribution networks. What is changing now is not the creators themselves, but the way investors gain exposure to this growth.

Directly investing in individual creators, tokens, or personalities remains highly volatile and concentrated. Performance depends on personal relevance, platform algorithms, and audience behavior, all of

Directly investing in individual creators, tokens, or personalities remains highly volatile and concentrated. Performance depends on personal relevance, platform algorithms, and audience behavior, all of

- Reward

- 1

- Comment

- Repost

- Share

#2025GateYearEndSummary The year-end summary is not just a record of past performance; it is a foundation for what comes next. Numbers matter, but what matters more is the behavior behind them. A year shaped by discipline, controlled risk, and steady participation creates something far more valuable than short-term gains: preparedness for the future.

Moving beyond 2025, the focus shifts from measuring results to refining process. Every trade placed, every position managed, and every pause taken during volatility contributes to a clearer trading identity. The goal ahead is not to trade more, bu

Moving beyond 2025, the focus shifts from measuring results to refining process. Every trade placed, every position managed, and every pause taken during volatility contributes to a clearer trading identity. The goal ahead is not to trade more, bu

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketMildlyRebounds The conversation around 2026 is changing, and that change itself is the real signal. The market is slowly moving away from expectations of unlimited liquidity and easy upside toward a more selective, data-driven environment. This shift does not signal the end of opportunity, but it does mark the end of simplicity.

In the coming cycle, Bitcoin will no longer be driven primarily by narratives alone. Rate-cut expectations, once the dominant force, are losing their power. What replaces them is more concrete and less forgiving: capital flows, economic data, and real dema

In the coming cycle, Bitcoin will no longer be driven primarily by narratives alone. Rate-cut expectations, once the dominant force, are losing their power. What replaces them is more concrete and less forgiving: capital flows, economic data, and real dema

BTC0.22%

- Reward

- 1

- Comment

- Repost

- Share

As this year draws to a close, my attention naturally shifts from reflection to intention. What matters most now is not only what has been experienced, but how those experiences shape the direction ahead. I move forward with a clearer mindset, grounded understanding, and a growing sense of responsibility toward my own decisions in the market.

Gate has become more than a platform for activity; it is a space for continuous learning and refinement. Each initiative, tool, and format I encountered over time reinforced an important idea for me: progress is built gradually, through curiosity, discipl

Gate has become more than a platform for activity; it is a space for continuous learning and refinement. Each initiative, tool, and format I encountered over time reinforced an important idea for me: progress is built gradually, through curiosity, discipl

- Reward

- 1

- Comment

- Repost

- Share

#GateChristmasVibes As we move toward a new phase in the markets, my focus is no longer just on what happened — it’s on what’s forming. Experience has taught me that the most important shifts don’t start with explosive moves; they begin quietly, with structure, sentiment changes, and subtle confirmations that only patience reveals.

I’ve learned that strong markets are built before they are celebrated. Accumulation happens when attention is low, confidence is fragile, and narratives are still forming. This is where discipline matters most — reading price action without emotion, respecting risk,

I’ve learned that strong markets are built before they are celebrated. Accumulation happens when attention is low, confidence is fragile, and narratives are still forming. This is where discipline matters most — reading price action without emotion, respecting risk,

- Reward

- 2

- Comment

- Repost

- Share

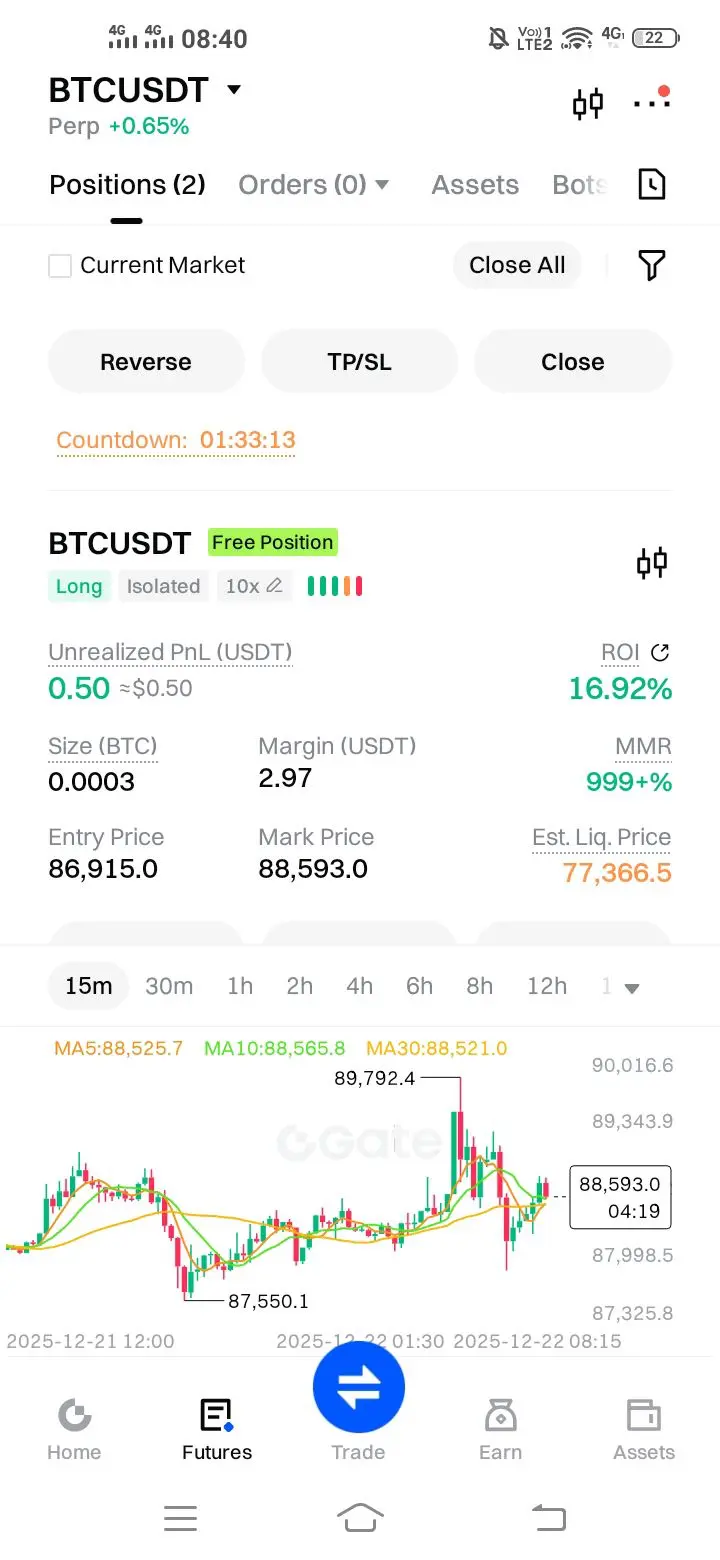

#ShareMyTrade:

Entry at $86,915 reflects a strategic position taken within a high-value market zone. Bitcoin is currently transitioning through consolidation at elevated levels, a phase that often precedes directional expansion. Price behavior suggests active absorption of sell pressure as the market evaluates its next move.

Market Outlook:

Bitcoin’s sideways structure indicates strength rather than weakness after the recent rally. Sustained consolidation at higher levels typically signals accumulation and preparation for continuation.

Key Support Area: $85,000 – $86,000, where demand remains

Entry at $86,915 reflects a strategic position taken within a high-value market zone. Bitcoin is currently transitioning through consolidation at elevated levels, a phase that often precedes directional expansion. Price behavior suggests active absorption of sell pressure as the market evaluates its next move.

Market Outlook:

Bitcoin’s sideways structure indicates strength rather than weakness after the recent rally. Sustained consolidation at higher levels typically signals accumulation and preparation for continuation.

Key Support Area: $85,000 – $86,000, where demand remains

BTC0.22%

- Reward

- 3

- Comment

- Repost

- Share

#ShareMyTrade: Closing a trade profitably is not just about the percentage gained, but about the process behind it. Successfully securing a strong return on a DOGE long position reinforces the value of disciplined execution, structured analysis, and patience in volatile markets.

This trade was guided by clear market structure, trend alignment, and predefined risk parameters. Instead of reacting to noise or short-term hype, the focus remained on following the plan from entry to exit. Managing the position step by step and respecting risk limits made it possible to lock in profits at the right m

This trade was guided by clear market structure, trend alignment, and predefined risk parameters. Instead of reacting to noise or short-term hype, the focus remained on following the plan from entry to exit. Managing the position step by step and respecting risk limits made it possible to lock in profits at the right m

DOGE-1.09%

- Reward

- 4

- Comment

- Repost

- Share

#ShareMyTrade:

The future of trading is no longer built in isolation. It is shaped by shared insight, collective learning, and open dialogue. #ShareMyTrade represents a shift from silent charts to meaningful conversations where every trade becomes a source of knowledge.

As markets grow more complex and interconnected, the ability to learn from real-world experiences becomes a powerful advantage. Sharing a trade is not about perfection or performance; it is about transparency, discipline, and continuous improvement. Each shared setup, risk decision, and outcome contributes to a broader underst

The future of trading is no longer built in isolation. It is shaped by shared insight, collective learning, and open dialogue. #ShareMyTrade represents a shift from silent charts to meaningful conversations where every trade becomes a source of knowledge.

As markets grow more complex and interconnected, the ability to learn from real-world experiences becomes a powerful advantage. Sharing a trade is not about perfection or performance; it is about transparency, discipline, and continuous improvement. Each shared setup, risk decision, and outcome contributes to a broader underst

- Reward

- 3

- Comment

- Repost

- Share

#GateChristmasVibes

The festive season is a time for reflection, connection, and looking ahead to new opportunities. At Gate, Christmas is not only about celebration, but also about appreciating the strong community that continues to grow together throughout the year.

As we move toward a new year, this season reminds us of the importance of unity, trust, and shared progress. Whether you are spending time with family, enjoying quiet moments of reflection, or preparing for new market opportunities, we hope the holidays bring clarity, motivation, and renewed energy.

This Christmas, our focus is

The festive season is a time for reflection, connection, and looking ahead to new opportunities. At Gate, Christmas is not only about celebration, but also about appreciating the strong community that continues to grow together throughout the year.

As we move toward a new year, this season reminds us of the importance of unity, trust, and shared progress. Whether you are spending time with family, enjoying quiet moments of reflection, or preparing for new market opportunities, we hope the holidays bring clarity, motivation, and renewed energy.

This Christmas, our focus is

- Reward

- 3

- Comment

- Repost

- Share

#ETHTrendWatch #ETHTrendWatch | Ethereum Market Outlook: Range Consolidation Continues

Ethereum is currently trading near $2,989, remaining inside a broad consolidation range that has defined price action over the past month. Momentum remains neutral, with recent price behavior suggesting stabilization rather than trend continuation.

Market Structure

Over the last 30 days, ETH has posted a moderate gain of approximately 5.8%, fluctuating between $2,700 and $3,300. Price remains near the midpoint of this range, indicating balance between buyers and sellers rather than directional dominance.

Key

Ethereum is currently trading near $2,989, remaining inside a broad consolidation range that has defined price action over the past month. Momentum remains neutral, with recent price behavior suggesting stabilization rather than trend continuation.

Market Structure

Over the last 30 days, ETH has posted a moderate gain of approximately 5.8%, fluctuating between $2,700 and $3,300. Price remains near the midpoint of this range, indicating balance between buyers and sellers rather than directional dominance.

Key

ETH0.05%

- Reward

- 3

- Comment

- Repost

- Share

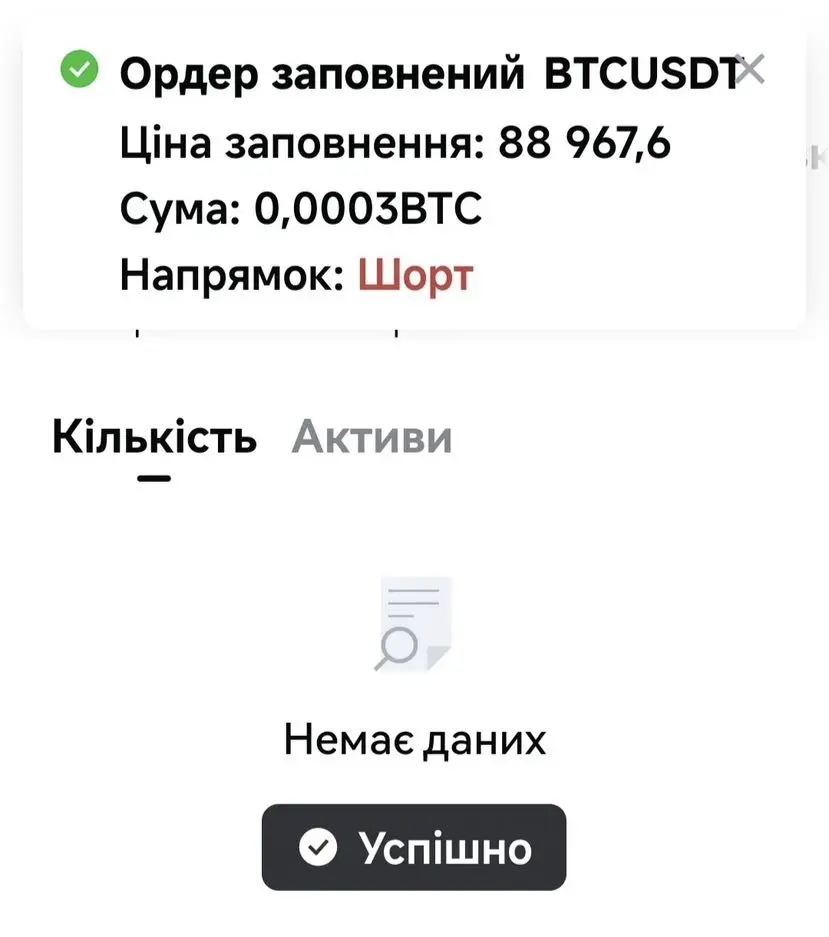

#GateChristmasVibes BTC Futures Trade Review: A Disciplined Approach to Capital Preservation

This post outlines a recently executed independent futures trade on the Gate exchange, focusing on disciplined execution, controlled risk, and consistent outcomes rather than aggressive profit chasing.

Market Context

The trade was executed in the BTC/USDT futures market during a period of elevated Bitcoin volatility. Given current market conditions, the primary objective remained capital preservation and controlled exposure rather than high-risk growth.

Trade Execution

Position Type: Short (Futures)

En

This post outlines a recently executed independent futures trade on the Gate exchange, focusing on disciplined execution, controlled risk, and consistent outcomes rather than aggressive profit chasing.

Market Context

The trade was executed in the BTC/USDT futures market during a period of elevated Bitcoin volatility. Given current market conditions, the primary objective remained capital preservation and controlled exposure rather than high-risk growth.

Trade Execution

Position Type: Short (Futures)

En

BTC0.22%

- Reward

- 4

- 1

- Repost

- Share

EagleEye :

:

Thanks for sharing this#CryptoMarketMildlyRebounds XRP Technical Outlook: Price Stabilizes at Major Demand Within Bearish Structure

XRP continues to trade under sustained bearish pressure, respecting a well-defined descending channel following a strong rejection from the $3.45–$3.66 supply zone near the Fib 1.0 extension. That rejection marked a clear distribution phase and initiated the current corrective trend.

The breakdown below the $2.95–$2.74 region (0.618–0.5 Fib) accelerated downside momentum, pushing price beneath all major EMAs and confirming short- to medium-term bearish control.

EMA Structure (Bearish Al

XRP continues to trade under sustained bearish pressure, respecting a well-defined descending channel following a strong rejection from the $3.45–$3.66 supply zone near the Fib 1.0 extension. That rejection marked a clear distribution phase and initiated the current corrective trend.

The breakdown below the $2.95–$2.74 region (0.618–0.5 Fib) accelerated downside momentum, pushing price beneath all major EMAs and confirming short- to medium-term bearish control.

EMA Structure (Bearish Al

XRP0.1%

- Reward

- 6

- 1

- Repost

- Share

EagleEye :

:

watching closely#2025GateYearEndSummary Looking ahead to the next phase of digital assets, every market shift and calculated decision has shaped the path forward. From periods of volatility to moments of opportunity, each step has strengthened experience and strategy.

Review your #2025Gate年度账单 and take a detailed look at how your crypto journey evolved this year. Use these insights to prepare for smarter moves in the year ahead. Share your review and receive 20 USDT.

https://www.gate.com/zh/competition/your-year-in-review-2025?ref=AQBEAwg&ref_type=126&shareUid=VlFGUVtaAAO0O0OO0O0O

Review your #2025Gate年度账单 and take a detailed look at how your crypto journey evolved this year. Use these insights to prepare for smarter moves in the year ahead. Share your review and receive 20 USDT.

https://www.gate.com/zh/competition/your-year-in-review-2025?ref=AQBEAwg&ref_type=126&shareUid=VlFGUVtaAAO0O0OO0O0O

- Reward

- 3

- Comment

- Repost

- Share

#DoubleRewardsWithGUSD As the digital finance ecosystem matures, users are increasingly valuing stability, transparency, and predictable outcomes over high-risk speculation. Stablecoins like GUSD (Gemini Dollar) play a pivotal role in this evolution, offering a fully regulated, 1:1 USD-backed digital dollar that allows participants to hold, transfer, and deploy capital without exposure to market volatility.

The concept of “double rewards” illustrates how platforms are innovating to engage users within stable financial frameworks. By combining base yields with campaign-based bonuses or temporar

The concept of “double rewards” illustrates how platforms are innovating to engage users within stable financial frameworks. By combining base yields with campaign-based bonuses or temporar

GUSD-0.01%

- Reward

- 5

- Comment

- Repost

- Share

#CryptoMarketMildlyRebounds After a period of heightened volatility, the crypto market is showing early signs of stabilization rather than full recovery. Price action across major assets suggests cautious participation, with buyers testing confidence while sellers gradually lose urgency. This phase is less about momentum and more about assessment.

A mild rebound often serves as a transition zone where sentiment resets and strategies are refined. It allows the market to digest recent moves, identify stronger structures, and reveal which assets are attracting sustained interest. For participants

A mild rebound often serves as a transition zone where sentiment resets and strategies are refined. It allows the market to digest recent moves, identify stronger structures, and reveal which assets are attracting sustained interest. For participants

- Reward

- 5

- Comment

- Repost

- Share

#GoldPrintsNewATH BTC Market Outlook | Structure Over Noise, Preparation Over Prediction

As global markets react to shifting macro signals and tightening liquidity, Bitcoin continues to trade in a critical consolidation phase where direction is being negotiated rather than decided. Price action near key psychological levels reflects hesitation, with buyers and sellers both testing conviction without committing fully. This environment favors patience, structure, and disciplined execution over emotional decision-making.

From a technical perspective, Bitcoin remains range-bound, with momentum ind

As global markets react to shifting macro signals and tightening liquidity, Bitcoin continues to trade in a critical consolidation phase where direction is being negotiated rather than decided. Price action near key psychological levels reflects hesitation, with buyers and sellers both testing conviction without committing fully. This environment favors patience, structure, and disciplined execution over emotional decision-making.

From a technical perspective, Bitcoin remains range-bound, with momentum ind

BTC0.22%

- Reward

- 4

- Comment

- Repost

- Share

#EthereumWarnsonAddressPoisoning As the Ethereum ecosystem continues to expand, so do the methods used by attackers to exploit user behavior rather than technical flaws. One of the most concerning developments is address poisoning, a scam that targets habits, speed, and assumptions instead of smart contracts or private keys.

Address poisoning works by inserting deceptive wallet addresses into a user’s transaction history. Attackers send tiny transactions from addresses that closely resemble legitimate ones, knowing that many users copy addresses from past activity without verifying them charac

Address poisoning works by inserting deceptive wallet addresses into a user’s transaction history. Attackers send tiny transactions from addresses that closely resemble legitimate ones, knowing that many users copy addresses from past activity without verifying them charac

ETH0.05%

- Reward

- 4

- Comment

- Repost

- Share

#FHETokenExtremeVolatility Volatility often draws the most attention, but it rarely tells the full story. In fast-moving digital markets, sharp price movements are a reflection of discovery in progress, where uncertainty, speculation, and belief collide as a project searches for equilibrium. These phases can feel uncomfortable, yet they are often where resilience and clarity begin to form.

For emerging tokens, turbulent periods act as stress tests. They reveal the strength of underlying fundamentals, the commitment of builders, and the maturity of the community. While short-term reactions may

For emerging tokens, turbulent periods act as stress tests. They reveal the strength of underlying fundamentals, the commitment of builders, and the maturity of the community. While short-term reactions may

FHE-2.51%

- Reward

- 5

- Comment

- Repost

- Share