#Bitcoin ATH after Tariffs

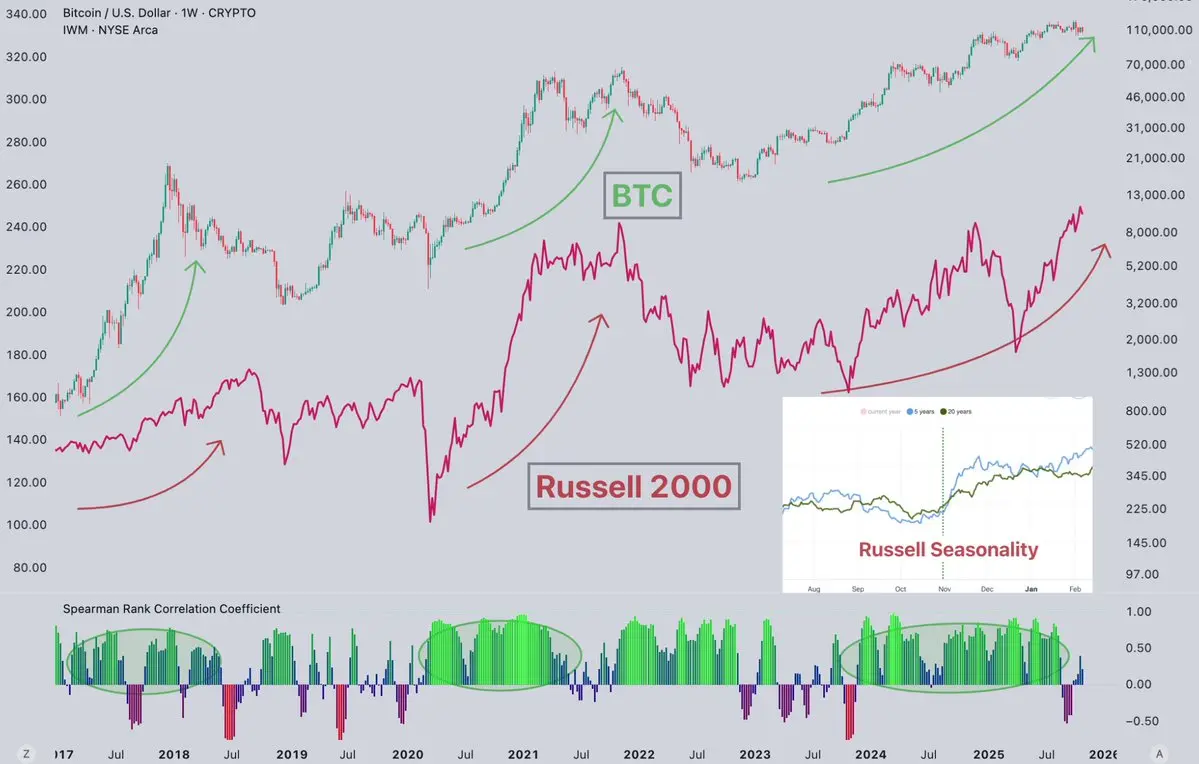

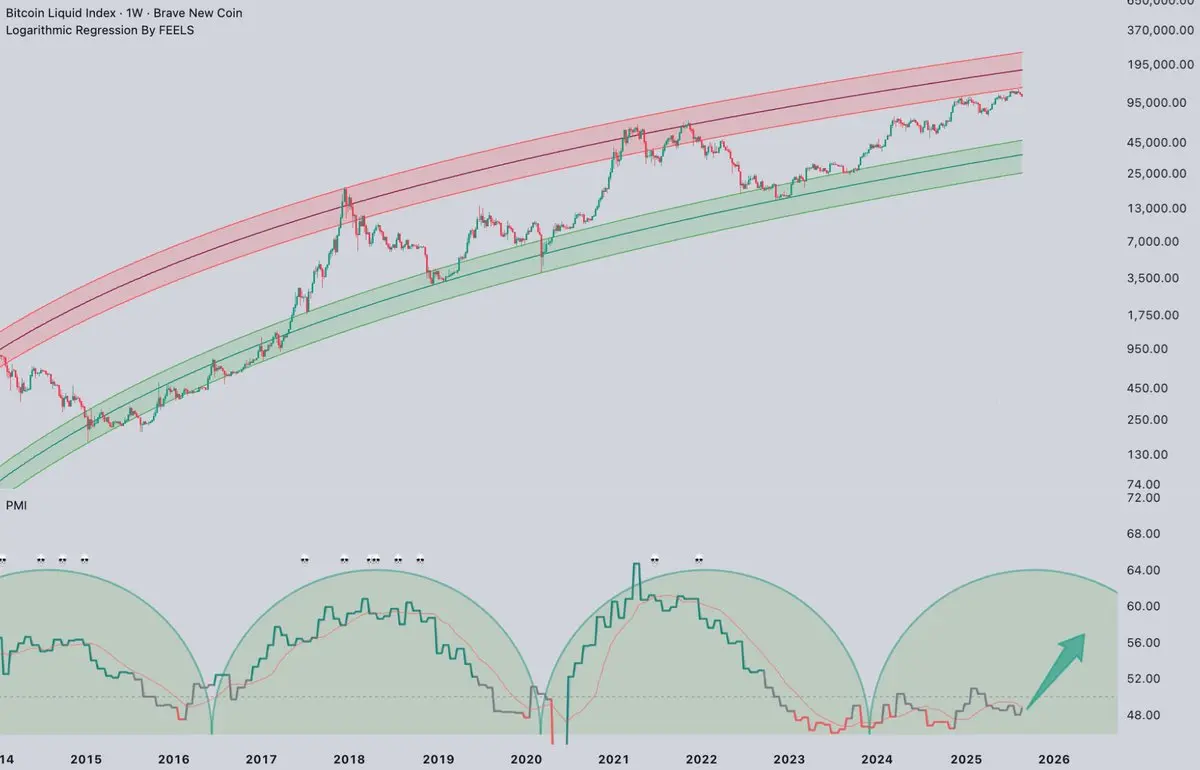

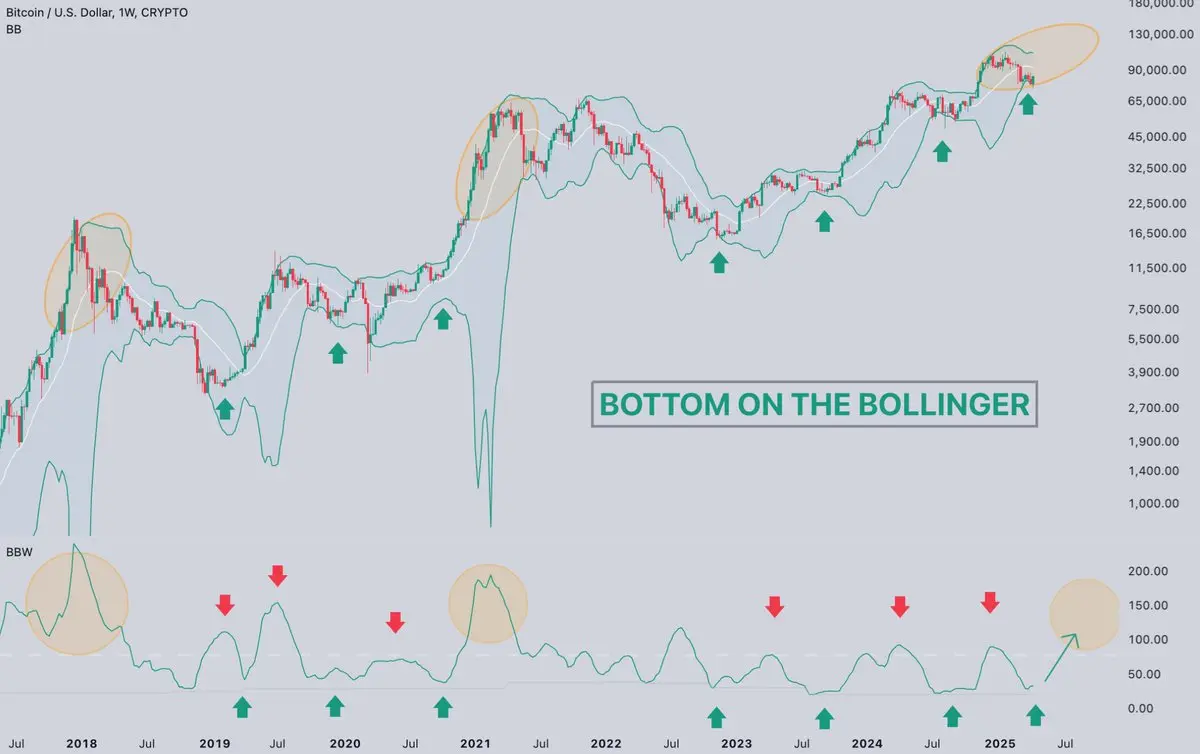

💧 The M2 money supply has been rising since late 2023—and Bitcoin followed almost perfectly, just like in previous cycles. Liquidity led, $BTC responded.

📊 Add in the growing expectation of rate cuts ahead, and you’ve got the perfect setup for a structurally bullish Bitcoin environment.

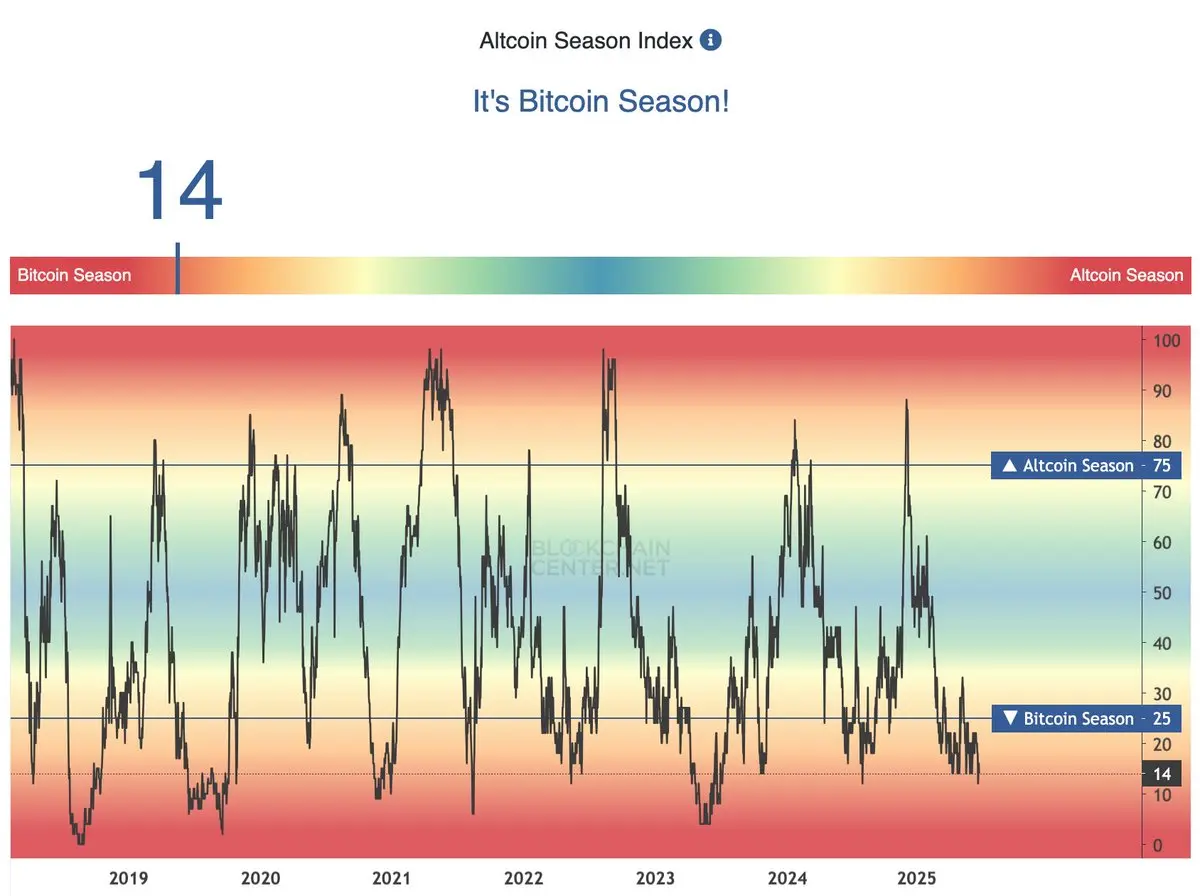

💡 If you followed my advice and entered the market at 16k, you’re now deep in profit. But this is also when emotions get loud and greed kicks in. Stay focused. Don’t let euphoria blind you. Take profits gradually, hedge risk, and prepare for volatility. This market still has upside

💧 The M2 money supply has been rising since late 2023—and Bitcoin followed almost perfectly, just like in previous cycles. Liquidity led, $BTC responded.

📊 Add in the growing expectation of rate cuts ahead, and you’ve got the perfect setup for a structurally bullish Bitcoin environment.

💡 If you followed my advice and entered the market at 16k, you’re now deep in profit. But this is also when emotions get loud and greed kicks in. Stay focused. Don’t let euphoria blind you. Take profits gradually, hedge risk, and prepare for volatility. This market still has upside