2025 AKTPrice Prediction: Exploring Future Trajectories for the Akash Network Token in a Maturing Web3 Ecosystem

Introduction: AKT's Market Position and Investment Value

Akash Network (AKT), as a decentralized cloud computing marketplace, has made significant strides since its inception. As of 2025, Akash Network's market capitalization has reached $289,003,879, with a circulating supply of approximately 278,236,140 tokens, and a price hovering around $1.0387. This asset, often referred to as the "DeCloud for DeFi," is playing an increasingly crucial role in the decentralized cloud computing sector.

This article will provide a comprehensive analysis of Akash Network's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

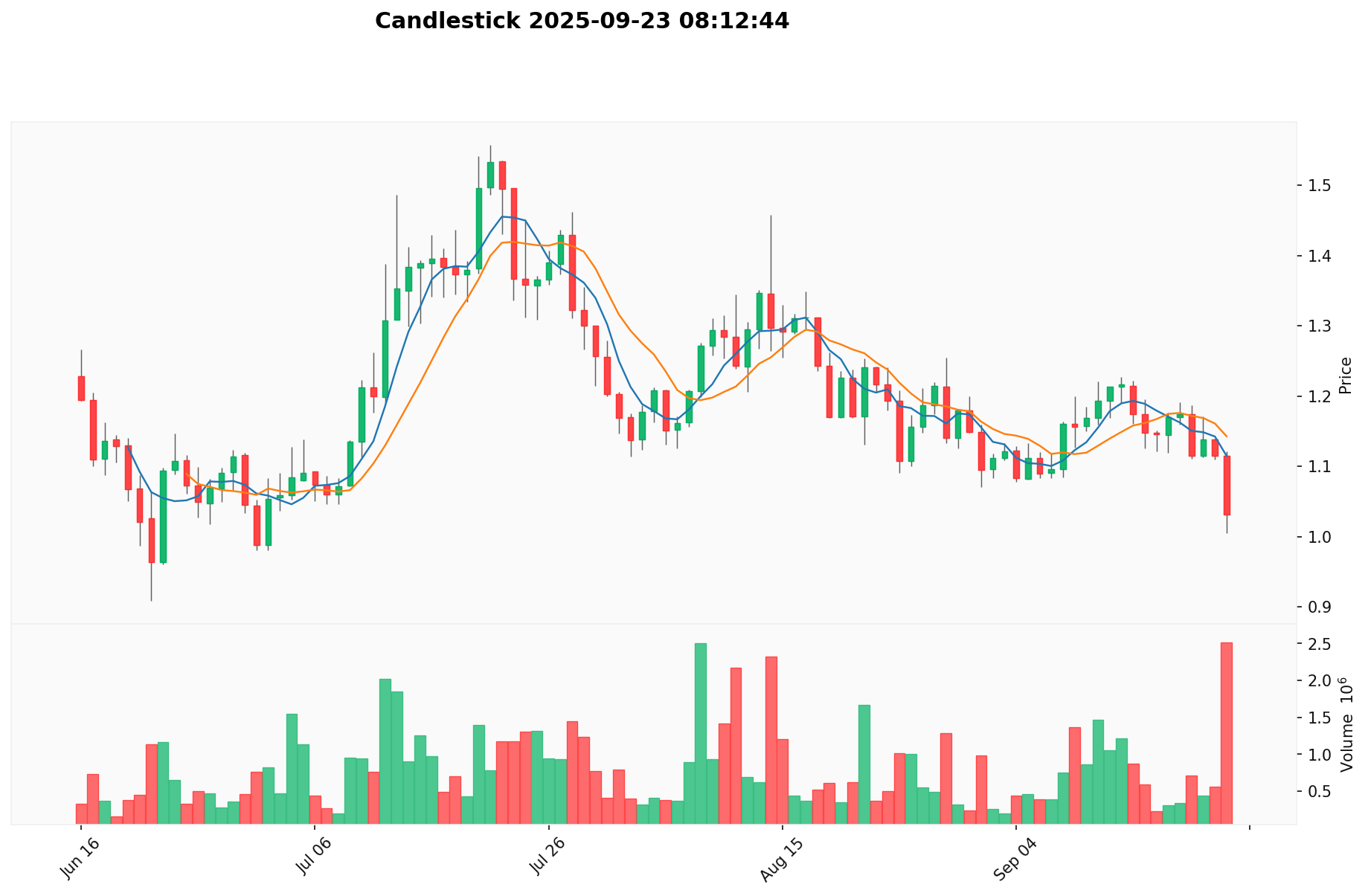

I. AKT Price History Review and Current Market Status

AKT Historical Price Evolution Trajectory

- 2021: Reached all-time high, price peaked at $8.07 on April 7

- 2022: Market downturn, price dropped to all-time low of $0.164994 on November 22

- 2025: Gradual recovery, price currently at $1.0387

AKT Current Market Situation

As of September 23, 2025, AKT is trading at $1.0387. The 24-hour trading volume stands at $1,946,122.58, with a market capitalization of $289,003,879.35. AKT has experienced a slight decline of 0.77% in the last 24 hours. The current price represents a significant drop of 63.24% compared to one year ago. In the short term, AKT has shown negative performance across various timeframes, with declines of 0.13% in the past hour, 9.11% over the last week, and 13.17% in the past month. The circulating supply of AKT is 278,236,140.71 tokens, which is 71.61% of the maximum supply of 388,539,008 AKT.

Click to view the current AKT market price

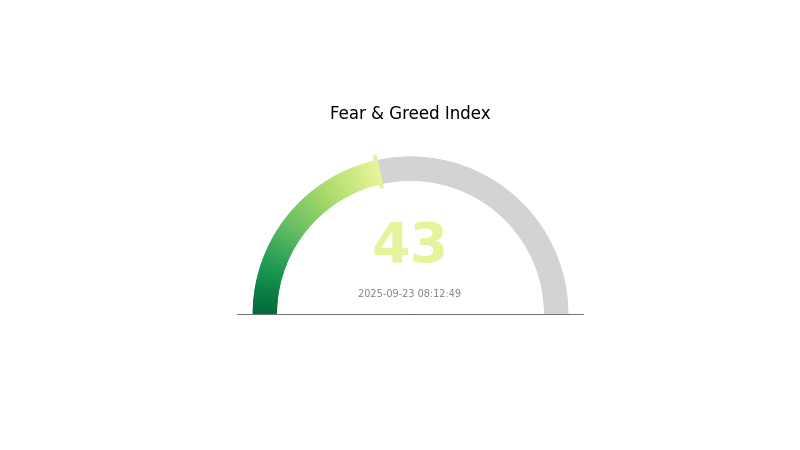

AKT Market Sentiment Indicator

2025-09-23 Fear and Greed Index: 43 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index at 43. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to take calculated risks. However, it's crucial to remember that market sentiment can change rapidly. Traders should stay informed, conduct thorough research, and consider diversifying their portfolios to mitigate risks in this uncertain environment. As always, it's advisable to invest only what you can afford to lose.

AKT Holdings Distribution

The address holdings distribution data for AKT reveals an interesting pattern in the token's ownership structure. This data typically shows the concentration of tokens among different addresses, providing insights into the decentralization and potential market dynamics of the asset.

In the case of AKT, the absence of specific data points suggests a relatively dispersed ownership structure. This lack of highly concentrated holdings among top addresses indicates a more distributed token ecosystem. Such a pattern generally implies a lower risk of market manipulation by large individual holders, potentially contributing to a more stable and resilient market structure.

The distributed nature of AKT holdings could be indicative of a broader adoption base or a more decentralized governance model. This characteristic may positively impact the token's market behavior, potentially leading to more organic price movements driven by a wider range of market participants rather than being influenced by a few major holders.

Click to view the current AKT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting AKT's Future Price

Supply Mechanism

- Inflationary Model: AKT has an inflationary supply model with new tokens minted to reward validators and delegators.

- Historical Pattern: The gradual increase in supply has historically put downward pressure on the price.

- Current Impact: The ongoing inflation is expected to continue exerting mild selling pressure on AKT's price.

Technical Development and Ecosystem Building

- Network Upgrades: Akash Network continues to implement upgrades to improve scalability and functionality.

- Ecosystem Applications: The platform hosts various decentralized applications and services leveraging its cloud computing infrastructure.

III. AKT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.6964 - $0.9000

- Neutral prediction: $0.9000 - $1.0394

- Optimistic prediction: $1.0394 - $1.14334 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.74388 - $1.46451

- 2028: $0.81431 - $1.35281

- Key catalysts: Technological advancements and wider adoption of Akash Network

2030 Long-term Outlook

- Base scenario: $1.23526 - $1.50641 (assuming steady market growth)

- Optimistic scenario: $1.50641 - $2.03366 (assuming strong market performance)

- Transformative scenario: $2.03366+ (under extremely favorable conditions)

- 2030-12-31: AKT $2.03366 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.14334 | 1.0394 | 0.6964 | 0 |

| 2026 | 1.23325 | 1.09137 | 0.56751 | 5 |

| 2027 | 1.46451 | 1.16231 | 0.74388 | 11 |

| 2028 | 1.35281 | 1.31341 | 0.81431 | 26 |

| 2029 | 1.67972 | 1.33311 | 0.99983 | 28 |

| 2030 | 2.03366 | 1.50641 | 1.23526 | 45 |

IV. Professional Investment Strategies and Risk Management for AKT

AKT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized cloud computing

- Operation suggestions:

- Accumulate AKT during market dips

- Stay informed about Akash Network's development and adoption

- Store AKT in a secure wallet with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor overall market sentiment and Akash Network news

AKT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different crypto assets and traditional investments

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Software wallet recommendation: Gate Web3 Wallet

- Hardware wallet solution: Store large amounts in cold storage

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AKT

AKT Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price swings

- Competition: Increasing competition in the decentralized cloud computing space

- Adoption: Slow adoption of decentralized cloud services could impact AKT's value

AKT Regulatory Risks

- Regulatory uncertainty: Evolving cryptocurrency regulations may affect AKT's operations

- Compliance challenges: Potential difficulties in meeting varying global regulatory requirements

- Tax implications: Changing tax laws may impact AKT holders and Akash Network participants

AKT Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the underlying smart contracts

- Network scalability: Challenges in scaling the Akash Network to meet growing demand

- Interoperability issues: Possible difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

AKT Investment Value Assessment

AKT presents a unique opportunity in the decentralized cloud computing sector with long-term potential. However, investors should be aware of short-term volatility and the emerging nature of the technology.

AKT Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding the technology ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider AKT as part of a diversified crypto portfolio

AKT Trading Participation Methods

- Spot trading: Buy and sell AKT on Gate.com

- Staking: Participate in AKT staking to earn rewards and support network security

- DeFi integration: Explore DeFi opportunities involving AKT as they become available

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for AKT in 2030?

Based on market trends and potential growth, AKT could reach $50-$75 by 2030, driven by increased adoption and technological advancements in the decentralized cloud computing sector.

How high will Akash go?

Akash could potentially reach $10-15 by 2026, driven by increased adoption of decentralized cloud computing and overall crypto market growth.

What is the price prediction for Akash in 2025?

Based on market analysis and growth trends, Akash (AKT) is predicted to reach around $5 to $7 by 2025, showing significant potential for long-term investors.

What is the price prediction for Act 1 AI?

Act 1 AI's price is expected to reach $0.15 by the end of 2025, with potential for further growth in 2026 due to increased adoption and market demand.

2025 OMNIA Price Prediction: Potential Surge or Market Correction Ahead?

2025 MOBILE Price Prediction: Analyzing Future Trends and Market Dynamics in the Smartphone Industry

2025 FLUX Price Prediction: Will the Decentralized Cloud Platform Reach New Heights?

2025 FILPrice Prediction: Analyzing Market Trends, Network Adoption, and Potential Growth Factors for Filecoin

Reason to Invest Resonates the Most With You and Why?

What Is TP in Text Slang? Complete Guide to Its Usage

Understanding ZAP in Blockchain: A Comprehensive Guide to Protocols and DeFi Integration

Understanding Web3 Wallets: A Comprehensive Guide

Exploring ULTI: An In-Depth Look into the Web3 Gaming Metaverse

Explore Tominet (TOMI) Token: Your Ultimate Web3 Resource

Safe Ways to Purchase Bitcoin (BTC) – A Comprehensive Guide