2025 EVER Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of EVER

Everscale (EVER) stands as one of the technologically advanced blockchain networks, integrating recent innovations and concepts in the blockchain space. Since its launch in 2020, Everscale has established itself as a distributed supercomputer capable of processing millions of transactions per second. As of December 21, 2025, EVER's market capitalization has reached approximately $17.59 million, with a circulating supply of around 1.985 billion tokens, trading at approximately $0.008307 per token. This blockchain infrastructure, renowned for its dynamic sharding and multithreading technology, is playing an increasingly vital role in decentralized applications including GameFi, DeFi, and supply chain solutions.

This article will comprehensively analyze Everscale's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Everscale (EVER) Market Analysis Report

I. EVER Price History Review and Market Status

EVER Historical Price Evolution

- 2020: Project launch on October 14, EVER reached its all-time high of $2.56, establishing the peak valuation in the project's history.

- 2020-2025: Extended bear market phase, with EVER experiencing significant depreciation over approximately five years.

- 2025: Continued downward pressure, with EVER reaching its all-time low of $0.00652265 on April 7, 2025, representing a decline of approximately 99.75% from the all-time high.

EVER Current Market Status

As of December 21, 2025, EVER is trading at $0.008307, with a 24-hour trading volume of $18,000.85. The token shows mixed short-term performance: down 0.11% in the past hour, down 0.52% over the past 24 hours, and down 15.01% over the past 7 days. Over longer timeframes, the token continues to display weakness, with a 13.34% decline over 30 days and a significant 57.94% drop over the past year.

The current market capitalization stands at approximately $16.49 million with a fully diluted valuation of $17.59 million. The circulating supply comprises 1.985 billion EVER tokens out of a total supply of 2.118 billion tokens, representing a circulation ratio of 93.77%. With a market dominance of 0.00054%, EVER ranks 940th among all cryptocurrencies.

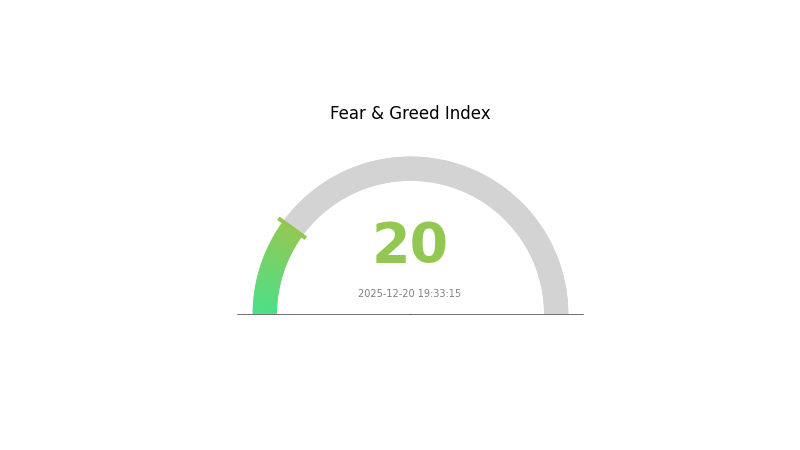

Current market sentiment reflects extreme fear, with a VIX reading of 20. The 24-hour price range indicates trading between $0.008233 and $0.008643. There are currently 504 token holders tracked on the network.

Click to view current EVER market price

EVER Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During periods of extreme fear, asset prices often reach lower levels, presenting potential buying opportunities for long-term investors with strong risk tolerance. However, volatility remains high, requiring careful position management. Monitor market developments closely and consider your risk profile before making investment decisions. Trading on Gate.com offers real-time market data and tools to help you navigate these challenging market conditions.

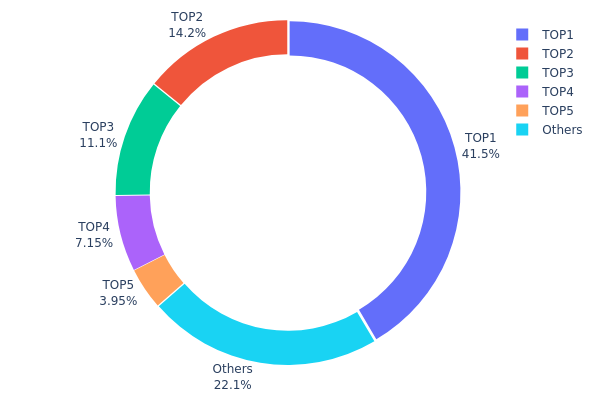

EVER Holdings Distribution

The address holdings distribution map illustrates the concentration of EVER tokens across the blockchain network's top holders, revealing the degree of decentralization and potential systemic risks inherent in the token's supply structure. By analyzing the percentage allocation of tokens among individual addresses, this metric provides critical insight into whether wealth concentration poses obstacles to genuine decentralization or introduces vulnerabilities to market manipulation.

Current data demonstrates significant concentration risk within the EVER ecosystem. The top address commands 41.52% of the total supply, while the combined top five addresses control 77.9% of all tokens in circulation. This distribution pattern indicates pronounced centralization, with the leading holder possessing nearly three times the holdings of the second-ranked address. Such extreme concentration in fewer hands fundamentally compromises the principle of decentralized governance and creates notable counterparty risk, as decisions or movements by these major stakeholders could substantially influence network security parameters, community voting outcomes, and market price dynamics.

The structural imbalance evident in EVER's holder distribution carries material implications for market stability and fair price discovery mechanisms. With the top four addresses collectively accounting for approximately 73.95% of total supply, the potential for coordinated actions—whether intentional or circumstantial—remains elevated. The remaining 22.1% fragmented among other addresses suggests a long tail of smaller participants with limited collective influence on protocol decisions. This asymmetric holder landscape indicates that EVER currently exhibits relatively poor decentralization characteristics, with chain-on-chain governance structures likely dominated by a small cohort of major stakeholders rather than representing genuine community-wide consensus.

Click to view current EVER holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x167a...aa6476 | 46235.73K | 41.52% |

| 2 | 0x8078...d7ee1a | 15789.36K | 14.18% |

| 3 | 0xf89d...5eaa40 | 12371.29K | 11.11% |

| 4 | 0x0d07...b492fe | 7956.44K | 7.14% |

| 5 | 0x9d68...3081e7 | 4398.18K | 3.95% |

| - | Others | 24583.24K | 22.1% |

Core Factors Influencing EVER's Future Price

Institutional and Major Holders Dynamics

-

Institutional Capital Inflow: Institutional investment is identified as a primary driver of EVER's future price movement. The influx of institutional capital is expected to support upward price momentum.

-

Ecosystem Development: Ecosystem building represents a key factor in driving EVER adoption and price appreciation. The expansion of the Everscale ecosystem and its supporting infrastructure is crucial for long-term value creation.

Macroeconomic Environment

- Geopolitical Factors: International geopolitical developments and events impact global market sentiment and risk appetite, which in turn affects EVER's price trajectory. Shifts in geopolitical risk perceptions can significantly influence cryptocurrency valuations.

Technology Development and Ecosystem Building

- Ecosystem Applications: The development of mainstream DApps and applications on the EVER ecosystem plays a vital role in driving adoption and utility, thereby supporting price appreciation.

Three、2025-2030 EVER Price Forecast

2025 Outlook

- Conservative Prediction: $0.00506 - $0.00829

- Neutral Prediction: $0.00829

- Optimistic Prediction: $0.01052 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with incremental growth momentum building

- Price Range Prediction:

- 2026: $0.00555 - $0.01035

- 2027: $0.00523 - $0.01402

- Key Catalysts: Ecosystem expansion, increased adoption metrics, improved market liquidity, and positive regulatory developments

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01052 - $0.01458 (assuming moderate ecosystem growth and sustained market participation)

- Optimistic Scenario: $0.01207 - $0.01890 (assuming accelerated adoption and strengthened fundamentals)

- Transformative Scenario: $0.01890+ (extreme favorable conditions including mainstream adoption and significant technological breakthroughs)

- Cumulative Growth: EVER demonstrates a 59-63% appreciation range from 2025 to 2029-2030 periods, reflecting gradual but consistent value recognition across the projected timeframe

Note: Price forecasts are based on predictive models and market analysis. Trading on Gate.com or other platforms should incorporate risk management strategies given cryptocurrency market volatility.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01052 | 0.00829 | 0.00506 | 0 |

| 2026 | 0.01035 | 0.00941 | 0.00555 | 13 |

| 2027 | 0.01402 | 0.00988 | 0.00523 | 18 |

| 2028 | 0.01458 | 0.01195 | 0.01052 | 43 |

| 2029 | 0.01393 | 0.01326 | 0.01207 | 59 |

| 2030 | 0.0189 | 0.0136 | 0.01074 | 63 |

Everscale (EVER) Professional Investment Strategy and Risk Management Report

IV. EVER Professional Investment Strategy and Risk Management

EVER Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Long-term blockchain technology believers, institutional investors, and patient capital allocators

-

Operation Recommendations:

- Accumulate EVER during market downturns, particularly when prices fall below historical support levels. With EVER trading at $0.008307 as of December 21, 2025, and having declined 57.94% over the past year, patient investors may view this as a potential accumulation opportunity

- Implement dollar-cost averaging (DCA) strategy through regular monthly purchases, reducing the impact of price volatility and market timing risk

- Hold EVER on secured storage solutions to benefit from Everscale's technological development milestones and potential ecosystem expansion across GameFi, DeFi, and supply chain applications

-

Storage Solutions:

- Utilize Gate.com's Web3 Wallet for secure EVER storage combined with convenient access to trading and DeFi opportunities on the platform

- Maintain private key control through hardware wallet solutions for the majority of long-term holdings exceeding 6 months

- Implement multi-signature wallet architectures for institutional-scale positions

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average (MA) Convergence Divergence (MACD): Monitor MACD signals for trend confirmation; apply to identify potential reversal points when EVER approaches key support levels ($0.008 area)

- Relative Strength Index (RSI): Use RSI oscillator to identify overbought (>70) and oversold (<30) conditions; particularly useful given EVER's recent 24-hour low of $0.008233 and high of $0.008643

- Volume Profile Analysis: Analyze 24-hour trading volume of approximately $18,000.85 to confirm breakout authenticity and identify price resistance clusters

-

Wave Trading Key Points:

- Trade within identified support and resistance zones; establish buy orders near the 24-hour low ($0.008233) and sell near resistance at $0.009 levels

- Apply 4-hour and daily timeframe analysis to filter out noise and identify meaningful price movements above the 1% daily volatility baseline

- Set risk-reward ratios of at least 1:2, ensuring profit targets justify the exposure level given EVER's limited 24-hour liquidity

EVER Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 2-5% of total portfolio

- Limit EVER exposure given its smaller market cap ($16.49M circulating) and relative illiquidity ($18K daily volume)

- Prioritize capital preservation over growth

-

Aggressive Investors: 8-15% of total portfolio

- Tolerate higher volatility in exchange for exposure to Everscale's technological innovations

- Allocate resources based on multi-year development roadmap milestones

-

Professional Investors: 5-20% of alternative assets allocation

- Structure positions across spot holdings, staking opportunities (if available), and ecosystem participation

- Monitor Everscale network metrics including sharding efficiency and transaction throughput improvements

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-40% of allocated capital in USDT or USDC stablecoins through Gate.com to capitalize on sudden price dips while preserving purchasing power

- Diversification Strategy: Balance EVER holdings against other Layer 1 and Layer 2 blockchain projects to reduce single-protocol risk and technical failure exposure

(3) Secure Storage Solutions

-

Web3 Wallet Recommendation: Gate.com Web3 Wallet

- Provides direct integration with Gate.com trading platform for seamless asset management

- Enables secure custodianship with user-controlled private keys

- Supports ETH mainnet EVER tokens (contract: 0x1ffEFD8036409Cb6d652bd610DE465933b226917)

-

Self-Custody Approach:

- For holdings exceeding 6 months, transfer EVER to cold storage solutions maintained under personal control

- Document seed phrases and private keys in encrypted, geographically distributed storage

-

Critical Security Considerations:

- Never share private keys or seed phrases with any third parties

- Enable multi-factor authentication on all exchange and wallet accounts

- Verify contract addresses before any token transfers (Everscale ETH contract: 0x1ffEFD8036409Cb6d652bd610DE465933b226917)

- Conduct regular security audits of wallet infrastructure and access controls

V. EVER Potential Risks and Challenges

EVER Market Risks

- Liquidity Risk: With only $18,000.85 in 24-hour trading volume and 504 total holders, EVER faces significant liquidity constraints that can result in substantial price slippage during large buy or sell orders

- Market Concentration Risk: The relatively small circulating market cap of $16.49M makes EVER susceptible to manipulation and price volatility from concentrated trader positions or institutional liquidations

- Price Volatility: EVER has declined 57.94% over the past year and 15.01% over the past 7 days, indicating elevated systematic risk and potential further downside pressure

EVER Regulatory Risks

- Jurisdictional Uncertainty: Changing regulatory frameworks across major markets may impact Everscale's development priorities, user adoption, and token trading venues

- Compliance Requirements: Future regulatory mandates regarding token classification, trading restrictions, or staking requirements could affect EVER's utility and value proposition

- Exchange Listing Risk: With limited exchange availability (currently 3 exchanges), regulatory delisting or de-risking by exchanges could severely restrict EVER's liquidity and trading accessibility

EVER Technical Risks

- Smart Contract Vulnerabilities: Despite Everscale's claimed technological advantages in dynamic sharding and multi-threading, unknown code vulnerabilities or exploits in smart contracts could result in substantial losses or network disruption

- Network Scaling Challenges: While Everscale advertises dynamic sharding capabilities, untested scaling mechanisms under extreme load conditions could lead to network congestion, transaction failures, or security compromises

- Ecosystem Adoption Risk: Lack of widespread developer adoption or insufficient decentralized applications on Everscale may limit network utility and fail to justify the technology's technical complexity

VI. Conclusion and Action Recommendations

EVER Investment Value Assessment

Everscale presents a technically sophisticated blockchain platform with innovative features including dynamic sharding, multi-threading, and comprehensive developer tooling. However, current market conditions present a mixed outlook: the project has declined significantly over the past year (57.94%), indicating either substantial technical or market adoption challenges. The small market capitalization ($16.49M), limited trading liquidity ($18K daily volume), and concentrated holder base (504 addresses) create structural barriers to institutional adoption. The 93.77% ratio of circulating supply to fully diluted valuation suggests moderate inflation risk, while the unlimited maximum supply creates indefinite dilution potential. Long-term value depends on achieving meaningful ecosystem adoption across stated target applications (GameFi, DeFi, supply chain), which remains unproven at current adoption levels.

EVER Investment Recommendations

✅ Beginners: Start with minimal exposure (1-2% of portfolio) through Gate.com's Web3 Wallet or spot trading. Prioritize understanding Everscale's technical architecture and competitive advantages before increasing allocation. Use dollar-cost averaging over 3-6 months to reduce timing risk.

✅ Experienced Investors: Establish a 5-10% core position if convinced by Everscale's technological roadmap and development progress. Implement active trading strategies using technical analysis tools (RSI, MACD) on 4-hour timeframes. Maintain strict stop-loss orders at 10% below entry given elevated volatility. Monitor ecosystem development metrics including network transaction volume and developer engagement.

✅ Institutional Investors: Consider 5-15% allocation within alternative blockchain asset category only after comprehensive technical due diligence on sharding implementation and network security audits. Negotiate direct liquidity arrangements through Gate.com given limited public market liquidity. Structure positions with staged entry points and hedging against regulatory risk through stablecoin reserves.

EVER Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase of EVER tokens via Gate.com's trading platform with immediate settlement and access to Gate.com's Web3 Wallet for self-custody options

- Ethereum Network Access: Purchase ETH-wrapped EVER tokens (contract: 0x1ffEFD8036409Cb6d652bd610DE465933b226917) for potential decentralized exchange opportunities and cross-chain liquidity

- Long-term Staking: Research and participate in any Everscale validator or staking programs that may offer yield on holdings, if such programs become available through official ecosystem channels

Cryptocurrency investments carry extreme risk and may result in complete capital loss. This report does not constitute investment advice. Investors must assess their individual risk tolerance and conduct comprehensive due diligence before committing capital. Always consult qualified financial advisors before making significant investment decisions. Never invest funds you cannot afford to lose entirely.

FAQ

Does evergrow coin have a future?

EverGrow Coin's future depends on execution and real-world application adoption. With strong community support and innovative tokenomics, the project shows promising potential for growth and long-term value development.

What crypto will 1000x prediction?

No crypto guarantees 1000x returns, but emerging projects like VeChain, Kaspa, and SingularityNET show strong potential. Early adoption of innovative Layer 2 solutions and AI-driven protocols may offer significant upside opportunities.

How much is ever coin?

As of December 2025, one EVER coin is valued at approximately $0.0084 USD. The price reflects current market conditions, with 5 EVER coins costing around $0.0420 USD.

UDS vs KAVA: A Comparison of Two Leading Decentralized Finance Platforms

2025 SUPER Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 FITFI Price Prediction: Analyzing Market Trends and Potential Growth Factors

GM vs KAVA: The Battle of Coffee Giants Shaking Up the Morning Routine Market

Is Four (FORM) a good investment?: Analyzing the potential and risks of this emerging tech stock

How Does Crypto Fund Flow Impact Holding Patterns and Exchange Balances?

Understanding GameFi: The Future of Gaming Platforms

PEPE Coin Analysis and Future Prospects

Understanding the PEPE Project ($PEPE): A Guide to This Innovative Cryptocurrency

Convert USDT to INR Effortlessly | Live Exchange Rates

Syscoin Price Outlook: Can SYS Recover from Oversold Levels?