2025 LINK Price Prediction: Expert Analysis and Market Forecast for Chainlink's Future Performance

Introduction: LINK's Market Position and Investment Value

ChainLink (LINK), as a leading decentralized oracle network, has achieved significant milestones since its inception in 2017. As of 2025, ChainLink's market capitalization has reached $9.45 billion, with a circulating supply of approximately 696,849,970 tokens, and a price hovering around $13.57. This asset, often referred to as the "Oracle of Blockchain," is playing an increasingly crucial role in connecting smart contracts with real-world data.

This article will provide a comprehensive analysis of ChainLink's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LINK Price History Review and Current Market Status

LINK Historical Price Evolution

- 2017: LINK launched, price started at $0.148183

- 2020: DeFi summer, LINK price surged to over $10

- 2021: Bull market peak, LINK reached all-time high of $52.7

- 2022-2023: Crypto winter, price declined to single digits

LINK Current Market Situation

As of December 15, 2025, LINK is trading at $13.568, ranking 16th by market capitalization. The 24-hour trading volume is $3,334,155.99. LINK has a circulating supply of 696,849,970 tokens and a total supply of 1 billion tokens. The current market cap stands at $9.45 billion, with a fully diluted valuation of $13.57 billion.

LINK is showing mixed short-term performance, with a 0.59% decrease in the past hour and a slight 0.03% dip in the last 24 hours. The weekly and monthly trends are negative, with declines of 2.81% and 4.16% respectively. The yearly performance shows a significant drop of 53.32%, reflecting the broader crypto market conditions.

The token is currently trading at about 74.27% below its all-time high of $52.7, recorded on May 10, 2021. However, it remains significantly above its all-time low of $0.148183, set on November 29, 2017.

Click to view the current LINK market price

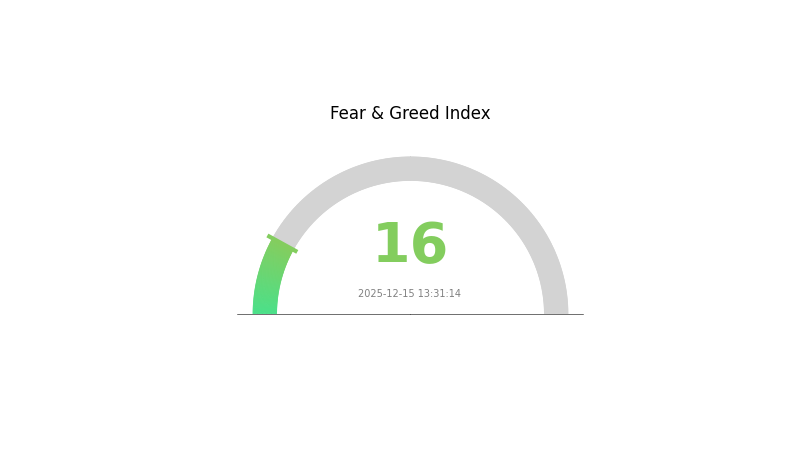

LINK Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider dollar-cost averaging and thorough research before making investment decisions. Remember, while fear can create opportunities, it's crucial to manage risk and avoid emotional trading in such turbulent times.

LINK Holdings Distribution

The address holdings distribution data provides insights into the concentration of LINK tokens among different wallet addresses. Analysis of this data reveals a relatively decentralized distribution pattern for LINK. The top five addresses collectively hold 17.88% of the total supply, with the largest single address owning 4.80%. This suggests a moderate level of concentration at the top, but not to an extent that raises immediate concerns about excessive centralization.

The majority of LINK tokens (82.12%) are distributed among numerous other addresses, indicating a broad base of holders. This distribution pattern contributes to market stability and reduces the risk of price manipulation by any single large holder. However, it's worth noting that the presence of several addresses holding 3% or more of the supply could still have some influence on short-term price movements if these holders decide to make significant transactions.

Overall, the current LINK holdings distribution reflects a relatively healthy balance between larger stakeholders and a diverse group of smaller holders. This structure supports the network's decentralization goals and suggests a reduced risk of market manipulation compared to more concentrated token distributions.

Click to view the current LINK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 48000.00K | 4.80% |

| 2 | 0xbc10...fcdb5e | 40875.54K | 4.08% |

| 3 | 0x9bbb...cc8db8 | 30000.00K | 3.00% |

| 4 | 0x35a5...3b5e45 | 30000.00K | 3.00% |

| 5 | 0x8652...4de081 | 30000.00K | 3.00% |

| - | Others | 821124.46K | 82.12% |

II. Key Factors Influencing LINK's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are closely monitoring LINK's performance and potential adoption.

- Enterprise Adoption: Notable companies are exploring Chainlink's oracle solutions for various applications.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially from the Federal Reserve, may influence LINK's price.

- Inflation Hedging Properties: LINK's performance in inflationary environments is being observed by investors.

- Geopolitical Factors: The trajectory of US-China relations has become a systemic factor affecting asset prices, including cryptocurrencies like LINK.

Technical Development and Ecosystem Building

- Chainlink 2.0: The upcoming economic model introduces a staking mechanism for LINK tokens, aiming to enhance the network's capabilities.

- Ecosystem Applications: Chainlink's oracle services are being integrated into various DApps and blockchain projects, expanding its ecosystem.

III. LINK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $11.79 - $13.56

- Neutral prediction: $13.56 - $14.78

- Optimistic prediction: $14.78 - $15.50 (requires favorable market conditions and increased adoption of Chainlink services)

2027-2028 Outlook

- Market stage expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $13.29 - $14.88

- 2028: $11.00 - $18.19

- Key catalysts: Expansion of Chainlink's oracle services, integration with new blockchain platforms, and overall crypto market recovery

2030 Long-term Outlook

- Base scenario: $15.83 - $19.30 (assuming steady growth in DeFi and smart contract adoption)

- Optimistic scenario: $19.30 - $20.65 (with widespread enterprise adoption of blockchain technology)

- Transformative scenario: $20.65 - $25.00 (in case of revolutionary breakthroughs in blockchain interoperability)

- 2030-12-31: LINK $19.30 (projected average price based on current data)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 14.77713 | 13.557 | 11.79459 | 0 |

| 2026 | 14.73375 | 14.16707 | 13.31704 | 4 |

| 2027 | 14.88392 | 14.45041 | 13.29437 | 6 |

| 2028 | 18.18728 | 14.66716 | 11.00037 | 8 |

| 2029 | 22.17675 | 16.42722 | 14.7845 | 21 |

| 2030 | 20.65312 | 19.30199 | 15.82763 | 42 |

IV. Professional LINK Investment Strategies and Risk Management

LINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in oracle technology

- Operation suggestions:

- Accumulate LINK tokens during market dips

- Set price targets and regularly review portfolio

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor oracle adoption rates in DeFi and other blockchain sectors

- Stay updated on Chainlink's technological advancements and partnerships

LINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different oracle projects

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Offline storage of private keys

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for LINK

LINK Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Emerging oracle solutions may challenge Chainlink's market dominance

- Adoption rate: Slower than expected integration of oracle services in blockchain projects

LINK Regulatory Risks

- Uncertain regulations: Potential changes in cryptocurrency regulations globally

- SEC scrutiny: Increased regulatory focus on token classifications

- Cross-border compliance: Varying legal requirements across different jurisdictions

LINK Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the Chainlink network

- Scalability challenges: Keeping up with increasing demand for oracle services

- Network security: Ensuring the integrity of off-chain data sources

VI. Conclusion and Action Recommendations

LINK Investment Value Assessment

Chainlink (LINK) presents a strong long-term value proposition as a leading oracle solution in the blockchain space. However, short-term volatility and regulatory uncertainties pose significant risks.

LINK Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Explore integrating LINK as part of a diversified crypto portfolio

LINK Trading Participation Methods

- Spot trading: Buy and hold LINK tokens on Gate.com

- Staking: Participate in Chainlink staking programs when available

- DeFi integration: Utilize LINK in decentralized finance protocols for additional yield opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will Chainlink be worth in 2025?

Based on current market analysis, Chainlink is predicted to reach a value of $14.16 by December 2025, showing potential for moderate growth in the coming years.

Can Chainlink reach $100?

Yes, Chainlink could potentially reach $100 by 2031. Its strong position in the oracle market and growth in real-world asset integration may drive significant price appreciation over the next several years.

How high can Chainlink realistically go?

Chainlink could potentially reach thousands of dollars. Some experts project significant growth, with estimates ranging from $100 to $1000+ in the coming years.

Can Chainlink hit $50?

Yes, Chainlink has the potential to reach $50. Some experts predict a rally to $20 in the near term, with possibilities of a breakout to $50 if current market support holds.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Hướng dẫn khai thác Dogecoin hiệu quả trong năm 2024

Understanding Wash Trading in Cryptocurrency Markets

What is KSM: A Comprehensive Guide to Kusama Network and Its Role in Polkadot Ecosystem

Complete Guide: How to Navigate Arbitrum Bridging for Web3 Enthusiasts

Is Ronin Network (RON) a good investment?: A Comprehensive Analysis of Performance, Risks, and Future Potential in the Gaming Blockchain Ecosystem