2025 MIRA Price Prediction: Analyzing Future Trends and Potential Growth Factors

Introduction: MIRA's Market Position and Investment Value

Mira (MIRA), as a decentralized verification network for autonomous AI, has made significant strides since its inception. As of 2025, Mira's market capitalization has reached $33,287,920, with a circulating supply of approximately 191,200,000 tokens, and a price hovering around $0.1741. This asset, hailed as the "AI Verification Infrastructure," is playing an increasingly crucial role in high-stakes domains such as healthcare, finance, and legal services.

This article will comprehensively analyze Mira's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. MIRA Price History Review and Current Market Status

MIRA Historical Price Evolution

- 2025 (September 26): MIRA reached its all-time high of $2.6662, marking a significant milestone for the project

- 2025 (November 18): MIRA hit its all-time low of $0.1676, experiencing a substantial price correction

MIRA Current Market Situation

MIRA is currently trading at $0.1741, representing a 93.47% decrease from its all-time high. The token has seen significant price volatility in recent periods:

- 1-hour change: -0.33%

- 24-hour change: -2.35%

- 7-day change: -18.82%

- 30-day change: -44.15%

- 1-year change: -87.75%

The current market capitalization stands at $33,287,920, with a circulating supply of 191,200,000 MIRA tokens. The 24-hour trading volume is $600,288.11, indicating moderate market activity. MIRA's fully diluted valuation is $174,100,000, and it currently ranks 721st in the cryptocurrency market.

Click to view the current MIRA market price

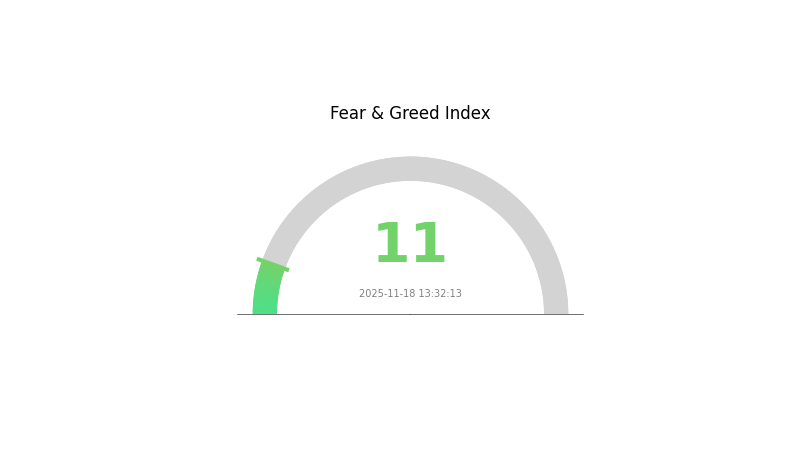

MIRA Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment indicator plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiments can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these uncertain waters. As always, only invest what you can afford to lose in this volatile market.

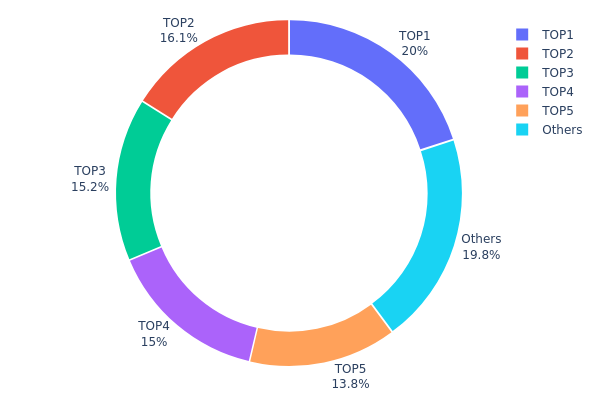

MIRA Holdings Distribution

The address holdings distribution data provides insights into the concentration of MIRA tokens among different wallet addresses. Analysis of this data reveals a significant concentration of MIRA tokens among the top holders. The top five addresses collectively control 80.15% of the total supply, with the largest holder possessing 20% of all tokens.

This high concentration of holdings raises concerns about potential market manipulation and price volatility. With such a large portion of tokens held by a small number of addresses, any significant movement or liquidation by these major holders could have a substantial impact on MIRA's market price and liquidity. Furthermore, this concentration suggests a relatively low level of decentralization in MIRA's ownership structure, which may be viewed unfavorably by investors seeking more distributed token ecosystems.

The current distribution pattern indicates a market structure that is potentially vulnerable to whale movements and coordinated actions by large holders. While this concentration doesn't necessarily imply immediate market instability, it does highlight the need for careful monitoring of large transactions and potential shifts in ownership that could affect MIRA's overall market dynamics and long-term stability.

Click to view the current MIRA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x157d...e91cb2 | 200000.00K | 20.00% |

| 2 | 0x8b78...84977f | 160991.95K | 16.09% |

| 3 | 0x231d...f67d81 | 152307.14K | 15.23% |

| 4 | 0xf688...528cf1 | 150000.00K | 15.00% |

| 5 | 0x5fc7...de4006 | 138311.62K | 13.83% |

| - | Others | 198389.29K | 19.85% |

II. Key Factors Influencing MIRA's Future Price

Supply Mechanism

- Token Distribution: MIRA tokens are currently trading at around $0.3, with a market cap exceeding $57 million.

- Current Impact: High demand for reliable AI is driving interest in MIRA tokens.

Institutional and Whale Dynamics

- Enterprise Adoption: MIRA provides SDKs for easy integration by developers, indicating potential for widespread enterprise adoption.

Macroeconomic Environment

- Inflation Hedging Properties: As a technology-focused token, MIRA may be viewed as a hedge against traditional economic uncertainties.

Technological Development and Ecosystem Building

- AI Reliability Enhancement: MIRA Network aims to solve the fundamental challenge of AI reliability, reducing error rates in complex reasoning tasks from 30% to 5%.

- Consensus Mechanism: MIRA employs a novel hybrid Proof-of-Work/Proof-of-Stake mechanism specifically designed for AI validation.

- Ecosystem Applications:

- Klok: The world's first trustless multi-LLM chat application built on Mira Network.

- Gigabrain: An AI trading application using Mira's verification system for real-time checks on AI recommendations.

- Integration with AI Models: MIRA's core technology uses multiple AI models to cross-check each other's work, creating a level of trust and reliability unachievable by single AI systems.

III. MIRA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.1654 - $0.1741

- Neutral prediction: $0.1741 - $0.2063

- Optimistic prediction: $0.2063 - $0.2385 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Steady growth phase

- Price range forecast:

- 2026: $0.1093 - $0.2620

- 2027: $0.1733 - $0.2857

- 2028: $0.1819 - $0.2885

- Key catalysts: Increasing adoption, technological advancements, and positive market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.2742 - $0.2948 (assuming consistent market growth)

- Optimistic scenario: $0.2948 - $0.3154 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.3154 - $0.4186 (assuming breakthrough innovations and widespread institutional acceptance)

- 2030-12-31: MIRA $0.4186 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23852 | 0.1741 | 0.1654 | 0 |

| 2026 | 0.26201 | 0.20631 | 0.10934 | 18 |

| 2027 | 0.28568 | 0.23416 | 0.17328 | 34 |

| 2028 | 0.28851 | 0.25992 | 0.18194 | 49 |

| 2029 | 0.31535 | 0.27421 | 0.19195 | 57 |

| 2030 | 0.41859 | 0.29478 | 0.21814 | 69 |

IV. MIRA Professional Investment Strategies and Risk Management

MIRA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors believing in AI technology advancement

- Operational suggestions:

- Accumulate MIRA tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AI industry news and developments

- Set stop-loss orders to manage downside risk

MIRA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MIRA

MIRA Market Risks

- High volatility: Cryptocurrency market fluctuations can lead to significant price swings

- Competition: Emerging AI verification projects may challenge MIRA's market position

- Adoption risk: Slow integration of AI verification in critical industries could impact growth

MIRA Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency and AI regulations may affect MIRA's operations

- Cross-border compliance: Varying international regulations could limit global expansion

- Data privacy concerns: Stricter data protection laws may impact AI model verification processes

MIRA Technical Risks

- Smart contract vulnerabilities: Potential security issues in the underlying blockchain infrastructure

- Scalability challenges: Ensuring network performance as demand for AI verification increases

- AI model limitations: Rapid advancements in AI may require frequent updates to verification protocols

VI. Conclusion and Action Recommendations

MIRA Investment Value Assessment

MIRA presents a unique value proposition in the AI verification space, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

MIRA Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Explore strategic partnerships and larger positions with hedging strategies

MIRA Trading Participation Methods

- Spot trading: Available on Gate.com for direct MIRA token purchases

- Staking: Participate in MIRA staking programs if available for passive income

- DeFi integration: Explore decentralized finance options involving MIRA tokens as they develop

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Mira a good stock to buy?

Yes, MIRA is a strong buy candidate. The stock price is $1.36, with potential for growth based on current analysis and forecasts.

Is Mira Coin a good investment?

Yes, Mira Coin shows strong potential for growth in the Web3 space. Its innovative technology and increasing adoption make it an attractive investment option for 2025 and beyond.

What is the price forecast for Mira?

Mira's price forecast is positive. By 2025, it's expected to average $5.18. The 2030 forecast projects an average of $23.46, indicating significant long-term growth potential.

What is the prediction for the Mira Network?

Mira Network is predicted to reach a maximum price of $1.41 and a minimum of $1.38 by February 2030, based on current market trends.

2025 FET Price Prediction: Analyzing Market Trends and Future Potential for Fetch.ai's Native Token

2025 TRACAIPrice Prediction: Future Valuation Analysis and Market Potential for Emerging Blockchain Technology

2025 CAMP Price Prediction: Analyzing Market Trends and Growth Potential for Blockchain Gaming Assets

2025 NC Price Prediction: Analyzing Market Trends and Future Growth Potential

2025 AITECHPrice Prediction: Market Trends, Economic Factors and Investment Opportunities in the Artificial Intelligence Sector

2025 REX Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

Earn Passive Income and Boost Health with Move-to-Earn Apps

Unlock Health and Crypto Rewards with Move to Earn Apps

Tomarket Daily Combo 22 december 2025

Meteora Innovative Liquidity Structure And Sustainable Economic Model

Noble Official Account Hacked Incident And Security Tips