2025 MPTPrice Prediction: Analyzing Market Trends and Future Projections for the Metaverse Property Token

Introduction: MPT's Market Position and Investment Value

Miracle Play (MPT), as a blockchain-based esports online tournament platform, has been making waves since its inception in 2023. As of 2025, MPT's market capitalization has reached $8,868,094, with a circulating supply of approximately 1,069,347,017 tokens, and a price hovering around $0.008293. This asset, often referred to as the "esports blockchain innovator," is playing an increasingly crucial role in the intersection of gaming and blockchain technology.

This article will provide a comprehensive analysis of MPT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MPT Price History Review and Current Market Status

MPT Historical Price Evolution

- 2024: All-time high of $0.1313 reached on April 10, marking a significant milestone

- 2025: Market downturn, price dropped to an all-time low of $0.00405 on August 3

MPT Current Market Situation

As of October 9, 2025, MPT is trading at $0.008293, experiencing a slight decline of 0.38% in the past 24 hours. The token's market capitalization stands at $8,868,094, ranking it 1479th in the global cryptocurrency market. MPT has seen a significant drop of 77.60% over the past year, indicating a bearish trend in the medium to long term.

The current price is 93.68% below its all-time high and 104.77% above its all-time low, suggesting that the token is in a recovery phase after hitting bottom. The 24-hour trading volume of $56,179 indicates moderate market activity. With a circulating supply of 1,069,347,017 MPT tokens, representing 35.64% of the total supply, there's potential for increased scarcity in the future.

Click to view the current MPT market price

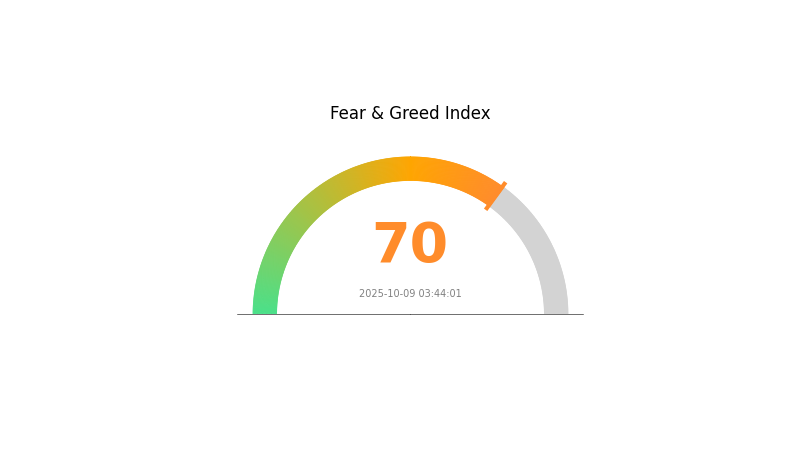

MPT Market Sentiment Indicator

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of greed, with the Fear and Greed Index reaching 70. This suggests that investors are optimistic and potentially overconfident. While this may indicate bullish momentum, it's crucial to remain cautious. High levels of greed often precede market corrections. Traders should consider taking profits or hedging their positions. Remember, market sentiment can shift quickly, so stay informed and manage your risk wisely on platforms like Gate.com.

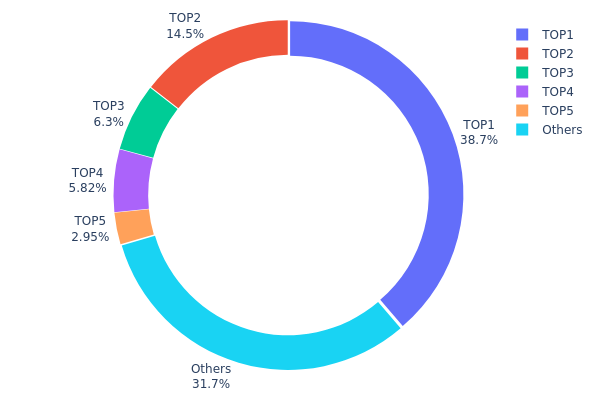

MPT Holdings Distribution

The address holdings distribution chart for MPT reveals a significantly concentrated ownership structure. The top address holds a substantial 38.73% of the total supply, while the top 5 addresses collectively control 68.27% of MPT tokens. This concentration level raises concerns about the token's decentralization and potential market vulnerabilities.

Such a high concentration of holdings in a few addresses could have significant implications for MPT's market dynamics. It potentially increases the risk of price manipulation and heightened volatility, as large holders have the capacity to influence the market through substantial buy or sell orders. Furthermore, this concentration may deter smaller investors due to perceived centralization risks.

From a broader perspective, the current holdings distribution suggests a relatively low level of decentralization for MPT. While this concentration might provide some stability in terms of reduced selling pressure from a dispersed holder base, it also poses risks to the overall ecosystem stability and governance structure of the project. Potential investors and analysts should closely monitor any changes in this distribution for insights into MPT's long-term market health and decentralization efforts.

Click to view the current MPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xee3e...ddca37 | 308726.95K | 38.73% |

| 2 | 0x4a54...b7f42f | 115325.43K | 14.47% |

| 3 | 0x0d07...b492fe | 50211.63K | 6.30% |

| 4 | 0xef96...7c2c61 | 46410.57K | 5.82% |

| 5 | 0x863d...02354a | 23513.99K | 2.95% |

| - | Others | 252773.28K | 31.73% |

II. Core Factors Affecting MPT's Future Price Trends

Supply Mechanism

- Dynamic Asset Allocation: MPT emphasizes diversifying investments across various asset classes to optimize risk-return balance.

- Historical Pattern: Asset allocation strategies have historically accounted for over 90% of portfolio return variations.

- Current Impact: MPT's flexible approach allows for real-time adjustments to market changes, potentially leading to more stable returns.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions are increasingly adopting MPT strategies for portfolio management.

- Corporate Adoption: Investment firms like Man Group's AHL are incorporating MPT principles with machine learning for enhanced performance.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, including interest rate changes and quantitative easing, significantly influence MPT strategy effectiveness.

- Inflation Hedging Properties: MPT's diversification principle can help portfolios maintain value during inflationary periods.

- Geopolitical Factors: Global economic uncertainties and trade tensions affect asset correlations, impacting MPT model assumptions.

Technological Development and Ecosystem Building

- Machine Learning Integration: Advanced algorithms are being used to enhance MPT models, improving asset allocation decisions.

- Real-time Data Processing: Improved computing power allows for more frequent portfolio rebalancing based on MPT principles.

- Ecosystem Applications: Robo-advisors and automated trading platforms are increasingly utilizing MPT for retail investors.

III. MPT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00598 - $0.00831

- Neutral prediction: $0.00831 - $0.01026

- Optimistic prediction: $0.01026 - $0.01221 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00950 - $0.01252

- 2028: $0.00996 - $0.01564

- Key catalysts: Project milestones, broader crypto market recovery, increased adoption

2029-2030 Long-term Outlook

- Base scenario: $0.01375 - $0.01664 (assuming steady project growth and market adoption)

- Optimistic scenario: $0.01664 - $0.02479 (assuming strong project performance and favorable market conditions)

- Transformative scenario: $0.02479+ (assuming breakthrough innovations and mass adoption)

- 2030-12-31: MPT $0.02479 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01221 | 0.00831 | 0.00598 | 0 |

| 2026 | 0.0121 | 0.01026 | 0.00718 | 23 |

| 2027 | 0.01252 | 0.01118 | 0.0095 | 34 |

| 2028 | 0.01564 | 0.01185 | 0.00996 | 42 |

| 2029 | 0.01952 | 0.01375 | 0.01045 | 65 |

| 2030 | 0.02479 | 0.01664 | 0.01298 | 100 |

IV. MPT Professional Investment Strategies and Risk Management

MPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate MPT tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to manage downside risk

MPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MPT

MPT Market Risks

- High volatility: Significant price fluctuations common in small-cap tokens

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

MPT Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of esports tokens

- Cross-border compliance: Challenges in adhering to varying international regulations

- AML/KYC requirements: Possible impact on token utility and adoption

MPT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability issues: Possible network congestion on the Polygon blockchain

- Cybersecurity threats: Risk of hacks or attacks on the Miracle Play platform

VI. Conclusion and Action Recommendations

MPT Investment Value Assessment

MPT offers exposure to the growing esports industry through blockchain technology. While it presents long-term potential, short-term volatility and regulatory uncertainties pose significant risks.

MPT Investment Recommendations

✅ Beginners: Consider small, experimental positions with strict risk management ✅ Experienced investors: Implement dollar-cost averaging strategy with defined exit points ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

MPT Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Limit orders: Use to potentially capture better entry/exit prices

- DCA strategy: Regular small purchases to average out price volatility

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What meme coin will explode in 2025 price prediction?

Popcat is predicted to explode in 2025. It's expected to be listed on major exchanges like Binance, with a strong community and high market cap potential.

What is the prediction for Mog coin in 2040?

By 2040, MOG coin is predicted to reach a maximum of $0.000005539 and a minimum of $0.000000483, based on current market analysis.

What is Nvidia's price prediction for 2025?

Based on market analysis, Nvidia's price prediction for 2025 is $223.90. This forecast suggests potential growth in the stock's value.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, marking a significant milestone in its growth trajectory.

2025 WILDPrice Prediction: Analyzing Market Trends and Growth Potential for the WILD Token Ecosystem

2025 NBLU Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SOMI Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is VEMP (VEMP) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 WILD Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

2025 WILD Price Prediction: Navigating the Crypto Jungle - Will WILD Roar or Whimper?

What is SHIB token holdings and fund flow: exchange net inflows, concentration, staking rate, and on-chain lock-up analysis?

What is Kaspa (KAS) vs Bitcoin: Competitive Analysis of Performance, Market Cap, and User Base in 2025?

How to Use On-Chain Data Analysis to Identify BEAT Token Whale Movements and Trading Opportunities

Gate Fun: The No-Code Token Launch Platform for Web3 Creators and Investors

How to Conduct Competitive Analysis in Crypto: A Complete Guide to Market Positioning and Market Share Comparison