2025 OLA Price Prediction: Analyzing Growth Potential and Market Trends for OLA Token

Introduction: OLA's Market Position and Investment Value

Ola (OLA), as an Earnings-Enhancing Layer driven by the Bitcoin ecosystem, has been unlocking the potential of $1.5 trillion in BTC assets since its inception. As of 2025, OLA's market capitalization has reached $17,890.2024, with a circulating supply of approximately 130,872,000 tokens, and a price hovering around $0.0001367. This asset, known as the "Bitcoin Ecosystem Enhancer," is playing an increasingly crucial role in empowering the Bitcoin network and providing earning opportunities for users.

This article will comprehensively analyze OLA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. OLA Price History Review and Current Market Status

OLA Historical Price Evolution

- 2024: OLA launched, reaching its all-time high of $0.041581 on November 15

- 2025: Significant market correction, price dropped to its all-time low of $0.0001025 on November 2

OLA Current Market Situation

As of November 3, 2025, OLA is trading at $0.0001367, showing a 7.8% increase in the last 24 hours. The token has experienced a substantial decline over the past month, with a 64.18% decrease in value. OLA's market capitalization currently stands at $17,890.2024, ranking 6853rd in the cryptocurrency market. The circulating supply is 130,872,000 OLA, which represents 6.232% of the total supply of 2,100,000,000 tokens. The 24-hour trading volume is $5,113.49, indicating moderate market activity. Despite the recent uptick, OLA is still trading significantly below its all-time high, reflecting the volatile nature of the cryptocurrency market.

Click to view the current OLA market price

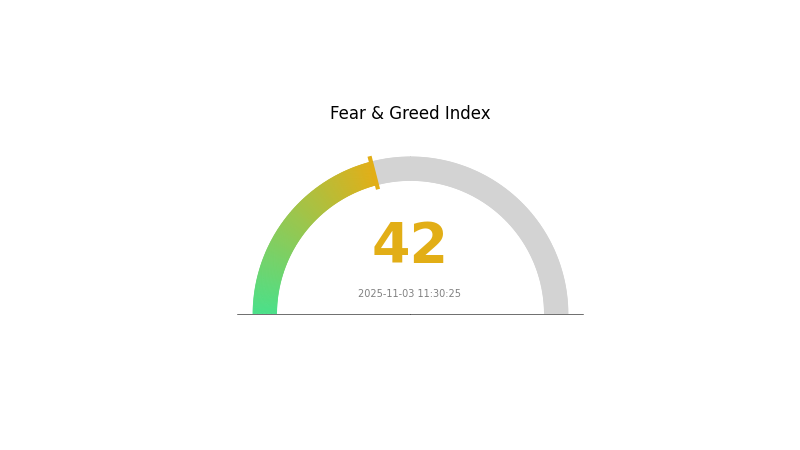

OLA Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 42, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. During such periods, it's crucial to stay informed and make rational decisions. Remember, market cycles are natural, and periods of fear often precede recoveries. Consider using Gate.com's advanced tools to navigate these uncertain times and potentially capitalize on market movements.

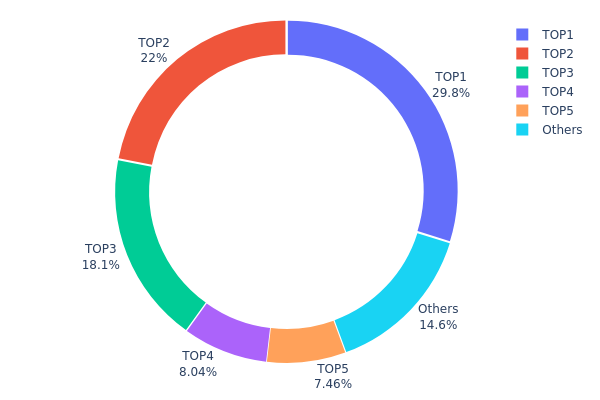

OLA Holdings Distribution

The address holdings distribution data for OLA reveals a highly concentrated ownership structure. The top 5 addresses collectively hold 85.41% of the total OLA supply, with the largest single address controlling 29.82%. This level of concentration raises concerns about the token's decentralization and potential market manipulation risks.

The second and third largest holders, with 22.00% and 18.09% respectively, further contribute to the centralized nature of OLA's distribution. Such a top-heavy structure could lead to increased volatility in OLA's price, as large holders have the potential to significantly impact the market with their trading activities. Additionally, this concentration may affect the overall stability of the OLA ecosystem, as decisions or actions by these major holders could have outsized effects on the token's governance and utility.

While a certain degree of concentration is not uncommon in newer cryptocurrencies, OLA's current distribution suggests a need for increased diversification to enhance its resilience and market stability. Potential investors should be aware of these dynamics when considering OLA's long-term prospects and potential for decentralized governance.

Click to view the current OLA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x127d...9e5573 | 626330.47K | 29.82% |

| 2 | 0x5034...fb644e | 462000.00K | 22.00% |

| 3 | 0x5da5...ac6ba8 | 380035.00K | 18.09% |

| 4 | 0xe1cd...3a98d4 | 168919.24K | 8.04% |

| 5 | 0x637c...58d8ba | 156660.00K | 7.46% |

| - | Others | 306055.29K | 14.59% |

II. Key Factors Affecting OLA's Future Price

Supply Mechanism

- Tokenomics: Details of OLA's supply mechanism are not specified in the given information.

- Current Impact: The current impact of supply changes on OLA's price is not mentioned in the provided context.

Institutional and Whale Dynamics

- Corporate Adoption: OLA has been expanding its deployment of screens, customer base, and geographical coverage over the past seven calendar quarters.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve is expected to continue rate cuts in October, which could influence crypto market liquidity.

- Geopolitical Factors: Potential trade tensions between the US and China, as well as ongoing conflicts in Ukraine and the Middle East, may impact global markets and cryptocurrency prices.

Technological Development and Ecosystem Building

- Geographical Expansion: OLA's future plans include expanding to more Mexican cities and international expansion across Latin America.

- Screen Deployment: OLA aims to increase the number of deployed screens as part of its growth strategy.

III. OLA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00009 - $0.00012

- Neutral prediction: $0.00012 - $0.00016

- Optimistic prediction: $0.00016 - $0.0002 (requires favorable market conditions and project developments)

2026-2028 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2026: $0.00013 - $0.00021

- 2027: $0.00017 - $0.00024

- 2028: $0.00016 - $0.00023

- Key catalysts: Ecosystem expansion, technological advancements, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00022 - $0.00026 (assuming steady project development and market growth)

- Optimistic scenario: $0.00026 - $0.00035 (with significant project milestones and favorable market conditions)

- Transformative scenario: $0.00035+ (with groundbreaking innovations and mass adoption)

- 2030-12-31: OLA $0.00035 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0002 | 0.00014 | 0.00009 | 0 |

| 2026 | 0.00021 | 0.00017 | 0.00013 | 23 |

| 2027 | 0.00024 | 0.00019 | 0.00017 | 39 |

| 2028 | 0.00023 | 0.00021 | 0.00016 | 56 |

| 2029 | 0.00026 | 0.00022 | 0.00012 | 61 |

| 2030 | 0.00035 | 0.00024 | 0.00021 | 77 |

IV. Professional Investment Strategies and Risk Management for OLA

OLA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and Bitcoin ecosystem believers

- Operation suggestions:

- Accumulate OLA tokens during market dips

- Monitor the development of Ola's core products: Onis and Massive

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Pay attention to Bitcoin ecosystem news and updates

- Set stop-loss orders to manage downside risk

OLA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance OLA with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for OLA

OLA Market Risks

- High volatility: OLA price may experience significant fluctuations

- Low liquidity: Limited trading volume may impact price stability

- Correlation with Bitcoin: OLA's performance may be heavily influenced by Bitcoin's market movements

OLA Regulatory Risks

- Uncertain regulatory environment: Potential changes in cryptocurrency regulations

- Cross-border compliance: Varying legal standards across different jurisdictions

- Tax implications: Evolving tax laws related to cryptocurrency earnings

OLA Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token's underlying code

- Scalability challenges: Possible limitations in handling increased network activity

- Dependency on Bitcoin network: Technical issues with Bitcoin could impact OLA's functionality

VI. Conclusion and Action Recommendations

OLA Investment Value Assessment

OLA presents a unique opportunity within the Bitcoin ecosystem, offering potential long-term value through its earnings-enhancing layer. However, it carries significant short-term risks due to its low market cap and limited trading history.

OLA Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the project ✅ Experienced investors: Allocate a modest portion of portfolio, focusing on long-term potential ✅ Institutional investors: Conduct thorough due diligence and consider OLA as part of a diversified crypto strategy

OLA Trading Participation Methods

- Spot trading: Purchase OLA tokens on Gate.com

- Staking: Participate in staking programs if available on the Ola platform

- Ecosystem participation: Engage in roles like BitVM challengers or ZK bridge supervisors to earn rewards

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future prediction of Ola stock?

Based on current analysis, Ola stock is predicted to decrease by 25.10% and reach $0.0001085 by November 29, 2025. This forecast is subject to market conditions.

Why are Ola shares falling?

Ola shares are falling due to reports of SoftBank Group reducing its stake in the company, causing a 4% drop in stock prices.

Can Apple stock reach $1000?

Yes, Apple stock could potentially reach $1000 with continued strong performance, market expansion, and favorable economic conditions. Historical growth and future projections support this possibility.

Is Ola Electric overvalued?

Based on recent market analysis, Ola Electric may be overvalued. Its stock price has been questioned since early 2025, but current valuation remains uncertain due to market fluctuations.

Share

Content