2025 OORT Price Prediction: Expert Analysis and Market Forecast for the Next Generation Storage Token

Introduction: OORT's Market Position and Investment Value

OORT (OORT) is a decentralized AI infrastructure designed for data privacy and cost savings by integrating global compute and storage resources to empower trustworthy AI applications. Since its launch in January 2024, OORT has established itself as a significant player in the decentralized AI infrastructure space. As of December 2025, OORT's market capitalization has reached approximately $31.62 million with a circulating supply of around 669.11 million tokens, currently trading at $0.01582 per token.

This innovative infrastructure asset is playing an increasingly critical role in advancing decentralized artificial intelligence applications and data protection solutions. OORT is available for trading on Gate.com and other major platforms, making it accessible to global investors seeking exposure to the AI infrastructure sector.

This article will provide a comprehensive analysis of OORT's price movements and market trends through 2025-2030, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

OORT Price Historical Review and Market Status

I. OORT Price History Review and Current Market Situation

OORT Historical Price Evolution Trajectory

- 2024: OORT reached its all-time high of $1.22 on January 15, 2024, marking the peak of the asset's historical performance.

- 2025: The token experienced significant depreciation throughout the year, declining from its peak levels as market conditions shifted.

- December 2025: OORT approached its all-time low of $0.0151 on December 15, 2025, reflecting sustained downward pressure on the asset.

OORT Current Market Dynamics

As of December 22, 2025, OORT is trading at $0.01582, representing a marginal decline of 0.44% over the past 24 hours. The token's 1-hour price movement shows a slight decrease of 0.13%, while the 7-day period reflects more pronounced weakness with a 9.32% decline. Over the past 30 days, OORT has experienced a substantial pullback of 40.82%, and the one-year performance demonstrates a severe contraction of 90.33% from previous levels.

The 24-hour trading volume stands at $106,625.51, with the current market capitalization positioned at approximately $10.59 million based on circulating supply metrics. The fully diluted valuation reaches $31.62 million, indicating that circulating tokens represent approximately 33.46% of the maximum supply. With a total circulating supply of 669.11 million OORT tokens against a maximum supply cap of 2 billion tokens, the asset maintains a market dominance of 0.00099%.

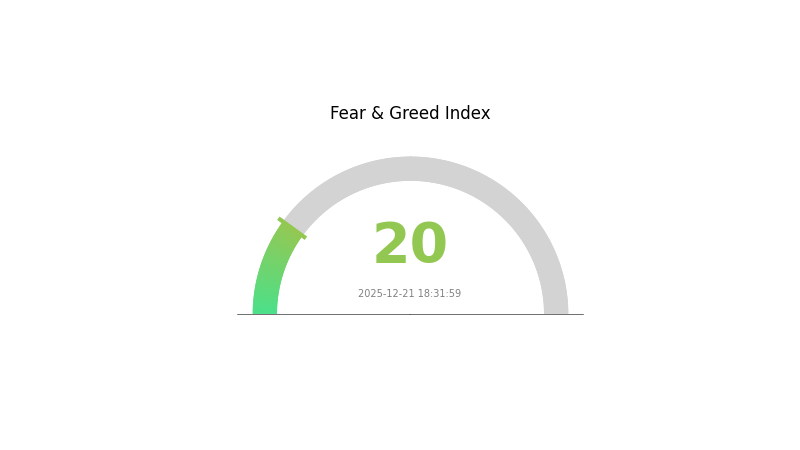

Current market sentiment reflects extreme fear conditions, with the VIX reading at 20, suggesting heightened volatility and risk aversion across cryptocurrency markets. OORT ranks 1,134 by market capitalization among cryptocurrencies globally.

Click to view current OORT market price

OORT Market Sentiment Index

2025-12-21 Fear & Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index dropping to 20. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as investors reassess risk exposure. However, extreme fear often presents contrarian opportunities for long-term investors, as assets may become oversold. Traders should exercise caution, conduct thorough analysis, and avoid panic-driven decisions. Consider diversifying your portfolio and monitoring market developments closely on Gate.com to make informed investment choices.

OORT Holdings Distribution

Click to view current OORT holdings distribution

The address holdings distribution map serves as a critical indicator for assessing token concentration risk and the decentralization level of a cryptocurrency project. By analyzing the distribution of OORT tokens across different addresses, investors and analysts can evaluate market structure stability, potential manipulation risks, and the overall health of the project's tokenomics. This metric provides transparent insights into whether holdings are widely dispersed among numerous participants or concentrated among a limited number of major stakeholders.

Unfortunately, the current dataset provided contains no recorded address holdings, which indicates either an insufficient data collection window or a lack of significant on-chain activity at this particular point in time. The absence of observable top holder positions suggests that either the OORT token is in an early distribution phase, has minimal on-chain presence, or the measurement period has not yet captured meaningful concentration patterns. This situation warrants continued monitoring to establish a comprehensive baseline for future comparison and risk assessment.

To properly evaluate OORT's decentralization characteristics and market structure integrity, ongoing observation of address distribution trends will be essential as the project matures and on-chain activity increases.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting OORT's Future Price

Supply and Demand Dynamics

- Mining Reward Mechanism: OORT token price fluctuations serve as a modulating factor for mining rewards, directly impacting future mining returns. However, token price movements are not the decisive factor in determining mining profitability.

- Market Demand Growth: The global cloud storage market demonstrates stable growth trends, with the decentralized cloud storage market currently representing a small portion of the overall storage market. The decentralized cloud storage sector is projected to double in growth over the next five years, driving increased demand for OORT tokens.

Market Sentiment and Ecosystem Dynamics

- Project Partnership Changes: OORT price movements are significantly influenced by project cooperation announcements and partnerships. On December 14, 2025, the project team announced the termination of partnership relations with a major exchange, which directly impacted market confidence and investor sentiment.

- Institutional Interest: Multiple institutional investors are actively monitoring and positioning in the DePIN narrative, with growing institutional FOMO (Fear of Missing Out) affecting market dynamics.

Technical Development and Ecosystem Construction

- Three-Layer Node Architecture: OORT implements enterprise-grade product experience through its proprietary three-layer node service provider system consisting of backup nodes, edge nodes, and super nodes, enhancing network efficiency and reliability.

III. 2025-2030 OORT Price Forecast

2025 Outlook

- Conservative Forecast: $0.01407 - $0.01581

- Neutral Forecast: $0.01581

- Optimistic Forecast: $0.01818 (requires sustained ecosystem development and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, characterized by moderate growth and infrastructure maturation

- Price Range Forecast:

- 2026: $0.0119 - $0.0187 (7% upside potential)

- 2027: $0.00946 - $0.02088 (12% upside potential)

- Key Catalysts: Platform upgrades, expanded partnership ecosystem, growing developer adoption, and mainstream awareness building

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01839 - $0.02575 (22% growth by 2028), assuming steady market conditions and consistent protocol improvements

- Optimistic Scenario: $0.02008 - $0.02887 (42% growth by 2029), contingent on accelerated institutional adoption and successful network expansion

- Transformational Scenario: $0.02572 - $0.03009 (62% growth by 2030), under conditions of breakthrough technological innovations, major exchange listings on platforms like Gate.com, and widespread enterprise integration

- 2030-12-31: OORT approaching $0.03009 (multi-year accumulation phase completed)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01818 | 0.01581 | 0.01407 | 0 |

| 2026 | 0.0187 | 0.017 | 0.0119 | 7 |

| 2027 | 0.02088 | 0.01785 | 0.00946 | 12 |

| 2028 | 0.02575 | 0.01936 | 0.01839 | 22 |

| 2029 | 0.02887 | 0.02256 | 0.02008 | 42 |

| 2030 | 0.03009 | 0.02572 | 0.01569 | 62 |

OORT Investment Strategy and Risk Management Report

I. Executive Summary

OORT is a decentralized AI infrastructure platform designed to protect data privacy while reducing operational costs. By integrating global compute and storage resources, OORT enables trustworthy AI applications. As of December 22, 2025, OORT is trading at $0.01582 with a market capitalization of approximately $10.59 million and a 24-hour trading volume of $106,625.51.

Key Metrics:

- Current Price: $0.01582

- 24-Hour Change: -0.44%

- Market Rank: #1,134

- Circulating Supply: 669,110,737 OORT (33.46% of total supply)

- Total Supply: 1,998,899,999 OORT

- Market Cap: $10,585,331.86

- All-Time High: $1.22 (January 15, 2024)

- All-Time Low: $0.0151 (December 15, 2025)

II. OORT Market Performance Analysis

Price Volatility Assessment

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | -0.13% | -$0.000020592 |

| 24 Hours | -0.44% | -$0.000069915 |

| 7 Days | -9.32% | -$0.001625963 |

| 30 Days | -40.82% | -$0.010912004 |

| 1 Year | -90.33% | -$0.147778759 |

Analysis: OORT has experienced significant downward pressure over the past year, with a 90.33% decline from its all-time high. The token has traded down 40.82% over the past month, indicating considerable volatility and bearish sentiment in the short to medium term.

Market Position

- Market Dominance: 0.00099%

- Circulating to Total Supply Ratio: 33.46%

- Listed on: 4 exchanges

- Trading Status: Active on Gate.com

III. OORT Professional Investment Strategy and Risk Management

OORT Investment Methodology

(1) Long-Term Holding Strategy

Suitable For: Long-term believers in decentralized AI infrastructure, risk-tolerant investors with extended time horizons, and those positioned to accumulate during market downturns.

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Accumulate OORT periodically regardless of price fluctuations to reduce timing risk and build positions gradually

- Accumulation Phase: Current low prices near all-time lows may present entry opportunities for those bullish on AI infrastructure adoption

- Secure Storage: Transfer acquired OORT to secure cold storage solutions for extended holding periods, minimizing exchange counterparty risk

(2) Active Trading Strategy

Technical Analysis Considerations:

- Volatility Monitoring: Track extreme price swings; the 90% year-over-year decline suggests significant volatility requiring careful position sizing

- Support and Resistance Levels: Monitor trading patterns between the current price of $0.01582 and recent lows near $0.0151

- Volume Analysis: Current 24-hour volume of $106,625.51 indicates moderate liquidity; ensure position sizes accommodate exit requirements

Wave Trading Key Points:

- Trend Identification: The long-term downtrend requires careful analysis before pursuing mean reversion strategies

- Risk Management: Set strict stop-loss orders to protect against further downside; the 40% monthly decline demonstrates rapid loss potential

- Profit-Taking: Establish predefined exit targets during any recovery phases rather than holding through extended downturns

OORT Risk Management Framework

(1) Asset Allocation Principles

Given OORT's high volatility and recent sharp declines, position sizing should reflect risk tolerance:

- Conservative Investors: 0-2% of portfolio allocation recommended

- Moderate Investors: 2-5% of portfolio allocation recommended

- Aggressive Investors: 5-10% of portfolio allocation recommended

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance OORT positions with established cryptocurrencies and traditional assets; avoid concentration risk in a single volatile token

- Staged Entry Approach: Deploy capital across multiple entry points rather than all-at-once purchases to reduce timing risk

(3) Secure Storage Solutions

- Custodial Security: For active trading, maintain positions on Gate.com with strong authentication protocols (two-factor authentication, withdrawal whitelisting)

- Non-Custodial Storage: For long-term holdings, consider professional-grade security solutions with multi-signature protection

- Security Best Practices: Never share private keys or seed phrases; use separate devices for trading and storage; enable all available security features on exchanges and wallets

IV. OORT Potential Risks and Challenges

Market Risk

- Extreme Volatility: The 90.33% annual decline and 40.82% monthly drop demonstrate severe price instability, creating significant liquidation and loss risks for leveraged positions

- Liquidity Constraints: Limited exchange listings (only 4 exchanges) and moderate trading volumes may result in slippage and difficulty exiting large positions

- Low Market Cap: At $10.59 million, OORT has a relatively small market capitalization, making it susceptible to market manipulation and sudden price swings

Regulatory Risk

- AI Regulation Uncertainty: Evolving global AI regulations could impact the demand for and operation of decentralized AI infrastructure platforms

- Exchange Listing Constraints: Regulatory developments may affect which exchanges list and trade OORT tokens

- Jurisdictional Challenges: Different countries' approaches to cryptocurrency and AI technology create operational uncertainties

Technology Risk

- Project Development: Limited historical data and recent market performance raise questions about execution capability and product-market fit

- Competition: The AI infrastructure space faces competition from both centralized and decentralized solutions; OORT must demonstrate competitive advantages

- Ecosystem Adoption: The success of OORT depends on developer adoption and integration into trustworthy AI applications; slow adoption could undermine value proposition

V. Conclusion and Action Recommendations

OORT Investment Value Assessment

OORT represents a potentially significant innovation in decentralized AI infrastructure with a compelling privacy-first value proposition. However, the severe year-over-year decline of 90.33% and concentrated market position present substantial risks. The current market valuation may reflect either significant pessimism or genuine concerns about project execution and market adoption.

The token's long-term value depends on:

- Successful integration into real-world AI applications

- Growth in the decentralized AI infrastructure market

- Ability to differentiate from competing solutions

- Successful mainnet operations and ecosystem development

OORT Investment Guidance

✅ Beginners: Start with minimal positions (0-2% portfolio) only if you understand decentralized AI infrastructure concepts; use this primarily as a learning opportunity rather than core portfolio holding. Dollar-cost averaging entry strategies are preferable to lump-sum purchases.

✅ Experienced Investors: Consider small tactical positions (2-5% portfolio) with strict risk management protocols. The current depressed valuation may warrant accumulation for experienced traders comfortable with high volatility, but should not represent core holdings.

✅ Institutional Investors: Conduct thorough technical due diligence on project development progress, competitive positioning, and regulatory compliance before any consideration. Institutional positions should incorporate comprehensive risk management and diversification strategies.

OORT Trading Participation Methods

- Gate.com Trading: Trade OORT directly on Gate.com with spot trading or margin trading options (use margin trading only with comprehensive risk management)

- Dollar-Cost Averaging Purchases: Set up periodic purchases through Gate.com to systematically build positions while reducing timing risk

- Exchange Fund Transfers: For long-term storage, transfer purchased OORT to secure self-custody solutions for optimal security

Disclaimer: Cryptocurrency investment carries extreme risk. This report does not constitute financial or investment advice. Investors should make decisions based on their personal risk tolerance, financial situation, and investment objectives. Consult qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely. Past performance does not guarantee future results.

FAQ

Is Oort a good investment?

Oort demonstrates strong investment potential with promising technical indicators and growth prospects. Its innovative technology and increasing adoption suggest favorable long-term value appreciation opportunities for investors.

What is OORT token and what is its use case?

OORT token is the native token of Oort Mainnet, used for gas fees, network security, and staking. It powers transactions and secures the decentralized data cloud blockchain ecosystem.

What factors could influence OORT price in the future?

OORT price will be influenced by supply and demand dynamics, protocol updates, hard forks, and block reward halvings. Market sentiment, adoption rates, and macroeconomic conditions also play significant roles in price movements.

How does OORT compare to other similar blockchain projects?

OORT stands out by developing its native Olympus protocol rather than relying on existing blockchains like Ethereum or Solana. It uniquely focuses on decentralized AI infrastructure, offering superior scalability and specialized features for distributed machine learning compared to similar projects.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

Beginner's Guide: How to Purchase ONDO Coins and Understanding the ONDO Token

Understanding Swarms: Essential Details and Purchase Guide

Decentralized AI: A New Dawn with Blockchain Mainnet Launch

A Comprehensive Guide to America's Iconic Digital Meme Coin on Solana

Kaito AI: Exploring the Web3 Crypto Analytics Platform and Purchase Guide