2025 QANX Price Prediction: Expert Analysis and Market Forecast for Quantum Computing's Next Digital Asset

Introduction: QANX's Market Position and Investment Value

QANplatform (QANX) stands as the first hybrid blockchain platform designed with quantum resistance, marking a significant innovation in Layer 1 blockchain technology since its inception in 2021. As of December 2025, QANX has achieved a market capitalization of $28.56 million, with a circulating supply of approximately 1.7 billion tokens trading at around $0.0168 per unit. This quantum-resistant asset is increasingly playing a critical role in enabling developers to build secure smart contracts, DApps, DeFi solutions, tokens, NFTs, and metaverse applications on a future-proof blockchain infrastructure.

This comprehensive analysis will examine QANX's price dynamics through 2030, incorporating historical performance trends, market supply-demand mechanics, ecosystem development trajectories, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants seeking exposure to quantum-resistant blockchain technologies.

QANplatform (QANX) Market Analysis Report

I. QANX Price History Review and Current Market Status

QANX Historical Price Evolution

- November 28, 2021: All-time high (ATH) reached at $0.203412, representing the peak market valuation during the initial hype cycle.

- January 13, 2023: All-time low (ATL) recorded at $0.00011724, marking the lowest point in the token's trading history.

- December 19, 2025: Current price stands at $0.0168, down 75.22% over the past year, reflecting sustained downward pressure from the 2021 peak.

QANX Current Market Status

As of December 19, 2025, QANX is trading at $0.0168 with a 24-hour price decline of 3.63%. The token is experiencing significant bearish momentum across multiple timeframes:

- 1-hour change: -2.33%

- 7-day change: -10.17%

- 30-day change: -25.89%

- 1-year change: -75.22%

The 24-hour trading volume stands at $39,772.67, with the price range fluctuating between $0.0163 (low) and $0.01763 (high). The market capitalization is valued at $28.56 million, with a fully diluted valuation of $35.27 million, placing QANX at rank #716 in the overall crypto market with a market dominance of 0.0010%.

The circulating supply comprises 1.7 billion tokens out of a total supply of 2.1 billion QANX, representing approximately 51% of the maximum supply cap of 3.33 billion tokens. The token maintains a holder base of 7,266 addresses and is currently listed on 3 exchanges.

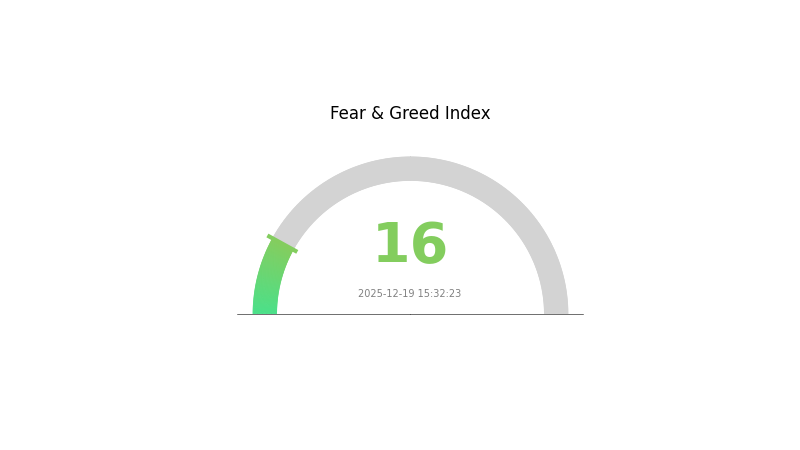

Market sentiment reflects "Extreme Fear" conditions with a VIX rating of 16, indicating heightened market anxiety and risk aversion among investors.

View current QANX market price

QANX Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reaching 16. This indicates strong bearish sentiment and significant market pessimism. During such periods, investors often exhibit heightened risk aversion and reduced appetite for market participation. However, contrarian investors may view extreme fear as potential buying opportunities, as historically, major market recovers often follow periods of severe negative sentiment. Monitor market developments closely and consider your risk tolerance when making trading decisions on Gate.com.

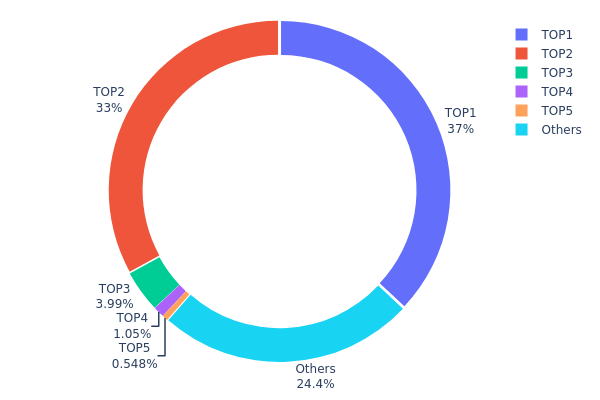

QANX Token Holdings Distribution

The address holdings distribution map provides a comprehensive view of how QANX tokens are allocated across different blockchain addresses, serving as a critical indicator of token concentration and decentralization. This metric reveals the proportion of total token supply held by top addresses and the remaining distribution among other holders, offering crucial insights into the token's market structure and potential vulnerability to price manipulation.

The current holdings distribution of QANX exhibits significant concentration characteristics. The top two addresses collectively control 70.01% of the total token supply, with the largest address holding 37.01% and the second-largest holding 33.00%. The third-largest address accounts for 3.99%, while the remaining top five addresses hold comparatively smaller proportions at 1.05% and 0.54% respectively. The "Others" category, representing all remaining addresses, holds 24.41% of the total supply. This distribution pattern indicates a moderate to high degree of token concentration, particularly pronounced in the top two positions.

This concentrated holdings structure presents notable implications for market dynamics and stability. The substantial accumulation of tokens in a small number of addresses raises concerns regarding potential market manipulation and price volatility. Large holders, often referred to as whales, possess significant influence over supply dynamics and could theoretically execute coordinated selling or holding strategies that impact token price movements. The relatively high concentration suggests limited decentralization, which may inhibit the development of a truly distributed and resilient market ecosystem. However, the 24.41% distribution among other addresses does provide a degree of checks and balances, preventing absolute market dominance by any single entity or coordinated group.

Click to view current QANX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 1233783.00K | 37.01% |

| 2 | 0x3e9d...33a32a | 1100000.00K | 33.00% |

| 3 | 0xaaa9...cc3aaa | 133071.26K | 3.99% |

| 4 | 0xc882...84f071 | 35023.84K | 1.05% |

| 5 | 0xd7f3...904cd8 | 18275.10K | 0.54% |

| - | Others | 813179.80K | 24.41% |

II. Core Factors Affecting QANX Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central bank policies and global economic trends significantly influence QANX price movements. The cryptocurrency market remains sensitive to macroeconomic fluctuations and policy shifts.

-

Regulatory and Policy Environment: Policy regulation and government oversight are key factors affecting price trajectories. Changes in cryptocurrency regulatory frameworks can create substantial price volatility in the market.

Technology Development and Ecosystem Construction

-

Market Sentiment and Innovation: Investor sentiment combined with technological advancements play crucial roles in determining QANX's future valuation. Continued innovation within the platform ecosystem supports long-term price appreciation potential.

-

Market Demand Dynamics: Market demand represents a fundamental driver of price movements. Investor interest and adoption rates directly impact the cryptocurrency's market performance.

III. 2025-2030 QANX Price Forecast

2025 Outlook

- Conservative Forecast: $0.01118 - $0.01644

- Base Case Forecast: $0.01644

- Optimistic Forecast: $0.02285 (requires sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Perspective

- Market Stage Expectation: Potential recovery and consolidation phase with gradual upward momentum building on fundamental developments

- Price Range Predictions:

- 2026: $0.011 - $0.02574

- 2027: $0.0118 - $0.03041

- 2028: $0.01726 - $0.03796

- Key Catalysts: Expansion of ecosystem partnerships, improved market sentiment, increased protocol adoption, and potential regulatory clarity supporting digital assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02419 - $0.0458 (assumes steady ecosystem development and moderate market expansion)

- Optimistic Scenario: $0.02498 - $0.04645 (assumes accelerated adoption and favorable macroeconomic conditions)

- Transformative Scenario: $0.03226 - $0.04645 (assumes breakthrough technological milestones and mainstream institutional participation)

- 2030-12-31: QANX projected at approximately $0.03903 (midpoint valuation representing 132% cumulative gain from 2025)

Note: These forecasts are analytical projections based on historical data patterns and represent potential price movements. Actual market performance may vary significantly based on technological developments, regulatory changes, market cycles, and macroeconomic factors. Investors should conduct independent research before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02285 | 0.01644 | 0.01118 | -2 |

| 2026 | 0.02574 | 0.01965 | 0.011 | 16 |

| 2027 | 0.03041 | 0.02269 | 0.0118 | 35 |

| 2028 | 0.03796 | 0.02655 | 0.01726 | 58 |

| 2029 | 0.0458 | 0.03226 | 0.02419 | 92 |

| 2030 | 0.04645 | 0.03903 | 0.02498 | 132 |

QANplatform (QANX) Professional Investment Analysis Report

IV. QANX Professional Investment Strategy and Risk Management

QANX Investment Methodology

(1) Long-Term Holding Strategy

- Suitable investors: Investors with conviction in quantum-resistant blockchain technology and long-term cryptocurrency adoption

- Operational recommendations:

- Accumulate QANX during market downturns, taking advantage of the current -75.22% year-over-year decline

- Hold through market cycles to benefit from potential adoption of the QANplatform ecosystem

- Rebalance portfolio quarterly based on market conditions and project milestones

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use 20-day and 50-day moving averages to identify trend direction and potential entry/exit points

- Support and resistance levels: Current price of $0.0168 serves as recent support; historical high of $0.203412 represents significant resistance

- Wave trading key points:

- Monitor 24-hour volume ($39,772.67) for liquidity confirmation before executing trades

- Enter positions when market sentiment shifts from negative to neutral, supported by increasing volume

QANX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio allocation

- Active investors: 3-5% of portfolio allocation

- Professional investors: 5-10% of portfolio allocation

(2) Risk Hedging Strategies

- Position sizing: Limit individual QANX positions to prevent significant portfolio impact given the asset's high volatility

- Dollar-cost averaging: Implement systematic purchasing over time to reduce timing risk and average entry costs

(3) Secure Storage Solutions

- Hot wallet solution: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold storage approach: Transfer long-term holdings to secure offline storage to mitigate hacking risks

- Security considerations: Always enable two-factor authentication, never share private keys, regularly verify contract addresses before transactions

V. QANX Potential Risks and Challenges

QANX Market Risk

- Extreme price volatility: QANX has experienced a 75.22% decline over one year and a 25.89% decline over 30 days, indicating significant price instability

- Low trading volume: Daily volume of $39,772.66 suggests limited liquidity, which may result in slippage on larger trades

- Market cap concentration: With a market cap of $28.56 million (ranking #716), the token faces challenges in maintaining sustained investor interest

QANX Regulatory Risk

- Quantum computing regulatory uncertainty: Regulatory frameworks for quantum-resistant technologies remain underdeveloped globally

- Token classification ambiguity: Potential changes in how regulators classify blockchain tokens could impact QANX's operational status

- Jurisdictional compliance: Different regulatory approaches across regions may limit platform accessibility and adoption

QANX Technical Risk

- Proof of Randomness (PoR) consensus validation: The relatively new consensus algorithm requires extensive real-world testing and community validation

- EVM compatibility challenges: While Ethereum compatibility is promised, integration complexities may impact developer adoption

- Ecosystem maturity: Early-stage platform development means potential technical issues, protocol changes, and unexpected vulnerabilities

VI. Conclusion and Action Recommendations

QANX Investment Value Assessment

QANplatform presents a speculative investment opportunity centered on quantum-resistant blockchain technology. The platform's unique value proposition—enabling quantum-safe smart contracts, DApps, and DeFi solutions with minimal hardware requirements—addresses a genuine long-term need as quantum computing advances. However, the significant 75.22% year-over-year decline, low trading volume, and early-stage development status indicate substantial risk. The project remains primarily in the development phase with limited real-world adoption metrics. Investment decisions should be grounded in belief in the quantum-resistance narrative and long-term blockchain adoption, not short-term price appreciation.

QANX Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through Gate.com, focus on understanding quantum-resistant blockchain concepts before increasing exposure

✅ Experienced investors: Consider 3-5% portfolio allocation using dollar-cost averaging strategy, monitor project development milestones and community growth metrics

✅ Institutional investors: Conduct thorough technical audits of the PoR consensus algorithm and evaluate the team's execution capabilities before significant commitment

QANX Trading Participation Methods

- Gate.com spot trading: Direct purchase and sale of QANX tokens with real-time price discovery and transparent order books

- Long-term staking: Hold QANX to potentially participate in platform validation as verifier nodes once the mainnet reaches maturity

- Portfolio integration: Include QANX as a satellite position within a diversified crypto portfolio focused on emerging blockchain infrastructure

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly advised to consult with professional financial advisors. Never invest funds you cannot afford to lose.

FAQ

What is qanx crypto?

QANX is the native cryptocurrency of QANplatform, a quantum-resistant blockchain designed for enterprise applications. It incentivizes developers, enables staking, and powers transactions on the platform.

How much is a Quanx coin worth?

As of December 2025, a Quanx coin is worth approximately $0.0175, with a market cap of $29.77 million. The price fluctuates based on market demand and trading volume.

What will QNT be worth in 2030?

Based on current market analysis, Quant (QNT) is projected to reach between $101.21 and $190.35 by 2030. The exact value depends on market adoption, network growth, and broader crypto market conditions during this period.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Understanding Ethereum Name Service: A Comprehensive Overview

QKC vs UNI: Comparing Two Leading Decentralized Exchange Tokens in the DeFi Ecosystem

AI Agents Transforming DeFi: The Next Frontier in Crypto Innovation

Unveiling Bitcoin Inscriptions: A Guide to Ordinal Theory in Web3

HSK vs FLOW: A Comprehensive Comparison of Two Popular Chinese Language Proficiency Assessment Systems