2025 RSC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: RSC's Market Position and Investment Value

ResearchCoin (RSC) is an innovative token designed to incentivize participation in the ResearchHub ecosystem, a decentralized platform dedicated to accelerating scientific discovery through collaborative research and open access. Since its launch in November 2022, RSC has established itself as a unique asset bridging blockchain technology and academic advancement. As of December 2025, RSC boasts a market capitalization of $150.2 million with a circulating supply of approximately 128.2 million tokens, trading at around $0.1502. This utility token represents a novel approach to democratizing scientific knowledge and rewarding scholarly contributions.

This article provides a comprehensive analysis of RSC's price trajectories from 2025 to 2030, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for participants considering exposure to this emerging research-focused digital asset.

ResearchCoin (RSC) Market Analysis Report

I. RSC Price History Review and Current Market Status

RSC Historical Price Movement Trajectory

Based on available data, ResearchCoin (RSC) has experienced significant volatility since its launch on November 7, 2022:

-

2025 (Year-to-date): RSC reached its all-time high of $1.6 on January 3, 2025, reflecting strong early-year market sentiment. However, the token subsequently experienced a prolonged decline throughout the year.

-

December 2025: RSC touched its all-time low of $0.1411 on December 18, 2025, representing a dramatic 91.19% decline from its peak. This marks the most severe drawdown in the token's trading history.

Key Performance Metrics:

- 1-Year Change: -84.96%

- 30-Day Change: -37.01%

- 7-Day Change: -15.7%

- 24-Hour Change: +0.6%

- 1-Hour Change: +0.86%

RSC Current Market Situation

As of December 20, 2025, ResearchCoin is trading at $0.1502, showing marginal recovery from its recent lows. The token currently ranks 882nd by market capitalization.

Key Market Metrics:

| Metric | Value |

|---|---|

| Current Price | $0.1502 |

| 24-Hour High/Low | $0.1511 / $0.1438 |

| Market Capitalization | $19,256,741.51 |

| Fully Diluted Valuation | $150,200,000.00 |

| 24-Hour Trading Volume | $24,553.04 |

| Circulating Supply | 128,207,333.60 RSC |

| Total Supply | 1,000,000,000 RSC |

| Circulating Supply Ratio | 12.82% |

| Market Dominance | 0.0046% |

| Active Holders | 75,128 |

The current market sentiment indicates "Extreme Fear" with a VIX reading of 20. Despite the severe year-long decline, RSC has stabilized near its recent lows and shows modest intraday gains. The token maintains liquidity across 12 exchanges and demonstrates sustained holder engagement with over 75,000 active addresses.

View current RSC market price

RSC Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear sentiment with an index reading of 20. This indicates heightened market anxiety and significant risk aversion among investors. During periods of extreme fear, assets are typically undervalued, presenting potential buying opportunities for long-term investors with strong conviction. However, extreme fear also signals increased volatility and downside risks. Traders should exercise caution, manage position sizing carefully, and avoid making emotional decisions. Consider dollar-cost averaging strategies to mitigate timing risks while maintaining disciplined risk management protocols.

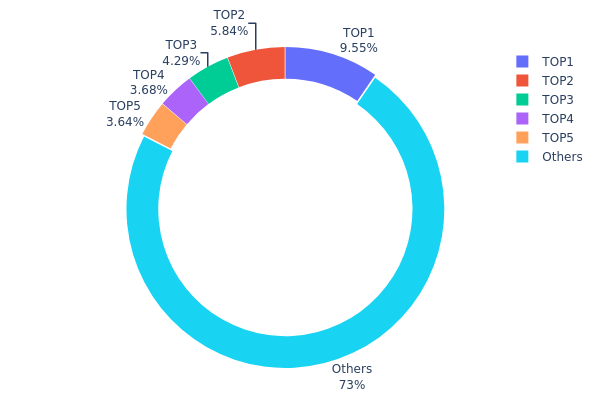

RSC Holdings Distribution

The address holdings distribution chart illustrates how RSC tokens are allocated across different wallet addresses on the blockchain. This metric serves as a critical indicator of token concentration, measuring the degree to which holdings are distributed among market participants. By analyzing the top addresses and their respective token quantities, we can assess the level of decentralization, evaluate potential market manipulation risks, and understand the overall health of the token's ecosystem structure.

Current analysis reveals a relatively balanced distribution pattern for RSC. The top five addresses collectively hold approximately 26.97% of total token supply, with the largest holder accounting for 9.54%. This concentration level suggests moderate centralization, where no single entity maintains overwhelming control. The remaining 73.03% of tokens dispersed among other addresses indicates substantial distribution across the broader holder base, demonstrating a degree of decentralization that mitigates extreme concentration risks.

From a market structure perspective, the current holdings distribution presents a stable foundation for healthy price discovery mechanisms. While the top five addresses represent significant stakeholders with potential market influence, their individual holdings remain below critical thresholds that would enable unilateral market manipulation. The substantial proportion of tokens held by dispersed addresses reduces the likelihood of coordinated liquidations or sudden supply shocks from major holders. This distribution pattern suggests RSC maintains reasonable on-chain structural integrity, supporting long-term ecosystem stability and reducing vulnerability to concentration-driven volatility. The decentralized holder base reinforces market resilience and facilitates more organic price discovery processes.

Click to view current RSC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe92e...c5a03f | 4838.61K | 9.54% |

| 2 | 0x0d07...b492fe | 2959.24K | 5.83% |

| 3 | 0x9e77...0c404d | 2175.96K | 4.29% |

| 4 | 0x7851...4d986d | 1865.26K | 3.68% |

| 5 | 0x55a2...804efe | 1842.83K | 3.63% |

| - | Others | 36998.60K | 73.03% |

II. Core Factors Affecting RSC's Future Price

Supply Mechanism

- Historical Pattern: Supply fluctuations are highly correlated with Bitcoin market movements, consistent with characteristics of most altcoins.

- Current Impact: If Bitcoin continues its upward trajectory, RSC is expected to potentially benefit from positive market sentiment and increased capital inflows into the broader cryptocurrency market.

III. 2025-2030 RSC Price Forecast

2025 Outlook

- Conservative Forecast: $0.13809 - $0.15010

- Base Case Forecast: $0.15010

- Optimistic Forecast: $0.18312 (requiring sustained market bullish sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.12829 - $0.19160 (10% potential upside)

- 2027: $0.14508 - $0.22209 (19% potential upside)

- 2028: $0.17853 - $0.22668 (33% potential upside)

- Key Catalysts: Ecosystem expansion, increased institutional interest, technological upgrades, and market maturation

2029-2030 Long-term Outlook

- Base Case Scenario: $0.17091 - $0.29909 (42% potential upside by 2029), consolidating to $0.19740 - $0.26662 by 2030 (70% cumulative upside from current levels)

- Optimistic Scenario: $0.29909 by 2029 (sustained bull market, strong network effects, and broad-based adoption)

- Transformational Scenario: $0.25637 average by 2030 with sustained growth momentum (assuming major regulatory clarity, mainstream adoption acceleration, and strategic partnerships)

- 2025-12-20: RSC trading at baseline levels with long-term growth potential across all scenarios

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.18312 | 0.1501 | 0.13809 | 0 |

| 2026 | 0.1916 | 0.16661 | 0.12829 | 10 |

| 2027 | 0.22209 | 0.17911 | 0.14508 | 19 |

| 2028 | 0.22668 | 0.2006 | 0.17853 | 33 |

| 2029 | 0.29909 | 0.21364 | 0.17091 | 42 |

| 2030 | 0.26662 | 0.25637 | 0.1974 | 70 |

ResearchCoin (RSC) Professional Investment Analysis Report

IV. RSC Professional Investment Strategy and Risk Management

RSC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Academic researchers, science enthusiasts, and long-term blockchain believers who support decentralized scientific collaboration

- Operation Suggestions:

- Accumulate RSC during market downturns when prices are significantly below all-time highs, considering RSC's 84.96% annual decline

- Hold positions for extended periods aligned with ResearchHub platform adoption and academic community growth

- Reinvest rewards from platform participation back into RSC holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical range between $0.1411 (all-time low) and $1.6 (all-time high) to identify trading opportunities

- Volume Analysis: Observe 24-hour trading volume ($24,553.04) relative to market cap ($19.26M) to assess liquidity and price movement reliability

- Wave Operation Key Points:

- Execute short-term trades during intraday volatility, capitalizing on the 1-hour positive momentum (+0.86%)

- Avoid major positions during extreme downtrends; the 30-day decline of -37.01% suggests consolidation periods

RSC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of diversified portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of specialized blockchain/science-tech focus allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance RSC holdings with established cryptocurrencies and traditional assets to mitigate concentrated risk exposure

- Dollar-Cost Averaging (DCA): Execute systematic purchases over time to reduce impact of price volatility and timing risk

(3) Secure Storage Solutions

- Hardware wallet Recommendations: Self-custody through hardware wallet solutions for long-term holdings exceeding 6 months

- Exchange Storage: Gate.com provides secure custodial services for active traders requiring frequent liquidity access

- Security Considerations: Enable two-factor authentication on exchange accounts, use separate hardware wallets for holdings exceeding personal risk tolerance thresholds, and never share private keys or seed phrases

V. RSC Potential Risks and Challenges

RSC Market Risks

- Severe Price Volatility: RSC has experienced an 84.96% one-year decline from historical highs, indicating extreme market instability and susceptibility to speculative swings

- Limited Liquidity: With only 12 trading pairs across exchanges and daily volume of approximately $24,553, RSC faces significant liquidity constraints that may impact large trade execution

- Low Market Capitalization: At $19.26M fully diluted valuation, RSC remains highly susceptible to market manipulation and sudden price reversals from institutional or coordinated retail movements

RSC Regulatory Risks

- Cryptocurrency Classification Uncertainty: Regulatory authorities globally continue debating whether tokens like RSC should be classified as securities, utilities, or other asset classes, creating potential compliance uncertainty

- Academic Institution Adoption Barriers: Institutional acceptance of blockchain-based research incentives remains limited, with traditional academia showing resistance to cryptocurrency integration

- Jurisdictional Compliance: Different regulatory frameworks across regions where ResearchHub operates may impose restrictions on token distribution, trading, or utility functions

RSC Technology Risks

- Smart Contract Vulnerabilities: Base network deployment carries inherent risks related to smart contract security and blockchain protocol updates that could affect token functionality

- Platform Scalability: ResearchHub's ability to handle increasing user growth and transaction volume without performance degradation remains unproven at scale

- Blockchain Network Dependency: RSC functionality depends entirely on Base network reliability; network outages or technical failures would directly impact token utility and accessibility

VI. Conclusion and Action Recommendations

RSC Investment Value Assessment

ResearchCoin represents a speculative investment in the intersection of academic research democratization and blockchain technology. While the ResearchHub platform addresses genuine inefficiencies in traditional scientific collaboration, the token has experienced significant depreciation (-84.96% annually) and remains early-stage with limited adoption metrics. The project's long-term value depends critically on widespread institutional academic adoption and meaningful incentive utility within the ResearchHub ecosystem. Current market conditions suggest RSC is positioned as a high-risk, high-volatility asset suitable only for investors with substantial risk tolerance and belief in the platform's transformative potential.

RSC Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through Gate.com, focusing on small regular purchases via dollar-cost averaging to reduce timing risk rather than lump-sum investments

✅ Experienced Investors: Consider 3-5% portfolio allocation with active monitoring of ResearchHub platform metrics, academic partnerships, and token utility expansion; employ technical analysis tools to capitalize on oversold conditions

✅ Institutional Investors: Conduct deep-dive due diligence on ResearchHub's academic adoption rates, competitive positioning against traditional research platforms, and regulatory pathway before allocation; structure positions through multiple entry points to manage liquidity constraints

RSC Trading Participation Methods

- Gate.com Spot Trading: Direct purchasing and selling of RSC against major trading pairs; offers professional charting tools and secure custody options

- Dollar-Cost Averaging: Execute systematic fixed-amount purchases at regular intervals to average entry prices and reduce emotional decision-making

- Yield Participation: Engage directly with ResearchHub platform activities (sharing research, peer review) to earn RSC rewards while building protocol utility conviction

Cryptocurrency investments carry extreme risk. This report is provided for informational purposes only and does not constitute investment advice. Investors must conduct independent research and consult professional financial advisors before making allocation decisions. Never invest capital that exceeds your capacity to absorb complete loss.

FAQ

What is an RSC coin?

RSC is a governance and rewards token for the ResearchHub platform, designed to incentivize scientific contributors. It operates on blockchain technology, enabling decentralized participation in scientific research communities and ecosystem rewards.

What is the price of RSC today?

The price of RSC today is $0.1493. The 24-hour trading volume is $705,284, with a price increase of 1.69% in the last 24 hours.

What are the factors affecting RSC price prediction?

RSC price is influenced by supply and demand dynamics, blockchain protocol updates, hard forks, block reward halvings, market sentiment, trading volume, and adoption rates. Macroeconomic conditions and regulatory changes also impact price movements.

What is the price prediction for RSC in 2025?

Based on market analysis, RSC price prediction for 2025 ranges between $2.16 to $3.03, with potential maximum reaching $3.03 by year-end depending on market conditions and adoption growth.

Is RSC a good investment?

RSC shows strong investment potential with projected value reaching $0.150094 by 2028. The current market price aligns with this prediction, indicating solid growth prospects. However, past performance doesn't guarantee future results.

Crypto Crash or Just a Correction?

Pi to PHP: Current Exchange Rate and Conversion Guide (2025)

2025 KSM Price Prediction: Analyzing Market Trends and Future Growth Potential of Kusama Network

2025 DCR Price Prediction: Analyzing Decred's Future Potential Amid Evolving Market Dynamics

EXT Price Meaning: What It Is and How to Understand It

2025 RVNPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Ravencoin

Solana Investment Insights: A Beginner's Guide

Theo: Break Barriers Of Professional Trading

Understanding USDT to SOL Conversion: Expert Insights

Exploring Web3 Investment Opportunities for Beginners

Comprehensive Blockchain Security: Transaction Monitoring Solutions Explained