2025 RSS3 Price Prediction: Expert Analysis and Market Forecast for the Decentralized Information Protocol Token

Introduction: RSS3's Market Position and Investment Value

RSS3 (RSS3) is a decentralized content and social protocol designed to support efficient and decentralized information distribution. Since its inception in 2022, RSS3 has established itself as a key infrastructure layer for information aggregation and standardization in the Web3 ecosystem. As of December 2025, RSS3's market capitalization stands at approximately $11.00 million, with a circulating supply of approximately 873.89 million tokens, trading at around $0.01071 per token. This innovative protocol, recognized for its role in decentralized information distribution, is playing an increasingly important role in enabling efficient content delivery and social interactions across Web3 applications.

This article will provide a comprehensive analysis of RSS3's price trends and market dynamics, combining historical performance data, market supply and demand factors, ecosystem development, and macroeconomic conditions to offer investors professional price forecasts and practical investment strategies for the period through 2030.

RSS3 Price Analysis Report

I. RSS3 Price History Review and Market Status

RSS3 Historical Price Evolution Trajectory

- February 2022: RSS3 reached its all-time high (ATH) of $0.687355 on February 15, 2022, marking the peak of the token's market performance during the bull market cycle.

- December 2025: RSS3 declined to its all-time low (ATL) of $0.01054354 on December 21, 2025, representing a significant downturn from its historical peak, with a cumulative decline of approximately 91.19% over the one-year period.

RSS3 Current Market Status

As of December 22, 2025, RSS3 is trading at $0.01071, reflecting a 24-hour decline of 5.51%. The token demonstrates continued downward pressure with the following price movements:

- Short-term performance: The token declined 0.37% in the past hour and 22.59% over the past seven days, indicating persistent bearish sentiment in the near term.

- Market capitalization: With a circulating market cap of $9,359,333.38 and a fully diluted valuation of $11,002,872.14, RSS3 ranks 1,205th by market capitalization.

- Trading activity: The 24-hour trading volume stands at $15,807.00, reflecting moderate liquidity in the market.

- Supply metrics: The circulating supply represents 87.39% of the total supply of 1,027,345,670.88 tokens, with a maximum supply cap of 1,000,000,000 tokens.

- Token holders: The project has approximately 22,850 holders, indicating a relatively distributed token base.

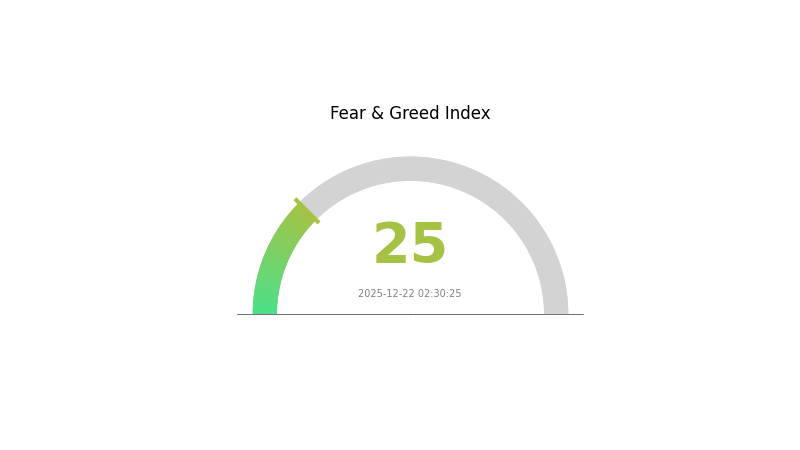

- Market sentiment: Current market conditions reflect "Extreme Fear" (VIX: 25), suggesting heightened risk aversion across the broader cryptocurrency market.

Click to view current RSS3 market price

RSS3 Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 25. This indicates heightened market anxiety and significant sell-off pressure across digital assets. Investors are displaying pronounced risk aversion, potentially creating both challenges and opportunities. During such extreme fear periods, contrarian investors often view market dips as potential entry points, while risk-averse traders may prefer to stay on the sidelines. Monitor market developments closely and consider your risk tolerance before making trading decisions on Gate.com.

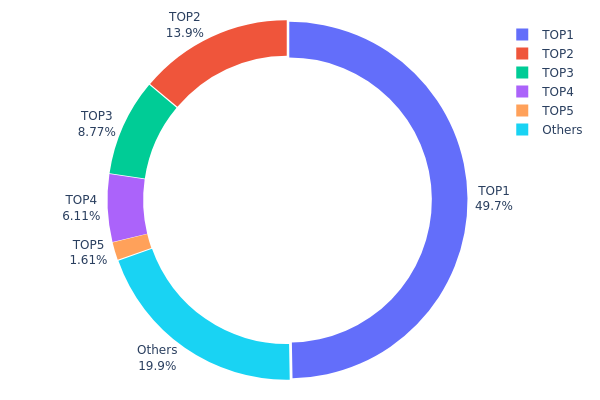

RSS3 Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing the decentralization level and potential market concentration risks of a cryptocurrency asset. By tracking the percentage of tokens held by top addresses, this indicator provides insight into the distribution dynamics and structural stability of the network's on-chain ecosystem.

The current RSS3 holdings data reveals a pronounced concentration pattern, with the top four addresses collectively controlling 78.48% of total token supply. The largest address (0x4cba...f18438) commands nearly half of all holdings at 49.71%, representing an exceptionally dominant position that significantly exceeds typical decentralization benchmarks. The secondary concentration is evident in the second and third addresses, holding 13.90% and 8.76% respectively. While the remaining distribution shows gradual tapering, with the fifth-largest address accounting for only 1.60%, the cumulative weight of the top tier creates a highly skewed ownership structure that warrants attention.

This extreme concentration introduces considerable structural risks to the RSS3 ecosystem. The dominant position of a single address—controlling nearly half of the circulating supply—presents meaningful implications for price volatility and potential market manipulation vectors. Such concentrated holdings can amplify price movements during significant transactions, reduce liquidity resilience, and create asymmetric information advantages for major token holders. The distribution pattern indicates that RSS3 currently operates with limited decentralization, with only 19.92% of tokens dispersed among untracked addresses. This structural characteristic suggests the token remains in a relatively early or controlled distribution phase, with governance and market dynamics potentially subject to coordinated actions by a small number of stakeholders.

Click to view current RSS3 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4cba...f18438 | 497101.64K | 49.71% |

| 2 | 0xc70c...6f7abe | 139062.44K | 13.90% |

| 3 | 0x91d4...c8debe | 87659.12K | 8.76% |

| 4 | 0x611f...dfb09d | 61117.49K | 6.11% |

| 5 | 0x9c06...fc5f0d | 16088.42K | 1.60% |

| - | Others | 198970.89K | 19.92% |

II. Core Factors Affecting RSS3 Future Price

Supply Mechanism

- Block Reward Halving: RSS3's price trends are influenced by block reward reduction events and supply changes, which historically impact token circulation and market dynamics.

- Historical Patterns: Supply adjustments through protocol updates have demonstrated direct correlation with price volatility in the cryptocurrency market.

- Current Impact: Anticipated supply variations from ongoing protocol developments are expected to continue influencing RSS3 token valuation.

Institutional and Major Holder Dynamics

- Enterprise Adoption: Adoption by enterprises and government entities represents a key factor in RSS3 price movements, as institutional use cases expand the utility and demand for the token.

Macroeconomic Environment

- Regulatory Impact: Financial, regulatory, and political events constitute external factors that significantly affect RSS3 price volatility, requiring investors to closely monitor regulatory landscape changes.

- Market Volatility: Cryptocurrency exchange security incidents and broader market dynamics can amplify price fluctuations in the RSS3 market.

Technology Development and Ecosystem Building

- Hard Forks and Protocol Updates: Hard fork implementations and protocol upgrades directly influence RSS3 price movements, as these technical modifications affect network functionality and token economics.

III. RSS3 Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00701 - $0.01078

- Base Case Forecast: $0.01078

- Optimistic Forecast: $0.01585 (subject to increased adoption of RSS3 protocol and Web3 content platforms)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation and gradual recovery phase with strengthening protocol fundamentals and ecosystem expansion

- Price Range Forecast:

- 2026: $0.01198 - $0.01385 (24% upside potential)

- 2027: $0.01127 - $0.01928 (26% upside potential)

- Key Catalysts: Enhanced RSS3 protocol adoption, strategic partnerships with major Web3 platforms, institutional interest in decentralized content distribution, and ecosystem development milestones

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01643 - $0.02120 (53% growth by 2028, reflecting steady protocol adoption)

- Optimistic Scenario: $0.01881 - $0.02465 (75% growth by 2029, assuming accelerated mainstream Web3 adoption)

- Transformative Scenario: $0.02173 - $0.02890 (102% growth by 2030, contingent on RSS3 becoming the standard for decentralized content distribution, major platform integrations, and broader cryptocurrency market recovery)

- December 22, 2025: RSS3 trading activity on Gate.com and major markets reflects sustained institutional and retail participation

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01585 | 0.01078 | 0.00701 | 0 |

| 2026 | 0.01385 | 0.01331 | 0.01198 | 24 |

| 2027 | 0.01928 | 0.01358 | 0.01127 | 26 |

| 2028 | 0.0212 | 0.01643 | 0.00838 | 53 |

| 2029 | 0.02465 | 0.01881 | 0.01054 | 75 |

| 2030 | 0.0289 | 0.02173 | 0.01891 | 102 |

RSS3 Professional Investment Strategy and Risk Management Report

IV. RSS3 Investment Methodology and Risk Management

RSS3 Investment Approaches

(1) Long-term Holding Strategy

-

Target Investors: Protocol believers and decentralized content ecosystem advocates who believe in the long-term potential of Web3 infrastructure.

-

Operational Recommendations:

- Dollar-cost averaging (DCA) approach: Invest fixed amounts at regular intervals to reduce timing risk and accumulate positions during market downturns.

- Set clear entry and exit targets based on fundamental analysis and protocol development milestones.

- Monitor protocol updates and ecosystem expansion initiatives that could drive utility growth.

(2) Active Trading Strategy

-

Market Analysis Tools:

- Price action patterns: Monitor support and resistance levels to identify entry and exit points during volatility cycles.

- Volume analysis: Track trading volume on Gate.com to confirm trend strength and identify potential reversal points.

-

Swing Trading Considerations:

- Capitalize on the current -22.59% 7-day decline to identify potential accumulation opportunities.

- Establish stop-loss orders at -10% to -15% below entry points to manage downside risk.

RSS3 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation to RSS3.

- Moderate Investors: 3-5% of portfolio allocation to RSS3.

- Aggressive Investors: 5-10% of portfolio allocation to RSS3.

(2) Risk Hedging Strategies

- Position sizing: Limit individual position sizes to prevent catastrophic losses during market corrections.

- Diversification: Balance RSS3 holdings with other Web3 protocol tokens and traditional assets to reduce concentration risk.

(3) Secure Storage Solutions

- Custodial Wallets: Gate.com native wallet offers convenience for active traders with insurance protection for digital assets.

- Self-custody approach: Transfer long-term holdings to secure wallets for enhanced security and full asset control.

- Security best practices: Enable two-factor authentication, use strong passwords, regularly backup recovery phrases, and verify URLs before accessing accounts.

V. RSS3 Potential Risks and Challenges

RSS3 Market Risks

- Extreme volatility: The token has experienced a -91.19% decline over 1 year and recently hit an all-time low of $0.01054354, demonstrating severe price instability.

- Low trading liquidity: With 24-hour volume of only $15,807, the token exhibits limited liquidity, which can result in significant price slippage on larger trades.

- Market sentiment deterioration: Current negative momentum across 1H, 24H, 7D, and 30D timeframes suggests sustained selling pressure and diminished investor confidence.

RSS3 Regulatory Risks

- Evolving Web3 compliance landscape: Changing regulations around decentralized protocols and content distribution may impact RSS3's operational framework.

- Securities classification uncertainty: Regulatory ambiguity regarding token classification could affect trading availability on regulated exchanges.

RSS3 Technology Risks

- Protocol adoption challenges: Success depends on achieving network effects and attracting content creators and platforms to utilize the decentralized distribution layer.

- Smart contract vulnerabilities: As with all blockchain protocols, potential security bugs or exploits could threaten user funds and platform integrity.

- Competition from established platforms: Traditional social networks and emerging Web3 alternatives present significant competition for market share and developer attention.

VI. Conclusions and Action Recommendations

RSS3 Investment Value Assessment

RSS3 operates as a decentralized content and social protocol addressing critical challenges in information distribution and standardization. With a current market cap of approximately $9.36 million and fully diluted valuation of $11.00 million, the project maintains modest market positioning. However, the extreme price deterioration (-91.19% YoY) and recent all-time low indicate significant market skepticism regarding current execution or market conditions. The protocol's success hinges on achieving meaningful adoption among content creators and platforms, which remains uncertain.

RSS3 Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of portfolio) through Gate.com to understand protocol mechanics before committing significant capital. Research the team and development roadmap thoroughly.

✅ Experienced Investors: Consider the current valuation as a potential accumulation opportunity if you believe in the long-term protocol thesis. Implement dollar-cost averaging strategies and establish clear fundamental milestones for position evaluation.

✅ Institutional Investors: Conduct comprehensive due diligence on protocol metrics, developer activity on GitHub, and team credentials. Only allocate capital if protocol traction metrics demonstrate network effect development.

RSS3 Trading Participation Methods

- Exchange Trading on Gate.com: Access RSS3/USDT trading pairs with competitive fees and robust order types for both spot and advanced trading strategies.

- Long-term Accumulation: Utilize Gate.com's recurring purchase features or API integration for systematic position building without market timing concerns.

- Active Monitoring: Track RSS3's development progress, community engagement on Twitter (@rss3_), and protocol updates through the official website (https://rss3.io).

Disclaimer: Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and financial circumstances before making decisions. Consult professional financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

Is RSS3 crypto a good investment?

RSS3 presents speculative opportunities with moderate growth potential. As a decentralized data protocol, it offers exposure to the Web3 infrastructure sector. However, like all cryptocurrencies, it carries volatility and risk. Consider your investment horizon and risk tolerance before participating.

How much is RSS3 crypto?

RSS3 is currently priced at $0.011, up 4.92% in the last 24 hours with a trading volume of $10.69 million. The token maintains steady momentum in the market.

Is RSS3 on Binance?

Yes, RSS3 is listed and available for trading. You can access RSS3 through major centralized platforms that support it. Check the official RSS3 website or your preferred trading platform for current listing status and trading pairs.

Is Gravity (G) a good investment?: Analyzing the potential of this cryptocurrency in the volatile market

2025 VSN Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Is MEET48 Token (IDOL) a good investment?: Analyzing the Potential and Risks of the New Crypto Asset

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

What Does GH/s Mean in Crypto Mining, Explained in Simple Terms

Is Covalent (CXT) a good investment? A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024

How Does UNI Price Volatility Compare to Bitcoin and Ethereum in 2025?

Is Alkimi (ALKIMI) a good investment? A comprehensive analysis of the digital advertising blockchain platform and its market potential

M Pattern in Trading, Meaning, Structure, and How It Predicts Price Drops