2025 WBTC Price Prediction: Expert Analysis and Market Outlook for Wrapped Bitcoin's Future Performance

Introduction: WBTC's Market Position and Investment Value

Wrapped Bitcoin (WBTC), as a tokenized version of Bitcoin on the Ethereum blockchain, has achieved significant milestones since its inception in 2019. As of 2025, WBTC's market capitalization has reached $11.16 billion, with a circulating supply of approximately 124,963 tokens, and a price hovering around $89,322. This asset, often referred to as "Bitcoin's bridge to DeFi," is playing an increasingly crucial role in decentralized finance and cross-chain applications.

This article will provide a comprehensive analysis of WBTC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. WBTC Price History Review and Current Market Status

WBTC Historical Price Evolution

- 2019: WBTC launched, price started at $3,139.17 (ATL)

- 2021: Bull market peak, price reached $67,000+

- 2022-2023: Crypto winter, price dropped to $15,000-$20,000 range

- 2025: New bull cycle, price hit ATH of $125,932 on October 7th

WBTC Current Market Situation

As of December 15, 2025, WBTC is trading at $89,322.6, with a market cap of $11,162,063,727. It ranks 14th in the overall cryptocurrency market, commanding a 0.34% market share. The 24-hour trading volume stands at $213,427,828.

WBTC has experienced a slight decline across various timeframes: -0.22% in the past hour, -0.15% in the last 24 hours, -2.56% over the week, -6.45% in the past month, and -11.41% year-to-date. Despite these short-term fluctuations, WBTC remains significantly above its all-time low of $3,139.17 set on April 2, 2019.

The current price represents a 29.07% retracement from its all-time high of $125,932 achieved on October 7, 2025. With a circulating supply of 124,963.48883569 WBTC, the token maintains a strong market presence.

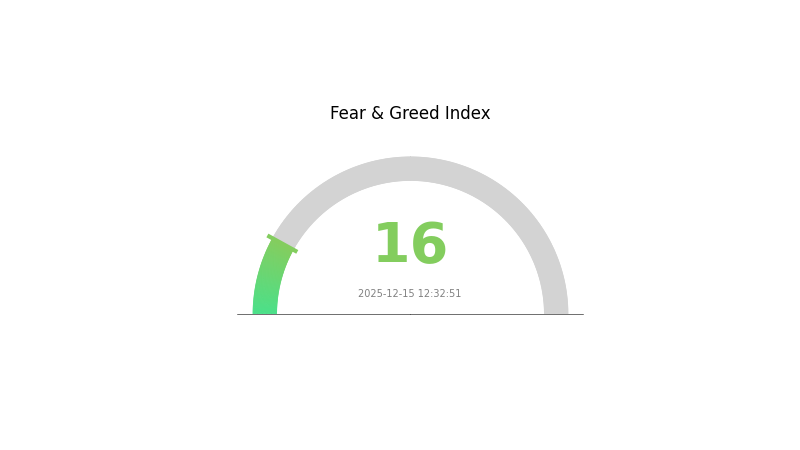

The market sentiment for cryptocurrencies is currently in the "Extreme Fear" zone, with a Fear & Greed Index reading of 16. This indicates a high level of uncertainty and risk aversion among investors in the crypto space.

Click to view the current WBTC market price

WBTC Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates a highly pessimistic sentiment among investors, potentially signaling oversold conditions. Historically, such extreme fear has often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should closely monitor market trends and conduct thorough research before making investment decisions in this challenging environment.

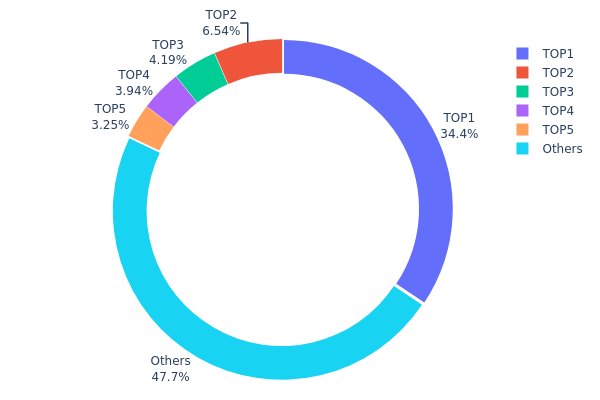

WBTC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of WBTC ownership. The top address holds a substantial 34.38% of the total WBTC supply, indicating a significant concentration of tokens. The next four largest addresses collectively account for an additional 17.9% of the supply. This high level of concentration among the top five addresses, totaling 52.28% of all WBTC, raises concerns about potential market manipulation and centralization risks.

The distribution pattern suggests a relatively centralized ownership structure for WBTC. With nearly half of the supply controlled by just five addresses, the market may be susceptible to large price swings if these major holders decide to sell or transfer their holdings. This concentration could also impact market liquidity and potentially lead to increased volatility. However, it's worth noting that 47.72% of WBTC is distributed among other addresses, which provides some level of diversification and may help mitigate some of the centralization risks.

Click to view the current WBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5ee5...ec6de8 | 42.97K | 34.38% |

| 2 | 0xa3a7...d60eec | 8.17K | 6.54% |

| 3 | 0xbbbb...eeffcb | 5.23K | 4.18% |

| 4 | 0xc3d6...84cdc3 | 4.93K | 3.94% |

| 5 | 0x3ee1...8fa585 | 4.06K | 3.24% |

| - | Others | 59.61K | 47.72% |

II. Key Factors Affecting WBTC's Future Price

Supply Mechanism

- Bitcoin Halving: Reduction of new Bitcoin supply every four years, impacting WBTC supply indirectly

- Historical Pattern: Previous halvings have led to significant price increases in the following months

- Current Impact: The next halving in 2024 is expected to create scarcity and potentially drive up WBTC prices

Institutional and Whale Dynamics

- Institutional Holdings: Major players like MicroStrategy and BlackRock's ETFs are accumulating large amounts of Bitcoin, indirectly affecting WBTC

- Corporate Adoption: Companies like Tesla and Square have added Bitcoin to their balance sheets, potentially influencing WBTC demand

- Government Policies: Potential for Bitcoin to become a national reserve asset, as suggested by some US presidential candidates

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve's interest rate decisions and quantitative easing policies affect Bitcoin and WBTC as alternative assets

- Inflation Hedging Properties: WBTC, reflecting Bitcoin's properties, is increasingly viewed as a hedge against inflation in uncertain economic times

- Geopolitical Factors: Global political tensions and economic instability can drive interest in cryptocurrencies, including WBTC

Technical Development and Ecosystem Growth

- Layer 2 Solutions: Development of Bitcoin Layer 2 technologies could enhance WBTC's utility and demand

- BTC-Fi: Emerging Bitcoin-based DeFi applications may increase WBTC's use cases and value proposition

- Ecosystem Applications: Growth in platforms utilizing WBTC for lending, borrowing, and other financial services

III. WBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $85,839 - $89,416

- Neutral forecast: $89,416 - $100,000

- Optimistic forecast: $100,000 - $115,347 (requires sustained institutional adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range prediction:

- 2027: $103,139 - $124,440

- 2028: $75,695 - $136,015

- Key catalysts: Increased mainstream adoption, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $127,144 - $143,673 (assuming steady market growth)

- Optimistic scenario: $160,202 - $192,522 (assuming accelerated adoption)

- Transformative scenario: $200,000+ (extreme favorable conditions like global economic shift)

- 2030-12-31: WBTC $192,522 (potential peak of the cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 115347.29 | 89416.5 | 85839.84 | 0 |

| 2026 | 121834.45 | 102381.89 | 79857.88 | 14 |

| 2027 | 124440.07 | 112108.17 | 103139.52 | 25 |

| 2028 | 136015.24 | 118274.12 | 75695.44 | 32 |

| 2029 | 160202.3 | 127144.68 | 83915.49 | 42 |

| 2030 | 192522.48 | 143673.49 | 132179.61 | 60 |

IV. WBTC Professional Investment Strategies and Risk Management

WBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking Bitcoin exposure with Ethereum functionality

- Operation suggestions:

- Accumulate WBTC during market dips

- Set up regular dollar-cost averaging purchases

- Store WBTC in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought/oversold conditions

- Moving Averages: Monitor for trend reversals and support/resistance levels

- Key points for swing trading:

- Monitor Bitcoin price movements as WBTC closely follows BTC

- Pay attention to Ethereum network congestion and gas fees

WBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of crypto portfolio

- Moderate investors: 5-10% of crypto portfolio

- Aggressive investors: 10-20% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different wrapped assets and native cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. WBTC Potential Risks and Challenges

WBTC Market Risks

- Price volatility: WBTC is subject to Bitcoin's price fluctuations

- Liquidity risk: Potential issues with redemption during extreme market conditions

- Market manipulation: Vulnerability to large holders' actions

WBTC Regulatory Risks

- Regulatory uncertainty: Changing government stance on wrapped assets

- Compliance challenges: Potential issues with KYC/AML regulations

- Cross-border restrictions: Varying legal status in different jurisdictions

WBTC Technical Risks

- Smart contract vulnerabilities: Potential bugs in the WBTC contract

- Custodian risks: Reliance on centralized entities for Bitcoin backing

- Ethereum network congestion: High gas fees and transaction delays

VI. Conclusion and Action Recommendations

WBTC Investment Value Assessment

WBTC offers Bitcoin exposure with Ethereum's programmability, presenting a unique value proposition. However, it carries risks associated with both Bitcoin and the Ethereum ecosystem.

WBTC Investment Recommendations

✅ Beginners: Start with small allocations, focus on understanding the technology ✅ Experienced investors: Consider WBTC for portfolio diversification and DeFi opportunities ✅ Institutional investors: Evaluate WBTC for large-scale Bitcoin exposure on Ethereum

WBTC Participation Methods

- Direct purchase: Buy WBTC on Gate.com

- DeFi integration: Use WBTC in Ethereum-based decentralized finance protocols

- Bitcoin wrapping: Convert BTC to WBTC through authorized merchants (for advanced users)

Cryptocurrency investments are extremely risky. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price of WBTC in 2030?

Based on current market models, the price of WBTC in 2030 is projected to reach $254,436.41. This prediction assumes continued growth in the crypto market.

Is WBTC equal to BTC?

No, WBTC is not equal to BTC. While they're closely related, WBTC is a tokenized version of BTC on Ethereum, with a typical 1:1 peg.

How much will $1 Bitcoin be worth in 2025?

Based on expert predictions, $1 Bitcoin is expected to be worth approximately $170,000 in 2025. This forecast considers factors such as potential Fed Rate cuts and increasing institutional demand for Bitcoin.

Why is WBTC being delisted?

WBTC is being delisted due to failure in meeting certain listing standards. The specific reasons are not disclosed, causing speculation in the crypto market.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is GUSD (GUSD) a good investment?: A Comprehensive Analysis of Gemini Dollar's Potential in 2024

Is MultiversX (EGLD) a good investment?: A comprehensive analysis of price potential, technology fundamentals, and market risks for 2024 and beyond

Is Eigenlayer (EIGEN) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Positioning

Is Immutable (IMX) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024 and Beyond

Is Mumubit Token (MCTP) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Long-term Viability