BPT vs MANA: Comparing Two Leading Cryptocurrencies in the Metaverse Space

Introduction: BPT vs MANA Investment Comparison

In the cryptocurrency market, the comparison between BPT and MANA has always been a topic that investors can't ignore. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

Best Patent (BPT): Since its launch, it has gained market recognition for its focus on intellectual property and blockchain technology intersection in the Web3 era.

Decentraland (MANA): Introduced in 2017, it has been hailed as a pioneering virtual world platform based on blockchain technology, and is one of the most traded and highest market cap cryptocurrencies in the metaverse sector.

This article will provide a comprehensive analysis of the investment value comparison between BPT and MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question that investors are most concerned about:

"Which is the better buy right now?"

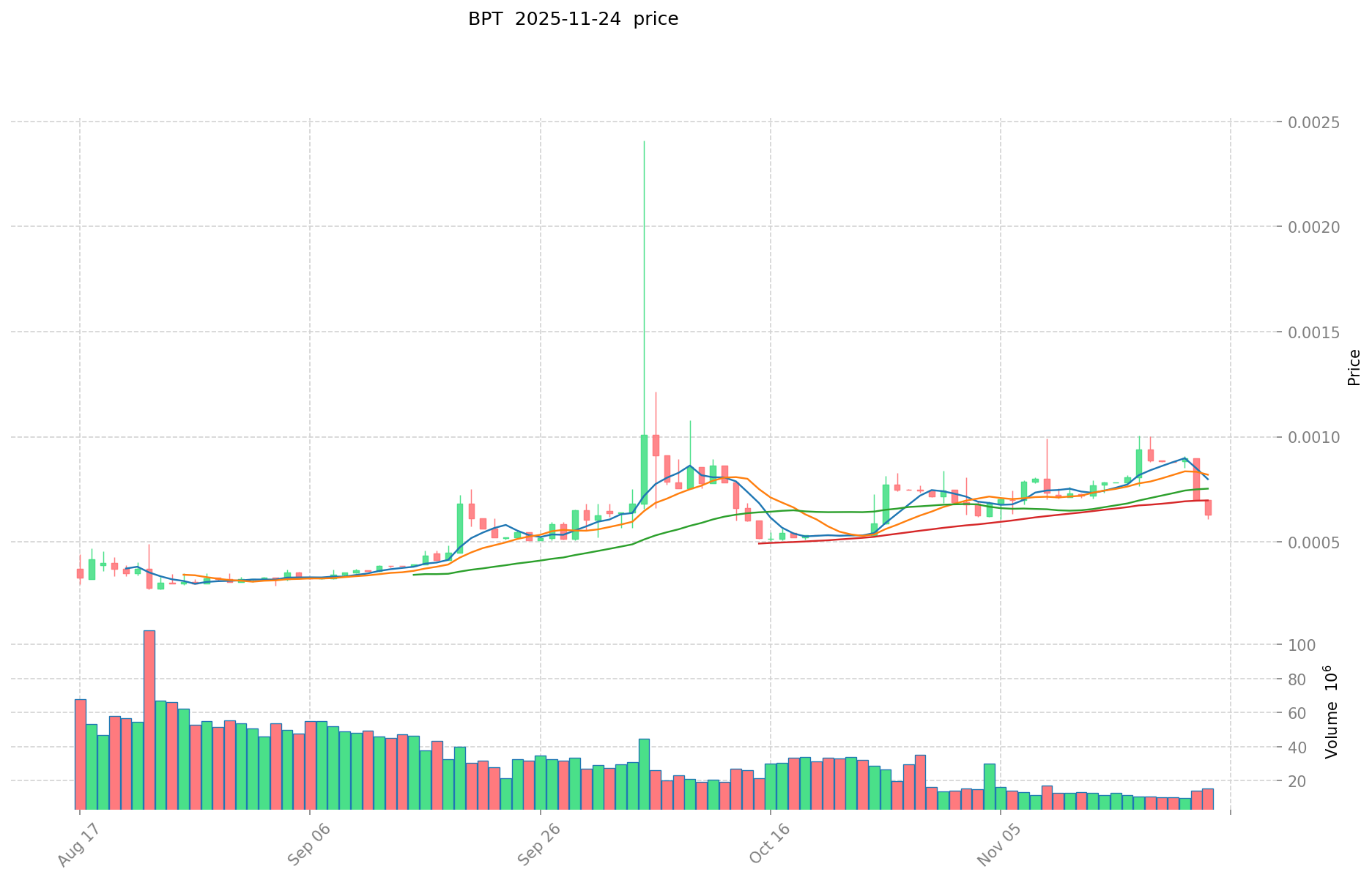

I. Price History Comparison and Current Market Status

BPT (Coin A) and MANA (Coin B) Historical Price Trends

- 2024: BPT reached its all-time high of $0.58 on December 31, 2024.

- 2025: BPT hit its all-time low of $0.0002546 on July 30, 2025, showing significant volatility.

- 2021: MANA achieved its all-time high of $5.85 on November 25, 2021.

- Comparative Analysis: In the recent market cycle, BPT has experienced extreme volatility, dropping from $0.58 to $0.0002546, while MANA has also seen a significant decline from its all-time high.

Current Market Situation (2025-11-24)

- BPT current price: $0.0007828

- MANA current price: $0.1653

- 24-hour trading volume: BPT $10,127.96 vs MANA $77,852.29

- Market Sentiment Index (Fear & Greed Index): 19 (Extreme Fear)

Click to view real-time prices:

- Check BPT current price Market Price

- Check MANA current price Market Price

II. Key Factors Affecting the Investment Value of BPT vs MANA

Supply Mechanism Comparison (Tokenomics)

-

BPT: Limited supply of 100 million tokens, with 45% allocated to the community and 55% to investors and team

-

MANA: Fixed maximum supply of 2.19 billion MANA, with approximately 2.16 billion already in circulation

-

📌 Historical Pattern: Limited supply tokens like BPT tend to have higher price volatility during bull markets, while MANA's larger but fixed supply typically provides more stability but less explosive growth.

Institutional Adoption and Market Applications

- Institutional Holdings: MANA has attracted more institutional interest due to its established position in the metaverse space and partnerships with major brands

- Enterprise Adoption: MANA is more widely used in virtual real estate, digital collectibles, and metaverse experiences, while BPT is primarily focused on powering the Blackpool protocol

- Regulatory Attitudes: Both tokens face similar regulatory scrutiny as utility tokens, though MANA's longer history in the market provides more regulatory clarity

Technical Development and Ecosystem Building

- BPT Technical Development: Focuses on risk management tools and DAO governance improvements for NFT financialization

- MANA Technical Development: Continuous improvements to the Decentraland platform, with focus on metaverse experience enhancement and creator tools

- Ecosystem Comparison: MANA has a more developed ecosystem with virtual land, wearables, and experiences, while BPT's ecosystem centers around NFT financialization services

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: Both tokens have historically struggled during high inflation periods, with neither showing strong anti-inflationary properties

- Macroeconomic Monetary Policy: Rising interest rates negatively impact both tokens, though MANA's larger market cap may provide some stability compared to BPT

- Geopolitical Factors: Increased digital asset adoption and metaverse development globally could benefit MANA more directly than BPT due to its broader use case

III. 2025-2030 Price Prediction: BPT vs MANA

Short-term Prediction (2025)

- BPT: Conservative $0.000510272 - $0.0007973 | Optimistic $0.0007973 - $0.000892976

- MANA: Conservative $0.111452 - $0.1639 | Optimistic $0.1639 - $0.234377

Mid-term Prediction (2027)

- BPT may enter a growth phase, with prices expected in the range of $0.000588216048 - $0.0013823077128

- MANA may enter a consolidation phase, with prices expected in the range of $0.1157791239 - $0.2092149081

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- BPT: Base scenario $0.000988582732527 - $0.001283873678607 | Optimistic scenario $0.001283873678607 - $0.001425099783254

- MANA: Base scenario $0.294005075633351 - $0.303098016116857 | Optimistic scenario $0.303098016116857 - $0.415244282080094

Disclaimer: The information provided is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

BPT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.000892976 | 0.0007973 | 0.000510272 | 1 |

| 2026 | 0.00111558216 | 0.000845138 | 0.00065920764 | 7 |

| 2027 | 0.0013823077128 | 0.00098036008 | 0.000588216048 | 25 |

| 2028 | 0.001287653947076 | 0.0011813338964 | 0.000685173659912 | 50 |

| 2029 | 0.001333253435477 | 0.001234493921738 | 0.000975250198173 | 57 |

| 2030 | 0.001425099783254 | 0.001283873678607 | 0.000988582732527 | 64 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.234377 | 0.1639 | 0.111452 | 0 |

| 2026 | 0.20710404 | 0.1991385 | 0.13541418 | 20 |

| 2027 | 0.2092149081 | 0.20312127 | 0.1157791239 | 22 |

| 2028 | 0.292758686451 | 0.20616808905 | 0.1628727903495 | 24 |

| 2029 | 0.356732644483215 | 0.2494633877505 | 0.227011682852955 | 50 |

| 2030 | 0.415244282080094 | 0.303098016116857 | 0.294005075633351 | 83 |

IV. Investment Strategy Comparison: BPT vs MANA

Long-term vs Short-term Investment Strategies

- BPT: Suitable for investors focusing on NFT financialization and DAO governance potential

- MANA: Suitable for investors interested in metaverse development and virtual real estate

Risk Management and Asset Allocation

- Conservative investors: BPT: 20% vs MANA: 80%

- Aggressive investors: BPT: 40% vs MANA: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- BPT: Higher volatility due to lower market cap and trading volume

- MANA: Susceptible to metaverse sector trends and overall crypto market sentiment

Technical Risk

- BPT: Scalability, network stability

- MANA: Platform adoption, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both tokens, with MANA potentially facing more scrutiny due to its established position in the metaverse space

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BPT advantages: Focus on intellectual property and blockchain intersection, limited supply

- MANA advantages: Established metaverse platform, larger market cap, institutional interest

✅ Investment Advice:

- Novice investors: Consider MANA for its more established market position and lower volatility

- Experienced investors: Balanced portfolio with both tokens, higher allocation to MANA

- Institutional investors: Focus on MANA for its liquidity and metaverse sector representation

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between BPT and MANA? A: BPT focuses on intellectual property and blockchain technology intersection, with a limited supply of 100 million tokens. MANA is a metaverse platform token with a larger supply of 2.19 billion tokens, established in the virtual world and digital real estate space.

Q2: Which token has shown better price performance historically? A: MANA has shown better historical price performance, reaching an all-time high of $5.85 in November 2021. BPT has experienced more extreme volatility, with its all-time high at $0.58 in December 2024 and a significant drop to $0.0002546 in July 2025.

Q3: How do the ecosystems of BPT and MANA compare? A: MANA has a more developed ecosystem centered around virtual land, wearables, and metaverse experiences. BPT's ecosystem focuses primarily on NFT financialization services and DAO governance within the Blackpool protocol.

Q4: Which token is more suitable for long-term investment? A: MANA may be more suitable for long-term investment due to its established position in the metaverse sector, larger market cap, and greater institutional interest. However, BPT could offer higher growth potential for investors interested in NFT financialization and blockchain-based intellectual property.

Q5: How do institutional adoption rates compare between BPT and MANA? A: MANA has attracted more institutional interest due to its established position in the metaverse space and partnerships with major brands. BPT has less institutional adoption at present, focusing more on its niche in the NFT and intellectual property space.

Q6: What are the key risks associated with investing in BPT and MANA? A: BPT faces higher volatility risk due to its lower market cap and trading volume. MANA is susceptible to metaverse sector trends and overall crypto market sentiment. Both tokens face regulatory risks, with MANA potentially facing more scrutiny due to its established market position.

Q7: How should investors allocate their portfolio between BPT and MANA? A: Conservative investors might consider allocating 20% to BPT and 80% to MANA, while more aggressive investors could opt for 40% BPT and 60% MANA. The specific allocation should be based on individual risk tolerance and investment goals.

Is ApeCoin (APE) a good investment?: Analyzing the potential and risks of the Bored Ape Yacht Club's cryptocurrency

2025 APE Price Prediction: Analyzing Market Trends, Ecosystem Growth and Investment Potential in the ApeCoin Ecosystem

Is Alien Worlds (TLM) a Good Investment?: Analyzing the Metaverse Token's Potential Returns and Risks

2025 APE Price Prediction: Bull Run or Bear Market? Analyzing Key Factors for ApeCoin's Future Value

Is BRN Metaverse (BRN) a good investment?: Analyzing the potential and risks of this virtual world token

Is Portals (PORTALS) a Good Investment?: Analyzing Potential Returns and Risks in the Metaverse Token Market

Top Privacy Coins for Investment with High Growth Potential in 2025

Beginner's Guide to Cryptocurrency ETFs

Step-by-Step Guide to Buying Blocktix (TIX)

2025 CUDIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SHDW Price Prediction: Expert Analysis and Market Forecast for Shadow Token's Growth Potential